In April 2023, the Indian Parliament passed the Competition Amendment Act, 2023 ("Amendment Act"), to amend the Competition Act, 2002 ("Competition Act").2 The Amendment Act has introduced sweeping changes to the substantive and procedural framework of the competition law regime in India. One of the most significant amendments is the introduction of two new tools in the enforcement kit of the Competition Commission of India ("CCI") – settlements and commitments.3 These mechanisms are intended to enable timely intervention, to the benefit of consumers and the economy at large, as well as significantly reduce administrative costs.4 Similar tools are already in place in several other jurisdictions such as the European Union ("EU"), United Kingdom, Germany, Japan, and Singapore.

The European Commission ("EC") has the power to accept settlements5 (for cartel conduct) and commitments (for non-cartel conduct) from parties under investigation. The commitments mechanism has in fact, been exercised very frequently by the EC, with a total of 43 decisions by 2022.6 Between 2005 and 2019, more than 50 percent of enforcement decisions were taken under the commitments route, with no finding of contravention by the parties under investigation.7 Recently, the EC accepted commitments from Amazon and closed its investigations into certain alleged anti-competitive practices in the e-commerce market.8 It also routinely benefits from the administrative efficiencies derived from the settlement procedures; 13 out of 18 cartel cases since 2018 involved all or some parties seeking to settle with the EC in exchange for a 10 percent reduction in their fine. The EC also employs an informal "cooperation procedure" for non-cartel conduct, where there is a finding of infringement along with imposition of structural remedies and the parties are rewarded with as much as 30 percent reduction in fines for their cooperation.9

National authorities in Europe have also heavily relied on these mechanisms for antitrust enforcement.10 In February 2022, the UK's Competition and Markets Authority ("CMA") accepted commitments from Google in relation to the Privacy Sandbox for its Chrome browser. In a separate investigation, the CMA is currently evaluating commitments offered by Google in relation to its Play Store billing policies.11 The German competition law regulator, Bundeskartellamt, also recently accepted commitments offered by the German Olympic Sports Confederation and International Olympic Committee in respect of advertising restrictions imposed on the participants in the Olympic games and companies.12

The CCI will now therefore have a toolkit which is at par with global competition law authorities. Given the increasing focus on regulation in digital markets, such powers may help the CCI in quickly addressing potential anti-competitive conduct, while also freeing up its resources to regulate hard-core anti-competitive conduct. It however, remains to be seen how these mechanisms will be implemented in the regulations and in practice, whether they can help CCI ensure effective enforcement against competition law violations in India.

Provisions under the Amendment Act

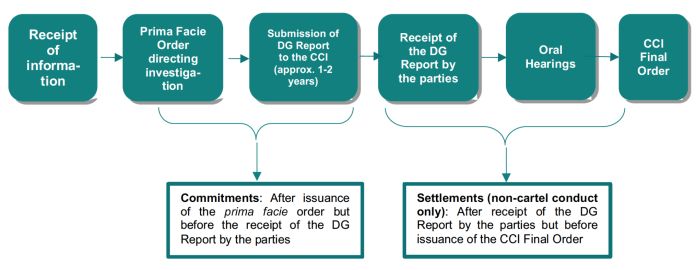

Under India's competition law regime, the CCI, on being prima facie satisfied of the existence of a violation, can direct the Office of the Director General ("DG Office") to initiate an investigation into the matter.13 The DG Office thereafter submits a report on its findings after completing the investigation ("DG Report").14 The parties are given an opportunity to review the DG Report and make their submissions to the CCI, before a final order is issued by the CCI.

The Amendment Act introduces two new provisions, Section 48A and Section 48B, that will allow parties to submit to the CCI (subject to payment of fees) an application for entering into settlements or commitments. Under the Amendment Act, commitments may be offered at any time after the CCI initiates an investigation against a party but before the DG Report is received.15 Settlements, on the other hand, may be offered by parties only after having received the DG Report, but before final adjudication by the CCI.16

The CCI would consider the nature, gravity and impact of the contraventions while assessing a proposal for settlement or commitments.17 In case of commitments, the CCI would also consider the effectiveness of the proposal in addressing the alleged contraventions being inquired.18 Other terms and conditions for implementation and monitoring of the settlement or commitments can also be imposed.19 Further, the CCI is bound to provide an opportunity to the party under investigation, the DG Office, or any other party, to submit their objections and suggestions to the proposed settlement or commitments.20 The order accepting the proposed settlement or commitments would be final, with no provision to file a statutory appeal before the National Company Law Appellate Tribunal or the Supreme Court of India.21 If the CCI does not find the proposal for settlement or commitments to be appropriate, and the party under investigation by the CCI fails to reach an agreement on the terms of the proposal with the CCI, the CCI may reject the proposal and proceed to adjudicate on the matter in accordance with the established procedure.

Several aspects of these mechanisms remain unclear as of now, such as the nature and objective of the settlement procedures, how the guilt of parties is to be established, the factors to be considered while assessing proposals, the role of third parties, etc.

Not So "Settled" Yet: A Review of the Finer Details

(a) Timelines and Procedure

- The provisions introduced in India stipulate cut-off events for the parties to exercise both the tools of settlement and commitments. Parties can offer settlements after receipt of the DG Report whereas commitments can be offered only prior to receipt of the DG Report.

- Interestingly, there are no strict cut-off "events" in most jurisdictions where these tools are deployed. The EC as well as the CMA and Bundeskartellamt do not typically impose a bar on when a party can enter into settlement discussions or offer commitments.22 Parties and the authority(ies) both, have the ability to decide the best course of action, depending on the nature of investigation and the status of evidence collected.

- A flexible approach indeed offers some value. For instance, in cases where there is overwhelming evidence of anti-competitive conduct in the early stages of investigation, the authority could convey this information to the parties and enter into an early settlement, avoiding expenditure of significant investigative resources (e.g. collating the evidence and preparing a report). Indeed, the CMA explicitly incentivizes parties to enter into settlements prior to the issuance of its statement of objections by offering a reduction of up to 20 percent on penalties, versus a reduction of only up to 10 percent if the settlement is entered into after the statement of objections is issued.

- In addition, courts have recognized that the DG Office has wide and expansive powers of investigation under the Competition Act. In fact, the DG Office has the ability to identify anti-competitive conduct in addition to what is already noted by the CCI in its prima facie order directing investigation, and may even report abuse of dominance violations in a matter arising out of a cartel complaint based on facts uncovered during the investigation.23 Parties under investigation may therefore, not have sufficient knowledge of the nature of allegations against them and would not be well placed to determine their strategy regarding negotiation with the CCI.

- It remains to be seen how the timelines will operate in practice and whether there are sufficient incentives built-in for the parties to opt for the commitment mechanism.

(b) Role of Third Parties in Commitments – Market Testing of Remedies

- The proposed mechanism for commitments may perhaps herald a significant change in the CCI's role from being a (largely reactive) adjudicatory body to a hands-on market regulator.24 Under the commitments procedure, the CCI must provide third parties the opportunity to submit suggestions or objections to the commitments offered by a party under investigation.25 This brings forth an interesting perspective to the role of third parties and informants in proceedings before the CCI.

- In the past, the CCI has stated that its proceedings are inquisitorial in nature and that the role of the Informant is "truncated" under the Competition Act to only be an "information provider."26 Once the CCI initiates investigation, it is not obligated to keep the Informant involved in the CCI proceedings. This is re-affirmed by the changes made to the confidentiality regime under the Competition Act, which specifically excludes the Informant from the confidentiality ring27 unless such inclusion is considered "necessary or expedient for effective inquiry."28

- The requirement to engage with third parties on commitments offered by a party under investigation is however, in line with other jurisdictions which require competition authorities to "market-test" commitments.29 This will be a welcome move as consultation with market participants will ensure that more effective remedies are arrived at by the CCI. For instance, the CMA is currently evaluating commitments offered by Google in relation to its Play Store billing policies. The CMA had published a notice of intention to accept the commitments offered by Google and invited representations from interested third parties on the proposed commitments. It is understood that numerous third parties have made representations to the CMA and that the CMA is currently assessing the suitability of the commitments based on the representations made. Such a consultative process is bound to result in the adoption of more effective commitments as CMA will benefit from the inputs of the market participants and can identify concerns with the proposed commitments, if any.

(c) Considerations for Assessing Proposals for Commitments

- While assessing a commitments proposal, the CCI may like to balance the benefits of seeking a speedy correction of the anti-competitive conduct against the long-term benefits of setting precedents against the conduct in question. The EC for instance, considers the speed of procedure, the resources used, the need to set a legal precedent and need to create deterrence against the conduct to assess whether to adopt the commitments offered by a party.30 Competition authorities consider commitments only in cases where the concerns are easily identifiable, and addressable by the commitments offered, within a short period of time.31 This therefore requires a case by case assessment.

- The use of commitments in addressing concerns in digital markets offers an interesting perspective. On the one hand, it will allow the CCI to offer quick targeted remedies in the market – one that it may perhaps not be in a position to direct under Section 27 or Section 28 of the Competition Act (which could also be challenged before appellate courts, thereby delaying necessary intervention in the market); and on the other, there might be several missed opportunities to set judicial precedents in this sector if commitments are accepted. It is indeed absolutely essential for the CCI to intervene in these markets, given the difficulties in determining relevant markets, dominance and contestability or competitiveness.

- It is, therefore, possible that commitments may be more likely to be accepted in cases involving established anti-competitive practices such as MFNs, RPMs, exclusivity, unfair terms and conditions etc. It would be timely to adjudicate on practices or conduct for which there is little jurisprudence; once the law is settled, subsequent conduct relating to similar practices may likely be addressed through commitments.

(d) Nature of the Settlements Mechanism and Admission of Liability

- The most striking aspect of the settlements mechanism under the Act is that it appears to be fairly lacking in its explicit objective (as set out in other major jurisdictions), namely, (i) admission of guilt of the party; and (ii) streamlining of administrative procedures.

- In several other jurisdictions, the settlement procedure is simply an administrative tool employed to fast-track the adjudicatory proceedings of a regulator to arrive at a finding of infringement by the party under investigation. On the other hand, the commitments procedure allows the regulator and the party under investigation to agree on a set of measures which would address the concerns in a timely manner (without a finding of infringement).

- Settlement procedures are perhaps most appropriately described by the Competition and Consumer Commission of Singapore ("CCCS") as "fast-track procedures." It describes the procedure as enabling the CCCS to: "achieve procedural efficiencies and resource savings through a streamlined administrative procedure that results in an earlier infringement decision than would have been possible without the fast track procedure."32

- Similarly, the CMA describes the settlement process as: "whereby a business under investigation is prepared to admit that it has breached competition law and confirms that it accepts that a streamlined administrative procedure will govern the remainder of the CMA's investigation. If so, the CMA will impose a reduced penalty on the business... Settlement, in appropriate cases, allows the CMA to achieve efficiencies through a streamlined administrative procedure, resulting in earlier adoption of any infringement decision, and/or resource savings."33

- The EC also describes the procedure in the same vein, noting that: "When parties are convinced of the strength of the Commission's case in view of the evidence gathered during the investigation and of their internal audit, they may be ready to acknowledge their participation to an infringement and accept their liability for it, in order to shorten the procedure and obtain a reduction of the fine. A settlement procedure therefore provides scope for reducing the length of the administrative procedure given the acceptance by parties of the Commission's case."34

- Typically, there is a ceiling on the quantum of fine reduction available under the settlement procedure and it is not negotiable between the regulator and the parties. The incentive for parties to enter into a settlement procedure is to receive a discount on the fine to be imposed by the regulator for a contravention of the law. Additionally, the quantum of reduction in the penalty under the settlement route should be limited as (i) by that stage, the DG would already have collected and analyzed all relevant evidence and completed the investigation; and (ii) the parties would have had the ability to review the DG Report and the contraventions found.

- Most major jurisdictions that have a settlement procedure require an admission of guilt for the party to benefit from this.35 The EC and the CCCS reward parties with a 10 percent reduction in penalty for streamlining the administrative process. The CMA incentivizes parties to enter settlement decisions even prior to the issuance of the statement of objections, by offering a 20 percent reduction in the fine (as opposed to a 10 percent reduction post the statement of objections).

- Indeed, while examining the international jurisprudence on liability under settlements and commitments mechanisms, the CLRC Report even noted that: "...a settlement decision establishes an infringement and requires an admission of guilt from the parties, a commitment decision does not establish an infringement and does not require any admission by the parties."36 However, no distinction was made when recommending the introduction of these mechanisms to the Indian competition law framework37. The provisions under the Amendment Act also do not seem to draw much distinction between the two procedures.

- The Amendment Act does not mandate admission of guilt in settlements or commitments, and such a determination may likely be made by the CCI on a case-to-case basis. Interestingly, however, parties that have settled with the CCI under Section 48A of the Competition Act may still be liable for damages claims. It is understood that such claims may lie only against parties that would have a finding of infringement against them; subjecting parties that are not found guilty of violating the Competition Act to damages claims is very likely to be challenged in writ courts in India on grounds of constitutionality.

- Further, in case of settlements, the CCI has the discretion to impose fines as well as draw out behavioral commitments from parties. While such discretion in itself is not problematic, it is hoped that the regulations will clearly set out the criteria for accepting settlements. The procedural efficiency gained from the cooperation by the party would likely be reflected in the quantum of penalty reduction granted to such a party.

Carrot and Stick: Restoring the CCI's Penalty Powers for Effective Adoption of the Mechanisms

In most jurisdictions,38 the quantum of fines that can be imposed on the contravening party is 10 percent of the overall global/total turnover of the party. In India, the power of the CCI to decide the quantum of penalty was heavily diluted by the Supreme Court of India (the highest court of law in India) in Excel Crop.39 Section 27(b) of the Competition Act empowered the CCI to impose a penalty not more than 10 percent of the average of the "turnover" for the last three preceding financial years. In line with global jurisprudence, the CCI had interpreted "turnover" to mean the "total turnover" of the party i.e. its global turnover. However, in Excel Crop, the Supreme Court held that the quantum of penalty has to be restricted to not more than 10 percent of the "relevant turnover" of the erring enterprise on grounds of proportionality to the violation. The "relevant turnover" had been defined as the turnover pertaining to the products or services (and the geography) for which the anti-competitive conduct of the parties relates to.40 This severely reduced the scope of penalty that would be imposed by the CCI and also impacted the intended deterrent effect that such penalties should have had in the market.41

The 2023 Amendment Act has "re-stored" the CCI's powers to impose penalties calculated on the basis of a party's global turnover. This was critical to increase the attractiveness of the non-adjudicatory mechanisms for parties. In other jurisdictions as well, an introduction of cooperation or lenient regimes was coupled with increase in the level of fines. For instance, in the US, leniency was introduced in 1978, and made more generous in 1993 and 2004, whereas Congress raised the maximum jail term for antitrust offences and the maximum fines for corporations during the same time.42 The EC adopted its first Leniency Notice in 1996 and its first Fining Guidelines, which reflected an increase in the level of fines, in early 1998. The EU Member States followed a similar pattern for example, in France, a leniency programme was introduced in 2001 and the same legislation also increased the maximum fine.43 Therefore, it may be argued that the existence of such policies allows antitrust offenders to reduce their exposure to penalties by cooperating with the authorities. Their failure to take advantage of the cooperation mechanisms increases their culpability and should beget higher fines or penalties.

The increased penal powers of the CCI are therefore, a welcome change that would not just increase the deterrence effect against competition law violations but also act as a catalyst for the adoption of the settlement and commitment mechanisms.

Rewarding companies for cooperation with the CCI is also not a new feature in the Competition Act. The "Leniency Regime" of the CCI incentivizes companies participating in a cartel to blow the whistle for a reduction in the fine imposed by the CCI. A party that first approaches or provides vital disclosures to the CCI may receive full immunity (i.e. a 100 percent reduction) from fines.44 The incentive of lenient treatment to a whistle blower destabilizes cartels and also ensures that the CCI does not waste its scarce resources in uncovering evidence and proving the existence of cartels.

Enforcement against cartels through the Leniency Regime has been largely successful. Since its introduction in 2017, the CCI has decided 16 cases under the Leniency Regime and there are several more under investigation. However, while the leniency mechanism may be relied upon for enforcement against cartels, it is worth assessing whether the settlements and commitments mechanisms should be limited as enforcement tools primarily for non-cartel conduct. A scenario involving non-cartel conduct is markedly different as such conduct is undertaken publicly; the difficulty in investigation of such conduct is to evaluate if the evidence is strong enough to prove the case such that the findings can withstand the test of appeals.

Conclusion

The settlements and commitments mechanisms are much needed tools to aid antitrust enforcement in India. They will offer procedural efficiency and allow the CCI to intervene swiftly and effectively in certain cases where parties are willing to close investigations sooner. Major competition authorities around the world are frequently relying on such mechanisms to achieve their enforcement objectives.

Several aspects need to, however be addressed in order to ensure that the CCI is able to effectively implement these mechanisms in India. It remains to be seen how CCI frames the supporting regulations and the clarity they bring to the operation of the settlement and commitment procedures in practice.

Footnotes

1. Authors: Sonam Mathur, Partner, Shubhang Joshi, Managing Associate and Riya Shah, Associate.

2. On August 5, 2022, the Competition (Amendment) Bill 2022 ("2022 Bill") was introduced in the Indian Parliament which was subsequently referred to Parliamentary Standing Committee on Finance ("Committee") for their recommendations. The Committee submitted its recommendations in December 2022 and on 8 February 2023, the Ministry of Corporate Affairs ("MCA") introduced certain additional modifications to the 2022 Bill. The Competition (Amendment) Bill, 2023 ("2023 Bill") as passed by the Indian Parliament in April 2023 contains some recommendations of the Committee and also certain additional modifications brought by the MCA.

3. On May 19, 2023, the Government brought into effect several provisions of the Amendment Act including, wider investigation powers, inclusion of hub and spoke cartels as anti-competitive horizontal agreements, etc. The provisions regarding settlements and commitments mechanisms have not yet been notified.

4. The CLRC Report stated that "procedural economy and efficiency of enforcement action are driving factors for recognising settlements and commitments in the Competition Act. Such mechanisms are likely to enable the CCI to resolve antitrust cases faster and consequently, also free up its scarce resources. Further, businesses can avoid long investigations and uncertainty. Such negotiated remedies also enable authorities to impose innovative deterrents upon respondents while achieving equitable remedies for victims." Para 4.3, Page 42.

5. Article 10(a), Commission Regulation (EC) No 622/2008 of 30 June 2008 amending Regulation (EC) No 773/2004, as regards the conduct of settlement procedures in cartel cases.

6. European Commission: Article 9 commitment decisions (Table), Practical Law Competition, available at: (https://uk.practicallaw.thomsonreuters.com/w-019-4941?comp=pluk&transitionType=Default&contextData=(sc.Default)&firstPage=true&OWSessionId=0a63dc70663e4e449e5f2cdc12a7c41f&skipAnonymous=true) last accessed on July 26, 2023.

7. See, EU: Settling Antitrust Non-cartel Conduct Matters with the European Commission, Global Competition Review 2 February 2021, available at (https://globalcompetitionreview.com/guide/the-settlements-guide/first-edition/article/eu-settling-antitrust-non-cartel-conduct-matters-the-european-commission), last accessed on July 26, 2023.

8. Case COMP/AT.40462 and Case COMP/AT.40703 – Amazon, available at (https://ec.europa.eu/competition/antitrust/cases1/202252/AT_40462_8825091_8265_4.pdf), last accessed on July 26, 2023.

9. For instance, See Case AT. 39759 – ARA Foreclosure, European Commission, paras 161-162, September 20, 2016 (https://ec.europa.eu/competition/antitrust/cases/dec_docs/39759/39759_3071_5.pdf) last accessed on July 26, 2023

10. (i) UK: Section 31A of the Competition Act, 1998; Rule 9 of the Competition Act 1998 (Competition and Markets Authority's Rules) Order 2014 read with Guidance on the CMA's investigation procedures in Competition Act 1998 cases (para 10.17 and para 14); and (ii) Germany: Section 32b of the Competition Act – GWB, as amended; Information Leaflet Settlement procedure used by the Bundeskartellamt in fine proceedings, February 2016.

11. Case number 50972 – Investigation into Google's 'Privacy Sandbox' browser changes, February 11, 2022 (https://assets.publishing.service.gov.uk/media/62052c52e90e077f7881c975/Google_Sandbox_.pdf) last accessed on July 26, 2023. ; See, Investigation into suspected anti-competitive conduct by Google, 10 June 2022 (https://www.gov.uk/government/consultations/proposed-commitments-regarding-changes-to-google-plays-rules-to-allow-certain-app-developers-to-use-alternative-billing-systems-for-in-app-purchases), last accessed on 26 July 2023.

12. B 2 – 26/17, Decision pursuant to Section 32b GWB (https://www.bundeskartellamt.de/SharedDocs/Entscheidung/EN/Entscheidungen/Missbrauchsaufsicht/2019/B2-26-17.pdf?__blob=publicationFile&v=2) last accessed on July 26, 2023.

13. Section 26(1) of the Competition Act.

14. Section 26(3) of the Competition Act.

15. Section 48B(2) of the Amendment Act.

16. Section 48A(1) of the Amendment Act.

17. Sections 48A(3) and 48B(3) of the Amendment Act.

18. Section 48B(3) of the Amendment Act

19. Sections 48A(3) and 48B(3) of the Amendment Act.

20. Sections 48A(4) and 48B(4) of the Amendment Act.

21. Sections 48A(4) and 48B(4) of the Amendment Act.

22. In the EU, cut off dates do exist for initiation of the settlement procedure; parties cannot enter into settlement discussions later than either the issuance of a preliminary assessment, the statement of objections, the deadline set by the EC to enter into such discussions or the issuance of notice of final hearings, whichever is earlier. Please refer to Regulation (EC) No Article 2, paragraph 1, (EC) No 773/2004, as amended.

23. Competition Commission of India v. Grasim Industries Limited, (LPA 137 of 2014), 2019 SCC OnLine Del 10017

24. Dunne, 'Commitment decisions in EU competition law', Journal of Competition Law & Economics [2014] 10(2), 399.

25. Section 48B(4) of the Amendment Act

26. Shikha Roy vs. Jet Airways (India) Limited & Ors., para 13, Case No. 32 of 2016.

27. Confidentiality ring consists of representatives of the parties who will be given access to all confidential information (including the confidential version of the DG Report, documents obtained during search and seizure and complete version of the CCI's orders).

28. Regulation 35, Competition Commission of India (General) Regulations, 2009. In fact, in In Re: International Spirits and Wines Association of India vs. Prohibition & Excise Department, Government of Andhra Pradesh, Case No. 45 of 2021, the CCI rejected the informant's plea for the formation of a confidentiality ring to access the confidential submissions of the opposite parties, noting that there is no inherent right of the Informant to be part of the confidentiality ring, and that its inclusion was not necessary or expedient for the case. The CCI ultimately rejected the informant's allegations against the opposite parties, though it stated that no reliance was made on the confidential information of the opposite parties that was not made available to the informant.

29. See, Article 27(4) of the EU Reg 1/2003 for European Union; Guidance on the CMA's investigation procedures in Competition Act 1998 cases, CMA8, para 10.23.

30. See, Competition regime: EU Procedure, negotiation and enforcement, Practical Law Competition, available at (https://uk.practicallaw.thomsonreuters.com/6-107-3709?transitionType=Default&contextData=(sc.Default)), last accessed on July 26, 2023.

31. Guidance on the CMA's investigation procedures in Competition Act 1998 cases (para 10.18), available at ( https://www.gov.uk/government/publications/guidance-on-the-cmas-investigation-procedures-in-competition-act-1998-cases/guidance-on-the-cmas-investigation-procedures-in-competition-act-1998-cases#investigation-outcomes); and Commitment decisions – frequently asked questions, available at (https://ec.europa.eu/commission/presscorner/detail/en/MEMO_13_189) last accessed on July 26, 2023.

32. CCCS Practice Statement on The Fast Track Procedure For Section 34 And Section 47 Cases.

33. Guidance on the CMA's investigation procedures in Competition Act 1998 cases: CMA8, December 10, 2021.

34. Antitrust: Commission introduces settlement procedure for cartels – frequently asked questions, June 30, 2008..

35. (i) EU: Regulation (EC) No 773/2004, article 10a (1); (ii) UK: Guidance on the CMA's investigation procedures in Competition Act 1998 cases, CMA8, para 14.7; (iii) Germany: Information Leaflet on settlement procedure used by the Bundeskartellamt in fine proceedings (February 2016), part 2; and (iv) Singapore: CCCS Practice Statement on the fast track procedure for Section 34 and Section 47 Cases, para 3.7.

36. Para 4.2, CLRC Report

37. Paras 4.6 and 4.8, CLRC Report.

38. EU: Article 23(2) of the Council Regulation No 1/2003; UK: Section 36 of the UK Competition Act, 1998; Germany: Section 81c of the Act against Restraints of Competition (Competition Act – GWB)..

39. Excel Crop Care Limited v. Competition Commission of India & Anr., (2017) 8 SCC 47.

40. Interestingly, in the recent infringement orders against MMT-Go, Oyo, the CCI imposed penalties based on the entire turnover of the parties in India, and not on the 'relevant' turnover relating to the conduct of the parties. It noted that given the interdependent and integrated nature of digital market platforms, restricting the revenue to one segment of a platform would not serve the deterrence aims of the statute. The CCI's actions demonstrate the clear need to undo the limitations imposed upon its penalty powers by the Supreme Court in Excel Crop

41. The proviso to Section 27(b) states that in case of cartels, the CCI can impose a penalty amounting to up to three times of the profit of the contravening party for each year of its participation in the cartel. It can be argued that CCI's power to impose heavy penalties on cartel has escaped the restrictive interpretation in Excel Crop, thus retaining the attractiveness of the leniency regime.

42. United States, Department of Justice, Leniency Program, available at (https://www.justice.gov/atr/leniency-program) last accessed on July 26, 2023.

43. See, Cartel Leniency in France: Overview, Practical Law, available at (https://uk.practicallaw.thomsonreuters.com/8-501-0962?transitionType=Default&contextData=(sc.Default)) last accessed on July 26, 2023.

44. Regulation 4(a) of the Lesser Penalty Regulations.

Originally published 20 August 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.