- within Corporate/Commercial Law topic(s)

- in European Union

- within Corporate/Commercial Law topic(s)

- in European Union

- within Law Department Performance and Law Practice Management topic(s)

- with readers working within the Insurance industries

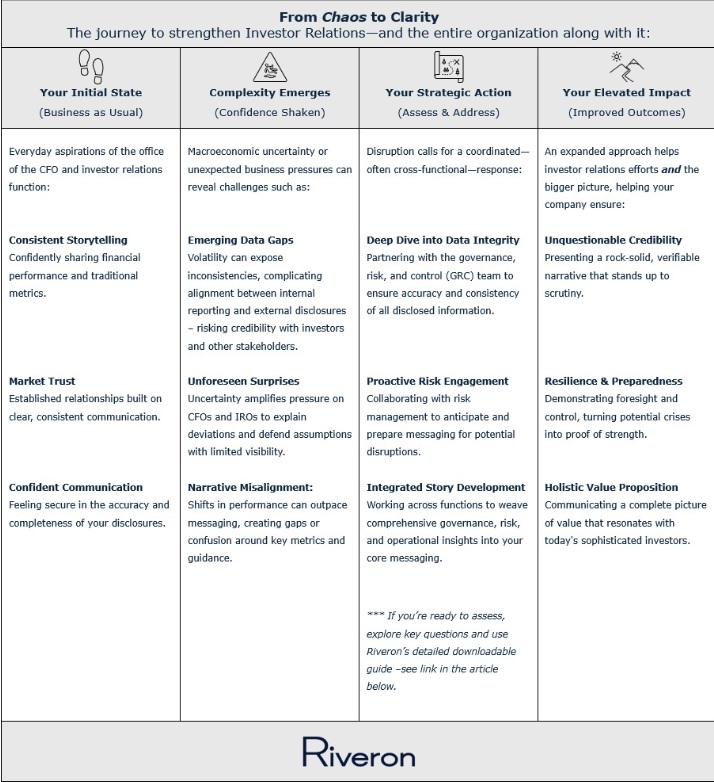

In today's business climate, uncertainty isn't the exception—it's the norm. Macroeconomic volatility, regulatory upheaval, and increasing operational complexity challenge even the most experienced finance and investor relations (IR) leaders. The risks are real: financial data under scrutiny, investor messaging that fails to keep pace with evolving KPIs, and misalignment across functions that erodes trust both internally and in the market. The result? Confused stakeholders, weakened market confidence, and executive credibility at risk.

But there is a path forward, and it starts with collaboration, integration, and a renewed focus on accuracy and agility.

Volatility Is the New Normal

CFOs and IROs are expected to deliver clear, credible guidance in a world where the variables constantly change. Forecasting is more complex. Stakeholder expectations are higher. And the stakes, including market credibility, investor confidence, and executive reputation, are unforgiving.

The financial planning and analysis (FP&A) function now plays a critical role in shaping external communications. Unfortunately, many FP&A teams are still operating with outdated tools, rigid models, and siloed processes, making it difficult to adapt quickly or explain performance with confidence.

When Guidance Misses, Credibility Suffers

In recent quarters, too many companies have issued guidance on stale inputs, only to miss the mark. Riveron partnered with a top-tier US retailer heavily exposed to tariffs. For years, the company and its IR team operated with confidence—consistently meeting or exceeding guidance and analyst expectations. But as trade policies shifted, cracks in the forecasting process were revealed. Each new policy change triggered a scramble—finance teams under siege, rebuilding forecasts from scratch, and IR pressured to reframe messaging overnight. Despite strong underlying performance, the company missed guidance in back-to-back quarters, resulting in stock price pressure and a blow to management credibility. Confidence in the numbers faltered internally and externally.

The problem wasn't performance—it was process: rigid systems, siloed functions, and limited visibility into the data that mattered most.

By adopting expanded—and in some cases reimagined—approaches, we've seen leaders turn disruption into opportunity, transforming complexity into clarity and reinforcing their strategic value within the organization. Their path forward isn't theoretical; it's already being charted by forward-thinking IR and finance executives.

Here's a look at that journey, illustrating how you, as a leader in Investor Relations or the Office of the CFO, can be the catalyst for elevated impact and sustained market confidence.

Variance Analysis: A Hidden Vulnerability

Another common pitfall is inaccurate variance analysis. During internal reviews, explanations may sound reasonable. But when investors probe deeper, the rationale can fall apart. Suddenly, the CFO is on the defense, the IRO is firefighting, and investor trust begins to erode.

These moments aren't just operational missteps, they're strategic failures. They reflect a disconnect between finance, operations, and IR, and a lack of systems capable of delivering traceable, real-time insights.

Collaboration Is No Longer Optional—It's a Strategic Imperative

Today's leading finance organizations operate with transparency, accountability, and alignment. CFOs, IROs, FP&A, and business unit leaders must speak a common language grounded in timely data, thoughtful forecasting, and shared ownership of outcomes.

This kind of collaboration is not easily built. It requires a deliberate approach to people, processes, and technology. Companies may choose to tackle this internally or enlist the support of outside advisors to help define the strategic narrative, build the foundational processes, and implement the necessary systems. The objective is to ensure the story being told externally is both compelling and credible, while also ensuring the mechanics behind it hold up to scrutiny. When the IR narrative is built on a foundation of accurate data, robust processes, and cross-functional alignment, it's a powerful differentiator.

Getting Started: A High-Level Assessment

For CFOs, IROs, and FP&A leaders who want to improve this critical collaboration, a good starting point is a high-level assessment of the current state. The following questions can help you identify potential gaps and opportunities for improvement.

People & Culture:

- Are Investor Relations and FP&A leaders meeting regularly to align on messaging and data?

- Do team members understand their roles in the external reporting process, beyond their core functions?

- Is there a clear, shared understanding of key performance indicators (KPIs) and how they connect to the company's strategic narrative?

Process & Governance:

- What is the single source of truth for all financial data used in internal forecasting and external communications?

- How is financial data gathered, reviewed, and finalized for external communications? Is the process clearly documented?

- Is there a formal process for conducting variance analysis and preparing for investor questions?

Technology & Systems:

- Do you have a single, unified source of data for both internal and external reporting?

- Are your FP&A and accounting systems integrated to minimize manual data reconciliation?

- Does your technology allow for real-time scenario modeling to quickly respond to market changes and investor inquiries?

Because when the story is clear, credible, and data-backed, companies don't just navigate uncertainty, they lead through it.

For a more detailed checklist to help you and your team assess the people, processes, and technologies that are hindering your investor relations effectiveness, download our free guide below.

A Deeper Dive: Your Guide to a Strategic Finance and IR Collaboration

By forging a more strategic collaboration between investor relations and financial planning functions, CFOs and IROs can elevate their impact and make lasting changes. This goes beyond just improving a single process; it's about shifting from siloed views toward being a proactive, forward-looking strategic partner. When IR and FP&A are seamlessly aligned, a company can not only meet but anticipate market expectations, communicate a more compelling and authentic growth story, and ultimately unlock greater value for shareholders and stakeholders alike.

To help you get started on this journey, download our in-depth questionnaire. The guide offers a detailed checklist of questions to help you and your team assess your current state and identify opportunities for improvement across people, processes, and technology. Guiding these key transformations will help investor relations and finance professionals to build a stronger, more resilient, and more valuable company. Get your copy today and take the first step toward leading through uncertainty.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]