- within Cannabis & Hemp topic(s)

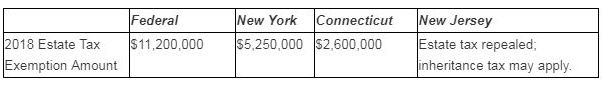

On December 22, 2017, the Tax Cuts and Jobs Act (the "Act") was signed into law. The Act temporarily doubles the estate, gift and generation-skipping transfer ("GST") tax exemption amount. Under prior law, the exemption amount would have been $5.6 million per person in 2018, which represents the $5 million "basic exclusion amount," adjusted for inflation. The Act doubles the basic exclusion amount to $10 million and changes the method by which annual inflation adjustments are made. Thus, in 2018 the exemption is now increased to roughly $11.2 million ($22.4 million per married couple), though the final amount may vary slightly under the new inflation calculation. The exemption will continue to be increased for inflation each year until January 1, 2026, when it will return to its pre-Act inflation-adjusted amount. Though the Act does not change the annual gift tax exclusion amount, which was set to increase to $15,000 for gifts made in 2018, the IRS has not yet released the final inflation-adjusted number as calculated under the new method.

When evaluating your estate plan in light of the Act's changes, it is also important to consider recent developments in state laws.

New York

As a result of legislation passed in 2014, the New York estate tax exclusion amount has increased incrementally to its current $5.25 million level and is scheduled to equal the exemption amount under pre-Act federal law in 2019 (i.e., $5 million, indexed for inflation). However, the benefit of the exclusion is "phased out" for taxable estates between 100% and 105% of the exclusion amount. As a result of this "cliff," taxable estates that exceed 105% of the exclusion amount will lose the benefit of the exclusion completely, subjecting the entire taxable estate to the New York estate tax (applied at graduated rates). Finally, while there is no New York gift (or GST) tax, New York residents should be aware that for decedents dying before January 1, 2019, all taxable gifts made after April 1, 2014 and within three years of the date of death will be taken into account for New York estate tax purposes.

Connecticut

Effective January 1, 2018, the Connecticut estate and gift tax exemption increased from $2 million to $2.6 million. In 2019, it is scheduled to increase to $3.6 million and in 2020, it is scheduled to match the federal estate and gift tax exemption amount. Unlike New York, the Connecticut rules are not tied to pre-Act federal law. Therefore, absent new legislation, the Connecticut exemption amount in 2020 will be $11.2 million, adjusted for inflation. There is no GST tax in Connecticut.

New Jersey

In 2016, the New Jersey legislature raised the estate tax exemption amount from $675,000 to $2 million for estates of decedents dying in 2017 and repealed the state's estate tax entirely effective January 1, 2018. However, New Jersey has retained its separate inheritance tax, which is based on the relationship between the decedent and the beneficiary. This tax does not apply to transfers to a spouse, child, step-child or grandchild. New Jersey has no gift or GST tax.

In Summary

Estate tax repealed; inheritance tax may apply.

We invite you to contact us to review your estate plan in light of these significant changes in both federal and state laws.

This alert provides general coverage of its subject area. We provide it with the understanding that Frankfurt Kurnit Klein & Selz is not engaged herein in rendering legal advice, and shall not be liable for any damages resulting from any error, inaccuracy, or omission. Our attorneys practice law only in jurisdictions in which they are properly authorized to do so. We do not seek to represent clients in other jurisdictions.