- with Senior Company Executives, HR and Finance and Tax Executives

- in European Union

- in European Union

- with readers working within the Business & Consumer Services, Metals & Mining and Oil & Gas industries

On November 4 2025, the Government of Canada released Budget 2025, which represents a significant shift in Canada's infrastructure and energy policy. Budget 2025 sets out a framework to accelerate the planning, financing, and delivery of large-scale, nation-building projects that aim to define Canada's economic and environmental trajectory for decades to come.

With global markets in transition and domestic demand for reliable, clean electricity increasing, the federal government has positioned Budget 2025 as both a fiscal and regulatory blueprint for achieving long-term competitiveness, grid modernization, and net-zero alignment. The budget also comes at a time of renewed global trade uncertainty, including the introduction of new tariff measures and broader economic tensions between Canada and the United States. These developments reinforce the emphasis on strengthening domestic supply chains and promoting economic resilience through measures such as the One Canadian Economy Act and the Buy Canadian Policy, which aim to enhance internal trade, procurement alignment, and competitiveness amid unpredictable global trade conditions.

At the heart of this strategy is the recognition that Canada must expand its internal energy and transmission infrastructure at an unprecedented speed and scale. Interprovincial transmission lines, large hydroelectric developments, and offshore wind projects are identified as national priorities that will enhance energy security, facilitate decarbonization, and support industrial growth across regions.

A review of the budget text itself underscores the prominence of these priorities. The terms "energy" and "clean" appear 96 and 142 times respectively, suggesting the extent to which energy transition and clean-technology policy occupy a central place in the government's agenda. Likewise, "invest" appears nearly 1,000 times, reflecting the federal government's intent to pursue economic growth and emissions reduction through sustained public and private-sector capital deployment.

Collectively, these repeated references underscore the emphasis that the Carney government places on positioning Canada as a global clean-energy leader.

Building Canada Act and the creation of the Major Projects Office

Budget 2025 underpins the Building Canada Act, which provides the statutory foundation for a more integrated and efficient infrastructure development process. A central feature of this legislation is the creation of the Major Projects Office (MPO), a new federal institution designed to act as a single-window authority for major nation-building projects. The MPO, headquartered in Calgary, Alberta, is intended to address long-standing inefficiencies in Canada's regulatory and permitting regime. By also establishing the MPO in western Canada, the federal government also aims to encourage greater regional participation in project planning and oversight and to ensure that national infrastructure priorities are developed with perspectives from across the country.

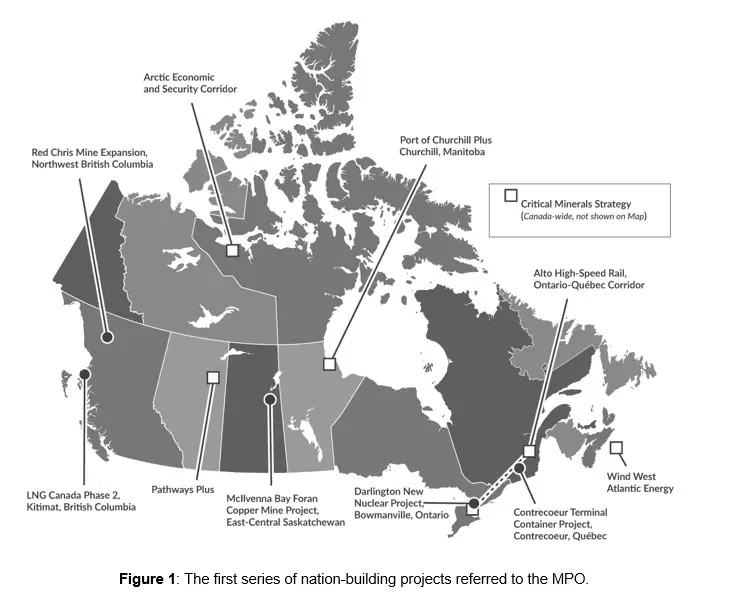

In September 2025, the government announced the first series of projects referred to the MPO for review. These include LNG Canada Phase 2 in Kitimat, the Darlington New Nuclear Project in Bowmanville, the ContrecSur Terminal Container Project in Québec, the McIlvenna Bay Foran Copper Mine in Saskatchewan, and the Red Chris Mine Expansion in Northwest British Columbia. Other initiatives such as the Arctic Economic and Security Corridor, Pathways Plus in Alberta, and the Port of Churchill Plus in Manitoba demonstrate the MPO's mandate to integrate critical mineral development, clean energy transmission, and trade infrastructure under a unified national strategy (seeFigure 1).

Historically, large projects have been subject to multiple sequential reviews under separate federal and provincial statutes, often leading to prolonged delays and inconsistent outcomes. This new approach introduces a coordinated model that allows for parallel reviews, harmonized assessments, and streamlined federal-provincial cooperation agreements.

The MPO is directed to evaluate projects according to defined criteria, including their contribution to national autonomy, resilience, and economic benefit; their likelihood of successful execution; their potential to advance Indigenous participation; and their alignment with clean growth and climate objectives. The office is supported by an allocation of $213.8 million over five years, enabling it to recruit experts in finance, law, project management, and regulatory analysis. It will also host an Indigenous Advisory Council to ensure that Indigenous perspectives are integrated into the early stages of project planning and review.

Streamlining approvals: One project, one review

Budget 2025 operationalizes the government's policy goal of "one project, one review," establishing formal cooperation agreements under the Impact Assessment Act between the federal government and each province and territory. This initiative was reaffirmed in the Speech from the Throne, where the government committed to realizing this objective within six months, and further endorsed by Canada's First Ministers on June 2, 2025, who agreed to "work together toward efficiently and effectively implementing 'one project, one review' with the goal of a single assessment for all projects."

These cooperation agreements are intended to clarify how federal and provincial governments will work together on assessments of major projects, providing greater transparency and predictability for proponents, Indigenous Peoples, and stakeholders. They are designed to ensure timely and coordinated reviews for projects of national interest while maintaining environmental protection and upholding Indigenous rights. The agreements also aim to signal to investors that all levels of government are committed to a unified and efficient approach to major-project development in Canada.

Leveraging new authorities under sections 16 and 31 of the Impact Assessment Act, introduced in 2024, cooperation agreements may allow for joint assessments or substitution to a single harmonized process that draws on the best available provincial and federal expertise. They may also enable early-stage assessment decisions and full substitution to a provincial process that satisfies both federal and provincial requirements. Importantly, these arrangements do not alter or diminish the duty of proponents, provinces, territories, or the federal government to consult fully with Indigenous Peoples whose rights may be affected.

This model represents a broader shift toward cooperative federalism in environmental governance. It acknowledges that while the federal government retains authority over interprovincial and transboundary impacts, provinces bring valuable expertise and regulatory experience. By formalizing these partnerships, Budget 2025 aims to reduce duplication, enhance administrative efficiency, and strengthen confidence in Canada's ability to deliver large-scale infrastructure projects on time and within budget.

Together with the MPO, which serves as a single-window authority for coordinating reviews and approvals, the "one project, one review" framework is intended to streamline Canada's overall approach to major project delivery while maintaining rigorous environmental and Indigenous consultation standards.

Interprovincial transmission and the One Canadian Economy Act

Interprovincial transmission development lies at the heart of the federal government's ambition to create a unified, reliable, and low-carbon electricity system. Budget 2025 positions east-west transmission as both an economic and nation-building priority, recognizing that modernizing and integrating interprovincial grids is essential for achieving Canada's net-zero objectives and for unlocking regional clean-energy potential. The Budget introduces the One Canadian Economy Act, a legislative framework designed to remove internal trade and labor barriers that impede the development of large-scale, interprovincial infrastructure.

The Act provides a statutory foundation for harmonizing regulatory and permitting standards across provincial and territorial boundaries. Its objective is to establish consistent, transparent, and efficient processes for approving projects that cross jurisdictions, including electricity interties and clean-energy corridors. By promoting regulatory alignment, the Act seeks to address one of the most persistent structural challenges in Canada's infrastructure development—the fragmentation of authority among federal, provincial, and territorial bodies.

Budget 2025 expressly identifies several priority initiatives that exemplify this interconnection agenda. These include potential interties between New Brunswick and Nova Scotia, transmission cables linking Prince Edward Island and New Brunswick, and expanded hydroelectric generation capacity through Churchill Falls and Gull Island. Together, these projects would improve grid reliability across Atlantic Canada, support industrial electrification, and reduce regional disparities in electricity costs. The Eastern Energy Partnership referenced in Budget 2025 envisions further collaboration among Atlantic provinces and Quebec to strengthen cross-border infrastructure and expand access to low-carbon electricity from hydroelectric and wind resources.

Beyond the Atlantic region, the federal government has also highlighted opportunities for large-scale infrastructure development in Northern and Western Canada, including clean-energy corridors that would connect remote communities and resource projects to the national grid. This broader interconnection strategy reflects a view of transmission as a catalyst for economic diversification, resource development, and regional equity.

The One Canadian Economy Act complements several other legislative and institutional reforms announced in Budget 2025. It is closely tied to the Building Canada Act and the establishment of the MPO which serves as a single-window authority for coordinating approvals, financing, and intergovernmental reviews. Under the new framework, the MPO will be empowered to designate transmission and energy-infrastructure projects as being in the national interest and to coordinate their assessment under the principle of "one project, one review." This mechanism is intended to streamline regulatory processes, reduce duplication between federal and provincial assessments, and accelerate the delivery of major interprovincial projects while maintaining environmental and Indigenous rights protections.

To further enable investment, Budget 2025 expands the statutory capital of the Canada Infrastructure Bank (CIB) from $35 billion to $45 billion, authorizing it to invest in projects referred by the MPO, including electricity interties and clean-energy corridors. This aims to strengthen the CIB's capacity to participate in blended-finance arrangements that combine public and private capital, reducing project risk and improving financial feasibility. Budget 2025 also confirms that the Canada Indigenous Loan Guarantee Corporation will be empowered to provide guarantees supporting Indigenous equity participation in new transmission and renewable-energy projects, ensuring that economic benefits are shared equitably among partners.

In practice, the successful implementation of this framework will depend on sustained coordination between the federal and provincial governments and regulators, Indigenous governments, and industry stakeholders. If these relationships are effectively managed, the One Canadian Economy Act could become a cornerstone of Canada's transition toward a modern, interconnected, and low-carbon energy system.

Clean Electricity Investment Tax Credit and Climate Competitiveness Strategy

A central pillar of Budget 2025 is the introduction of the Clean Electricity Investment Tax Credit (CEITC), a 15 percent refundable tax credit for capital investments in low-emitting electricity generation, energy storage, and interprovincial transmission infrastructure. The credit applies retroactively to projects that began after April 16, 2024, and extends eligibility to Crown corporations, municipalities, Indigenous-owned entities, pension funds, and federal institutions such as the CIB and the Canada Growth Fund. By expanding eligibility and removing earlier restrictions on Crown corporations, the federal government seeks to broaden access to investment support for major public-sector and mixed-ownership projects.

The CEITC is part of a wider suite of Clean Economy Investment Tax Credits, which include incentives for clean hydrogen, carbon capture and storage, clean-technology manufacturing, and waste-to-energy systems, ranging from 15 to 60 percent depending on the technology and emissions profile. Together, these measures are designed to establish a consistent, rules-based framework for clean-energy investment that complements environmental regulations and federal fiscal policy.

In parallel, Budget 2025 introduces a Climate Competitiveness Strategy, intended to provide greater regulatory clarity on greenhouse gas management, strengthen industrial carbon pricing, and reinforce Canada's position in the global transition to a low-carbon economy. These investment tax credits operate alongside environmental standards and compliance mechanisms, ensuring that eligibility is contingent not only on the technology deployed but also on adherence to labor, emissions, and reporting requirements. This approach aligns fiscal incentives with broader policy goals—advancing decarbonization while supporting economic growth and industrial competitiveness.

For project developers and investors, these measures are expected to provide predictable conditions that support long-term planning and capital allocation, particularly in sectors such as renewable generation, transmission, and storage. Collectively, they reflect the federal government's intent to use targeted fiscal tools to accelerate clean-energy deployment while strengthening Canada's industrial and regulatory foundation for the energy transition.

The Gowling WLG Tax Group has published its analysis of the tax measures under Budget 2025, available here: Federal budget 2025 Investment in uncertain times | Gowling WLG.

Procurement reform and domestic preference

Budget 2025 also advances procurement reforms under the Buy Canadian Policy, mandating that federal departments, agencies, and Crown corporations prioritize Canadian suppliers for infrastructure and energy-related projects. Any exceptions require ministerial approval and are exempt from review by the Canadian International Trade Tribunal.

This policy introduces important legal and trade considerations. While it supports domestic manufacturing and job creation, it must be implemented in a manner consistent with Canada's international trade obligations under agreements such as the Comprehensive Economic and Trade Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership.

Indigenous rights, consultation, and capacity building

Budget 2025 includes new measures related to Indigenous participation in major project development and recognizes the constitutional protection of Indigenous rights. The MPO's mandate includes consideration of how projects may involve Indigenous Peoples and support opportunities for economic participation.

To operationalize this, Budget 2025 provides $10.1 million over three years to Crown-Indigenous Relations and Northern Affairs Canada to support meaningful participation of Indigenous rightsholders in consultations for projects designated under the Building Canada Act. It also allocates $40 million over two years to Indigenous Services Canada, through the Strategic Partnerships Initiative, to enhance Indigenous capacity for engagement prior to project designation. These measures are accompanied by funding for the Indigenous Advisory Council within the MPO.

The policy framework is grounded in Section 35 of the Constitution Act, 1982, and aligned with the principles of the United Nations Declaration on the Rights of Indigenous Peoples. By embedding Indigenous consultation funding into the capital planning process, Budget 2025 seeks to prevent procedural conflicts and ensure that Indigenous governments are positioned as genuine partners rather than afterthoughts in project development.

The establishment of consultation protocols and Indigenous-led resource centers will also provide a more structured avenue for participation, reducing the risk of legal challenges that often arise from insufficient consultation. The government intends these new reforms to signal a more proactive compliance approach that integrates constitutional obligations directly into the infrastructure governance framework.

Legal and regulatory implications

The reforms introduced through Budget 2025, if implemented as intended, would represent one of the most comprehensive recalibrations of Canada's infrastructure governance framework in decades. Taken together, the combined effect of the Building Canada Act, the Clean Electricity Investment Tax Credit, and the Capital Budgeting Framework establishes a more integrated model of fiscal, regulatory, and constitutional compliance.

Projects undertaken under this framework will need to navigate complex interjurisdictional issues involving environmental assessments, Indigenous consultation, and trade compliance. At the same time, the new institutional architecture offers clearer procedural pathways and greater transparency.

By consolidating reviews and embedding Indigenous participation, the federal government aims to reduce litigation risk, accelerate timelines, and foster greater investor confidence in the predictability of Canadian regulatory processes.

Conclusion: Toward a modernized infrastructure regime

Budget 2025 lays the groundwork for a market-driven, cohesive, and forward-looking infrastructure regime. Its measures combine financial incentives, regulatory streamlining, private sector rigour and constitutional obligations into a unified strategy designed to accelerate the development of critical energy and transmission projects.

The success of this strategy will depend on sustained intergovernmental coordination, rigorous regulatory oversight, and continuous engagement with Indigenous governments and affected communities. If effectively implemented, the framework will help position Canada as a global leader in clean infrastructure development while upholding the rule of law, fiscal accountability, and environmental stewardship.

In legal and policy terms, Budget 2025 is more than a fiscal document. It is a statement of intent that aims to redefine how Canada builds its future, balancing growth with governance, ambition with accountability, and innovation with inclusion.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.