- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Healthcare industries

More Enforcement and Expanded Policy Objectives

Canada's competition and foreign investment law regimes entered 2025 with substantial momentum. After years of, at times plodding, legislative effort, sustained political and public attention had produced substantial reforms to Canada's Competition Act and Investment Canada Act. However, 12 months later, the brave new world of Canadian competition and foreign investment law enforcement is yet to arrive. Does 2025 signal an enduring status quo? Or, as new legislative tools mature, will 2026 see Canada's competition and foreign investment authorities establish new enforcement paradigms?

Matthew Boswell, the former Commissioner of Competition ("Commissioner"), was outspoken in pursuing Competition Act reform and predicting big change from the ensuing legislative victories. In September 2024, the Commissioner presented a vision for more enforcement action, which would be faster, stronger and more people-focused than before. It is much too soon to issue a final verdict; but, such change appears to be, at least, delayed. While the Commissioner forecasted a "healthy skepticism" towards mergers and a focus on those that make everyday life less affordable for Canadians, 2025 saw no new merger challenges and only two merger remedies, both in the upstream oil & gas industry. Outside of mergers, the Competition Bureau ("Bureau") brought only two new applications before the Competition Tribunal ("Tribunal") in 2025, both adding to the Bureau's long running string of drip pricing cases.

Whether emboldened Competition Act enforcement takes hold in 2026 will be the responsibility of Commissioner Boswell's successor, following his decision to step down from the role as of December 2025. An interim Commissioner is in place until the permanent appointment of his successor, which is expected in early 2026. Both Commissioner Boswell and his immediate predecessor were drawn from the Competition Bureau's own ranks; and while many of the odds on favourites to succeed Commissioner Boswell similarly already call the Bureau home, there is precedent for an external appointment.

As Canada grapples with a shifting economic landscape brought on by the U.S. government's vacillating tariff policy, what role does the government see for competition policy and where does it rank with other priorities?

The choice of new Commissioner will provide the Carney government with an explicit opportunity to respond to Commissioner Boswell's repeated appeals for a whole-of-government approach to competition. As Canada grapples with a shifting economic landscape brought on by the US' vacillating tariff policy, what role does the government see for competition policy and where does it rank with other priorities? Just over a year after the repeal of the much maligned efficiencies merger defence, will resurgent economic nationalism rekindle a desire to foster "Canadian champions"? While the Bureau has a strong record of political independence, which is expected to endure, the installation of a new commissioner provides the Canadian government with an opportunity to steer the direction of Canadian competition law enforcement for years to come.

In the year ahead, Canada's twin efforts to buttress domestic industries and to diversify international economic partnerships are likely to create both new opportunities and risks for foreign investors.

As the Canadian government develops its industrial policy in the face of geopolitical challenges, the Investment Canada Act provides a direct tool for political intervention. In 2025, the Canadian government announced the importance of economic security as a component of national security, but also hit pause on the implementation of Investment Canada Act amendments intended to strengthen Canada's ability to act against investments seen as injurious to Canada's national security. Overall, notwithstanding heightened cross-border tensions, in 2025, the government's enforcement of the Investment Canada Act remained generally consistent with past practice. In the year ahead, Canada's twin efforts to buttress domestic industries and to diversify international economic partnerships are likely to create both new opportunities and risks for foreign investors.

As we take stock of what changed in 2025 and what remained stubbornly the same, our 2026 Outlook sets it sights on the year head. We look at what is next for Canada's competition and foreign investment law enforcement landscape as governments, enforcement agencies, businesses and other stakeholders find their footing among new legislative regimes, shifting geopolitics and changing priorities.

Investment Canada Act – Is 2026 the Year for the Expanded Filing Regime?

For decades, Canada's foreign investment review regime sought to balance the need to attract foreign capital with the protection of national interests. That balance is now shifting toward enhanced oversight. Once viewed primarily as an economic tool, the Investment Canada Act has evolved into a mechanism for safeguarding Canadian sovereignty amid growing geopolitical uncertainty. The year 2025 marked a turning point: Prime Minister Justin Trudeau stepped down, and Mark Carney assumed leadership of the Liberal Party and the Prime Minister's office ahead of a spring election, leading to the appointment of a new Minister for Innovation, Science and Industry (the "Minister"), the department primarily responsible for the administration and enforcement of the Investment Canada Act. At the same time, the inauguration of President Donald Trump in the United States reignited trade tensions, sending ripples across North America and beyond. These significant political changes, coupled with the emergence of an Investment Canada Act national security regime already on a path towards reform, have created real uncertainty for foreign investors in Canada. This climate is likely to persist before conditions stabilize.

Once viewed primarily as an economic tool, the Investment Canada Act has evolved into a mechanism for safeguarding Canadian sovereignty amid growing geopolitical uncertainty

COUNTDOWN TO THE MANDATORY FILING REGIME

Following the enactment of several amendments to the Investment Canada Act in 2024, some of the most practical changes in decades are still pending. Expected to come into force in 2026, after the necessary regulations are amended or interpretative notes are developed in consultation with key stakeholders, these amendments lay the foundation for a more interventionist approach to foreign investment.

Following the enactment of several amendments to the Investment Canada Act in 2024, some of the most practical changes in decades are still pending.

The pending changes include:

- Mandatory Pre-Implementation Filings: Non-passive investments, both controlling and minority, in (to be) prescribed sensitive sectors will require notification before closing, irrespective of the nationality of the investor. This measure aims to prevent potentially injurious investments from proceeding unchecked, but also creates timing uncertainty and regulatory risk allocation considerations for transacting parties. A consultation on implementing regulations is anticipated early in 2026.

- Expanded "Call-In" Powers: Currently, only direct acquisitions of control that exceed the relevant financial thresholds are subject to a (pre-closing) net benefit review and approval under the Investment Canada Act. Conversely, foreign acquisitions of control of Canadian businesses that fall below the net benefit review financial thresholds, as well as indirect acquisitions of control, are subject only to a notification obligation, which may be filed up to 30 days after closing. As a result of incoming amendments, the government will gain authority to call in for review any direct or indirect investments by entities owned or influenced by foreign states under the net benefit review regime if it is in the public interest. This call in power can be exercised any time up to 45 days following receipt of a completed notification filing, and reflects Ottawa's growing concern about state-linked capital and its potential impact on Canadian interests.

ECONOMIC SECURITY JOINS THE NATIONAL SECURITY EQUATION

The Investment Canada Act's evolution in the last year has not been limited to procedural changes, but also reflects a conceptual shift in how Canada defines "security". On March 5, 2025, the government updated the "Guidelines on the National Security Review of Investments" (the "Guidelines"), introducing economic security as a formal consideration. The revised Guidelines also incorporate the Sensitive Technology List, published on February 6, 2025, which identifies 11 technology areas deemed critical to Canada's security and therefore may be considered sensitive for the purposes of a national security review, including artificial intelligence, quantum science, advanced energy, and aerospace, among others.

These collective changes acknowledge that opportunistic acquisitions, including transfers of emerging or novel technologies to non-allied nations during periods of economic vulnerability, can undermine Canada's innovation ecosystem and supply chains—risks that are inseparable from national security.

Trade tensions with the United States have also shaped current Canadian enforcement priorities.

POTENTIALLY HEIGHTENED SCRUTINY OF CERTAIN FOREIGN INVESTMENTS

Trade tensions with the United States have also shaped current Canadian enforcement priorities. The government's March 2025 amendments to the Guidelines explicitly cite the need to protect Canadian businesses from predatory investment behavior amid tariff-driven economic pressures. In this environment, foreign investment reviews have become a proxy for the Canadian government's broader economic strategy. Investor origin remains a critical national security consideration, with investments from U.S.-controlled purchasers in some circumstances facing heightened scrutiny. Where previously U.S.-backed investments were considered lower risk, increasing tensions have prompted the Canadian government to give greater consideration to foreign investment from its southern neighbour, although the evolution of US-Canada geopolitical and trade relationships in the coming months is likely to have an impact on enforcement risks under the ICA .

As well, investors can continue to take some comfort in the fact that very few foreign investments into Canada are subject to, let alone blocked by, national security reviews. However, with the likely implementation of the new mandatory filing regime for certain (to be) prescribed investments in 2026, the timing for national security review is expected to move forward, with more transactions investigated pre-closing, which could affect risk allocation in transaction agreements and the commercial incentives to undertake transactions in sectors known to be sensitive.

TESTING THE BOUNDS OF THE FOREIGN INVESTMENT REGIME THROUGH JUDICIAL REVIEW

This year has seen continued assertiveness from the Minister and the federal government in blocking new investments and mandating the wind-up of existing ones.

Some of these actions have been challenged through judicial review. In particular, on June 27, 2025, Canada ordered Hikvision, a Chinese surveillance camera supplier, to wind-up its Canadian operations after a national security review was initiated in November 2024 on the jurisdictional basis that the company failed to file an Investment Canada Act notification in 2015. Hikvision's judicial challenge was dismissed in September, with the Federal Court prioritizing national security interests over commercial harm.

The Federal Government's decision to order the wind-up of Hikvision signals an enhanced willingness to scrutinize existing businesses in Canada that the government considers to potentially pose a threat to Canadian national security. It also serves as a reminder of the government's broad powers to initiate and conclude reviews of foreign investments on grounds of national security—powers that have now been extended to the Minister, where previously they were only held by the Federal Cabinet.

The Federal Government's decision to order the wind-up of Hikvision signals an enhanced willingness to scrutinize existing businesses in Canada that the government considers to potentially pose a threat to Canadian national security

This decision by the Federal Court follows TikTok's ongoing judicial review of an order requiring it to cease its Canadian operations, echoing parallel actions at the time in the United States (which were later abandoned in favour of redomesticating TikTok's ownership to the U.S.). The number of judicial review challenges, such as these, is expected to increase as the new Minister (and private parties through judicial review) explore the limits of her expanded authority.

THE EVOLVING NATURE OF NET BENEFIT REVIEWS

Parallel to developments in national security, the net benefit review regime is evolving as the Minister has demonstrated unprecedented engagement with merging parties, including holding direct conversations with CEOs prior to the commencement of net benefit reviews in the case of Teck Resources Ltd.'s proposed merger with UKbased miner, Anglo American PLC—a departure from past practice. It also remains to be seen how the Minister will use her new powers to "call-in" for review investments by state-owned enterprises ("SOE") once they come into force, further amending the contours of the net benefit review regime.

Nonetheless, what appears to remain static is the continued spotlight on SOE investors (such as those from China and the UAE) as well as investments in critical minerals, oil and gas, and mining companies (including Teck and Anglo American, Ovintiv Inc.'s acquisition of certain assets of Paramount Resources Ltd., and Sunoco LP's takeover of Parkland Corp. ), a trend that will likely continue in the year to come.

ADAPTING TRANSACTION TERMS TO ENHANCED REGULATORY OVERSIGHT

The cumulative effect of these changes, and those still to come into effect, is evident. Our annual review of the 30 largest negotiated deals involving Canadian publicly listed entities between January and December 1, 2025 ("Canadian M&A Deal Study") indicates that the manner in which the Investment Canada Act is incorporated in transaction agreements continues to evolve. There was an increase in agreements containing a representation that the purchaser was not a "non-Canadian" for Investment Canada Act purposes, reaching 33% in 2025, stabilizing back to levels seen in 2023 (27%) from only 13% in 2024. While it is premature to conclude that this trend reflects a market preference for Canadian purchasers amid global tensions, it is certainly a development worth monitoring in the years ahead.

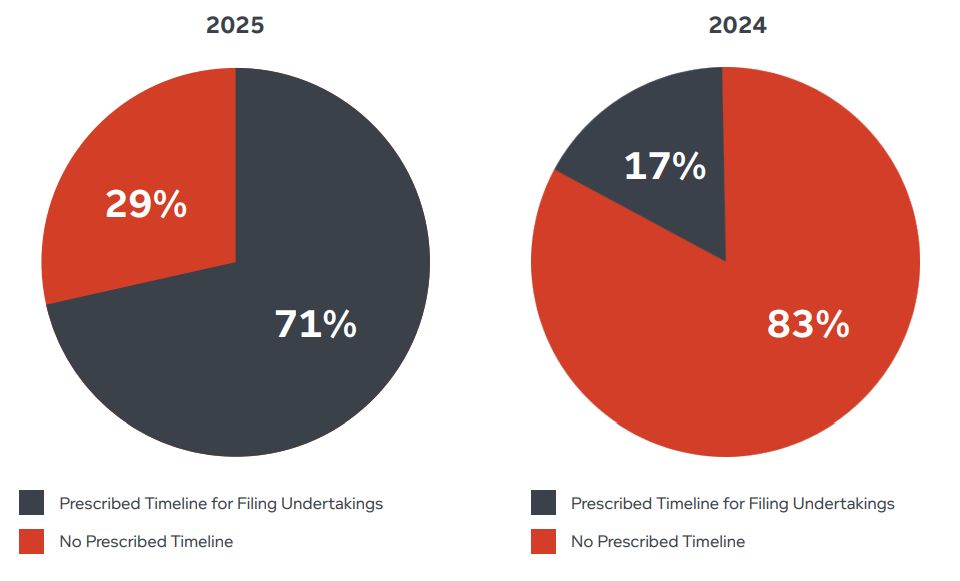

The Investment Canada Act's impact extends beyond representations and warranties as it also remains pertinent to deal timing. Of the seven deals in 2025 that included a covenant regarding filing timelines for net benefit review applications, five (or 71%) required the foreign purchaser to file undertakings within a prescribed timeline compared to only 17% of such instances in 2024. These covenants are typically seen as a means of expediting the review process by forcing an investor to engage on remedies with the Minister at a particular point in the review. Additionally, of the 20 deals with a foreign-controlled buyer, 25% included national security clearance under Part IV.1 of the Investment Canada Act as a closing condition, compared to 19% and 27% in the previous two years, perhaps signalling that the market is in a relatively settled state on codifying the assessment of national security risk in transaction agreements.

The following chart illustrates the comparison between deals that included a covenant requiring foreign purchasers to file undertakings within a prescribed timeline and those that did not, for the years 2024 and 2025.

Recent changes to the Investment Canada Act regime reflect a shift from a reactive to a proactive regulatory

posture. As the mandatory filing regime comes into force in 2026 and the Minister begins to explore the contours of the new economic security factor, the timeline and outcome of potential national security reviews, and the Investment Canada Act regime more generally, may need to become a more explicit consideration for parties in transaction agreements.

Incidence of Timeline for Filing ICA Undertakings in Merger Agreements

To view the full pdf, click here.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.