- within Real Estate and Construction topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Basic Industries, Metals & Mining and Property industries

Article Summary

If your builder has gone bust in Queensland then this means that the builder has become bankrupt, or the building company has gone into liquidation.

This act of going bust is very likely a breach of the residential building contract, allowing the owner to terminate the residential building contract.

Once terminated, the owner will likely be able to take advantage of the QBCC's Home Warranty Insurance Scheme.

The QBCC will make a pay a builder from their list of panel builders on behalf of the owner:

- If the building work has not commenced - a refund of the deposit.

- If the building work is incomplete - to complete the build of the house.

- If the building work is complete - any defective works claims.

This article will explain everything you need to know about that happens if your builder goes bust in Queensland.

Strict eligibility and time requirements apply, so it is vital that you seek qualified legal advice.

Has you builder gone bust in Queensland?

The term "gone bust" refers to liquidation if your builder is a company (XYZ Pty Ltd, for example); or bankruptcy if your builder is a natural person (B. Builder sole trader, for example).

There are significant problems in the building and construction industry, including (allegedly):

- Increase in the costs of labour and materials.

- COVID-19 (even though that was years ago now).

- Flooding, fires, and natural disasters in Queensland.

- Global surge in building materials.

- Homebuilder grants increasing demand; and

- Russia / Ukraine conflict.

It may possibly be some of the above, but more often than not it is just simple mismanagement.

Whatever the reason, there has been a sharp increase in building and construction insolvencies, which is causing significant problems for owners.

If your builder has gone bust in Queensland, then there are several things that you have to do to ensure that your rights are protected.

In this article our building and construction lawyers tell you (as an owner) everything you need to know. It is very important to seek suitably qualified legal advice.

Why do Builders Become Insolvent?

There are a number of reasons cited as to why builders go bust.

We have seen a vast array of excuses from builders and building companies, including:

- Flooding, fires, and natural disasters in Queensland.

- Global surge in building materials causing supply chain problems.

- Greater losses on multiple projects from larger builders.

- Homebuilder grants increasing demand for houses.

- Increase in the costs of labour exacerbated by labour shortages.

- Rising material costs for a variety of reasons.

- State-enforced shutdowns.

- The continuing hangover from COVID-19; and/or

- The Russia / Ukraine conflict.

Ultimately, whatever the builder cites as the reason, at a fundamental level it is a result of increased costs and reduced profit, causing significantly reduced cash flow.

The builders do not have the cash to pay their current liabilities, causing insolvency, as defined at section 95A of the Corporations Act 2001 which says:

(1) A person is solvent if, and only if, the person is able to pay all the person's debts, as and when they become due and payable.

(2) A person who is not solvent is insolvent.

Builder Gone Bust - Understanding the Situation

The first thing that you have to do is try to understand the situation.

This can be done if you think that your builder is going to go bust, or if your builder has gone bust.

The first thing you can do is conduct some free, publicly available searches, including:

- A QBCC license search.

- An ASIC Search.

- A company insolvency search; and/or

- A bankruptcy search.

We will explain these in a little more detail below.

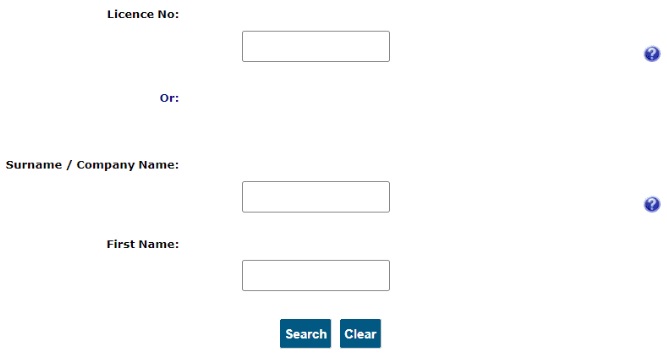

A QBCC License Search

The first thing you can do is conduct a QBCC license search. You can do that here.

As a homeowner, you can search for the name of the builder or the license number of the builder.

Once you have chosen the correct builder from the list, you have the option to either:

- See the licensee's full history; or

- See the adjudication decision report.

If you click through to see the full history, you can gather the following information:

- All current information.

- Licence class status.

- Disciplinary record.

- Nominee details - current.

- Key personnel details - current.

- The licensee's history.

- Maximum revenue financial category.

- Record of residential construction work.

- Record of claims approved under statutory insurance scheme.

- Directions to rectify.

- Tribunal direction orders.

- Disciplinary record, exclusions, infringement notices and demerit points.

You will be able to see from this search if the builder is moving toward liquidation (increased infringements, etc.) or is actually bankrupt or in liquidation and lost their license.

You can also conduct an ASIC company search.

An ASIC Company Search

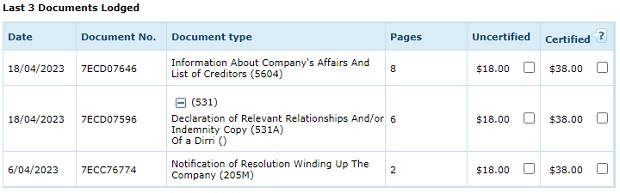

The next search you can undertake to get information about your building company is an ASIC company search. You can do an ASIC building company search here.

From the dropdown box select "organisation and business names" and then insert the name or the ACN of the building company into the other box.

Once you have selected the correct company from the list, you can obtain a number of different documents from the database, including:

- Company Summary

- Company extract

- Current and historical company information

- Satisfied charges

- Roles and relationship extract

- Details of registration of corporations(s)

- Documents Lodged with ASIC

You will be able to obtain details about the company (for a fee), see the last documents lodged with ASIC, and also see if the building company is in external administration.

External administration in this search does not actually mean an 'administration' insolvency appointment but refers to a number of different insolvency appointments.

A Company Insolvency Search

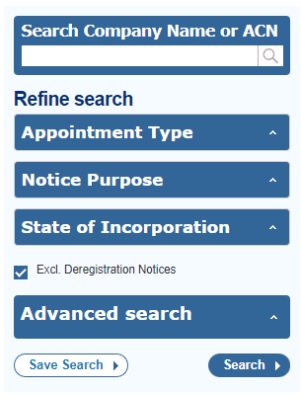

The next search you can do is an insolvency notices search. You can view them here.

In an insolvency appointment, as per the requirements of the Corporations Act 2001 and Corporations Regulations, this a website maintained by ASIC where mandatory notices, specifically those pertaining to insolvency and external administration, are published.

You can search by search company name or ACN, appointment type, notice purpose, and/or state of incorporation.

If your building is in this list, and there is a published notice, then it is likely that the building company has gone bust.

These notices will also show the name and contact details of the liquidator, so you can contact them and ask them any questions you want the answers to in relation to the liquidation.

If your building company is a person (not a company) then you can also conduct a bankruptcy search.

A Bankruptcy Search

A bankruptcy search will show you if your builder has gone bankrupt. You can search here.

If you have the builder's full name and date of birth, then you will be able to ascertain if the builder is bankrupt or has been bankrupt.

This is a paid service, but it will give you all the information that you need to see if your builder has gone bust.

The bankruptcy notice will also show the name and contact details of the bankruptcy trustee, so you can contact them and ask them any questions you want the answers to in relation to the bankruptcy.

What Happens if my Builder is Insolvent?

Most importantly, when a builder goes bust, or a building company goes into liquidation, the company and all relevant key officers of the company automatically lose their building licenses.

Section 56AC of the QBCC Act says that if the company has a provisional liquidator, liquidator, administrator or controller appointed; or is wound up, or is ordered to be wound up - then the director or secretary of, or an influential person for, the construction company currently or up to two (2) years prior - are excluded individuals.

Further, because they are all excluded individuals, a construction company is an excluded company if an individual who is a director or secretary of, or an influential person for, the construction company is an excluded individual for a relevant event.

This essentially means that the company or person is insolvent and not allowed to continue to trade, and they lose their building license, and so unable to continue building whatsoever.

This is very likely a breach of the construction contract allowing you to terminate.

Termination for Breach of the QBCC Building Contract

Section 27 of the general conditions of QBCC New Home Construction Contract says:

Notwithstanding Condition 26, if a party to this Contract:

(a) is made bankrupt; or

(b) being a company, goes into liquidation,

then the other party may forthwith by written notice terminate this Contract.

Therefore, if a builder goes bust, and you have a QBCC new home construction contract, then you do not need to serve a notice to remedy breach, you simply need to serve a termination notice.

Extreme care should be taken when terminating a residential building contract, and you should always seek legal advice.

Termination for Breach of a Master Builders Building Contract

If you have a Master Builders contract, then there is a clause (usually clause 22) in the residential building contract which allows the homeowner to terminate the residential building contract. It will usually say something like:

Subject to Clause 22.3, either the Contractor or the Owner may terminate this Contract immediately on giving written notice to the other party, if the other party:

a) commits an act of bankruptcy, or is made bankrupt:

b) makes a composition or other arrangement with creditors;

c) assigns assets for the benefit of creditors generally;

d) being a company, becomes insolvent, enters into a deed of company arrangement, has a controller, administrator or receiver appointed, or is in liquidation.

Therefore, if a builder goes bust, and you have a Master Builders residential construction contract, then you do not need to serve a notice to remedy breach, you simply need to serve a termination notice.

Extreme care should be taken when terminating a residential building contract, and you should always seek legal advice.

Termination for Breach of a HIA Building Contract

If you have an HIA residential building contract, then there is a clause (usually clause 29) in the residential building contract which allows the homeowner to terminate the residential building contract. It will usually say something like:

If a party:

(a) informs the other party in writing or its creditors generally that the party is insolvent; or

(b) becomes or is bankrupt or seeks to take advantage of the laws relating to bankruptcy; or

(c) has a Court order made for the winding up of the party or a resolution for its winding up is made, and

as a consequence, that party is unable to perform its obligations under this contract, the other party may immediately end this contract by giving written notice to that party to that effect.

Therefore, if a builder goes bust, and you have an HIA residential construction contract, then you do not need to serve a notice to remedy breach, you simply need to serve a termination notice.

Extreme care should be taken when terminating a residential building contract, and you should always seek legal advice.

Termination Notice for Insolvency

An owner can terminate a residential building contract is a contractual clause allows for it, or by operation of the law.

In the case of insolvency, it is highly likely that a clause in your residential construction contract which will allow for instant termination.

Read more here - Terminating a Residential Building Contract in Queensland

Even though on the face of it, it looks simple, it is still important to seek qualified legal advice before terminating any contract.

What Happens after Termination of a Building Contract?

After the building company or the builder has gone bust; and you have terminated the residential building contract; then the next step is to make a claim under the QBCC's home warranty insurance scheme.

If you have incomplete or defective work on your build due to the insolvency of the builder in Queensland, you may be eligible to make a claim through the Queensland Home Warranty Scheme.

This claim can cover additional costs to complete the work, including expenses for rectifying any defective work, as well as reimbursement for any deposit you paid if the work hasn't yet started.

Making a claim under the QBCC home warranty scheme is only applicable to residential construction work under a residential construction contract.

Making A Claim Under the QBCC Home Warranty Scheme

If your builder goes bust, you can make a claim against the Home Warranty Insurance Scheme for:

- Non-completion of the building work; and/or

- Defective building work; and/or

- Return of your deposit.

We will explain these in more detail below.

QBCC Claim for Return of Your Deposit

If your builder goes bust (bankruptcy or liquidation) and the build on your house has not yet commenced, then you can make a claim for the return of your deposit paid.

To be eligible to make the claim, the owner:

- Must have a fixed-price residential construction contract; and

- You have properly terminated the residential building contract; or

- The builder becomes insolvent (bankruptcy or liquidation).

A claim must be made to the QBCC within three months after the date the contract ends.

For more information see - https://www.qbcc.qld.gov.au/your-property/queensland-home-warranty-scheme

QBCC Claim for Non-Completion of the Building Work

If your builder goes bust (bankruptcy or liquidation) and the build on your house remains incomplete, then you can make a claim for incomplete works.

To be eligible to make the claim, the owner:

- Must have a fixed-price residential construction contract; and

- You have properly terminated the residential building contract; or

- The builder becomes insolvent (bankruptcy or liquidation).

A claim must be made to the QBCC within three months after the date the contract ends.

If construction work has begun on-site, the QBCC will provide payment for the difference between the remaining funds you hold under the contract, and the actual cost required to finish the construction of your home.

You may also be able to claim expenses for accommodation while the build is completed.

The maximum claim you can make is $200,000 , increasing to $300,000 if additional cover is taken out.

You will need to complete the following form - https://www.qbcc.qld.gov.au/resources/form/non-completion-claim-form

What you Need to Provide to the QBCC for Non-Completion Claim?

To make a claim for non-completion, you must provide the following documents to the QBCC:

- Evidence of contract termination or liquidation/bankruptcy of the builder

- The construction contract, all of the contract documents (plans etc.) all terms and conditions.

- Any Contract variations (agreed or not agreed).

- If relevant, council development, building permission, and building plans.

- Receipts or proof of payment to the builder and/or contractor.

For more information see - https://www.qbcc.qld.gov.au/your-property/queensland-home-warranty-scheme

QBCC Claim for Defective Building Work

If your builder goes bust (bankruptcy or liquidation) and the works have been completed but remain defective, then you can make a claim for defective works.

For a detailed guide on defective works - https://stonegatelegal.com.au/defective-building-work-in-queensland-complete-guide/

The QBCC will pay another builder to rectify defects in the residence the subject of the residential building contract, and also works that are annexed to that building, including:

- Anything requires building or plumbing approval.

- Anything used for water supply, drainage, sewerage, or stormwater.

- Awning or handrail

- The construction or installation of a swimming pool.

- Stairs or a ramp

- A veranda or deck.

You may also be able to claim expenses for accommodation while the defects are being rectified (if applicable).

Structural defects are covered for up to six years and six months from the date of payment of the insurance premium.

Non-structural defects are covered if the owner becomes aware of, or should reasonably have been aware of, the problem within six months of the work being completed.

You must file a claim for defective works within three (3) months of discovering the defect.

You will need to use the following form - https://www.qbcc.qld.gov.au/resources/form/residential-commercial-construction-work-complaint-form

For more information see - https://www.qbcc.qld.gov.au/your-property/queensland-home-warranty-scheme

Who will Complete the Build of my House?

The QBCC have a list of panel builders who tender for the QBCC home warranty insurance work.

The QBCC (or its agents) will provide a scope of works, and then the panel builders tender on that scope of works. The contractor who is appointed is usually the tenderer with the lowest price.

The builders on the QBCC panel must satisfy certain standards in order to be included on the panel, including:

- The builder is not, and has never been, barred from performing tier 1 faulty work, disqualified for demerit violations, or an excluded individual or company.

- The builder has not received a direction to rectify more than 5 years old.

- The number of complaints to the QBCC against the builder must be fewer than 5% of the total number of contract notifications for that contractor.

Once appointed, the new panel builder will complete the works.

Builder Gone Bust in Queensland - Key Takeaways

If your builder has gone bust in Queensland then this means that the builder has become bankrupt, or the building company has gone into liquidation.

This act of going bust is very likely a breach of the residential building contract, allowing the owner to terminate the residential building contract.

Once terminated, the owner will likely be able to take advantage of the QBCC's Home Warranty Insurance Scheme.

The QBCC will make a pay a builder from them list of panel builders on behalf of the owner:

- If the building work has not commenced - a refund of the deposit.

- If the building work is incomplete - to complete the build of the house.

- If the building work is complete - any defective works claims.

Strict eligibility and time requirements apply, so it is vital that you seek qualified legal advice.

Builder Gone Bust in Queensland - FAQ

We get a number of enquiries every day in relation to builders going bust in Queensland.

In these FAQ section, we try to answer the most frequently asked questions.

Who will complete my building project now my builder has gone bust?

A panel builder from the QBCC's panel of builders will tender for the job. The builder who is appointed is usually the tenderer with the lowest price.

How do you know when a builder has gone insolvent?

There are a number of things that you can do, to check if your builder has gone insolvent, including doing a QBCC license search; and/or doing an ASIC company search; and/or doing an insolvency notices search; and/or doing a bankruptcy search.

What are people's rights when their builder goes bust?

An owner has the following rights when their builder goes bust: the right to terminate the residential building contract; and the right to make a claim on the QBCC's Home Warranty Insurance Scheme.

What happens when a builder goes insolvent?

When a builder goes insolvent then they go bankrupt, or the building company goes into liquidation. When this happens, the builder loses their building license and must immediately cease working as a builder. In most cases this is a breach of the contract allowing the owner to terminate.

What does builder insolvency mean?

Section 95A of the Corporations Act 2001 which says:

(1) A person is solvent if, and only if, the person is able to pay all the person's debts, as and when they become due and payable.

(2) A person who is not solvent is insolvent.

Builder insolvency means that the builder does not have enough cash to pay its debts.

Builder Gone Bust - Useful Links

Terminating a Building Contract Factsheet - https://www.qbcc.qld.gov.au/sites/default/files/2021-10/factsheet-terminate-a-building-contract.pdf

Terminating a Residential Building Contract in Queensland - https://stonegatelegal.com.au/terminating-a-residential-building-contract-in-queensland/

Queensland Home Warranty Scheme product disclosure - https://www.qbcc.qld.gov.au/sites/default/files/2021-10/publication-qld-home-warranty-product-disclosure.pdf

Who owns the copyright in the building plans - https://stonegatelegal.com.au/copyright-in-building-plans-after-termination-of-building-contract/

Home Warranty information - For more information see - https://www.qbcc.qld.gov.au/your-property/queensland-home-warranty-scheme

QBCC lists and registers - https://www.qbcc.qld.gov.au/about-us/our-lists-registers

QBCC Claims Procedures Manual - https://www.qbcc.qld.gov.au/sites/default/files/2021-10/rti-disclosure-resolution_services_-_claims_procedures_manual.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.