- with readers working within the Construction & Engineering industries

- in Canada

- within Family and Matrimonial topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit, Insurance and Healthcare industries

Overview

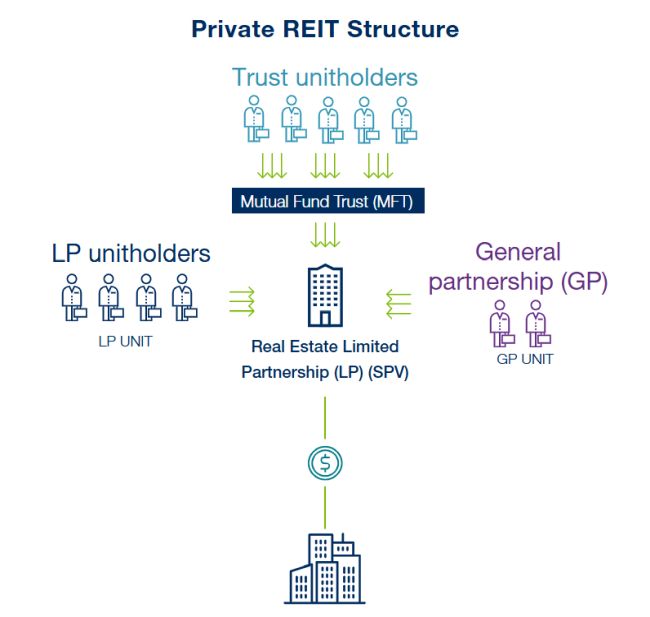

When thinking Real Estate Investment Trust, or REIT, most picture a large public company with an extensive portfolio of assets. However, a private real estate investment trust (Private REIT) can be an excellent vehicle for commercial real estate investment. Real estate investors can create a Private REIT by optimizing the use of a mutual fund trust (per the Income Tax Act).

A Private REIT is a great alternative to the standard limited partner (LP)/general partner (GP) investment structures that are commonly used in the real estate investment sector as there are many benefits of the Private REIT that are not available with any other structure.

There is not much involved in converting a standard LP/GP structure to a Private REIT. Typically, minimal changes are required to be made to the limited partnership agreement. Private REITs are set up as mutual fund trusts (MFTs) which make an election to be treated as such within 90 days after the end of its first taxation year. MFTs must also have 150 distinct holders of units, with each holding a required minimum value of units, within 90 days after the end of its first taxation year.

Why create a Private REIT?

- Private REITS offer a favourable tax structure not afforded to standard corporations as they are typically deemed "flow-through" vehicles.

- Units of Private REITS are eligible for registered plans (RRSP, RESP, TFSA, etc.) which increases the pool of investor capital.

- Private REITs are efficient holding vehicles for "non-reporting" issuers in Canada due to their tax efficiency and simplicity of creating eligibility for registered plans without having to go through the cost of creating a public company.

- As the pool of investor capital is larger, more funds are available and can be used to maximize rents, develop properties, fund real estate expansion and other business strategies. Private REITS allow businesses to get more out of their hard assets by increasing cash flow without having to liquidate assets. Ownership and control stay with the business, and unit sale cash flow can be used to fund expansion and other business growth strategies.

- Private REITs do not have to meet the disclosure (including financial) obligations of publicly traded REITs.

- Converting an existing structure to a Private REIT can also be used for retirement, exit, and succession planning.

- The general partner continues to control the management of the hard assets; all the unitholders are passive investors.

- The Private REIT documents can be drafted to allow for an IPO and the conversion to a public REIT.

A typical private REIT structure would be as follows:

Legal concerns

While there are many benefits to creating a Private REIT, there are also some considerations from a legal perspective:

- Although private REITS are not regulated by corporate statute, the market demands that trust units have similar features to shares of a corporation such as shareholder protection.

- Managed by a board of trustees that have a similar function as a board of directors - slightly higher duty of care.

- Can be structured to hold US/International real estate.

- Private REIT units are retractable by holder (subject to reasonable limits).

- Large number of investors introduces complexity from a securities law compliance perspective, and clients should be aware of exempt market dealer requirements, investment management regulations and securities filing obligations.

BLG's Corporate Group, Investment Management Group, Tax Group and Real Estate Group can help those already investing in real estate get more out of their real estate. Reach out to any of the key contacts below for more information on reorganizing SPV/LP into Private REITs or for help with navigating the regulatory and tax environment applicable to REITs and MFTs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.