Welcome to the September edition of Blakes upRound, a

regular publication from the Blakes Emerging Companies &

Venture Capital (EC&VC) group that highlights legal

developments relevant to venture investors and emerging companies

and provides concise insights on recent trends and market

developments.

The Blakes EC&VC group is a nationwide practice with lawyers in

Toronto, Calgary, Vancouver and Montréal providing

transactional and ongoing legal assistance to some of the most

dynamic emerging companies in Canada and venture investors from

Canada, the United States and beyond. As a full-service business

law firm, Blakes provides advice on all aspects of Canadian law

relevant to our clients. Our EC&VC practice includes Blakes

Ventures, an innovative service offering to support the entire

emerging company ecosystem, and Nitro, our legal support program

for early-stage companies and founders.

In this Edition

- Secondary sales and alternative options for companies seeking liquidity

- Cybersecurity insights, the B.C. government's plan to tax cloud services and other need-to-know topics

- Canadian venture financing continues to have a slow year, but certain industries see growth

Market Insights

Secondary Sales 101 —

When a tech worker joins a startup, the two sides usually strike a

bargain in which the employee accepts a reduced salary in exchange

for a stake in the company's upside. This bargain is vital to

the success of venture capital-backed companies. The company

preserves precious cash to fuel growth, and the employee gets

rewarded upon an exit (an IPO or sale of the business) —

typically by exercising previously granted options that enable them

to purchase shares at a fraction of their current value and,

thereby, participate in the exit event as a shareholder.

However, exits can be a long time coming. The significant growth of

private capital as an alternative to seeking funding in the public

markets means that, on average, companies are staying private

longer. On average, they're staying private over twice as long

as in 2000. This creates a situation in which founders and

employees hold a valuable but illiquid, and possibly volatile,

asset. Reasonably, at some point while the company remains

privately held, these individuals may want to realize some of the

value of the company's success and diversify their investment

portfolio. Read more in our Blakes Bulletin: Secondary Sales 101.

Legal Update

Founders and investors may find the following insights from our Blakes colleagues helpful and instructive:

- Cybersecurity — As ransomware attacks become more prevalent, businesses should develop a strong cybersecurity program to enhance information security accountability while also upholding data protection and privacy obligations. See our Blakes Bulletin: Protecting Your Organization from Ransomware Threats: New Guidance from Ontario's Information and Privacy Commissioner regarding guidance from the IPC, and our fourth annual Canadian Cybersecurity Trends Study for valuable information to help you develop or update your cybersecurity-preparedness strategy.

- AgTech — With scientific discovery advancing at an unbelievable pace in the field, agtech companies are regularly seeking strategic legal advice to protect their inventions. An overarching IP strategy will contribute to increasing revenue growth while protecting market share over the long term. This approach is equally important for the large seed company developing new insecticide proteins and the agtech start-up using satellite technology to boost crop yields. Read Blakes Bulletin: AgTech: Four Steps to a Winning IP Strategy to find out how you can build a sound IP strategy of your own.

- B.C. Cloud Services Tax — In response to Hootsuite Inc. v. British Columbia (Finance), the B.C. government published a notice to providers and purchasers of cloud software and services. The notice states that the B.C. government intends to introduce retroactive legislation in the 2024 provincial budget that would impose tax on these services. Read more about potential impacts in our Blakes Bulletin: B.C. Update: Retroactive Legislation to Reverse Court Decision and Tax Cloud Services.

- The Metaverse — Businesses should consider the application of privacy laws to the collection, use or disclosure of personal information when providing goods or services in the metaverse. It is also important to keep in mind the unique litigation challenges a virtual environment might raise. See our following bulletins outlining key considerations. Blakes Bulletin: Key Privacy Considerations for Launching Your Presence in the Metaverse and Blakes Bulletin: The Metaverse: Litigation Challenges.

Deal Monitor

Data sourced from PitchBook.

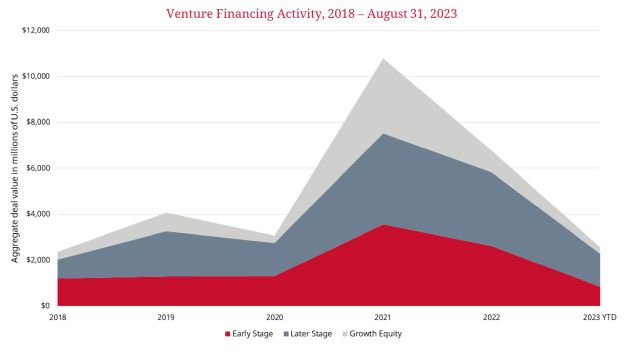

- The year-over-year decline in overall transaction activity has continued. The year-to-date dollars invested was approximately 50% lower in 2023 than the same period in 2022 (which itself was 33% lower than the same period in the record-breaking 2021 period).

- There has been a reduction in activity across all stages of investment. By some measures, earlier stage (Seed and Series A) investment has declined significantly more than the decline in later stage and growth equity investments. However, this is largely attributable to unusually strong reported activity in Series B financing rounds. Excluding that factor, the decline appears more even across all stages of financing, with seed financing rounds remaining generally stronger than Series A rounds.

- When considered by industrial sector, a different story appears. While overall deal volume was 50% lower than the same period in 2022, the energy (209%), healthcare (18%), and materials & resources (452%) sectors reported increased investment activity. However, the commercial products & services (-38%), consumer products & services (-51%), financial services (-48%) and information technology (-39%) sectors all reported significant year-over-year declines.

- In our recent transactions, we continue to see reliance on structured equity rounds and convertible notes intended to provide bridge financing. While companies are working to conserve cash, at least some investors remain willing to allow founders limited secondary participation in financing rounds to achieve some personal liquidity.

For permission to reprint articles, please contact the bulletin@blakes.com Marketing Department.

© 2025 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.