- within Finance and Banking topic(s)

- with readers working within the Law Firm industries

- within Privacy, Government, Public Sector and Immigration topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit industries

An Australian Financial Services Licence (AFSL) is generally required to carry on a financial services business in Australia. However, the Australian Securities and Investments Commission (ASIC) provides licensing relief and exemptions for Foreign Financial Services Providers (FFSPs) who wish to provide services to clients in Australia.

There are a number of pathways, but not all are currently open to new entrants:

- Individual Relief (open)

- New licensing exemptions for FFSPs (from 1 April 2025 and subject to passage of legislation)

- Class-based sufficient equivalence relief (closed except for entities which relied on it prior to 1 April 2020)

- Limited connection relief (open until 31 March 2026)

- Standard AFSL (open)

If you are a new entrant to the Australian market – individual relief

Under the current regime, FFSPs who are new entrants to the Australian market can apply to ASIC for individual relief. Applications for relief are to be made via the ASIC Regulatory Portal.

If individual relief is granted, the FFSP will be allowed to provide financial services to Australian clients under a modified form of an AFSL. This means that some obligations under the Corporations Act 2001 (Cth), that would normally apply to standard AFSL holders, do not apply to the FFSP.

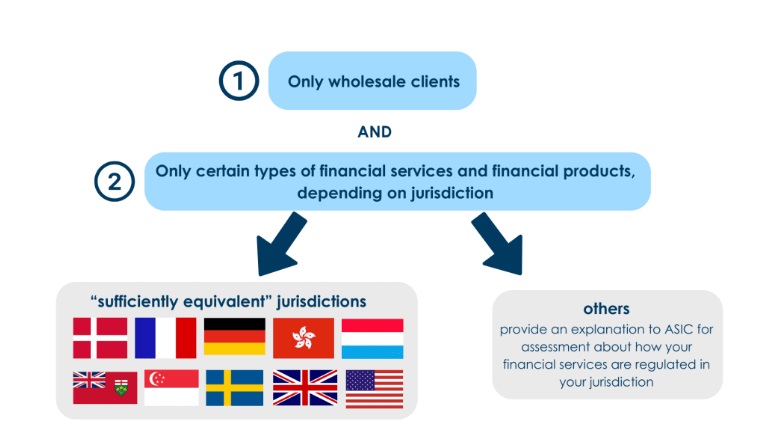

There are two pathways for individual relief:

- Relief for FFSPs which are regulated by a "sufficiently equivalent" overseas regulator; and

- Relief for FFSPs which are regulated by a "non-sufficiently equivalent" overseas regulator.

The following overseas regulators are considered to be "sufficiently equivalent":

- Denmark – Danish Financial Supervisory Authority (FSA)

- France – Autorité des marchés financiers of France (AMF) or Autorité de contrôle prudentiel et de resolution of France (ACPR)

- Germany – Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin)

- Hong Kong – Securities and Futures Commission (SFC)

- Luxembourg – Commission de Surveillance du Secteur Financier (CSSF)

- Ontario, Canada – Ontario Securities Commission (OSC)

- Singapore – Monetary Authority of Singapore (MAS)

- Sweden – Finansinspektionen (FI)

- United Kingdom – Financial Conduct Authority

- United States – Commodity Futures Trading Commission (CFTC), or Federal Reserve and Office of the Comptroller of the Currency (OCC), or Securities and Exchange Commission (SEC)

To be eligible under this pathway, the following criteria must be met:

- The FFSP is regulated by an overseas regulatory authority;

- The FFSP intends to provide financial services only to wholesale clients in Australia; and

- The financial services to be provided are specified in Schedule 1 of ASIC Corporations (Foreign Financial Services Providers – Foreign AFS Licensees) Instrument 2020/198.

The application process for individual relief for FFSPs which are regulated by a "sufficiently equivalent" overseas regulator differs from FFSPs regulated by other (or "non-sufficiently equivalent") overseas regulatory regimes.

FFSPs from a non-sufficiently equivalent jurisdiction will need to first provide to ASIC for assessment a detailed explanation about how their financial services are regulated in their jurisdiction.

Note: A new licensing exemption regime for FFSPs (see below) is expected to commence on 1 April 2025 (subject to the passage of legislation) and will replace the existing FFSP licensing exemptions. Subject to legislation being passed:

- FFSPs who have successfully obtained individual relief prior to the commencement of the new licensing regime can continue providing financial services in Australia under the conditions of their modified AFSL.

- FFSPs whose application for individual relief has been submitted but not decided by the commencement date of the new licensing regime will continue to be subject to requirements that existed at the time the application was submitted.

Proposed new licensing exemptions for FFSPs

In 2023, the Australian Government introduced a new licensing exemptions regime for FFSPs in Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill 2023. This regime is expected to commence on 1 April 2025, subject to passage of legislation.

The new licensing exemptions for FFSPs under this proposed legislation are:

- Professional investor exemption – The FFSP provides financial services from outside Australia to professional investors only.

- Comparable regulator exemption – The FFSP is regulated by a comparable regulator and provides financial services to wholesale clients only (this exemption is designed to replace the individual relief pathway).

- Market maker exemption – The FFSP provides financial services from outside Australia that involve making a market for derivatives that are able to be traded on a specified licensed market.

If an exemption applies, the FFSP may provide financial services to Australian clients without the need to hold an AFSL.

Additionally, it is also proposed that where the FFSP is regulated by a comparable regulator and is applying for an AFSL to provide financial services to wholesale clients only, the fit and proper person test will not apply, thus fast-tracking the licensing process.

Sophie Grace will provide further details about how the new licensing regime will operate when the legislation has been passed.

If you are already relying on an existing relief (except individual relief)

Class-based sufficient equivalence relief (closed as of 1 April 2020)

Prior to 1 April 2020, some FFSPs were able to rely on the following Class Orders (CO) or legislative instrument that provided an exemption from the requirement to hold an AFSL:

- CO 03/1099: UK regulated FFSP

- CO 03/1100: US SEC regulated FFSP

- CO 03/1101: US Federal Reserve and OCC regulated FFSP

- CO 04/829: US CFTC regulated FFSP

- CO 03/1102: Singapore MAS regulated FFSP

- CO 03/1103: Hong Kong SFC regulated FFSP

- CO 04/1313: German BaFin regulated FFSP

- ASIC Corporations (CSSF-Regulated Financial Services Providers) Instrument 2016/1109: Luxembourg CSSF regulated FFSP

These instruments were repealed on 31 March 2020. FFSPs which were able to rely on the licensing exemption in these instruments as of 31 March 2020 and had notified ASIC of their intention to rely on these instruments can continue to rely on the licensing exemption in these instruments, but only until 31 March 2026. Before 1 April 2026, these FFSPs must transition to the new licensing exemptions regime for FFSPs (see above) by notifying ASIC of their intention to rely on the new licensing exemptions regime when it commences.

Limited connection relief

Under the limited connection relief, an FFSP does not need to hold an AFSL if all of the following criteria are met:

- The FFSP does not have presence in Australia;

- The FFSP is taken to "carry on a financial services business in Australia" only because it engages in conduct that induces, or intends to induce, people in Australia to use the financial services provided by the FFSP ("inducing conduct"); and

- The financial services are provided to wholesale clients only.

No application is required to rely on the limited connection relief. However, this relief is only available until 31 March 2026. Before 1 April 2026, these FFSPs must transition to the new licensing exemptions regime for FFSPs (see above) by notifying ASIC of their intention to rely on the new licensing exemptions regime when it commences.

Standard AFSL

If the above relief or exemptions are not available to a FFSP, the FFSP must apply for a standard AFSL to provide financial services to clients in Australia (including providing financial services to retail clients). More information about the standard AFSL application process and requirements is available here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.