INTRODUCTION

Today's discussion will focus on some of the more interesting or important tax developments that have transpired over the last year or so. The new developments addressed in this presentation will include numerous tax court cases, decisions of various federal circuit courts, as well as IRS pronouncements, revenue rulings and regulatory changes.

PART ONE

IRS AUDIT STATISTICS

A. Audit Statistics; What Are Your Chances of Being Audited? The 2023 Internal Revenue Service Data Book released in April 2024 contains audit statistics for years 2013 through 2021, as of the fiscal year ended September 30, 2023 (FY 2023).

For tax years 2019 and earlier, the statute of limitations for audits had generally expired as of September 30, 2023. However, for 2020 and later returns, the statute of limitations has yet to expire, so additional returns of those years may be audited.

For 2013 through 2021, audit rates dropped significantly. For example, individual tax returns had an audit rate of 0.6% for 2013 returns versus 0.2% for 2021. In addition, for individuals with income between $1 million and $5 million, the audit rate dropped from 3% for 2013 returns to .5% for 2021 returns.

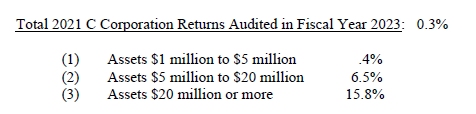

The overall audit rate for C corporations dropped from 1.2% for 2013 returns to .3% for 2021 returns. For partnerships and S corporations, the audit rate for 2013 returns was 0.3% and 0.3%, respectively, compared to 0.1% and 0.1% for 2021 returns.

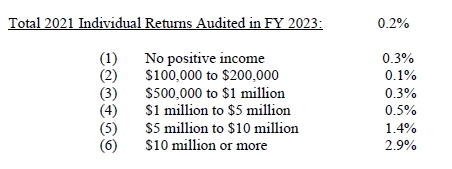

In FY 2023, 22.7% of audits were field audits. The others were correspondence audits. Below are the FY 2023 audit statistics for 2021 tax returns:

B. Audit Rates for Individual Tax Returns. During FY 2023, only 0.2% of individual income tax returns filed for 2021 were audited (same as for 2020 returns).

C. Audit Rates For Partnerships and S Corporations: For partnership and S corporations, the FY 2023 audit rate for 2021 returns was .1% (same as for 2020 returns).

- Audit Rates for C Corporations. C corporation returns filed for 2021 had an audit rate of 0.3% during FY 2023 (down from .6% for 2020 returns).

D. Schedule C Returns. Not surprisingly, the audit rates for Schedule C returns are much higher than for other individual returns. According to Internal Revenue Service Data Book 2019, Schedule Cs filed for 2018 with receipts of $100,000-$200,000 had a 1.6% audit rate. Schedule C returns filed for 2018 with income over $200,000 had a 1.4% audit rate. Since 2019, the IRS has not published similar Schedule C audit statistics for tax returns after 2018.

A. Offers in Compromise and Criminal Case Referrals.

B. Offers in Compromise. For FY 2023, the IRS received around 30,000 offers in compromise but accepted only about 12,700.

- Criminal Case Referrals. The IRS initiated 2,676 criminal investigations for FY 2023 and completed 2,584 cases. The IRS referred 1,838 cases for criminal prosecutions (484 for legal source tax crimes, 874 for illegal source financial crimes, and 480 for narcotics– related financial crimes) and obtained 1,508 convictions. For convictions, 1,167 were incarcerated.

PART TWO

ORDINARY INCOME OR CAPITAL GAIN ON THE SALE OF REAL PROPERTY?

- Background and Overview.

- Summary of Tax Differences. When a taxpayer sells real estate, often the IRS and the taxpayers are at odds as to whether the sale should be treated as the sale of investment property or as the sale of ordinary income "inventory" property. The tax differences can be significant for both the taxpayer and the IRS.

If the transaction is treated as a sale of "investment" real property, then any gain on the sale will be taxed at the capital gain tax rates. And the gain recognized by the investor will not be subject to self-employment taxes.

In addition to the capital gain tax and self-employment tax benefits available to the real estate investor, such investors also can benefit from:

(i) Section 1031 nontaxable exchanges; (ii) Section 1033(g) (relating to condemnation of real property held for productive use in a trade or business or for investment); and (iii) Section 453 installment sale reporting.

These are tax benefits that are not available to dealers of real property.

On the other hand, investors in rental real estate must be cognizant of (i) the passive activity loss limitations of Section 469 and (ii) the capital loss limitations applicable to investment property (since, if the sale generates a loss, then the taxpayer's loss will be limited by the capital loss limitation rules - that is, the capital loss can only offset other capital gains income and another $3,000 of ordinary income for the year).

If the sale is treated as a sale of inventory by a developer, then any gain will be treated as ordinary income, and thus will be subject to the ordinary income tax rates as well as subject to self-employment tax. On the other hand, if the sale of the deemed inventory generates a tax loss, then the tax loss will be fully deductable against other ordinary income as well as capital gains.

- Past Case Law.

The issue of whether the sale of real property should be treated as the sale of investment property versus inventory property has generated much litigation in the past.

Throughout various court cases analyzing these issues, most courts cite the "investor versus dealer tests" analyzed under Biedenharn Realty Company v. United States, 526 F.2d 409 (5th Cir. 1976); Suburban Realty Co. v. US, 615 F.2d 171 (5th Cir. 1980). Under these cases, the courts have focused on the question of whether the property is held primarily for sale to customers in the ordinary course of the taxpayer's business versus whether the taxpayers held the property purely for investment purposes.

Because gain or loss from the disposition of real property is capital if it was held as an investment and ordinary if it was held "primarily" for sale to customers, the identification of a particular parcel of real property as investment property or as property held primarily for sale to customers is critical.

According to the court in Malat v. Riddell (383 U.S. 569 (1966)), the term "primarily" means of "first importance" or "principally," so that the issue turns on the taxpayer's intent with respect to holding of the property, which is obviously a factual issue.

Accordingly, a taxpayer's position, that an investment in real estate is merely being disposed of in the most economically profitable manner is a sustainable argument, despite the taxpayer's engagement in activities traditionally conducted by a real estate dealer, provided that the taxpayer otherwise manages his property holdings in a manner substantially similar to that of an investor. Further, the taxpayer must be careful not to reinvest in substantially similar property shortly after the liquidation of the investment if he seeks to avoid ordinary income characterization.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.