- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy and Technology industries

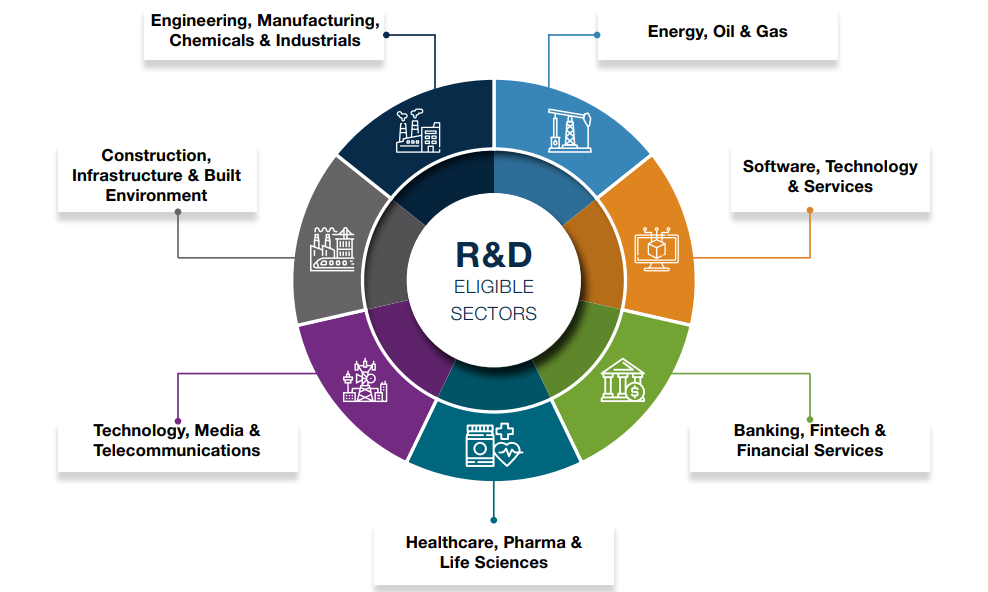

An exciting start to the year with the announcement of great incentives for key industries in the UAE. The MoF recently announced the introduction of Research and Development (R&D) Tax credits that will begin from 1 January 2026. This incentive aims to increase inward investment into the UAE to support and grow established and emerging industries.

The prize: A tax credit ranging between 30 and 50% has been hinted at by the MoF1.

The detail so far: Typically, R&D tax credits regimes require companies to demonstrate a Technological or Scientific activity and to have incurred costs associated with that activity. MoF has already announced that activities will need to adhere to the OECD's Frascati Manual guidelines to qualify, which is consistent with other existing R&D tax incentives around the world.

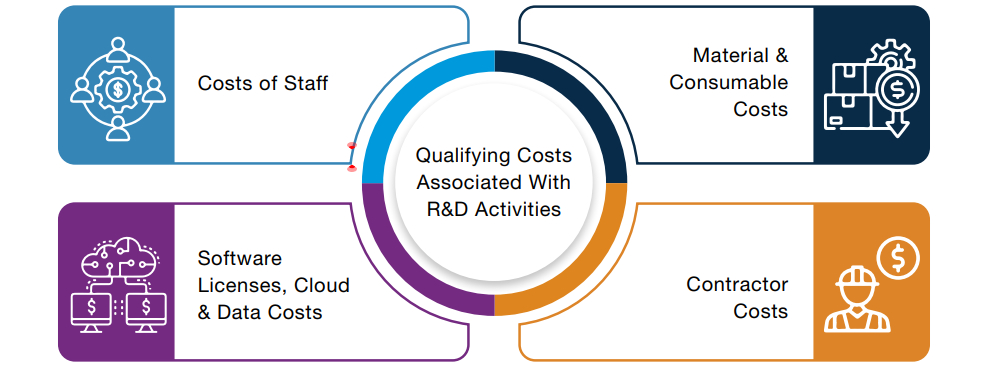

Little is currently known about which costs may qualify in the new UAE regime or how the refund will work in practice. Looking internationally to more established schemes around the world like the US, UK, France and Canada, the following costs tend to be eligible:

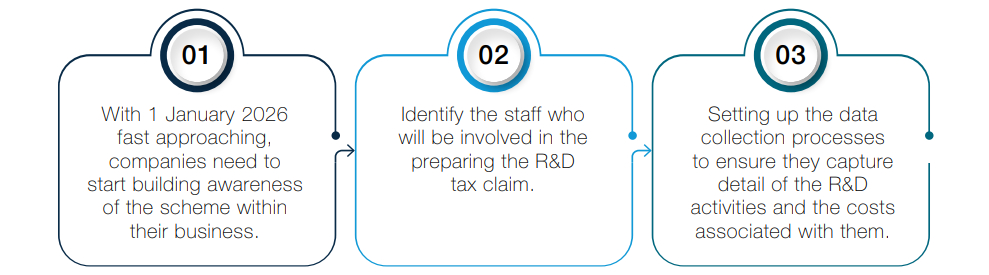

Your Next Steps:

Footnote

1 https://mof.gov.ae/ministry-of-finance-announces-amendments-to-the-corporate-tax-law/

Originally published 6 November 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.