An important choice that companies funding their Chilean entities need to make is the form in which they do this— by debt or equity. In many cases, a good tax strategy is to use debt because at some point when the local entity is creating profit, this allows the debt to be repaid without any withholdings taxes.

What many do not know is that loan agreements often have taxes associated with them. It is very common for companies to fund their local entity without properly recording the operation or paying the associated taxes. The risk is that if audited, the entity is then subject to fines.

The statute of limitation is 3 or 6 years depending on the good faith of the taxpayer. Only once this time has passed by, counted from the date of birth of the obligation, the taxpayer may write of this tax liability.

Below we have provided a high-level overview of taxes associated with financial transactions, in this case, mainly related to loans:

What is Stamp Tax?

The Stamp Tax is an indirect tax that is levied on all financial transactions, technically known as "credit operations".

Law No.18,010, article 1, defines "credit operations" as those in which one of the parties delivers to, or commits to deliver, an amount of money and the other party commits to repay it at a moment other than the one in which the convention is set forth. Following the provision of the law, the Chilean IRS has indicated that a credit operation must be set forth in a written document for it to be subject to Stamp Tax. This means that the document must be issued and signed by the two parties that take part in the operation.

While some expert may say that the Stamp Tax (ST) replaces the Value Added-Tax (VAT), in reality the taxes have very different functions. In Chile, these kinds of operations are not within the scope of the VAT, substituting it with a lower tax burden.

How much is Stamp Tax?

The normal tax rate of VAT in Chile is a flat 19% made on the sale of goods or services, however, credit operations are subject to a much lower rate of 0.066% on the amount of the operation for each month or fraction of month between disbursement and maturity, capped at 0.8%. For documented credit operations payable on demand or with no maturity date, the applicable rate is 0.332%.

This tax is applied directly on the amount of the debt or money lent and must be withheld and paid by the debtor.

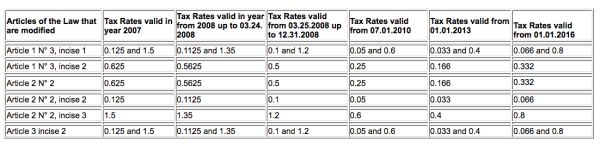

The stamp tax rate has fluctuated up and down depending on the current administrations' position and the cash necessity of the Government. In recent years, several modifications of law have taken place as seen below:

How does it work and when should it be paid?

For foreign credit operations, whenever a credit operation is made and the money has been accounted in the debtors' records, the stamp tax is triggered giving the parties five days to enter it the into Treasury.

Despite the above, not all money operations are levied with the stamp tax. For example, the Chilean IRS has indicated that when someone makes a written recognition of debt via a document containing a unilateral statement, this will not qualify as an operation subject to the stamp tax.

In some of these cases, the recognition of debt may hide an underlying loan, however, it is not easy to determine the exact legal nature of a debt. For example, it is different if one party owes another the completion of the price for a purchase made in the past or if it was a simple loan of money made between the same parties.

On the other hand, the IRS has followed simple rules to determine if an operation may be qualified as a loan and therefore as a credit operation or not. If the document is not signed by the two parties taking part in the operation, it may be considered as a recognition of debt instead of a loan. Despite this, certain documents issued by a single party are still subject to stamp tax by an express provision of the law, such as promissory notes.

What are the penalties?

There are a number of different sanctions related to the stamp tax. The declaration and / or payment outside the deadlines set forth by the Law incurs a penalty equal to three times the intitially due tax, in addition to additional adjustments, interests and penalties set forth in the Tax Code.

In accordance with article 26 of the Stamp Tax Law, documents that have not paid the relevant stamp tax may not be enforced before the judicial, administrative or municipal authorities and will lack executive merit until the payment is made, along with the corresponding adjustments, interests and penalties.

The statute of limitation is 3 or 6 years depending on the good faith of the taxpayer. Only once this time has passed, counted from the date of the obligation, the taxpayer may write off this tax liability.

Conclusion:

The stamp tax has been a very controversial tax, not only because of the unique way it has been implemented (it places a greater levy on a document compared to a simple operation), but also because economically it makes little sense to burden the debtor with an extra cost besides the loan itself and the associated interests. In this regard, since often investments are made through debt, many experts argue that these kinds of taxes are not foreign investment friendly at a policy level.

The stamp tax is not exempt from controversy and it is not an easy tax to even identify. On one hand, it is an extra burden for investors, existing as an added cost on a mortgage or even when a company provides a promissory note as a security. On the other hand, the manner in which it has been implemented in the law leaves ample room for interpretation, making it difficult to determine the exact legal nature of many operations, especially those made between related parties.

It is common to see foreign loans entering the country that have not properly paid the stamp tax which can create problems with the tax office that includes fines. Many companies are simply not aware. This is the reason it is critical to have a legal and accounting team that can guide foreign companies through the process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.