Welcome to the January issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

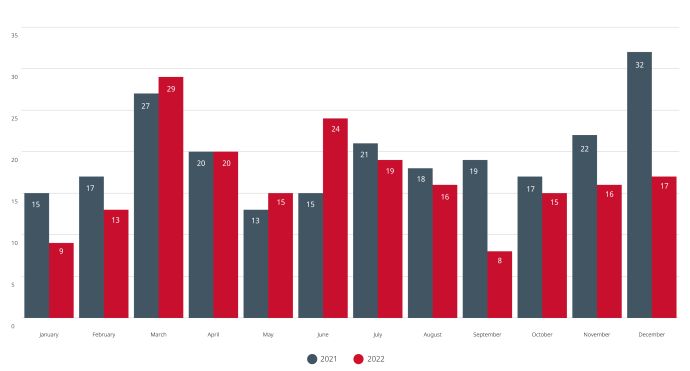

- While the number of completed merger reviews by the Bureau during 2022 started above historical averages, merger review activity slowed considerably in the final quarter of the year. Ultimately, 201 merger reviews were completed in 2022, a 14.8% decrease over the same period in 2021 (236) and the third slowest year on record (i.e., since 2012).

- The Bureau enters into a consent agreement to conclude its review of Domtar Corporation's acquisition of Resolute Forest Products Inc.

- The Bureau publishes draft guidance on the upcoming criminal prohibition of wage fixing and no-poach agreements.

- The Bureau publishes its Performance Measurement and Statistics Report for the first half of its 2022-2023 fiscal year.

Merger Monitor

December 2022 Highlights

- 17 merger reviews completed

- Primary industries: manufacturing (18%); mining, quarrying, and oil and gas extraction (12%); real estate and rental and leasing (12%); information and cultural industries (12%)

- One consent agreement (remedy) filed

- One judicial decision filed

- Six transactions received an Advance Ruling Certificate (35%); nine transactions received a No Action Letter (53%)

Annual 2022 Highlights

- 201 merger reviews completed

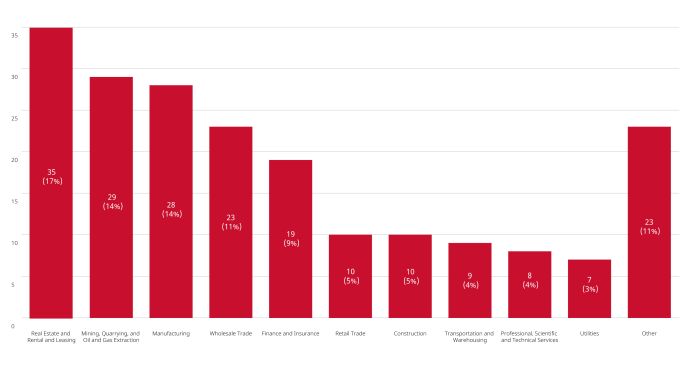

- Primary industries: real estate and rental and leasing (17%); mining, quarrying, and oil and gas extraction (14%); manufacturing (14%); wholesale trade (11%); finance and insurance (9%)

- Seven consent agreements (remedies) filed

- Two judicial decisions filed

- 103 transactions received an Advance Ruling Certificate (51%); 89 transactions received a No Action Letter (44%)

Merger Reviews Completed in 2022 by Primary Industry

Monthly Merger Reviews Completed, 2021 and 2022

Merger Enforcement Activity

Bureau appeals Competition Tribunal's dismissal of its challenge of the Rogers-Shaw merger

- On January 1, 2023, the Competition Tribunal (Tribunal) released its decision to dismiss the Commissioner's challenge to the merger between Rogers Communications Inc. and Shaw Communications Inc. The Tribunal found the transaction (i.e., the merger of Rogers and Shaw as modified by the divestiture of Freedom Mobile Inc. to Vidéotron Ltd., which would be completed prior to Rogers' acquisition of Shaw) would be unlikely to prevent or lessen competition substantially. The Bureau has appealed the decision to the Federal Court of Appeal (FCA), alleging several legal errors in the Tribunal's decision. The appeal has been scheduled for January 24, 2023, and the FCA has stayed the Tribunal's dismissal of the Commissioner's application pending the outcome of the appeal. The public will be permitted to observe proceedings at the FCA via Zoom. For more information about the decision, see our December 2022 Blakes Bulletin: Competition Bureau Loses Challenge to Rogers-Shaw-Vidéotron Mergers.

Bureau enters consent agreement in Domtar Corporation's acquisition of Resolute Forest Products Inc.

- On December 29, 2022, the Bureau announced it had reached a consent agreement with Domtar Corporation to resolve the Bureau's concerns with Domtar's acquisition of Resolute Forest Products Inc. Following its review of the proposed transaction, having determined that the transaction would result in market shares above the 35% threshold and provide Domtar monopsony power in the purchase of wood fibre in northwestern Ontario, the Bureau concluded that the transaction would likely lessen competition substantially in the supply of northern bleached softwood kraft pulp in Eastern and Central Canada and in the purchase of wood fibre from private lands in northwestern Ontario. Under the consent agreement, Domtar is required to divest one pulp mill and one pulp and paper mill.

Other Enforcement Activity

Public Prosecution Service of Canada files preferred indictment against contractors in Brandon, Manitoba for conspiracy

- On December 19, 2022, the Bureau announced that the Public Prosecution Service of Canada had filed a preferred indictment against five contractors in Brandon, Manitoba for an alleged conspiracy to allocate between themselves contracts for refurbishment of social housing units. The individuals have been charged with conspiracy to commit fraud over C$5,000 under the Criminal Code and conspiracy to allocate contracts under section 45 of the Competition Act. Under section 45(2) of the Competition Act, individuals convicted of conspiracy to allocate sales may be liable for fines up to C$25-million and imprisonment for up to 14 years, or both.

Non-Enforcement Activity

Bureau publishes draft guidance on upcoming prohibition of wage-fixing and no-poach agreements

- On January 18, 2022, the Bureau released draft guidance setting out the Bureau's views with respect to the application of the new criminal prohibition against wage-fixing and no poach agreements which comes into effect on June 23, 2023. Interested parties are invited to provide comments by mail until March 3, 2023. For more information regarding the draft guidance, see our January 2023 Blakes Bulletin: Competition Bureau Publishes Draft Guidance on Wage-Fixing and No-Poach Agreements.

Bureau publishes summary of Competition and Green Growth Summit 2022

- On January 10, 2023, the Bureau published its summary of the 2022 Competition and Green Growth Summit hosted in Ottawa on September 20, 2022. Participants at the Summit from the legal, academic, business, policy, and competition enforcement communities discussed and considered the relationship between competition policy and sustainability goals. Panels at the Summit explored the role of competition policy in helping the Government of Canada's sustainability goals and improving how Canada competes globally; practical ways to consider the environment in competition enforcement; and the role of competition enforcement in the change to a greener economy. In its conclusion, the Bureau highlighted the role of competitive markets in helping the change to a greener economy. For more on the Green Growth Summit, see the August 2022 and October 2022 editions of Competitive Edge.

Competition Bureau releases Performance Measurement & Statistics Report

The Bureau released their Performance Measurement and Statistics Report (PMSR) for the first half of its 2022-2023 fiscal year (April 1, 2022-September 30, 2022). Highlights of the PMSR include:

- Bureau received 100 pre-merger notifications filings pursuant to section 114(1) of the Competition Act and Advance Ruling Certificate (ARC) requests pursuant to section 102 of the Competition Act. This represents a decrease of 12 filings from the same period in the 2021-2022 fiscal year.

- Six Supplementary Information Requests were issued for concluded matters pursuant to section 114(2) of the Competition Act. This is relatively consistent with previous years (five were issued in this period in 2021-2022; eight in 2020-2021).

- 99% of the 70 non-complex merger reviews were completed within the Bureau's service standard, with the average duration of non-complex merger reviews being 10.03 days, slightly up from 9.99 days in the same period in 2021-2022.

- 97% of the 33 complex merger reviews were completed within the Bureau's service standard, with the average complex merger review being 30.76 days. This is down from 43.42 in the same period in 2021-2022.

Section 36 Remedies under the Competition Act

Federal Court approves settlement agreement with one defendant in condo refurbishment class action

- On December 28, 2022, the Federal Court (FC) granted the plaintiffs' motion for an order approving a settlement agreement with one of the defendants in Toronto Standard Condominium Corporation No. 1654 v. Tri-Can Contract Incorporated. The defendants were alleged to have conspired, agreed or arranged with each other to commit fraud and rig bids for condominium refurbishment services in the Greater Toronto Area, contrary to sections 45 and 47 of the Competition Act. The settlement, which represented approximately 10% of the impacted commerce won by the settling defendant, was inspired in part by the base fine described in the Bureau's Immunity and Leniency Programs Under the Competition Act publication. The Bureau calculates the base fine at 20% of the affected volume of commerce in Canada in the absence of readily accessible compelling evidence demonstrative of a more appropriate measure of the overcharge caused by the criminal conduct (10% as a proxy for the overcharge [the basis for the amount of the settlement], and 10% for deterrence and to ensure that the fine does not represent a mere licensing fee or a cost of doing business). The FC further found that the fact that the criminal fine recommended to the ONSC in related criminal proceedings (which were described in the February 2022 edition of Competitive Edge) accounted for a higher volume of commerce did not cause the settlement to fall outside the zone of reasonableness in the circumstances of this case.

Investment Canada Act

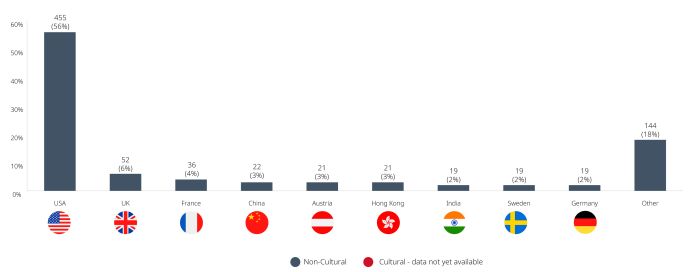

Non-Cultural Investments

September 2022 Highlights

- Zero reviewable investment approvals and 54 notifications filed (45 for acquisitions and nine for the establishment of a new Canadian business)

- Country of origin of investor: U.S. (69%); U.K. (7%); Sweden (4%)

January – September 2022 Highlights

- One reviewable investment approval and 807 notifications filed (604 for acquisitions and 203 for the establishment of a new Canadian business)

- Country of origin of investor: U.S. (56%); U.K. (6%); France (4%); China (3%); Austria (3%); Hong Kong (3%)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.