- in Asia

- in Asia

- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Automotive, Business & Consumer Services and Consumer Industries industries

Introduction:

With high interest rates and extensive market shifts, insolvency and bankruptcy are concepts on the minds of many, including commercial landlords. The possibility of tenant insolvency can create uncertainty and unease for landlords leasing to commercial tenants on the brink of financial collapse.

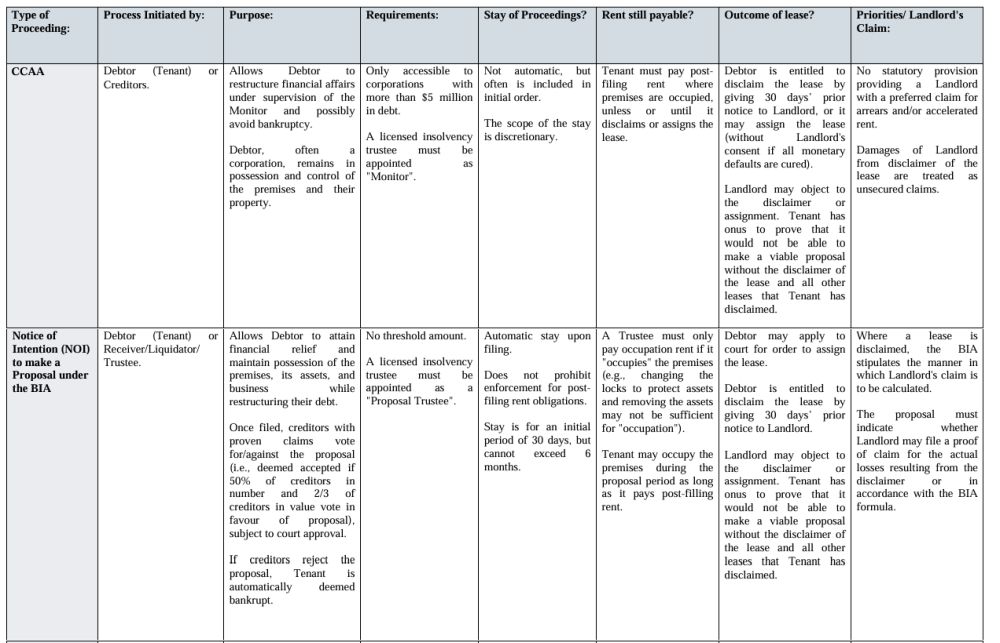

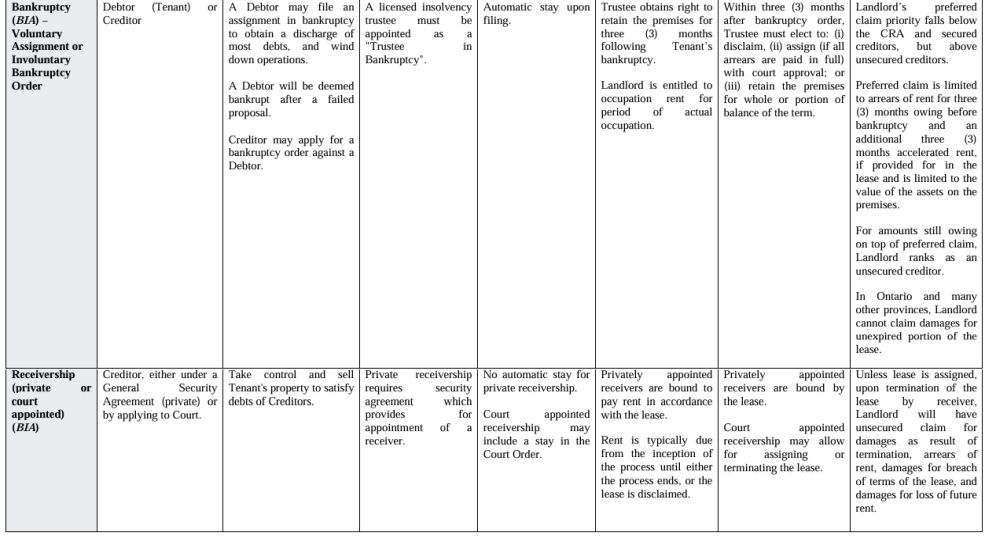

In this article, we compare the four insolvency and restructuring proceedings which may apply to a commercial tenant under the Bankruptcy and Insolvency Act ("BIA") and the Companies' Creditor Arrangement Act ("CCAA"). We further outline best practices for commercial landlords and explain the nuances of each proceeding, including its purpose, the requirements for a tenant to proceed, whether there may be a stay of proceedings, whether rent is payable, potential outcomes relating to the lease, and the priority ranking of a landlord's claim.

By gaining an understanding of the nuances of each proceeding, commercial landlords can anticipate the issues, understand their rights, and plan for the future.

A Comparative Chart of Bankruptcy and Insolvency Proceedings in Commercial Leasing:

Best Practices for Commercial Landlords:

When Suspecting Your Tenant is in Financial Difficulty

- Promptly Draw on Letters of Credit and Apply Deposits: Promptly draw on letters of credit and apply deposits if your tenant is in arrears and if you become aware that your tenant may be facing financial difficulty.

- Take Action Against Lease Guarantors and Indemnifiers: Take action against any guarantors or indemnifiers upon default of the tenant.

- Consider a Surrender of the Lease: Consider if the premises are marketable, the amount of rent being paid, and if a voluntary surrender would make sense for both landlord and tenant.

When Your Tenant is involved in an Insolvency Proceeding

- Ensure Comprehensive Information Flow: Take necessary steps to ensure you receive all information available to creditors (e.g.: ensuring the Trustee or Monitor has your contact information and your lawyer receives the relevant documents).

- Address Key Questions:

-

- Type of Proceeding: What type of legal proceeding is it?

- Location of the Proceeding: Where is the proceeding taking place (i.e.: in/outside of Canada)?

- Important Dates: Identifying critical dates, such as court hearings or document submission deadlines, is vital. (i.e. when is the next court hearing, deadline to submit documents)

- Effective Communication with Court Officers: Promptly communicate any concerns or legal issues to court officers.

- Timely Submission of Proof of Claim: Ensure that any proof of claim is submitted within the deadline.

- Leasing Plan for Tenant Disclaimer: Prepare a leasing plan in case the tenant disclaims the lease.

A special thanks to Catherine Francis, a Partner in our Insolvency practice, and our former Articling Student, Kaylee Rich, for their assistance with this article.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]