- within Compliance topic(s)

ABSTRACT

When it comes to the period of year end, most of companies will come to the end of the fiscal year and prepare the financial results for the year in their annual financial report. Over the years, and due to European Directives, the regulation and legislation with respect to the annual accounts in the Netherlands have increased significantly, in this regard the Netherlands offers a highly regulated environment for corporations, partnerships and privately owned businesses. The legal requirements relating to the annual accounts are included in Title 9 Book 2 of the Dutch Civil Code (DCC).

Key Words: Financial Statements in the Dutch Law, Publication of the Annual Accounts, Audit, Corona Pandemic, Dutch Emergency Act.

INTRODUCTION

The annual accounts or the financial statements are part of the three foundation of the Dutch corporate regime. The other two essential foundation of the regime are the audit and the publication of the accounts itself.

The obligation to prepare financial statements practically applies to every Dutch corporation, and this obligation is usually stated in the statutes of the corporate entity. Some derogation applies to certain type of legal entity. The company can follow the format and the layouts of the financial statements as required by the law, these are extensively explained and provided in Title 9 Book 2 of DCC.

Further details on the annual accounts, the audit to the annual accounts as required by Dutch law, the publication of the accounts and the current development due to Corona pandemic will be explained below.

THE FINANCIAL STATEMENTS AND THE DUTCH LEGAL SYSTEM

The financial statements are an essential building stone for the Dutch legal system and form the basis for corporate governance.

Title 9, Book 2 of the Dutch Civil Code provides rules on the drawing up and publication of annual accounts. These provisions are the result of the implementation of the Fourth and Seventh Company Law Directives of the European Communities Council into Dutch company law1.

The following are the two Directives with their own specific subject:

- Directive 78/660/EEC of 25 July 1978, OJ 1978 L 222. This Directive is based on Article 54 (3) (g) of the Treaty on the annual accounts of certain types of companies.

- Directive 83/349/EEC of 13 June 1983, OJ 1983 L 193. This Directive is based on Article 54 (3) (g) of the Treaty on consolidated accounts.

The financial statements offer transparency into the company business activities and mainly serve as a report to the shareholders and to protect the creditors. It generally consists of a balance sheet, a profit and loss account and notes to the accounts. The layouts of each item of the accounts are proposed in the Directive to be chosen. The implementation of this provision in the Netherlands can be found in Article 2:361 DCC.

In addition, the company is obliged to publish its annual report after the determination or approval of the financial statements by the shareholders within 8 days. This means filing a copy of the financial statements with the Dutch Chamber of Commerce, this lays in Article 2:394 DCC.

The following is the highlights of the Article 2:394 on the publication of the annual accounts in the Dutch Chamber of Commerce.

- The legal person is obliged to publish the annual accounts within eight days after adoption. Publication is made by depositing a full copy of the annual accounts, drawn up in the Dutch language or in other languages, French, German or English are allowed. The annual accounts are deposited or filed at the office of the commercial register kept by the Chamber of Commerce. The date of adoption and approval are noted on the copy.

- When the annual accounts have not been adopted in agreement with the legal requirements within two months after the required period for their preparation has ended, the draft of the annual accounts (unadopted) shall be filed and shall mention that the accounts have not yet been adopted.

- No later than thirteen months after the end of the financial year, the legal person must have published the annual accounts in the legally required way.

AUDIT REQUIREMENTS IN THE NETHERLANDS

The audited annual accounts are required by law in the Netherlands, this applies only for medium and large companies. Addition to that it also applies to companies that apply IFRS. They fall in this category and have obligation to have their accounts audited. An exemption may be granted for a Dutch company to have the audit performed at Dutch level, when it can apply for a Group Exemption in accordance with article 2:403 and article 2:408 DCC 2,3.

In article 2:403 mainly explains the conditions of a company to be exempted or as a part of Group Exemption (after liability has been accepted for group subsidiaries). The conditions such as the members or shareholders have stated in writing, after the start of the financial year and prior to the adoption of the annual accounts, to agree with an exemption from these requirements; the financial data of the company are consolidated by another company into its consolidated annual accounts.

While article 2:408 focuses on part of groups which not required to do consolidation. The exemption applies for this part of groups with conditions such as the financial data that a company should consolidate are included in the consolidated annual accounts of a larger entity in the group; the consolidated annual accounts and annual report are drawn up in accordance with the provisions of the Seventh Council Directive (83/349/EEC) on annual and consolidated accounts or, if those rules need not be followed, in a similar way.

For medium and large companies as mentioned earlier, the law requires that companies in these categories must create an annual financial report audited by an independent, a qualified and a registered auditor, from a Dutch accounting firm. This auditor also needs to be appointed by the general meeting of shareholders of the company, or the managing or supervisory board (Article 2:393 DCC).

Micro and small companies, they are not required to be audited. A branch of a parent company is generally exempted from an audit. If the audit is not obligatory, they may have the option for a voluntary audit.

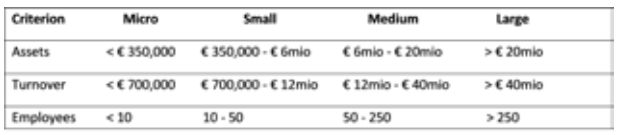

The size classifications are based on 3 (three) criteria, the value of the assets, the net revenue and the number of employees (Article 2:396 and Article 2:397 DCC). The parameters for these classifications are summarized in the table below. In order to qualify for the medium or large categories, at least two of the three criteria must be met in two successive years.

CORONA PANDEMIC AND THE YEAR-END FINANCIAL PROCESS

The corona pandemic (COVID-19) can have an impact on the quality of financial processes and for the timely completion of the financial statements. For auditors, remote monitoring and interim adjustments in the risk analysis will lead to additional work. This is mentioned in the handout issued by the NBA (Koninklijke Nederlandse Beroepsorganisatie van Accountants or Royal Dutch Association of Accountants)4.

The concerned aspects include the Continuity (assurance and risks valuation), the Processes (remote work leads to increase risk/fraud), the Accounting work (change of approach/no physical encounter), and the Timeliness (care is more important than speed). The Stakeholders should be proactively informed of the potential risks of delays in processes which lead in delaying the delivery of the audited financial statements. The advance planning and good coordination should be set among all parties involved, in order reduce this risk5.

Because of this pandemic outbreak, the Dutch Emergency Act was issued on 24 April 2020 by the Dutch Authority. This Emergency Act facilitates for temporarily rules deviating from the current requirements of Book 2 of the DCC for Dutch legal entities on the subjects among others as follows:6

- The form of decision-making and general meeting.

- Extension of the period to prepare the annual accounts.

- Limitation on the 'presumptions of proof' for directors' liability for the late filing of the annual accounts, in the event of bankruptcy.

This Emergency act was initially expired in September 2020, it is now extended to 1 April 2021. The temporarily rules under the Emergency Act apply retroactively from 16 March 2020.

CONCLUSIONS

In the Netherlands, companies generally need to produce and also publish their annual accounts. In some cases, in view of their size, the annual accounts should be consolidated and audited. COVID-19 brings its own challenges, but the law remains in place. Some derogations have been issued to ease temporarily rules and regulations due to COVID-19 measurements.

Footnotes

1. DCC, Book 2 Legal Persons, Title 2.9 Annual accounts and annual report.

2. DCC, Book 2 Legal Persons, Section 2.9.12 Provisions regarding legal persons of distinguished types.

3. DCC, Book 2 Legal Persons Section 2.9.13 Consolidated annual accounts.

4. NBA handout 1147, dated 22 December 2020.

5. NBA handout 1147, dated 22 December 2020.

6. Dutch Authority, Regeling - Tijdelijke wet COVID-19 Justitie en Veiligheid - BWBR0043413

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.