- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy industries

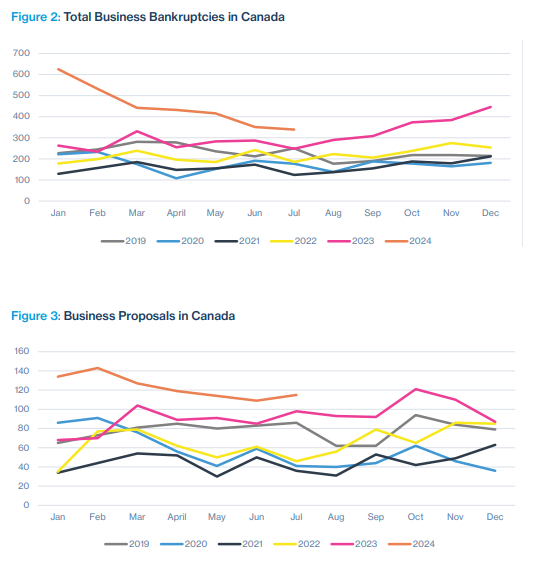

In this issue of Insolvency Now, we report on the data trends we are seeing at this point in 2024 in comparison with when we first started tracking data in 2019. Overall, we are seeing a marked increase in filings. However, we are not seeing the level of sector-specific distress that might have been expected in these filings. For example, we have not yet seen an impact on commercial real estate filings resulting from rising interest rates and changing work patterns that have affected commercial real estate values and occupancy rates. This effect will likely take time to be reflected in the data, with delayed response times to interest rate increases and cuts. In addition, we aren't seeing a clear-cut pattern in retail and hospitality – sectors that continue to face significant challenges resulting from increased online competition and the lingering effects of the pandemic.

While we do not report on personal insolvencies in Insolvency Now, we do note that personal insolvency rates have risen faster than corporate rates, and this too will have an impact on various corporate sectors. The inflationary pressures combined with debt accumulation during the pandemic and repayment terms coming due are likely significant contributors to the increase in filings. In particular, mortgage renewals at higher rates were prior to the Bank of Canada's recent rate cuts.

We note that Q1 and Q2 of 2024 operated quite differently: Q1 experienced most of the increases in filings, whereas Q2 had returns to similar levels in the same quarter in 2023.

In this issue of Insolvency Now, we also report on business openings and closings in the current period and compare this data with earlier data. Although Q1 2024 appeared to suggest an increase in insolvency filings across the board, we also saw an increase in net business openings in that quarter. In contrast, Q2 2024 experienced a drop in insolvency filings and a net decrease in business openings. This trend leads us to question whether there are, in fact, enough filings and it illustrates the importance of corporate insolvency and restructuring procedures for encouraging entrepreneurial risk-taking.

Related to this observation, in this issue of Insolvency Now, we discuss the role and impact of stigma associated with corporate restructuring. The stigma associated with bankruptcy has been much explored in the context of consumer bankruptcy – that is, whether it still exists and how it affects individual debtor decisions to file. Much less has been written in the corporate restructuring context. Yet in our practice we are often confronted with this issue in the form of reluctance by a corporate debtor to initiate restructuring proceedings or denial that it is necessary.

In this issue, we highlight the key points that are often raised in relation to corporate bankruptcy stigma and the associated reluctance to use restructuring procedures, despite the benefits and, particularly, the potential downside of not filing. Our commentary underscores the importance of addressing stigma to increase the effectiveness of reorganization legislation in the Canadian context and to improve outcomes across the board. In advising clients, our goal is to offer a set of restructuring options that can be understood as strategic tools for proactive recovery rather than as a mark of failure.

Davies Insolvency Now is a publication authored by Natasha MacParland, Robin B. Schwill and Stephanie Ben-Ishai that analyzes key trends and developments in the insolvency and restructuring community.

Misplaced Restructuring Stigma

Before considering the data on insolvencies and openings and closings, we open this issue of Insolvency Now by considering the key aspects of misplaced stigma related to restructuring that could be feeding into a debtor's hesitation to initiate reorganization proceedings.

KEY ASPECTS OF STIGMA OR HESITATION TO FILE

We have seen stigma explained and manifested both in academic studies and in our experience advising corporate debtors as follows:

— Perception of Filing as a Last Resort. Reorganization is often viewed as a last resort.

— Moral and Emotional Dimensions. This stigma is not just about financial failure but also about a perceived loss of integrity and responsibility.

— Misinformation and Lack of Information. Some debtors avoid filing owing to a lack of understanding or misinformation about its benefits and processes. This includes the misconception that initiating a filing, in particular filing under the Companies' Creditors Arrangement Act, is solely for liquidation, not reorganization.

— Impact on Relationships. There is often a fear that initiating proceedings can lead to the loss of relationships with creditors, suppliers and even customers, which further discourages businesses from considering this as an option.

— Cultural Perceptions. There is a broader cultural perception that reorganization can be seen as synonymous with failure. This perception needs to be addressed for reorganization to be a more viable option for struggling businesses. DETRIMENTAL IMPACTS OF STIGMA The perceptions of stigma associated with reorganization can significantly neuter the ability of reorganization tools to preserve value as intended. The following are some examples:

— Delayed Filing

> Timing Issues. Corporate debtors may delay filing until they are in dire financial straits. This delay can result in the depletion of valuable assets and resources that could have been preserved if reorganization options had been considered earlier. Even in the context of a liquidation, delayed filings often result in chaotic asset liquidation, reducing overall value.

> Reduced Options. By the time businesses consider filing, their financial situation may have deteriorated to a point at which reorganization is no longer viable, leaving liquidation as the only option.

Stigma and Moral Dimensions

> Failure. Some debtors associate the need to reorganize with failure, which discourages them from considering it as a strategic option. This stigma affects their decision-making process.

> Emotional Toll. The emotional burden of perceiving the initiation of a filing as a failure can lead to stress and poor decision-making, further exacerbating financial difficulties.

— Underutilization of Legal Tools

> This lack of understanding prevents businesses from taking advantage of a wide range of constantly evolving reorganization tools, including reverse vesting transactions and CBCA plans of arrangement, designed to help businesses maximize value that can be preserved. Various aspects of insolvency legislation are specifically designed to facilitate reorganization rather than liquidation. However, the "last-resort" mentality leads to missed opportunities for viable businesses to reorganize and continue operating.

Rebranding Corporate Reorganization

Strategic Approach. A strategic-focused rather than a stigma-focused approach to corporate reorganization would help avoid a business descending into crisis mode and would enable proactive management of financial distress. Corporate debtors can address issues before they become insurmountable, leading to better outcomes. Early filing can prevent the need for rushed asset sales at depressed prices, which often occur when businesses wait until they are in dire straits. Rebranding reorganization procedures from a last resort option to a strategic option can significantly enhance the effectiveness of insolvency legislation. This shift in perception can lead to earlier intervention, better asset preservation and more successful reorganizations, ultimately benefiting both debtors and creditors

Preservation of Assets. Reorganization legislation is designed to provide a framework for early intervention, which can help preserve assets and maximize their value for both debtors and creditors.

Economic Stability. Effective use of reorganization laws can contribute to broader economic stability by allowing businesses to restructure and remain operational, thereby preserving jobs and economic activity.

Negotiation Framework. Shifting the focus away from stigma also provides a more effective negotiation framework through which debtors can compel concessions from creditors, potentially leading to more favourable terms and a path to recovery. Viewing reorganization as a last resort means this strategic tool is underutilized.

Fresh Start. One of the goals of laws in this area is to provide a fresh start for some businesses, enabling them to overcome short-term challenges and return to profitability. Stigma can work to prevent businesses from achieving this fresh start where that is, or was, a possibility.

KEY TAKEAWAYS

As restructuring lawyers, we have a key role to play in reducing stigma and emotional barriers. By rebranding reorganization as a strategic tool to help normalize its use we can help reduce the stigma and emotional burden associated with it. This can make more debtors willing to consider it as a viable option. By emphasizing the strategic benefits, such as preserving jobs and maintaining economic stability, the moral and emotional dimensions can be reframed in a more positive light. Reducing the stigma associated with reorganization allows corporate debtors to make more rational decisions based on financial realities rather than emotional fears. This can lead to better outcomes for all stakeholders.

PROMOTING EFFECTIVE COUNSEL

Many of us regularly speak to the media and, to this end, should consider promoting success stories – for example, highlighting successful reorganizations to demonstrate the positive outcomes of using insolvency legislation strategically. We can also continue to provide the public and the media with accurate information about the benefits and range of restructuring options available, correcting any misconceptions.

We would be happy to assist you or your clients in better understanding the way that reorganization can serve as strategic option rather than a last resort and provide a supportive legal environment to better utilize the appropriate regulatory framework to preserve value and achieve successful outcomes.

In the following section, we move on to consider the insolvency data trends for the first half of 2024.

Insolvency Data for First Half of 2024: Highlights

As shown in Figure 1, in 2023 we saw a total of 4,810 filings. In the first five months of 2024, we have already seen 3,084 filings. With June and July included, there have been 3,998 filings so far in 2024. January had 759 filings, the highest of any month since tracking started in 2019. As shown in Figure 2, in 2023, the average monthly number of bankruptcy filings was 309, whereas in 2024, the average monthly bankruptcies through July totalled 448.

:

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.