- within Tax topic(s)

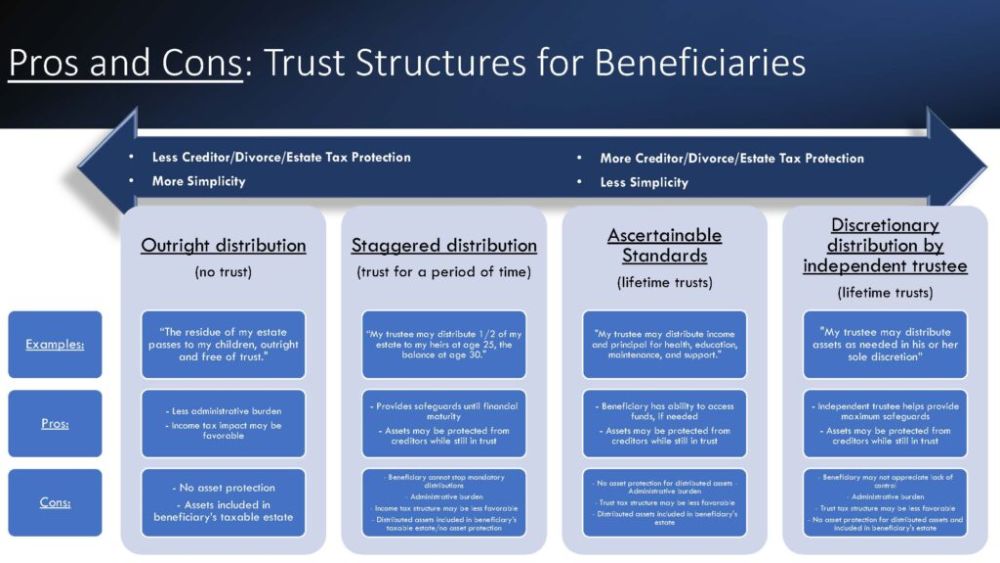

Clients will oftentimes ask their estate planning attorney what the best way for their loved ones to receive their inheritances from a revocable trust or irrevocable trust is. Frequently, the attorney will respond with the motto of the legal profession: "It depends." This piece seeks to provide additional guidance by examining the pros and cons of four common distribution structures (with each structure's common language), and why the best way to structure how a beneficiary receives property depends on the client's specific goals.

1. Outright Distributions

"The remainder of my estate passes to my children, outright and free of trust."

Many clients will decide not to incorporate trusts into how their beneficiaries receive property and will instead opt to have the property re-titled into the name of a given beneficiary upon the client's death. The reason that many clients will choose to incorporate this structure is to allow the beneficiary to have maximum flexibility and control over their inheritance.

Two of the main pros of outright distributions are that (1) it results in less complexity and administrative expense as the beneficiary does not need to administer or work within the rules of a trust and (2) it can be favorable from a federal income tax perspective if the beneficiary is in a lower tax bracket than a trust.

Some of the cons of outright distributions are that (1) it does not offer the beneficiary any asset protection as the beneficiary owns the property outright, (2) if the property is commingled with property owned by the beneficiary's spouse, it may be reachable by that spouse in a divorce proceeding, (3) if the beneficiary has a substance abuse issue or lacks the skills to manage financial assets, the assets may be depleted, and (4) if the beneficiary's estate is subject to estate taxes, then the outright distribution may increase those estate taxes.

Accordingly, the outright distribution structure is suitable for clients who value simplicity for their beneficiaries and have no present concerns regarding potential estate tax issues, significant creditors, or the risk of divorce affecting the client's beneficiaries.

2. Staggered Outright Distributions

"My trustee shall distribute 1/2 of my estate to my heirs at age 25, the balance at age 30."

Clients who want the simplicity of outright distributions, as discussed above, but whose beneficiaries are not currently ready to manage their inheritances may consider incorporating staggered outright distributions into their estate plan. A staggered distribution structure allows for the beneficiary to receive some of the trust estate at either a certain age (e.g., age 25) or after a certain event (e.g., graduating college) but withholds some of the inheritance inside a trust for the beneficiary's benefit until the occurrence of a later event.

Some of the pros of the staggered outright distributions are that (1) by holding some assets in trust, the assets are safeguarded from the creditors of the beneficiary and from the beneficiary's own misuse until the beneficiary has financial maturity, (2) it may be difficult for a divorcing spouse to reach the assets inside of the trust as the beneficiary does not own those assets, and (3) ultimately, after the beneficiary has received all of the assets, the expenses of administering the trust are no longer a financial burden.

Some of the cons of the staggered outright distribution structure are that (1) the distributions are mandatory, which means that the beneficiary cannot stop them from being paid (e.g., if the beneficiary is being sued, they might not want that distribution to come out of the trust), (2) once the beneficiary has the assets, such assets may be subject to the beneficiary's creditors or a divorcing spouse, (3) while assets are held inside the trust, administration expenses are incurred, and (4) the trust may be taxed at a higher tax rate than the beneficiary.

3. Distributions Subject to an Ascertainable Standard

"My trustee may distribute income and principal for each beneficiary's health, education, maintenance, and support."

Clients who are more comfortable with complexity if such complexity comes with advantages may consider a trust which allows the Trustee to make distributions subject to an ascertainable standard (e.g., health, education, maintenance, and support). This structure provides that the beneficiary's inheritance is held in a lifetime trust for the benefit of the beneficiary and / or the beneficiary's descendants. As the trust has an ascertainable distribution standard, the beneficiary may even be the Trustee of the trust, which means that they can manage the assets for their own benefit.

Some of the pros of having the assets in a lifetime trust with distributions subject to an ascertainable standard are that (1) the assets inside of the trust are generally not reachable by the beneficiary's creditors or divorcing spouses, (2) if the beneficiary is the Trustee of the trust, then the beneficiary may still access the funds as needed and may manage the funds inside of the trust, and (3) the assets and appreciation of the assets, as long as they remain in trust, are not includable in the beneficiary's taxable estate which allows for the accumulation of generational wealth.

Some of the cons of having the assets in a lifetime trust with distributions subject to an ascertainable standard are that (1) there are administrative expenses with administering the lifetime trust, (2) the beneficiary must exercise care as Trustee in managing the assets of the trust and also only making distributions subject to the ascertainable standard, (3) income not distributed to the beneficiary may be taxed at a higher federal income tax rate than the beneficiary would pay if the beneficiary earned such income, and (4) attorneys will oftentimes be needed to make adjustments to the trust if required.

4. Discretionary Distributions by an Independent Trustee

"My independent trustee may distribute assets as needed in his or her sole absolute and complete discretion."

Clients who want to utilize the services of an Independent Trustee (non-beneficiary Trustee) to administer a lifetime trust for the benefit of their beneficiaries will oftentimes incorporate a fully discretionary distribution standard whereby the Independent Trustee has the sole and absolute discretion to make or to withhold distributions to the beneficiary.

Some of the pros of having the assets in a lifetime trust with an Independent Trustee having the sole and absolute discretion to make or to withhold distributions are that (1) the Independent Trustee may be better situated to manage the assets than the beneficiary (e.g., in case the beneficiary has a substance abuse problem or is not financially literate), (2) as the beneficiary has absolutely no control over distributions, this standard oftentimes offers the greatest creditor and divorce protection for the beneficiary, and (3) if the Independent Trustee routinely administers trusts, they may be better suited than the beneficiary to operate the lifetime trust.

Some of the cons of having the assets in a lifetime trust with an Independent Trustee having the sole and absolute discretion to make or to withhold distributions are that (1) the beneficiary has no control over when they can benefit from their inheritance and may not benefit from it should the Independent Trustee decide not to make a distribution, (2) Independent Trustees will oftentimes charge a fee for their services, (3) income not distributed to the beneficiary may be taxed at a higher federal income tax rate than the beneficiary would pay if the beneficiary earned such income, and (4) attorneys will oftentimes be needed to make adjustments to the trust if required.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]