- within Insurance, Media, Telecoms, IT and Entertainment topic(s)

In Dealmaker's Digest, read the top 10 latest developments in global transactions. We offer insights into M&A activity across industries and borders. To receive our M&A thought leadership, please join our mailing list.

Key Takeaways

- Aggregate global deal value reversed course in August, falling 27% ($132B) from July to just over $350 billion; however, global deal count remained steady with July numbers.

- Acquisitions in the software sector led U.S. M&A activity by both deal count and deal value in August.

- Acquisitions of AI-related targets continue to surge in 2025, and are on track to more than double (+123%) by value year-over-year.

Global M&A Activity Update

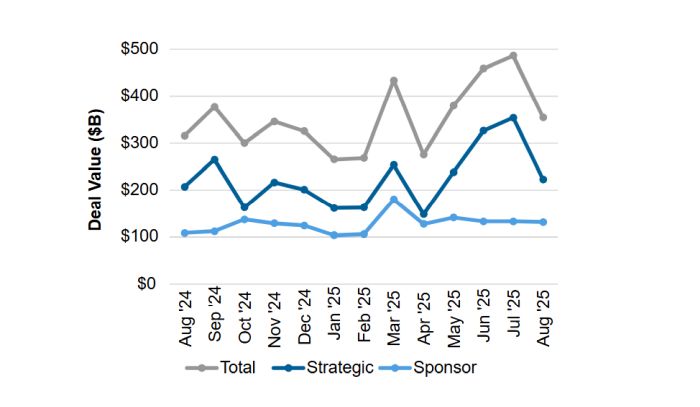

1 Deal Value Trends

Aggregate global monthly deal value1 reversed course in August, falling 27% from July to just over $350 billion. Year-over-year, deal value is still up 12%.

Transactions involving strategic buyers declined even more rapidly in August, down 37% from July to about $225 billion. Strategic buyer deal value is still up 8% year-over-year.

Financial, or sponsor, buyer transactions held steady in August, down by just $1.3 billion and continuing the three-month trend of relative stability. Year-over-year, sponsor buyer deal value is up 21%.

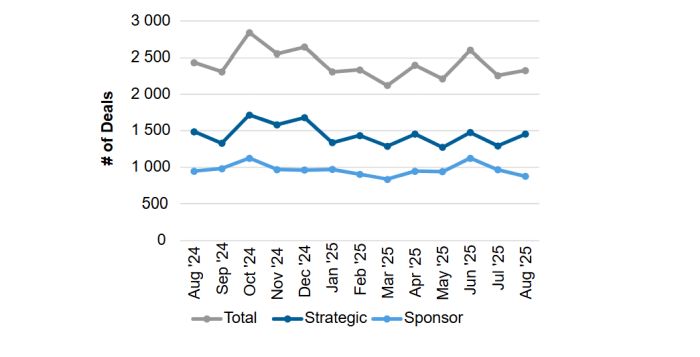

2 Deal Count Trends

Despite the downturn in monthly value, global deal count held roughly steady (+3%) in August from July. Year-over-year, deal count has been stable (-4%).

Strategic buyer deal count in July also declined 13% month-over-month and 10% year-over-year.

Sponsor buyer deal count in August fell 10% from July, continuing the Q3 decline, and 8% year-over-year.

Active M&A Industries (U.S. Targets)

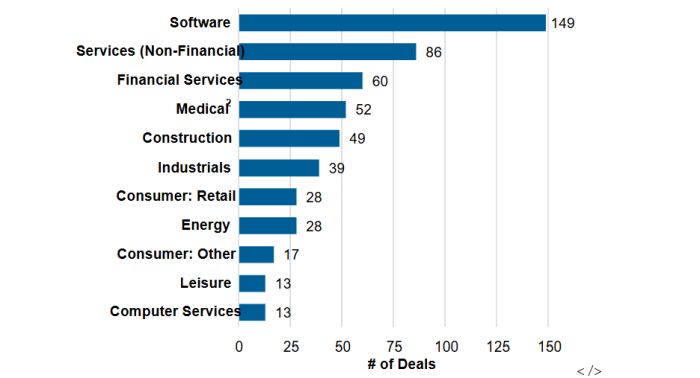

3 By Deal Count

- The software industry remained at the top for U.S. M&A activity by deal count in August, continuing its over two-year streak as the leading industry by volume.

- Services industries remained active, again rounding out the most active sectors in August by deal count.

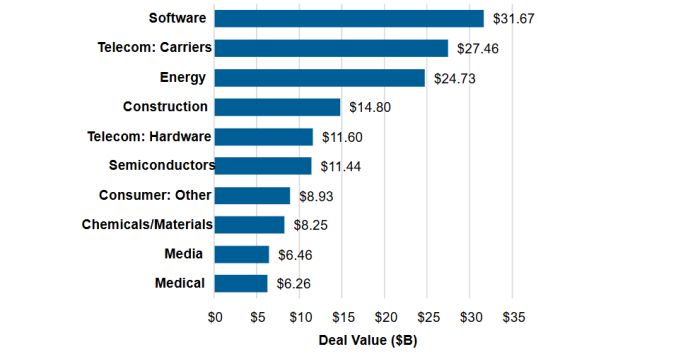

4 By Deal Value

- The software industry also topped the charts by deal value in August with 10 deals above $500 million.

- The telecom carriers industry came in a close second driven by the largest U.S. deal of the month, highlighted below. Energy followed closely in third place with two deals in the top 10 this month.

Monthly Blockbuster Deals

5 Largest U.S. Strategic Deal

- AT&T has agreed to acquire wireless spectrum licenses from EchoStar for approximately $23 billion.

6 Largest U.S. Sponsor Deal

- Thoma Bravo agreed to acquire Dayforce in an all-cash take-private transaction valued at $12.3 billion.

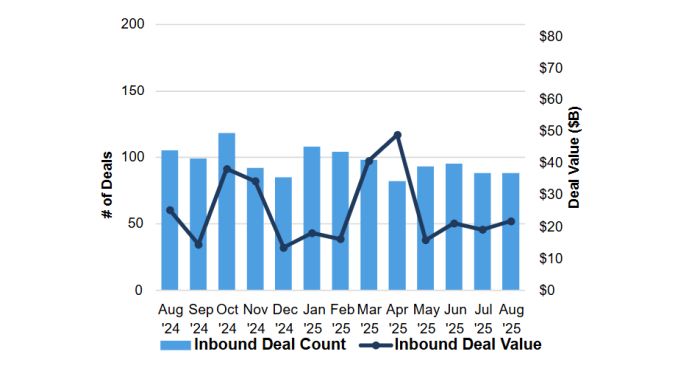

7 Inbound U.S. M&A Activity

- By deal value, inbound U.S. activity in August increased 14% from July, but remained below the 13-month average of about $25 billion. Year-over-year, inbound deal value dropped 14%.

- By deal count, acquisitions of U.S. targets by non-U.S. acquirers in August was equal to July count. Year-over-year, inbound deal count decreased 16%.

- Canada-based acquirers undertook the largest number of inbound transactions in August, with 17 deals. The UK and Japan trailed behind with 10 and 9 deals, respectively.

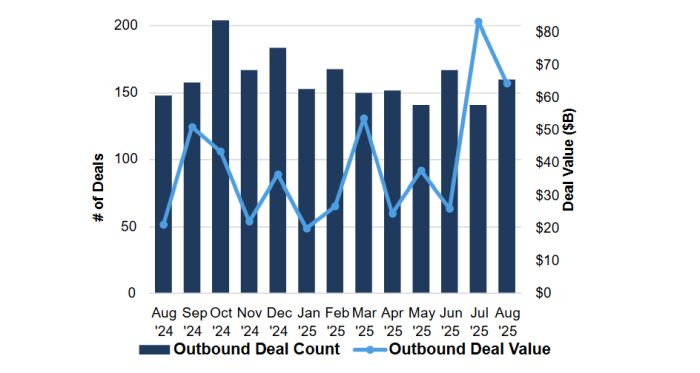

8 Outbound U.S. M&A Activity

- By deal value, acquisitions of ex-U.S. targets by U.S. buyers in August declined 23% from July's spike but still marked the second-highest monthly value in over three years. Year-over-year, outbound deal value more than tripled. Outbound deal count increased.

- Outbound deal count increased 13%, or by 19 transactions, from July to August and was up 8% year-over-year.

- U.S. acquirers predominantly looked to targets in the UK in August, with 23 transactions. Canada took second place with 15 transactions, and Germany took third with 12 deals.

AI Trends in M&A

9 AI Predicting Shareholder Activism?

- Researchers from the University of South Carolina and the University of Rhode Island developed an AI system trained on Institutional Shareholder Services (ISS) proxy voting guidelines and related statements, finding it could effectively predict shareholder voting outcomes on proposals. The model's recommendations aligned with ISS far more often than not (79% consistency). And notably, a "for" recommendation correlated with a 2% to 6% increase in investor support, even after accounting for ISS's own recommendations – demonstrating the model's statistically significant predictive power.

- Based on shareholder proposals filed in the U.S. between 2009-2021, the study 3 suggests that AI models could be used to refine proposals or opposition statements and to strategize on likely voting outcomes, though the technology is currently best suited for text-based shareholder proposals rather than more complex decisions.

- The effectiveness of AI in this area may be impacted by recent regulatory changes that reduce the number of proposals reaching proxy ballots, potentially limiting training data. Additionally, the study found that governance consultants can influence voting outcomes, especially in cases where proxy adviser guidelines require case-by-case judgment, highlighting the nuanced role of human expertise alongside AI.

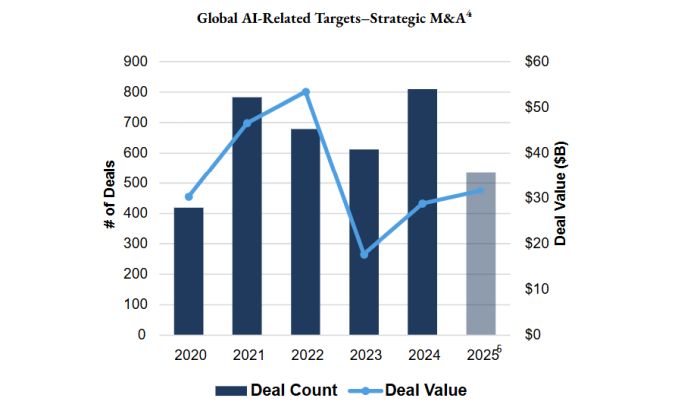

10 M&A Deal Trends: AI-Related Targets

- Strategic M&A involving AI-related targets has been strong through H1 2025, with full-year deal volume and value on pace to exceed those of the prior year by 33% and 123%, respectively.

- Due to rapid technology developments in the AI space, the next six to 12 months will be critical for business leaders to reposition their companies for the next wave of AI-driven innovation. The short timeline to adapt will fuel capability-driven deals in which large companies acquire smaller targets that expand product suites or add key AI talent to their organizations to bolster AI capabilities going forward.

- With businesses striving to maintain competitiveness amid rapid AI-driven technology change and disrupted markets, acquisitions of AI companies by strategic investors have accelerated in 2025 and are key to bolstering the ability of legacy businesses and product offerings to compete in the face of AI disruption.

- Read our full Artificial Intelligence H1 2025 report here.

Footnotes

1. Unless otherwise noted, charts compiled using Mergermarket data for August 2025 as of September 5, 2025. Aggregate deal values by dollar amount are calculated from the subset of deals with disclosed values.

2. Medical industry classification principally includes medical devices/technology/services, excluding biotech and pharmaceutical deals

3. Beyond Bias: AI as a Proxy Advisor (Lee, Souther, et. al).

4. Sourced from Pitchbook; closed/announced deals.

5. Data through 6/30/2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.