Introduction

In remarks delivered on May 12, 2025, at the Securities Industry and Financial Markets Association's ("SIFMA") Anti-Money Laundering and Financial Crimes Conference, the Head of the Criminal Division at the Department of Justice ("DOJ"), Matthew Galeotti, announced a new white collar corporate enforcement plan (the "Enforcement Plan") entitled "Focus, Fairness, and Efficiency in the Fight Against White-Collar Crime." Mr. Galeotti explained to conference attendees that, "[w]e are here to prosecute criminals, not law-abiding businesses." Concurrent with his speech, Mr. Galeotti issued a memorandum on the Enforcement Plan and also revised the Justice Department's Justice Manual's Criminal Division Corporate Enforcement and Voluntary Self-Disclosure Policy. The new Enforcement Plan crystalizes DOJ policy and provides clear incentives for companies to promptly self-disclose and cooperate with investigators, including assurances from DOJ that when properly done, self-disclosures accompanied by appropriate cooperation, remediation, and no aggravating circumstances "shall" result in criminal prosecution declinations.

The Enforcement Plan lists ten "high-impact areas" where the Criminal Division will prioritize investigating and prosecuting white-collar crimes. These enumerated categories are:

- Waste, fraud, and abuse, including health care fraud and federal program and procurement fraud that harm the public fisc;

- Trade and customs fraud, including tariff evasion;

- Fraud perpetrated through variable interest entities (such as trusts, joint ventures, etc.), including, but not limited to, offering fraud, "ramp and dumps," elder fraud, securities fraud, and other market manipulation schemes;

- Fraud that victimizes U.S. investors, individuals, and markets including, but not limited to, Ponzi schemes, investment fraud, elder fraud, servicemember fraud, and fraud that threatens the health and safety of consumers;

- Conduct that threatens the country's national security, including threats to the U.S. financial system by gatekeepers, such as financial institutions and their insiders that commit sanctions violations or enable transactions by cartels, transnational criminal organizations ("TCO"), hostile nation-states, and/or foreign terrorist organizations;

- Material support by corporations to foreign terrorist organizations, including recently designated cartels and TCOs;

- Complex money laundering, including Chinese money laundering organizations, and other organizations involved in laundering funds used in the manufacturing of illegal drugs;

- Violations of the Controlled Substances Act and the Federal Food, Drug, and Cosmetic Act, including the unlawful manufacture and distribution of chemicals and equipment used to create counterfeit pills laced with fentanyl and unlawful distribution of opioids by medical professionals and companies;

- Bribery and associated money laundering that impact U.S. national interests, undermine U.S. national security, harm the competitiveness of U.S. businesses, and enrich foreign officials; and

- As provided by the Digital Assets DAG Memorandum: crimes (1) involving digital assets that victimize investors and consumers; (2) that use digital assets in furtherance of other criminal conduct; and (3) involving willful violations that facilitate significant criminal activity. Cases impacting victims, involving cartels, TCOs, or terrorist groups, or facilitating drug money laundering or sanctions evasion shall receive highest priority.

A Clear and Streamlined Path to Declinations for Corporate Self-Disclosure

In a promising development for companies seeking consideration for disclosing misconduct in their ranks, the Enforcement Plan revises the Corporate Enforcement and Voluntary Self-Disclosure Policy ("CEP"). In his remarks, Mr. Galeotti acknowledged that the previous CEP was "unwieldy and hard to navigate." The new CEP, according to Mr. Galeotti, will focus on transparency and will simplify the policy to clarify the outcomes that companies can expect. Specifically, Mr. Galeotti noted that "self-disclosure is key to receiving the most generous benefits the Criminal Division can offer."

The revised policy also focuses on efficiency. Mr. Galeotti remarked that "Too often, businesses have been subject to unchecked and long-running investigations that can be costly. . . . These costs and uncertainty have deterred companies from working with the Department."

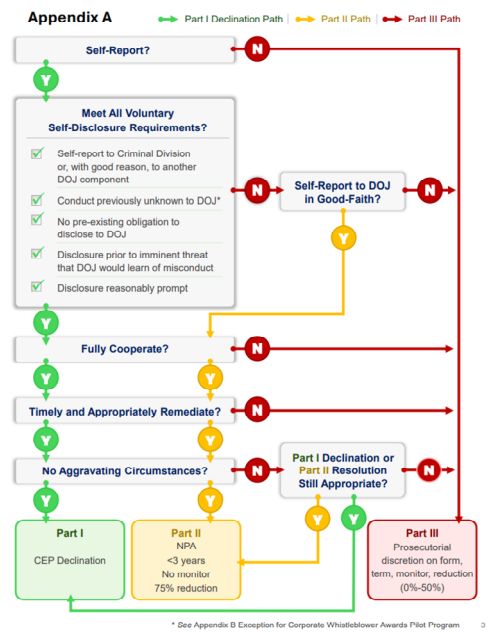

As part of the policy change and in concurrence with the memorandum publication, DOJ also published a self-report flowchart in Appendix A of the Justice Manual update (shown below) and supporting guidance that makes the path to and benefits of self-disclosure explicit.

The flowchart outlines three paths for corporations:

- Companies that promptly and voluntarily self-disclose

misconduct, fully cooperate with DOJ's investigation, and

timely and appropriately remediate will receive a declination (if

no aggravating circumstances exist).

- Where aggravating circumstances do exist, prosecutors may still grant a declination based on an assessment of the severity of the aggravating circumstances and the company's cooperation with DOJ as well as the extent of remediation.

- Where companies self-disclose but DOJ has already independently

learned of the misconduct, those companies may still be eligible

for significant reductions in criminal penalties, including the

possibility of a non-prosecution agreement ("NPA")

resolution with (1) a term of less than three years; (2) a 75%

reduction in criminal fines; and (3) no compliance monitor, as long

as there are no aggravating circumstances and the self-disclosure

was in good faith.

- Companies that do not self-report, do not cooperate, or do not good-faith self-report may be subject to full prosecution, including prosecutorial discretion on form, term, monitor, and any possible reduction (which cannot be more than 50%).

This notably streamlined CEP will likely result in more declinations, more NPAs, and quicker resolutions for companies that follow the new guidelines. Three key factors in the program are driving these changes. First, the new CEP provides assurances that previous policies did not, including that a company "will" receive a declination when it meets the established criteria. Second, the new CEP also establishes a new category, entitled "near miss" voluntary self-disclosures where a company should receive a NPA where it acted in good faith by self-reporting but its disclosure does not qualify as a voluntary self-disclosure or involves certain aggravating circumstances. Third, the new CEP relaxes DOJ's review of aggravating circumstances and provides that prosecutors have full discretion to recommend a CEP declination even where aggravating circumstances exist "based on weighing the severity of those circumstances and the company's cooperation and remediation."

Tighter Limits on Corporate Monitorships

In a simultaneously issued memorandum on May 12, DOJ also announced changes to the criteria for imposing and selecting independent compliance monitors in corporate resolutions. The Memorandum on Selection of Monitors in Criminal Division Matters ("2025 Monitor Memo") narrows the scope of what the monitor might oversee. Furthermore, to impose a monitor DOJ must determine that the benefits outweigh the burdens. Specifically, a monitor's estimated cost must be proportionate to (1) the severity of the underlying conduct, including consideration of fines and any forfeiture; (2) the profits of the company; and (3) the company's present size and risk profile. The new monitorship program also seeks to increase transparency and accountability where monitors are required by adding checks such as budget proposals and biannual meetings.

Mr. Galeotti emphasized in his remarks that historically "the money companies spend on their monitor would be better spent investing in their compliance programs or, if they haven't already, making victims whole." The changes to the monitoring program indicate that the Administration will continue to narrow the program and scrutinize existing and future corporate monitorships.

New Whistleblower Priorities

Mr. Galeotti also announced an expansion of DOJ's corporate whistleblower program. The program provides that whistleblowers may be eligible for a monetary award for providing original, truthful information about criminal misconduct in specific designated program areas, if the information provided leads to forfeiture exceeding $1,000,000. In an alignment with the Trump Administration's policies, the announcement stated that DOJ is adding the following areas for priority tips: procurement and federal programs fraud; trade, tariff, and customs valuation; immigration-related offenses; sanctions and national security violations; and financial facilitators of TCOs.

Conclusion

These announcements from DOJ largely parallel the Trump Administration's focus on efficiency, support of American businesses, and the push on criminal enforcement related to sanctions, trade policy, cartels, and national security issues.

The policy changes also present an undeniable opportunity for corporations to focus on and invest in compliance programs. In particular, companies should examine their internal reporting channels, training and compliance programs, and corporate disclosure protocols. Companies should also conduct thorough internal investigations to be best situated to assess their options regarding any non-compliance and make strategic choices if misconduct is discovered.

In particular, the Enforcement Policy's explicit agreement on declinations provides a clear incentive for corporate voluntary self-disclosure. The policy announcement also provides opportunities for companies to work candidly with the administration towards efficiently and proactively resolving investigations, and to tailor or eliminate monitorships.

As Mr. Galeotti said: "Now is the time to report, remediate, and strengthen compliance to ensure American prosperity. Never before have the benefits of self-reporting and cooperating been so clear."

To subscribe to Cahill Publications Click Here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]