- with Senior Company Executives, HR and Finance and Tax Executives

- in Europe

- in Europe

- in Europe

- with readers working within the Securities & Investment and Law Firm industries

Australian Financial Service Licence ("AFSL") and Australian Credit Licence ("Credit Licence") holders should provide notice to their clients that an Authorised Representative is no longer authorised under the AFSL. The case of Casaclang v WealthSure Pty Ltd [2015] FCA 761 ("WealthSure Case") suggests the most effective way to do this is by way of publication on the licensee's website.

The WealthSure Case involved a group of former clients of WealthSure and its former Authorised Representative, Mr Colin Oberg ("Mr Oberg"). It was alleged that:

- Mr Oberg misappropriated client funds during his time as an Authorised Representative of WealthSure.

- WealthSure breached its obligations as licensee and should pay damages to the former clients for the losses caused by Mr Oberg's conduct.

The Court highlighted that:

- WealthSure failed to alert clients about any risk or danger to their own finances, and even if WealthSure did attempt to contact those clients, it occurred at a much later date;

- it was unacceptable that WealthSure could not inform clients about the Authorised Representative's termination because only the Authorised Representative had the clients' contact details;

- there was no attempt by WealthSure to retrieve any materials which would suggest that the Authorised Representative was still associated with WealthSure; and

- WealthSure did nothing to publish the fact that it had severed ties with the Authorised Representative.

What does this mean for AFSL and ACL Holders?

In its judgement, the Court suggested that, amongst other things, WealthSure could have published on its website that Mr Oberg was no longer authorised under its AFSL. Although the WealthSure Case does not specifically deal with Credit Representatives ceasing to be authorised under a Credit Licence, Sophie Grace considers that the same principles are likely to apply.

In light of this case, licensees are encouraged to ensure they make adequate disclosures to all clients, and review their processes and procedures for ceasing Authorised or Credit Representatives. For AFSL holders, this may be documented in your:

For Credit Licence holders, the processes and procedures may be documented in your:

It is clear from the WealthSure Case that:

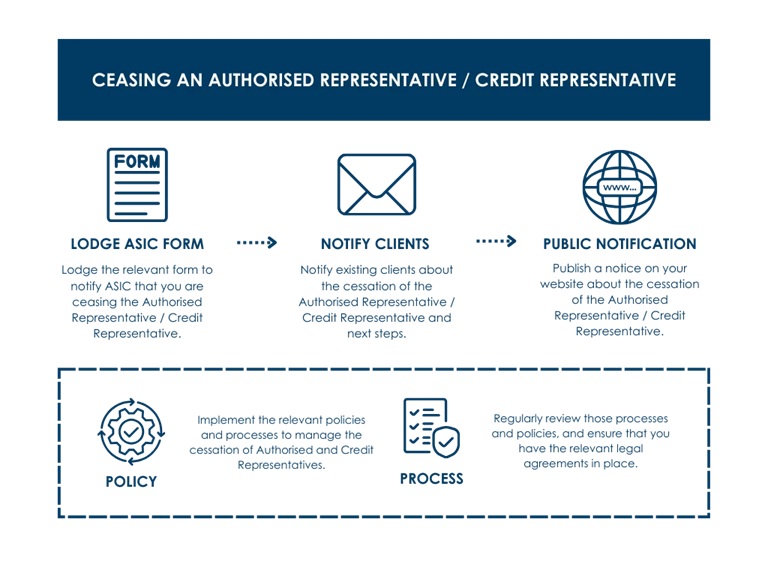

- merely submitting the relevant form to notify ASIC that you are ceasing an Authorised or Credit Representative is insufficient;

- licensees should consider taking steps to notify existing clients who were serviced by the Authorised or Credit Representative about their cessation and steps the licensee will take to ensure a smooth transition to another representative; and

- a public notification such as on the licensee's website, must be made.

Sophie Grace can assist with the review of your Authorised Representatives or Credit Representative processes and procedures as well as assist in preparing any legal agreements as required.

For further assistance, please contact Sophie Grace.

Further reading

- Casaclag v WealthSure Pty Ltd [2015] FCA 761 (Judgement)

- Appointing and ceasing an AFS authorised representative

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.