- within Tax topic(s)

- in Asia

- with readers working within the Construction & Engineering industries

- in Asia

- in Asia

- in Asia

- with readers working within the Technology and Utilities industries

- within Law Department Performance, Environment, Media, Telecoms, IT and Entertainment topic(s)

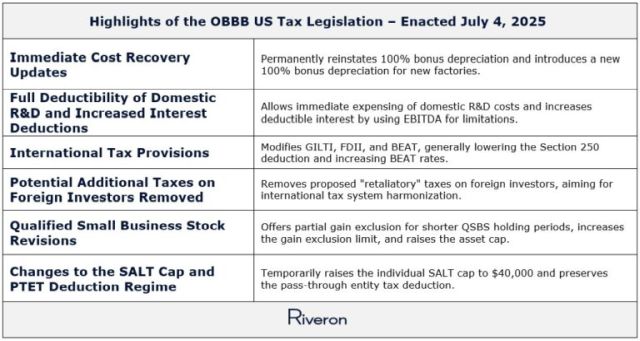

Business leaders, tax department heads, and other accounting professionals are moving swiftly to understand the implications of the latest tax and spending cut legislation, called One Big Beautiful Bill (OBBB), enacted on July 4. The bill reinstates or extends a number of business deductions, modifies US taxation of international operations, and provides individual tax incentives as well as a higher amount of deductible state and local taxes. Some of these measures were enacted in the 2017 Tax Cuts and Jobs Act (TCJA) and were scheduled to expire at the end of 2025.

Riveron's review of significant provisions in the bill is summarized below.

Immediate cost recovery updates

The OBBB amends and makes permanent certain depreciation provisions and introduces a new tax cost recovery election for production facilities. Specifically, the OBBB provides business taxpayers with the ability to elect 100% bonus depreciation deductions under section 168(k) on a permanent basis. Additionally, the OBBB contains a new temporary section 168(n) that provides a bonus depreciation provision for Qualified Production Property (QPP), broadly defined as new factories and enhancements to old facilities.

- Bonus Depreciation – Section 168(k): The 100% bonus depreciation deduction would apply to property acquired and placed in service after January 19, 2025. As mentioned above, Section 168(k) is now a permanent provision. According to Section 168(k)(2), any depreciable property with a recovery period of 20 years or less is eligible for bonus depreciation. If a taxpayer chooses not to apply the 100% bonus depreciation deduction, it must include an election out under Section 168(k)(7) with its federal tax return, otherwise the default is to apply 100% bonus depreciation.

- QPP 100% Depreciation – Section 168(n): The elective 100% depreciation allowance for QPP, defined as nonresidential real property (i.e., new factories and certain improvements to existing facilities) under new Section 168(n) would apply to property where construction starts after January 19, 2025, and before January 1, 2029, and is placed in service before January 1, 2031. Certain restrictions apply related to, inter alia, prior use of the property and acquisitions from related parties.

- Accelerated Depreciation – Section 179: The OBBB increases the maximum amount a taxpayer may expense under Section 179 to $2.5 million. This deduction is phased out when the cost of qualifying property placed in service during the year exceeds $4 million.

Riveron insights on OBBB immediate cost recovery updates The above changes are expected to be net positive for taxpayers; however, maximizing the benefit of these deductions while planning for cost-effective exits will require identifying and modeling the interaction between immediate expensing and a reduction of basis in depreciable property. For tax provision purposes, bonus depreciation could create significant deferred tax liabilities.

Companies with the intention of expanding US manufacturing capacity should consider their capital expenditure budgets in the context of the QPP 100% bonus depreciation election, as this is only available between January 19, 2025, and December 31, 2030.

Foreign investors may benefit from bonus depreciation and the QPP provisions by moving or increasing production capacity in the United States.

Full deductibility of domestic R&D and increased interest deductions

The OBBB reinstates immediate expensing of domestic research and development (R&D) costs for tax years starting after December 31, 2024. The OBBB additionally revises the interest expense limitations of section 163(j) to determine adjusted taxable income using earnings before interest, taxes, depreciation, and amortization (EBITDA) rather than earnings before interest and taxes (EBIT) only.

- R & D Costs – Section 174A: Under new section 174A, domestic research and experimental expenditures paid or incurred in tax years beginning after December 31, 2024, would be immediately deductible. Alternatively, taxpayers could choose to amortize R&D costs over ten years by making an election under Section 59(e). Additionally, an election would permit taxpayers to accelerate expenditures that were capitalized under Section 174 in tax years 2022 through 2024 thereby deducting the remaining unamortized balance.

- Interest Expense Limitation – Section 163(j): The OBBB reinstates the use of EBITDA in determining adjusted taxable income to calculate the interest deduction limitation for tax years beginning after December 31, 2024, with no expiration.

Riveron insights on OBBB impacts on R&D and interest deductions

The ability to immediately deduct domestic R&D costs is likely to be favorable for taxpayers. The new law allows the taxpayer to choose to deduct immediately or capitalize US research and development costs at the taxpayer's election.

In addition, taxpayers with prior year R&D costs will need to identify the remaining capitalized amounts to be expensed under the new section 174A and decide whether to take the deduction in one year or two years. Modeling the effect of Section 174A deductions under each possible scenario will assist taxpayers with planning. Companies will want to consider the state tax impact of Section 174A, as many states will not automatically follow the federal law. Results are likely to vary by state.

Further, multinational groups may want to shift R&D projects to the US to obtain immediate deductions, rather than the 15-year amortization schedule applicable to foreign R&D expenses.

The revision to Section 163(j) is likely to add to taxpayers' ability to deduct additional interest expense. Modeling may be helpful to analyze the impact on other relevant provisions such as Section 250 or 172.

International tax provisions

The OBBB contains modifications to global intangible low-taxed income (GILTI), foreign-derived intangible income (FDII), and the base erosion and anti-abuse tax (BEAT). These changes to existing law reduce the Section 250 deduction, increase the amount of GILTI foreign tax credits available, and increase the tax rate under BEAT. Each of these changes could impact existing tax planning and should be carefully considered on a go-forward basis by companies with an international tax profile. This is particularly the case since the changes could affect cash tax forecasts or other tax models.

- GILTI and FDII Renamed: GILTI and FDII are renamed as net CFC tested income (NCTI) and foreign-derived deduction eligible income (FDDEI), respectively.

- Section 250 Deduction Lowered: The section 250 deduction percentage is lowered for tax years beginning after December 31, 2025, from 50% to 40% for NCTI and from 37.5% to 33.34% for FDDEI, resulting in an effective tax rate of 14% for both NCTI and FDDEI. As background, Section 250 is the provision that adjusts the effective tax rate from the 21 percent corporate tax rate to the enacted NCTI and FDDEI tax rates.

- Deemed Tangible Income Return Eliminated: The net deemed tangible income return (DTIR) currently utilized in determining a US shareholder's NCTI (GILTI) inclusion is eliminated. The result is that the NCTI tax will now apply without the deduction equal to 10% of a Qualified Business Asset Investment (QBAI).

- Deemed Foreign Tax Credits and Expense Allocations: The OBBB amends Section 960(d)(1) to increase the deemed paid credit for NCTI inclusions from 80% to 90%. In addition, it removes certain corporate expenses, such as interest and R&D, from the computation of foreign source income in determining the foreign tax credit (FTC) limitation for NCTI income.

- Select changes to BEAT: The BEAT rate is increased to 10.5% beginning after December 31, 2025. The proposed change in the base erosion percentage threshold safe harbor from 3% to 2% for all taxpayers was not implemented.

Riveron insights on international tax provisions of the OBBB

The increase of the applicable NCTI tax rate, the increase in the NCTI deemed paid credit available, the removal of certain expenses in determining the FTC limitation may result in more NCTI FTCs being available to reduce taxpayers' US tax liability. We recommend modeling the potential effects of these changes on existing and go-forward tax structures to quantify any net US tax impact.

Potential additional taxes on foreign investors removed

The proposed section 899 would have imposed increased rates of tax on certain affected taxpayers connected to countries imposing defined taxes on US companies, which would include the OECD's undertaxed profits rule (UTPR), digital services taxes (DSTs), and diverted profits taxes (DPTs). Furthermore, special BEAT rules would have applied to US companies with majority ownership by residents of countries with an unfair tax. The proposed section 899 was removed from the OBBB at the US Treasury Department's request following progress in negotiations with G7 members to harmonize the US international tax system with the OECD's Pillar Two system.

Riveron insights on how current US tax policy affects foreign investors and multinational entities

The US, G7, and the OECD member nations will continue to work toward an agreement on the application of Pillar Two to US companies. Further, the risk of unilateral actions including digital services taxes remains. Companies should continue to monitor and model potential outcomes as more details emerge.

Qualified small business stock revisions

The OBBB made several modifications to the Qualified Small Business Stock (QSBS) provisions in Section 1202. Taxpayers are provided with a partial exclusion of gain when the QSBS is held for three years or more, but less than the five years required for a 100 percent exclusion. The OBBB also increased the total amount of gain exempt from tax under Section 1202 from $10 million to $15 million and raised the total asset cap for a qualified small business from $50 million to $75 million in total assets.

Riveron insights on OBBB policies related to small business stock

The addition of partial QSBS gain exclusion for holding periods shorter than five years could increase the pool of investors interested in QSBS holdings. Furthermore, the higher total asset limit allowed for a small business to qualify for the QSBS provision should enable more QSBS investments to be available.

Changes to the SALT cap and PTET deduction regime

Under prior federal tax legislation, the deduction for state and local taxes (SALT) at the individual taxpayer level had been subject to a cap of $10,000. However, state pass-through entity taxes (PTET) are generally considered by the IRS to be fully deductible from US federal income. Pass-through entity owners can elect to have the entity pay PTET resulting in taxes that are deductible against federal income. In total, thirty-six states and New York City have elective PTET regimes. Prior versions of the OBBB had contemplated eliminating the PTET deduction.

The OBBB temporarily increases the allowed federal deduction for state and local taxes (the SALT cap) to $40,000 (from the current $10,000) for tax years from 2025-2029, with adjustments for inflation. In 2026, the cap will be $40,400, and then will increase by 1% annually, through 2029. Starting in 2030, the SALT cap will revert to the current $10,000 limit. Additionally, the OBBB did not remove the PTET deduction, meaning pass-through entity owners can continue to utilize this election.

Riveron insights on how US tax legislation affects SALT and PTET

The adopted version of the OBBB increases the SALT cap for individuals for tax years 2025 through 2029 and leaves the deductibility of PTET intact.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.