- within Tax topic(s)

- in United States

- within Tax, Employment and HR and Corporate/Commercial Law topic(s)

Saudi Arabia has boarded on a significant transformation under Vision 2030, rapidly evolving into a global business and investment hub. A central component of this transformation involves a modernized tax and investment framework, including strong Value Added Tax (VAT) regulations, targeted permanent establishment (PE), withholding tax regimes, corporate income tax policies, and comprehensive incentive programs such as the Regional Headquarters (RHQ) initiative and Special Economic Zones (SEZs).

1- Value Added Tax (VAT)

Exports from Saudi Arabia enjoy a 0% VAT rate, conditional upon proof of transport outside1 the GCC, in line with Article 32 of the Saudi VAT Implementing Regulations.

Standard VAT Rate Saudi Arabia's standard VAT rate currently stands at 15%, requiring full compliance and registration with the Zakat, Tax and Customs Authority (ZATCA).

Zero VAT applies to supplies from the Saudi domestic economy to SEZ investors, as well as exchanges between SEZs.

2- Withholding Tax

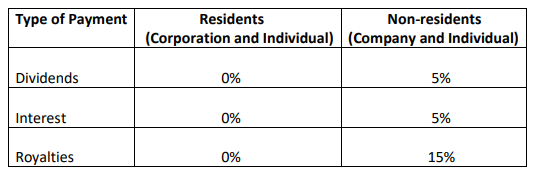

From a legal tax perspective, the withholding tax system will apply as follows:

i. No withholding tax is imposed on dividends paid to residents. For dividends paid to nonresidents, a 5% withholding tax is applicable unless a reduced rate is provided under an applicable tax treaty.

ii. Interest payments made to residents are not subject to withholding tax. However, a 5% withholding tax applies to interest paid to nonresidents, subject to any reduction under an applicable tax treaty.

iii. Payments for royalties made to residents are exempt from withholding tax. For royalties paid to nonresidents, a 15% withholding tax is imposed unless a lower rate is available under an applicable tax treaty.

iv. No withholding tax is imposed on fees for technical services paid to residents. A 5% withholding tax applies to technical service fees paid to nonresidents, unless a tax treaty provides for a reduced rate.

v. A 5% withholding tax is levied on the remittance of profits abroad by branches of foreign companies operating in Saudi Arabia.

3- Income Tax and Zakat

3.1. Foreigners and GCC National Taxable Incomes

According to the definition provided by Saudi Law, a company will be subject to income tax if it is resident in the KSA and registered in accordance with the applicable regulations for companies in Saudi Arabia and has its principal administration within the Kingdom.

A 20% income tax rate applies to non-Saudi (non-GCC) ownership shares in resident companies, while Saudi and GCC shares are subject to a 2.5% Zakat charge.

Where a company is owned by both Saudi and non-Saudi interests, the portion of taxable income attributable to the non-Saudi interest is subject to income tax, and the Saudi share goes into the basis on which Zakat is assessed.

Regarding the income tax, it is levied at a (i) 20% rate2 on (ii) income arising in Saudi Arabia (iii) from non-Saudi's shares (or non GCC national shares) in a resident company in the KSA3 .

While the income tax base is characterized by the fact that it only covers non- Saudi (and non GCC) shares, excluding de facto income deriving from Saudi shareholding, it should be noted that said base also excludes certain expenses from the gross income earned by a company during a tax period.

As a matter of fact, all the ordinary and necessary expenses incurred to create the income shall be deducted from the income tax base 4 , which may include outsource or external necessary services, payment of certain costs necessary for the implementation of the companies' activities.

3.2. Permanent Establishment Subject to Income Tax:

A permanent establishment (PE) is considered to exist when a non-resident has (i) a fixed place of business in the Kingdom, (ii) an agent with authority to conclude contracts on its behalf, or (iii) when services are performed by employees or personnel present in Saudi Arabia for more than 183 days in a 12-month period, as per most DTAs and Article 5 of the OECD and UN Model Tax Conventions5 .

Practical examples include a Dutch consulting firm providing on-site financial advisory services in Saudi Arabia for over 200 days, or a UK training company delivering in-person courses in Saudi Arabia for 204 days, both scenarios create a PE and subject the attributable profits to 20% income tax in Saudi Arabia.

Conversely, if services are delivered remotely from abroad without physical presence, such as a Vietnamese company providing online technical support, no PE is created, and payments may instead be subject to withholding tax on a gross basis.

A simple assessment for contracts: if services require physical presence in Saudi Arabia and are performed dependently (i.e., under direct supervision or control of the client, with significant duration), a PE is likely triggered; if services are executed independently and remotely, a PE is generally not established.

4- Regional Headquarters (RHQ) Tax Incentives

A 0% withholding tax rate applies for 30 years on (i) Payments to non-resident related parties, on (ii) Dividend payments from the RHQ entity to its foreign parent company or companies and (iii) on Payments to non-resident unrelated parties for services necessary for RHQ activities. .

A 0% corporate income tax rate applies for 30 years to all activities directly related to the RHQ's operations.

In this context it is worth assessing practically how the applicable tax framework related to the Tax Incentives and Transfer Pricing will apply to regional headquarter incomes.

The above exemption rate on income tax rate applies to all Eligible Income generated by the RHQ through the mandatory and optional activities that are conducted and selected under the RHQ entity. In addition, tax benefits are limited for the RHQ Licensed entity and not extended to subsidiaries, branches and affiliates under management that are incorporated to operate directly the business..

As for the withholding tax exemptions, it applies to payments made by the RHQ to nonresidents in relation to the following:

i. Dividends distributed by the RHQ.

ii. Payments to related persons, including entities within the same corporate structure.

iii. Payments to unrelated persons for services deemed necessary for the operations and activities of the RHQ.

In conclusion, to fully benefit from the RHQ program's tax and business incentives, the MNC must ensure that income attributed to the RHQ entity arises solely from eligible activities that are already known and selected by the RHQ under its MISA license. A compliant transfer pricing framework shall be supported by strong intercompany agreements and comprehensive documentation, to ensure compliance, and maximize the program's advantages.

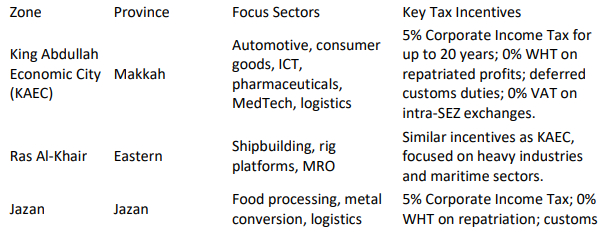

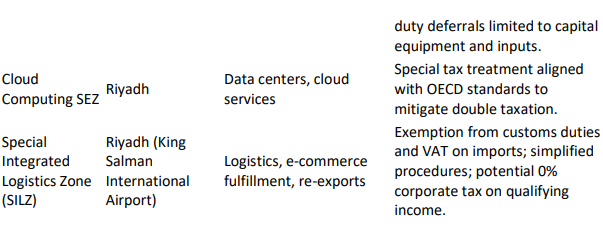

5- Special Economic Zones (SEZs)

Saudi Arabia has introduced a suite of SEZs designed to promote foreign direct investment, technological transfer, and advanced manufacturing. These zones are regulated by the Economic Cities and Special Zones Authority (ECZA).

5.1. Current SEZ Landscape

5.2. VAT and Customs Treatment.

Zero VAT applies to supplies from the Saudi domestic economy to SEZ investors, as well as exchanges between SEZs. Imports directly into SEZs from abroad are out of VAT scope. Goods entering SEZs from within Saudi Arabia are treated as re-exports, with customs exemptions and potential refunds applicable. Conditions:

i. Goods must be under customs suspension.

ii. Goods must be directly related to licensed SEZ activities.

The SEZ framework is a cornerstone in Saudi Arabia's strategy to attract advanced manufacturing, technology, and logistics players. Together with RHQ incentives and an attractive tax regime, these zones strengthen the Kingdom's position as the Middle East's foremost investment gateway.

6- Conclusion

Saudi Arabia's multidimensional approach, combining VAT modernization, corporate tax clarity, RHQ privileges, and SEZ advantages, provides unparalleled opportunities for global investors and multinational firms. Companies considering operations in Saudi Arabia should strategically assess each zone's incentives and compliance requirements to optimize tax exposure and operational efficiency.

Footnotes

1 (Source: ZATCA VAT Implementing Regulations)

2 Article 7 of Saudi Arabia Royal Decree No. M1/1425 related to the Income Tax Law

3 Article 2 and 6 of Saudi Arabia Royal Decree No. M1/1425 related to the Income Tax Law

4 Article 12 of Saudi Arabia Royal Decree No. M1/1425 related to the Income Tax Law

5 ZATCA Circular on Taxation of Permanent Establishments, May 2023)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.