- with Senior Company Executives, HR and Finance and Tax Executives

- in European Union

- with readers working within the Accounting & Consultancy, Advertising & Public Relations and Law Firm industries

On 3 December 2025, the Full Federal Court (Derrington, Feutrill and Hespe JJ) dismissed the Commissioner of Taxation (Commissioner)'s appeal in Commissioner of Taxation v Hicks [2025] FCAFC 171 (on appeal from Ierna v Commissioner of Taxation [2024] FCA 592 ).

In this case, the Commissioner unsuccessfully sought to argue section 45B of the Income Tax Assessment Act 1936 (ITAA 1936) or failing that, Part IVA of the ITAA 1936, applied to a 2016 restructure of the City Beach group, involving a $52 million selective share capital reduction used to facilitate repayment of Division 7A loans.

The Full Court rejected both arguments. In doing so, the Court gave important guidance on:

- how the "relevant circumstances" in section 45B(8)

must be approached by reference to the statutory purpose in section

45B(1); and

- the developing importance of identifying and proving a reasonable alternative postulate when running (or defending) Part IVA.

Summary

Background

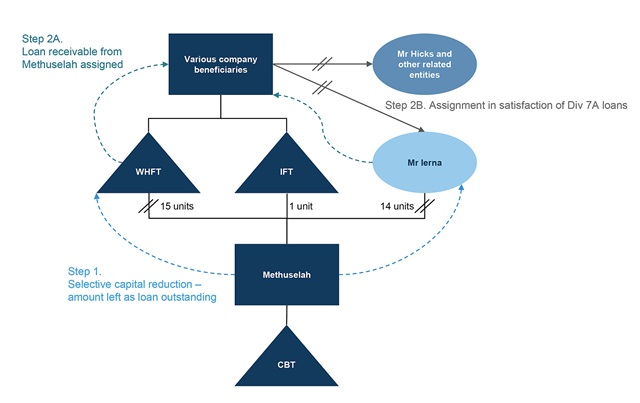

- Mr Ierna and Mr Hicks established City Beach, a streetwear business which structured its business through the City Beach Trust (CBT).MrIerna, the Ierna Family Trust (IFT) and the William Hicks Family Trust (WHFT), were each unitholders of CBT. These units were mainly pre-CGT assets.

- In 2016, the City Beach business underwent a restructure, in which a new holding company, Methuselah Holdings Pty Ltd (Methuselah) was interposed between CBT and its unitholders. The restructure was part of an arrangement to facilitate the repayment of the relevant entities' Division 7A loans.

- A selective capital reduction was then undertaken. In exchange for the cancellation of their shares, Mr Ierna and WHFT received a cancellation amount of $26 million each. Mr Ierna and WHFT then each loaned half of this amount to Methuselah.

- These loans were subsequently assigned and offset against the outstanding Division 7A loans within the group.

- In effect, the Division 7A loans were cancelled through the capital reduction, which had no tax liability (due to the pre-CGT assets used).

- This case is the first time that section 45B has been litigated and represents another loss for the Commissioner on the application of Part IVA.

Section 45B

- The Court's section 45B analysis ultimately turned on the absence of any realistic "dividend substitution" - the capital returned by Methuselah was not, in substance, standing in for a dividend that would otherwise have been paid to the taxpayers out of CBT's profits. Even if the funds in CBT reflected accumulated profits, CBT could only have paid a trust distribution (not a company dividend), and a trust distribution of those profits would not have been assessable to the taxpayers as a dividend.

- In coming to this conclusion, the Court rejected the Commissioner's argument that section 45B's operation was not controlled by the objects set out in section 45B(1)(b), which is to ensure "that amounts are treated as assessable dividends if a distribution is made in substitution for dividends". The Court considered that section 45B(1)(b) informs the construction of the other subsections of section 45B.

- The Court also rejected the taxpayer's argument (which was accepted by Logan J at first instance) that the attribution question in section 45B(8)(a) requires the existence of profits to be a contributory cause of the decision to return capital; rather it refers simply to the distribution of the capital being attributable to profits.

- The Court considered that the Commissioner had to predicate where the assessable dividend would otherwise come from - it is not enough that there is an entity in a group with profits available for distribution and another company which makes a capital return. There must be capital returned in substitution for a dividend.

- The Court found to the extent Methuselah's share capital reflected the unrealised profits of the CBT, then the capital distributed was attributable to profits. However, the Court considered that, in considering the extent to which the capital distribution was attributable to capital or profits for the purposes of section 45B(8)(a), it is necessary to have regard to the purpose of section 45B. The Court considered that whilst there was an identifiable tax benefit (for section 45B purposes), the relevant purpose was not met as the CBT profits were not distributable as a dividend as they were trust profits and not company profits.

- The Court accepted that the purpose of entering into and carrying out the selective capital reduction was to enable the repayment of Division 7A loans, and not to enable the relevant taxpayers to obtain a section 45B "tax benefit" by substituting capital for an assessable dividend.

- The primary judge had doubted whether a trust (being a relationship and not a legal person) could be an associate under section 318, and therefore whether the profits of the CBT could be profits of an associate. It was accepted that as the profits of the CBT were vested in the trustee, and the trustee was an associate of Methuselah, the profits of CBT were profits of an associate of Methuselah for the purposes of section 45B(8)(a).

- Of particular relevance is the clear statement that section 45B is not engaged merely because the Commissioner can identify profits within a corporate group - the Commissioner must engage with the following critical question: "if a capital return was not paid, how would the company otherwise pay as a dividend the profits that the capital return is supposedly attributable to?"

Part IVA

- The case reaffirmed that the 'bare fact' that a taxpayer enters a transaction which requires less payment of tax than another transaction, is not sufficient to attract the operation of Part IVA.

- Further, it demonstrated that taxpayers can successfully illustrate the non-existence of a tax benefit (for Part IVA purposes) through showing an alternative postulate that had the same tax consequences as the transaction that was actually entered into.

- The fact that tax advice was obtained does not, of itself, establish dominant purpose.

This case is yet another case that has gone against the Commissioner on Part IVA. With Merchant (one of the Commissioner's wins) being appealed to the High Court, it will be important to see how this decision will be applied and/or if it will trigger any reconsideration of the appropriate application of Part IVA and other anti-avoidance provisions.

The facts in detail

Background to the restructure

In 1985, Mr Hicks and Mr Ierna established City Beach, a streetwear retailer, which structured its business through the CBT. Prior to 2016, the following individuals/entities held units in CBT:

- 14 units held by Mr Ierna, acquired prior to 20 September 1985;

- 1 unit held by the trustee of the IFT, acquired in June 1991; and

- 15 units held by the trustee of the WHFT, acquired prior to 20 September 1985.

Both IFT and WHFT are discretionary trusts, the trustee of which were companies controlled by Mr Ierna (Oxlade Pty Ltd) and Mr Hicks (Corkdon Pty Ltd) respectively.

Prior to the year ended 30 June 2012, Mastergrove Pty Ltd (Mastergrove) was the corporate beneficiary to which the net income of each of the IFT and WHFT was distributed. Mr Ierna and Mr Hicks ultimately controlled Mastergrove. Mr Ierna and Mr Hicks were also the holders of A class shares in Mastergrove.

As opposed to distributing all of its profits, Mastergrove loaned moneys to Mr Ierna, Mr Hicks and their related entities, namely the trustee of the Ierna Property Trust (IPT) and the trustee of the Hicks Property Trust (HPT) - each controlled by Mr Ierna and Mr Hicks respectively. These loans were subject to Division 7A of the ITAA 1936, as they were loans made by a private company to its shareholders or to entities which were associates of its shareholders.

From the year ended 30 June 2012, IFT and WHFT stopped distributing net incomes to Mastegrove. Instead, IFT made distributions to Ierna BeneficiaryPty Ltd (Ierna Beneficiary)and WHFT made distributions to Hicks Beneficiary Pty Ltd (Hicks Beneficiary). Like Mastergrove, Ierna Beneficiary and Hicks Beneficiary distributed all of their profits as loans - these loans complied with the requirements in section 109N in Division 7A of the ITAA 1936.

Given the Division 7A loans were made on terms that required the periodical payment of interest and the repayment of principal, in the years of income ended 30 June 2005 to 30 June 2013, Mastergrove paid dividends on the A class shares held by Mr Ierna and Mr Hicks to fund the payments of interest and principal repayments required under the Division 7A loans.

It would seem that what drove the restructure was in part a response to the Commissioner's position expressed at the time in Taxation Ruling TR 2010/3 that unpaid present entitlements due to a corporate beneficiary were themselves Division 7A loans (which itself is subject to a High Court appeal in Bendel).

The restructure

In the year ended 30 June 2016, Mr Ierna and Mr Hicks decided to undertake a restructure involving the following steps:

- A new company, Methuselah, was interposed between CBT and its unitholders. The interposition was done by the unitholders in the CBT exchanging their units for shares in Methuselah - consequently, Methuselah became the sole unitholder in the CBT.

- There was then a selective share capital reduction. As part of the selective share capital reduction, shares in Methuselah issued to Mr Ierna and the trustee of the WHFT were cancelled for a cancellation amount of $52 million, where $26 million was payable to each of Mr Ierna and the trustee of WHFT.

- Mr Ierna and the trustee of the WHFT each entered into a loan agreement (theLoan Agreements) under which Mr Ierna and the trustee of the WHFT agreed to lend half of the cancellation amount to Methuselah through forbearance from requiring Methuselah to pay the cancellation amount, with no interest, no obligation to provide security, but with an obligation to repay the loan on demand.

- Deeds of assignment were entered by Mr Ierna and the trustee of the WHFT to assign the debts owed to them by Methuselah under the Loan Agreements to Mastergrove, Ierna Beneficiary and Hicks Beneficiary. This was in satisfaction of outstanding Division 7A loans owed to each of Mastergrove, Ierna Beneficiary and Hicks Beneficiary by Mr Ierna, Mr Hicks, the IPT and the HPT.

Effective 1 July 2016, Methuselah and CBT formed a tax consolidated group with Methuselah as the head company. It was intended that the net income of the CBT would be accumulated within Methuselah. Given Methuselah and CBT would be members of the same tax consolidated group, income tax consequences would not arise in respect of their transactions.

Relevantly, but for the operation of section 45B or Part IVA of the ITAA 1936:

- the cancellation of the Methuselah shares (which were pre-CGT assets) pursuant to the selective share capital reduction did not give rise to a taxable capital gain; and

- the proceeds of the capital reduction were not assessable to Mr Ierna or the trustee of the WHFT as a dividend for income tax purposes.

Commissioner's determinations

Under section 45B(3), determinations were made by the Commissioner to treat the capital benefits (proceeds from the selective share capital reduction) as unfranked dividends paid to Mr Ierna and the trustee of the WHFT by Methuselah.

In the alternative, the Commissioner made determinations under section 177F of Part IVA of the ITAA 1936 to include a dividend and franking credit gross up in the assessable income of each of Mr Ierna and Mr Hicks. This was founded on the view that, absent the scheme, Mr Ierna and Mr Hicks might reasonably be expected to have received a franked dividend from Mastergrove (equivalent to the amounts owed under the Division 7A loans).

Full Federal Court decision

Section 45B

On appeal, the Commissioner contended the primary judge should have found:

- there was a scheme under which Mr Ierna and Hicks Beneficiary obtained a tax benefit as defined in section 45B(9);

- having regard to the relevant circumstances provided for in section 45B(8), one of the persons who entered into or carried out the scheme or any part of the scheme did so for a purpose (whether or not it was the dominant purpose but not including an incidental purpose) of enabling Mr Ierna and Hicks Beneficiary to obtain a tax benefit (as defined in section 45B(9)); and

- the Commissioner was consequently entitled to make a determination under section 45C of the ITAA 1936 in relation to each of the capital benefits (each in the sum of $26 million) paid to each Mr Ierna and the trustee of the WHFT with the effect that those capital benefits were taken to be unfranked dividends.

Tax benefit

The Court found that a tax benefit (for section 45B purposes) would be obtained, being the additional tax payable if the distribution of capital had instead been an assessable dividend (which would have been unfranked as Methuselah did not have any franking credits).

Profits

The Commissioner put forward that the primary judge too narrowly focused on Methuselah's balance sheet. Whilst Methuselah itself only had share capital, section 45B(8)(a) also looks to the profits of an associate (and CBT was an associate of Methuselah).

On appeal, it was accepted that the value of the net assets of the CBT had increased from the time of its inception, and this increase was not attributable to an increase in capital contributed to the CBT. As such, there were unrealised profits in the CBT which were vested in the trustee of the CBT (in trustee capacity) and the trustee of the CBT was, in that capacity, an associate of Methuselah.

Attribution

Often the focus of engagement with the ATO on section 45B rulings is the attribution to profits question in section 45B(8)(a).

It was the Commissioner's view that the capital distributed by Methuselah was attributable to the profits of the CBT, as Methuselah's share capital account was a reflection of the unrealised profits of the CBT. This view was accepted by the Court:

"It may be accepted that the value that was recognised as share capital of Methuselah reflected the value of the units in the CBT which were exchanged for the shares issued by Methuselah. To the extent the value of those units reflected an increase in the net assets of the CBT (and not attributable to an increase in contributed capital to the CBT), the value of the share capital account of Methuselah was 'attributable' to the unrealised profits that hadaccrued in the CBT. The increase in the net assets of the CBT was the reason for and was causative of the value of Methuselah's share capital: Sun Alliance at [79]-[80] (albeit in the context of s 160ZK(5)).

Contrary to the submissions of the respondents, s 45B(8)(a) does not look to what was causative of thedecisionto return capital. The paragraph refers to the distribution of capital being attributable to profits."

In contrast, in the first instance decision, Logan J had accepted that the existence of profits "must actually be a contributory cause of the decision to return capital".

However, the Court still found that the attribution question in section 45B(8)(a) did not support a finding of purpose (discussed below). In this regard, the Court noted:

"As s 45B is directed to ensuring that capital distributions are treated as dividends if they aremade in substitution for dividends,the circumstance in s 45B(8)(a) will support the conclusion as to purpose if the profits of the associate might have, in the absence of the scheme, been distributed as a dividend that would have been assessable to Mr Ierna and Hicks Beneficiary."

Purpose

Per section 45B(1), section 45B focuses on a specific kind of arrangement, where capital is returned by a company instead of a dividend by that company (or a company's associate). The section is not triggered simply because the Commissioner recognises an entity in a group with available profits for distribution and another company makes a capital return.

The Court noted that, in his oral submissions, the Commissioner never made an attempt to establish where the assessable dividend would come from. This was because "on the Commissioner's construction of section 45B, he was not required to do so. The Commissioner's submissions [seek] to divorce the application of section 45B from its express purpose and is untenable."

From inference, the Commissioner contended:

- the capital return was attributable to CBT's profits and may be considered to be made in substitution for those profits; and

- given that the pattern of Mastergrove's distributions were to fund annual interest and principal repayments owed to it, Methuselah's capital return should be regarded as a payment in lieu of a Mastergrove dividend.

In respect of whether the capital return was attributable to CBT's profits, the Court stated:

"...the relevant purpose of s 45B is to tax amounts as unfranked dividends where the amounts are capital distributions made in substitution for dividends: s 45B(1)(b). It is not to tax amounts as unfranked dividends where it might be said that capital distributions are made by a company in substitution for a distribution of net income by the trustee of a trust."

In terms of the second contention, the Court noted the operation of section 45B has a narrow scope and the Commissioner appeared to incorrectly rely, at least partly, on the concept that given repayment of the Division 7A loans could have been made through payment of a dividend by Mastergrove, the capital that was returned by Methuselah should be treated as an unfranked dividend.

Methuselah's purpose in relation to the capital return was to fund the repayment of the Division 7A loans - the pattern of dividend distributions by Mastergrove did not support a conclusion that a purpose of a party of entering into or carrying out the scheme was for the capital return to be provided in substitution for a dividend. The dividends arising from Mastergrove were not historically applied to fund the interest and principal instalments due on the Division 7A loans owed to Ierna Beneficiary and Hicks Beneficiary.

Section 45B did not apply as the facts did not lend support to a conclusion that Methuselah's capital return was paid in substitution for an assessable dividend from Mastergrove (and there was no enablement of a tax benefit).

Part IVA

Primary Decision

The Commissioner's alternative argument was that Part IVA applied, because absent the scheme, Mr Ierna and Mr Hicks may reasonably have been expected to have received a franked dividend from Mastergrove (equivalent to outstanding Division 7A loans).

In the primary judge's decision, the taxpayers' alternate postulate was considered reasonable. The taxpayers' alternative was that had the scheme not been entered into, the CBT unitholders would have just transferred their units to Methuselah for market value (consideration for shares worth $23 million and cash of $52 million payable on the terms of the Loan Agreements). In turn, repayment of the Division 7A loans would have occurred by way of having the loan receivable assigned to the creditor companies. It was found that the evidence supported this alternate postulate, and the postulate featured the same substance as the scheme and achieved the same non-tax results as the scheme that was entered into.

On Appeal

Alternative postulate and no tax benefit

The Court observed that its role is to find what reasonably may be expected to occur if the scheme did not happen - this task is to be carried out on the totality of the evidence and based on facts and circumstances. The Commissioner cannot restrain the Court in this exercise by confining it to the Commissioner's particularisation of the scheme. The finding must be based on facts and evidence and must not be made in an artificial vacuum, divorced from reality or the wider context and circumstances. The integers that are relevant to the objective inquiry are not limited by the scheme. With reference to the Explanatory Memorandum to the 2013 amendments which introduced section 177CB, the Court noted:

"Where a scheme is carried out as part of a wider set of transactions, the identification of the alternate postulate may involve modification to those associated or connected transactions if that is what the evidence suggests."

The question the Court needs to determine is, as an objective matter of fact, what may reasonably be expected to occur if the scheme was not carried out. In this respect:

"The evidence supports a finding that the selective share capital reduction was entered into and carried out as part of a wider series of transactions, commencing with the interposition of Methuselah to which Div 615 of the ITAA 1997 applied. The scheme was entered into or carried out as a refinement of a proposal put forward but not pursued in 2014 which would have involved the sale of the units in the CBT to a new company."

In the appeal, the Commissioner put forward that the taxpayers' alternative postulate was not reasonable as it was rejected in 2014.

In 2014, a high-level proposal (2014 proposal) was presented which included the transfer of the CBT business or the CBT units to a new company in return for consideration for an amount outstanding equalling the value of the business, with that receivable then applied to discharge the Division 7A loans.

The Commissioner used the rejection of the above 2014 proposal as support for the position that the taxpayers' alternative postulate was not reasonable. The Court noted:

"... where the evidence shows that the taxpayer had rejected a commercial consequence of an alternate postulate, the evidence of that rejection can be important evidence in determining what would have or might reasonably be expected to have occurred if the scheme had not been entered into or carried out. It is not the mere fact that the alternate postulate was rejected that is important but why it was rejected."

The 2014 proposal was rejected due to the following reasons:

- There was no urgency to address the Division 7A loans at that time (as there was in 2016).

- Concerns around the loss of pre-CGT status and the potential future CGT consequences (matters which are disregarded in considering whether an alternative postulate is reasonable).

- Concerns around transfer duty (there ultimately was substantial duty paid as a result of the transactions as carried out, so this did not make the alternative postulate unreasonable).

The Court found that the taxpayers' reasons for the rejection of the 2014 proposal did not result in that proposal not being a reasonable alternative to the scheme.

The Commissioner also contended that the substance of the scheme involved accessing the net assets of an associate and the taxpayers' alternate postulate did not involve this. This submission was not accepted given it was the net asset value of the CBT that was reflected in the share capital account of Methuselah. The transfer of the units in the CBT would result in access to that same source of value by a realisation of the value of the units in the CBT.

The taxpayers were successful in arguing that if the scheme had not been carried out, a transfer of the units in the CBT to Methuselah for shares and a receivable would have occurred instead. The Division 7A creditors would have been assigned the receivable in consideration for the discharge of the Division 7A loans. This alternative also would not have caused any assessable income to arise for Mr Hicks and Mr Ierna. As such, the taxpayers successfully discharged their onus of showing that they did not obtain a tax benefit (for Part IVA purposes) in connection with the scheme.

Consideration of PepsiCo

This case provided a meaningful opportunity for the Court to consider and apply the principles from PepsiCo. The parties were invited to file written submissions on any matters arising from PepsiCo. As could be anticipated, the taxpayers contended that there was no reasonable alternative to the scheme in accordance with PepsiCo. Given the taxpayers discharged their onus with a reasonable alternative, the Court did not need to consider the taxpayers' PepsiCo-like contention, and it was sufficient to observe the difficulty that taxpayers engaging in related party transactions will face in raising a proposition that a scheme had no reasonable alternative:

"This conclusion makes it unnecessary to consider the taxpayers' alternative contention that there was no alternative to the scheme as entered into or carried out. It is sufficient to observe that in the case of related party transactions, it is very unlikely that a taxpayer will be able to demonstrate that there was no reasonable alternative to the scheme. As the High Court explained in PepsiCo:

[212] ... in unusual cases, a taxpayer may demonstrate the absence of a tax benefit by establishing that there is no postulate that is a reasonable alternative to entering into or carrying out the scheme."

Dominant purpose

Similarly, a finding of no tax benefit made it unnecessary to consider dominant purpose. However, the Court made some observations. First, entering a transaction after receiving tax advice which refers to "no adverse tax consequences" is not within itself sufficient to support a conclusion of the dominant purpose being a tax benefit. Further, it was reaffirmed that the mere fact that a taxpayer enters a transaction which requires less payment of tax than another transaction is not sufficient to attract the operation of Part IVA:

Whilst taxpayers may take some comfort in the approach taken by the Court in relation to obtaining tax advice, some caution is warranted on the extent of the tax advice that is received. In Merchant (a capital loss / wash sale - see our analysis here), the Full Federal Court noted that it"may be accepted that the seeking and obtaining of advice about the taxation implications of transactions of itself does not support a conclusion that the dominant purpose of a party to the scheme was to obtain a tax benefit. However, where a transaction is the product of advice, it is both possible and appropriate to take that advice into account in forming a conclusion as to purpose under s 177D".

Postscript: Part IVA - what is in store for 2026?

Hilton Part IVA dispute - Federal Court decision pending

In Orders dated19 September 2025, the parties were required to file and serve written submissions addressing the significance of the High Court's decision in PepsiCo. This may be the expectation going forward in the context of Part IVA, noting the Full Federal Court in Hicks also invited parties to make submissions on PepsiCo.

Proposed amendments to Part IVA

There remains no draft legislation relating to the Government's proposed amendments to Part IVA (announced on 9 May 2023 as part of the 2023-24 Federal Budget) which include schemes that:

- reduce tax paid in Australia by accessing a lower withholding tax rate on income paid to foreign residents; or

- achieve an Australian income tax benefit, even where the dominant purpose was to reduce foreign income tax.

Merchant appeal

Of particular interest will be the High Court decision onMerchant (the first round of submissions of which are available):

- On one hand, the Commissioner is appealing the dividend stripping outcome from the debt forgiveness; in particular that a determination to cancel a capital loss under Part IVA does not need to be taken into account in making a dividend stripping determination. The High Court's decision on this matter is expected to have significant ramifications on the interaction between anti-avoidance provisions.

- On the other hand, the taxpayer is appealing the Part IVA outcome, noting:

"The Commissioner has conceded that s 177D of the Income Tax Assessment Act 1936 (Cth) (ITAA36) does not prevent a taxpayer from exercising an ordinary incident of ownership - that of timing a sale of property so as to realise a capital loss which can be used to offset a future capital gain that is then in prospect, where that sale is to a wholly independent third party. The issue in this appeal is whether s 177D applies to such a transaction where the sale is at market value to a related party - one that is controlled by the same person but is not the "alter ego" of the first, and is subject to different legal, commercial and taxation considerations. On the Commissioner's case, s 177D applies in those circumstances to put the taxpayer to an election: sell the property to a wholly independent third party or defer the sale until such time as no future capital gain is in prospect. Such an election cannot have been contemplated by the ITAA36."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

|

|

| Lawyers Weekly Law firm of the year

2021 |

Employer of Choice for Gender Equality

(WGEA) |