- with readers working within the Retail & Leisure and Law Firm industries

- within International Law, Intellectual Property, Food, Drugs, Healthcare and Life Sciences topic(s)

The Department of Justice ("DOJ") recently announced a modest increase in monetary recoveries for 2024 from investigations and lawsuits under the False Claims Act ("FCA"), which is the Government's primary tool for combating fraud, waste, and abuse. In fiscal year 2024, the DOJ recovered over $2.9 billion from FCA settlements and judgments, marking a 5% increase over 2023's total and the highest amount in three years. Recoveries were fueled largely by qui tam lawsuits previously filed by whistleblowers, which contributed to $2.4 billion of the $2.9 billion recovered. The number of qui tams filed last year was also the highest ever in a single year at 979 cases. While health care fraud continues to be the primary source of enforcement activity, the rise in lawsuits stemmed from non-health care related cases. This underscores the Government's and private citizens' intensified enforcement efforts through FCA investigations and litigation in both the health care sector and beyond.

FCA Recoveries by the Numbers

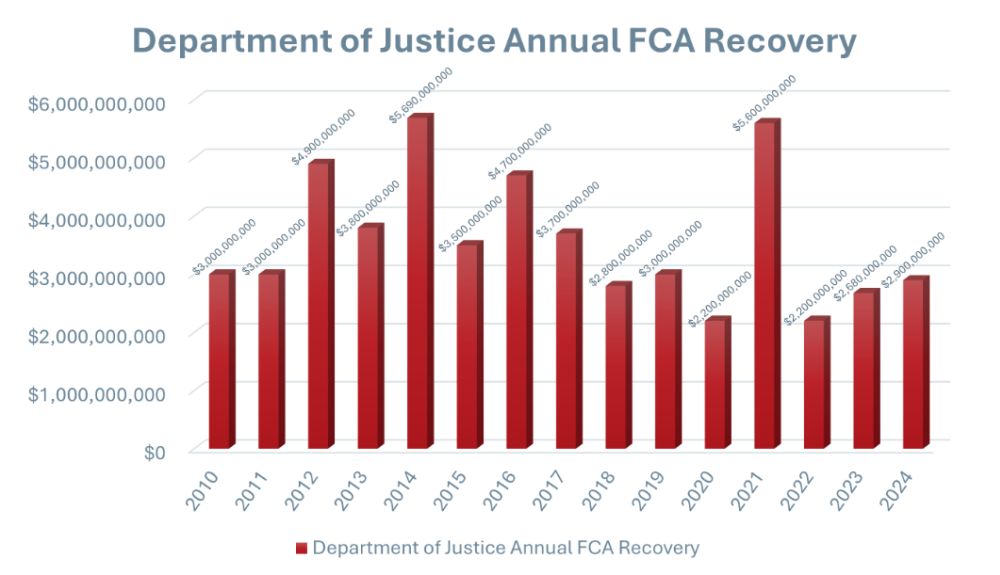

While the nearly $3 billion recovered last year resulted from a record-breaking number of 566 settlements and judgments, last year's haul remains well below peak year recoveries, such as 2014's $6.2 billion and 2021's $5.7 billion. The following chart illustrates the FCA recoveries by fiscal year, showcasing monetary trends over the past decade.

The Department of Justice ("DOJ") recently announced a modest increase in monetary recoveries for 2024 from investigations and lawsuits under the False Claims Act ("FCA"), which is the Government's primary tool for combating fraud, waste, and abuse. In fiscal year 2024, the DOJ recovered over $2.9 billion from FCA settlements and judgments, marking a 5% increase over 2023's total and the highest amount in three years. Recoveries were fueled largely by qui tam lawsuits previously filed by whistleblowers, which contributed to $2.4 billion of the $2.9 billion recovered. The number of qui tams filed last year was also the highest ever in a single year at 979 cases. While health care fraud continues to be the primary source of enforcement activity, the rise in lawsuits stemmed from non-health care related cases. This underscores the Government's and private citizens' intensified enforcement efforts through FCA investigations and litigation in both the health care sector and beyond.

FCA Recoveries by the Numbers

While the nearly $3 billion recovered last year resulted from a record-breaking number of 566 settlements and judgments, last year's haul remains well below peak year recoveries, such as 2014's $6.2 billion and 2021's $5.7 billion. The following chart illustrates the FCA recoveries by fiscal year, showcasing monetary trends over the past decade.

Key Enforcement Areas

In announcing 2024's recoveries, the Government highlighted several key enforcement areas, such as:

- The opioid epidemic. The Government continues to pursue health care industry participants that allegedly contributed to the opioid crisis, focusing primarily on schemes to market opioids and schemes to prescribe or dispense medically unnecessary or illegitimate opioid prescriptions.

- Medicare Advantage Program (Medicare Part C). As the Medicare Advantage Program is the largest component of Medicare in terms of reimbursement and beneficiaries impacted, the Government stressed this remains a critical area of importance for FCA enforcement.

- COVID-19 related fraud. Given the historic levels of government funding provided as a result of the COVID-19 pandemic, the Government also continues to pursue cases involving improper payment under the Paycheck Protection Program as well as false claims for COVID-19 testing and treatment. Close to half of 2024's settlements and judgments resolved allegations related to COVID-19.

- Anti-Kickback Statute and Stark Law violations. Cases premised on alleged violations of the AKS and Stark Law remain a driving force in FCA litigation for health care providers. In the last several years, there seems to be renewed interest in Stark Law enforcement, in particular.

- Medically unnecessary services. The provision of medically unnecessary health care services also remains a widely-used theory of FCA liability, despite this being a historically challenging enforcement area often involving disputes over subjective clinical decisions.

Looking Ahead

Polsinelli's Government Investigations team anticipates continued robust FCA enforcement, driven by increased whistleblower activity, advanced data analytics, and DOJ's focus on key areas such as the opioid epidemic, Medicare Advantage fraud, and Stark Law compliance. These efforts could very well yield significant recoveries in the coming years.

Polsinelli will soon release its annual Fraud and Abuse Year in Review e-book, providing a comprehensive analysis of key FCA settlements, cases, and enforcement trends. We will also host a webinar on February 26, 2025 at 12pm CT to discuss the Government's fiscal year 2024 enforcement numbers and broader fraud and abuse enforcement trends.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.