- within Technology topic(s)

- in United States

- within Litigation, Mediation & Arbitration and Law Department Performance topic(s)

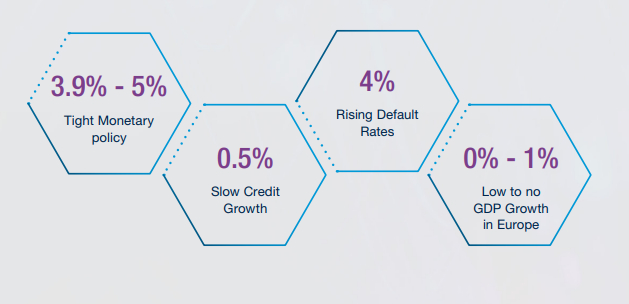

The current economic outlook in Eurozone indicates that lenders should focus on their collections operations. A maturing credit cycle compounded by cost of living increases and low-growth suggest a looming increase in Non-performing loans (NPLs).

In this article, A&M takes an in-depth look at the main reasons why lenders should be investing in their collections operations, as well as the key takeaways and next steps required to drive this optimisation and ensure success.

We are in the late stage of the credit cycle Characterised by:

Key Takeaways

1 Drivers for Optimisation

Given current economic pressures in Eurozone and changing customer behaviours, optimising collections is a sound investment. Acting now helps mitigate rising delinquencies and maintain competitiveness.

2 Benchmarking Works

Use the extensive A&M data pool of over 10,000 recovery curves to identify amount of the collection leakage and drive the optimisation of your collections operations.

3 Tangible Benefits

Optimisation and digitalisation delivers measurable results, as proven with positive benefits which shows at least 20% increase in cash collections and 15% reduction in costs.

Affordability Is Under Stress At This Point In The Credit Cycle

As traditional methods lag in efficiency and effectiveness, now is the opportune moment for lenders to optimise collections to stay ahead of incoming credit risks, and the competition.

We see a build-up of risk at this stage of the credit cycle due to levels of indebtedness, comparatively high interest rates, and inflationary pressures leading a rise in cost of living. Together, these factors are straining affordability most notably for lower- and middle-income segments.

Given this backdrop, the credit cycle is at a critical juncture with an increasing number of customers on the brink of financial distress. Proactively engaging at-risk customers through digital channels can reduce numbers lapsing into default while digitalising front-to-back collections journeys delivers hard benefits.

Moreover, the global shift towards digital banking has created a customer base that prefers digital-first interactions. This shift necessitates a move away from traditional contact methods, such as outbound calls, which are increasingly ineffective.

Instead, digital channels like email, SMS, and mobile apps, which align with customer preferences, offer more effective means of engagement and higher resolution rates. Implementing these digital strategies is crucial as delinquencies rise and the demand for resilient collection operations grows.

Challenges Faced By Lenders With Existing Collections Operations

While there is an urgent case for change, most lenders face a variety of challenges with their current operations. Taking stock of these to acknowledge the starting point for this digital transformation is critical to understanding as-is limitations and correctly scoping the overall transformation plan.

Labour-intensive And Manual Processes

Most lenders still rely heavily on manual, paper-based processes for collections, making it difficult to scale operations and respond swiftly to the increasing volume of at-risk accounts. These outdated practices not only reduce operational efficiency but also hinder the ability to implement proactive measures. Small adjustments to these processes could yield significant improvements in efficiency.

Misaligned Contact Channels

Despite customers' growing preference for digital communication channels, many collections operations continue to depend on outbound call centres. This approach is often seen as intrusive, especially for customers already facing affordability challenges, and can exacerbate their financial stress.

Furthermore, the traditional reliance on voice calls and letters has become increasingly ineffective. Customers today, particularly those who are digitally savvy, prefer to manage their finances through self-service portals and digital channels. These customers are significantly more likely to respond positively when contacted through their preferred channels, leading to improved payment rates and customer satisfaction.

Challenges Faced By Lenders With Existing Collections Operations

Regulatory Compliance Pressures

While Central Banks have given explicit guidance to lenders, few have automated these requirements into digital services. Financial institutions must adhere to specific requirements such as prior consent and opt-out options, transparency and disclosure, timing and frequency etc.

Customer-centricity Deficit

Lenders know that when it comes to at-risk customers who lapse into default, these can be categorised into several different segments:

- Those who are willing and able to pay

- Those who are willing but unable to pay

- Those who are able but unwilling to pay

- Those who are neither willing nor able to pay

Each of these segments require appropriately tailored and personalised communication, especially during financial hardships. However, current collections strategies often fail to segment customers effectively or tailor interventions to their specific needs, resulting in suboptimal outcomes for both the lender and its customers.

Underutilisation Of Data Insights

Lenders are not fully leveraging data to understand the reasons for their underperformance. With the use of A&M propitiatory data lenders can benchmark performance and recognise where leakages occur. Only then can an effective strategy be devised to mitigate those flaws. Once these flaws are recognised, lenders can create an effective strategy to increase in collections.

Use of A&M Proprietary DATA

Through its extensive experience as an acquirer of NPL portfolios, A&M developed benchmarks and proprietary methods to identify operational issues and areas for improvement.

A&M enjoys market leading position, with >10,000 recovery curves across various portfolios in EMEA.

Our recovery benchmarking methodology can be applied to unsecured consumer and credit card loans, effectively identifying data driven insights to uplift collections.

Our expert team deep dives into collection processes to diagnose reasons for leakages and recommend actionable remedies.

.jpg)

To view the full article click here

Originally published 1 November 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.