- within Compliance topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Healthcare and Law Firm industries

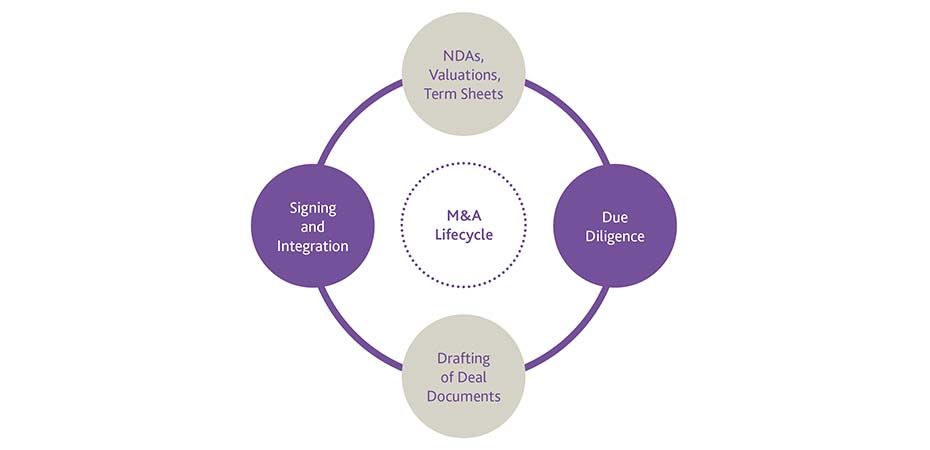

Our mergers and acquisitions (M&A) Lifecycle series has looked at the key stages of an M&A transaction, from the inception of the deal and term sheets, to the process of due diligence and the drafting of principal documents required. For this final part of our series, we will be focusing on what happens when deal documents are drafted and ready for signature, the completion process and post-completion actions parties may want to consider.

Signing and completion

Once the transaction documents have been drafted, negotiated and agreed between the parties to a transaction, they will need to be executed to become legally binding documents. Whilst this may be expected to be a simple process, it can often be complex, with schedules to be completed and ancillary documents often to be signed simultaneously, with timing also to be considered. In particular, parties may want to consider the following:

- Ancillary Documents – The parties to the transaction will need to ensure all required ancillary documents are prepared and ready for signature, alongside the key transaction documents. These documents may include licensing and transitional services agreements, corporate approvals for the buyer, seller and target company approving the transaction, new articles of association (or Memorandum of Association for onshore UAE entities) and various forms for filing with relevant authorities.

- Signing Mechanisms – Signing formalities will need to be considered, i.e. do the documents require signing in front of independent witnesses, how many directors of a company are required to sign them or is an authorised representative being appointed as a signatory. Location specific requirements will also need to be considered, for example ensuring any local share transfer documents are signed in front of a notary for onshore UAE entities or ensuring documents are signed in wet-ink for filing purposes in certain jurisdictions.

- Timing – Signing and completion of a transaction can often be split to allow for various conditions to be met prior to completion. The timing of both signing and completion will need to be considered, and the completion process and conditions carefully drafted to avoid any disagreement between the parties as to the mechanics to enable completion. In a lawyer managed process, documents will often only be dated once both parties agree they have seen everything they require to complete the signing process (or to proceed to completion of the transaction if this is simultaneous with signing). It is also critical to clearly define the trigger for completion (and payment), including timing of filings and the point at which the sale is completed – i.e. prior or after payment of the purchase price (this is particularly relevant in relation to UAE onshore or Abu Dhabi Global Market (ADGM) share transfers, which are subject to approvals from the relevant authority).

Post-completion integration and actions

Whilst efforts are often focussed on getting a transaction across the line, there are often many other matters, both legal and commercial, that both parties should focus on post-completion. In light of this, it is important to focus on not only what happens during a transaction, but also the landscape post-transaction.

Once a deal is complete, a buyer is likely to be focussed on taking control of the new business and (if required) integrating this into its current corporate group. Whilst business requirements often take precedence at this stage, well-advised buyers and sellers, should also be reminded of the following:

- Due diligence / rectification – Due diligence providers will not always recommend every issue they come across be rectified pre-completion of a transaction, particularly where the risks related to such issues are under a client's risk threshold. Instead, they may recommend certain actions be taken post-completion. Buyers should revisit the due diligence reports/recommendations and implement recommendations to 'tidy-up' the target company. These may include updating commercial and employment agreements and updating policies and procedures to ensure these conform with the buyer's corporate group or seeking registration of previously unregistered intellectual property (IP).

- Filings – A buyer should also be conscious of any post-completion filings or updates to records it needs to make if these are not made on Completion itself. These may include updates to beneficial owners of the target company, tax filings (jurisdiction dependent) and updating of statutory registers (including any register of members).

- Transaction document triggers – The transaction documents are likely to include dates which trigger a limitation of the rights of a buyer or an obligation of the buyer or seller. The buyer and the seller should remain cognisant of these. For example, the buyer may have a cut-off for bringing or notifying the seller of a warranty claim or cut-off dates for preparing completion accounts or earn-out payments. Sellers may also have some conditions to meet post-completion (within a certain timeframe) which may be contractually agreed in the transaction documents.

Final remarks

Whilst the completion of an M&A transaction marks the culmination of months, and sometimes years, of negotiation, it is by no means the end of the process. Post-completion activities, such as due diligence rectifications, filings and compliance with transaction document triggers, play a vital role in ensuring the ongoing success of the deal. The integration of the newly acquired business into the buyer's existing corporate structure requires careful planning and execution. By taking the right steps after completion, both parties can maximise on the value of the transaction and mitigate any lingering risks.

Gowling WLG is not only well-placed to assist with all aspects of M&A transactions and is consistently ranked for M&A work across the globe, but we also regularly advise on legal aspects of post-completion integration.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.