- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in India

- with readers working within the Accounting & Consultancy, Automotive and Business & Consumer Services industries

Payday Super Roadmap

The Treasury Laws Amendment (Payday Superannuation) Bill 2025 and the Superannuation Guarantee Charge Amendment Bill 2025 (collectively hereafter referred to as "the Bills") received Royal Assent on November 6, 2025.

The Bills instruct the implementation of Payday Super from 1 July 2026. In parallel, the Australian Taxation Office (ATO) released Draft Practical Compliance Guideline (PCG) 2025/D5, outlining the risk-based approach it will take when allocating compliance resources during the regime's first year.

What Is Payday Super?

Under the current SG regime, employers can make super

contributions on a quarterly basis. Payday Super will change that.

Starting 1 July 2026, employers will be required to pay SG

contributions at the same time as salary or wages are paid —

or no later than seven business days thereafter. There are very few

exceptions to this seven-day rule, one limited exception being for

new employees.

This reform is designed to:

- Minimise unpaid superannuation

- Increase transparency

- Support better retirement outcomes for Australian workers

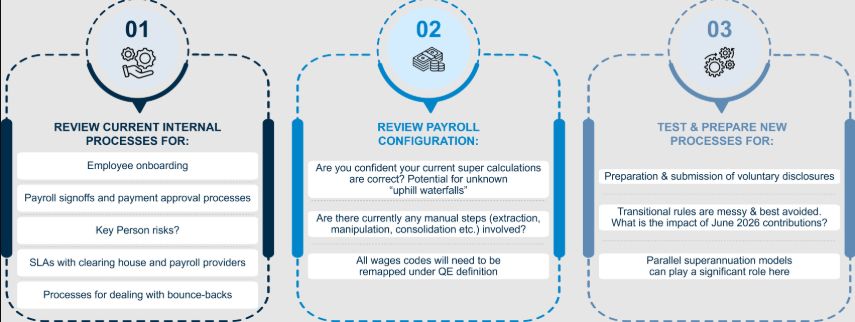

What should employers do to prepare for this change?

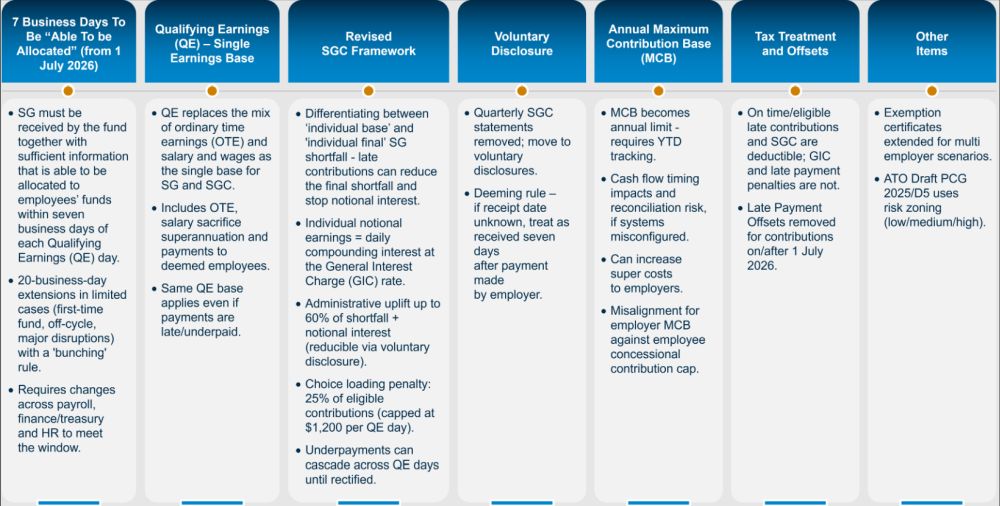

Summary of Key Changes

Originally published 16 December 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.