U.S. acquisitions of U.K. listed companies have traditionally

been a staple of global deal flow. This year is no exception,

although the volume of attempted bids far outweighs the number of

completed deals. Buyers need to understand the unique features of

the U.K. takeover regime to ensure their transactions succeed.

Transatlantic public M&A involving U.S. bidders and U.K.

targets has long underpinned global deal flow, with U.S.

corporations and private equity sponsors originating more inbound

takeovers of U.K. listed businesses than investors from other

countries. Indeed the size and volume of these deals is often seen

as a key indicator of the strength of the global M&A market,

and of the confidence levels of corporations and their boards to

seek international growth and scale.

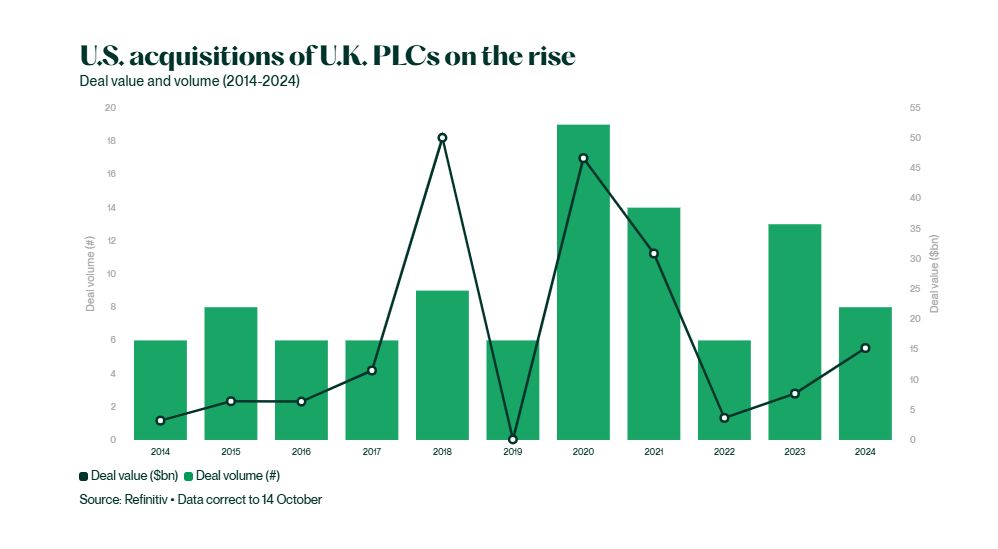

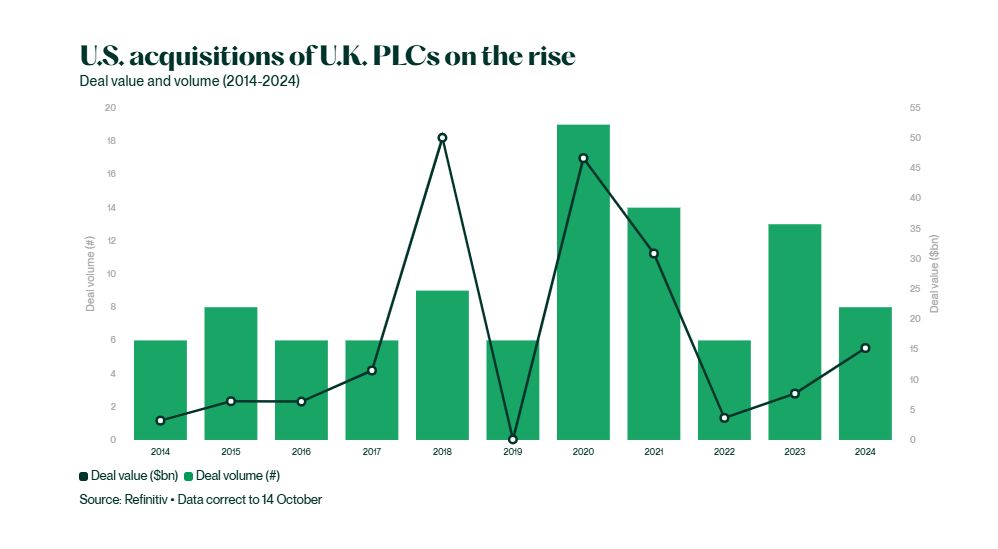

So far in 2024 we have seen a return of significant

transatlantic public M&A activity, with acquisitions of U.K.

listed companies by U.S. acquirors worth USD15.2 billion in the

period to mid-October, almost double 2023's annual total of

USD7.7bn. A number of these deals have been competitive, and some

have seen all or part of the consideration made up of shares issued

in a listed U.S. acquiror.

Several factors are driving this uptick in activity. Corporates

have been far more active in what has at times been a private

equity-dominated market in recent years, driven by greater

confidence in their businesses and the broader economic outlook,

the desire for scale and synergies to address higher costs, and a

more favorable financing market. This has been coupled with slight

improvement in private equity deal activity after an extended lull

in 2022 and 2023.

Relative strength of U.S. equity markets makes many inbound

bids attractive

Where deals involve an offer of U.S. listed shares as

consideration, clearly the synergy value is an important component

of the value opportunity presented to the target company's

shareholders. However, key to the narrative has also been the

chance to realize a re-rating of shareholders' equity to

reflect the typically higher multiples that the acquiror's

stock trades at the U.S. market.

This is part of a recent and much broader market theme involving

the relative strength and competitiveness of the U.S. compared to

other jurisdictions, which in some cases has seen companies move

their place of listing to the U.S. outside of an M&A

context.

U.K. takeover rules create a competitive market for

bidders

Bidders have found it hard to execute in 2024, with the number

of approaches made to U.K. targets far exceeding the volume of

announced and completed deals. In many of these cases the

target's board has been robust in its assessment of value, with

a 30%-40% bid premium (historically considered the benchmark) not

enough to obtain a recommendation. At the same time, several deals

have not proceeded on the basis of issues arising in due

diligence.

We have also seen greater competition for U.K. public companies,

with U.S. corporations prepared to engage in the level playing

field the U.K. regime creates for contested takeovers. U.K. boards

are permitted to switch their recommendation to another bidder

during a transaction, so the initial bidder needs to make its

package as attractive as possible, not just in terms of price but

also in relation to certainty and speed of execution.

The price of a target board recommendation is not necessarily as

high as the price required to discourage other bidders from

entering the race. We have seen examples of bidders being pushed to

terms higher than those which may have caused a potential

interloper to think twice about intervening had they been offered

from the outset.

Aspects of U.K. public M&A regime are unique in global

markets

Many aspects of the U.K. regime for public M&A are unique

among the major global financial centers, and certainly compared to

the regulation of U.S. public company transactions.

- Deals are overseen by the Takeover Panel, an organization which

is independent of government and the financial regulator, the

Financial Conduct Authority.

- The Panel has a high degree of discretion to apply the rules of

the Takeover Code in a manner that it considers achieves their

underlying purpose, which at a high level are to "ensure fair

treatment for all shareholders and an orderly framework for

takeover bids".

- The rules themselves are principles-based and not written in

the technical language of legislation.

- The Panel comprises a combination of permanent staff and

M&A practitioners on secondment (mainly from investment banks

and law firms), and is heavily involved in the day-to-day running

of deals.

- Its rules require advisors to consult with the Panel on any

matter of interpretation of the Takeover Code rather than to form

their own view. As a result, many key issues on a deal involve a

real-time discussion with the Panel. The U.S. approach is very

different in this regard, with the SEC's role more focused on

compliance with detailed rules and regulations primarily dealing

with appropriate disclosure.

- The Panel also has authority over certain aspects of a

transaction, such as the circumstances in which a regulatory

condition can be invoked, which in the U.S. are largely a matter of

contract between the parties, and ultimately the courts in the

event of a dispute.

The Panel system of M&A regulation in the U.K. takes some

getting used to for those unfamiliar with the process. However,

parties often recognize the benefits of being able to speak to an

experienced M&A practitioner at the regulator who can provide

certainty and quick decision-making (often 24/7) on a live

issue.

U.K. vs U.S. M&A regimes – key differences

compared

Clearly every transaction is different and expert advice should

be sought in each case. However, we set out below some of the key

differences between the U.K. and U.S. public M&A regimes which

are important to understand before embarking on a takeover of a

U.K. listed company.

| M&A issue |

U.K. regime |

U.S. regime |

|

Leaks

|

- The Panel may require a leak announcement at an early stage if

there is press speculation or an untoward price rise after the

point at which a bid is "actively considered" by the

potential bidder.

- The risk of a leak announcement is heightened on approaching

the target.

- The financial advisor leads engagement with the Panel on

whether a leak announcement is required.

- If it is, the Code imposes a 28-day deadline for the bidder to

announce a firm offer (fully financed, due diligence complete) or

walk away. This can be extended by the target.

- A maximum of six external parties (excluding advisors) may be

brought inside before announcement.

|

- As a general matter, no requirement to disclose approaches and

negotiations in response to inquiries, and therefore most companies

adopt a "no comment" policy in the event of a leak.

- A party may not remain silent about negotiations, however, if

silence would result in a temporally relevant disclosure becoming

inaccurate or misleading.

- Also, "no comment" typically does not work in

response to an official inquiry (e.g. resulting from unusual

trading or market rumors).

- However, stock exchanges will be reluctant to accept "no

comment" in response to an official inquiry.

|

|

Due diligence

|

- Typically more limited than in private and U.S. M&A

deals.

- Any due diligence information provided by the target must also

be given to other potential bidders that may emerge, even if less

welcome, which naturally constrains what information may be

forthcoming.

|

- Similar to the U.K. position, however no rule requiring that

all bidders be given the same due diligence information, even

though the result in practice may be the same.

|

|

Deal protection

|

- The target is prohibited from agreeing most deal protection

measures with a bidder (e.g. break fees, no-shop, matching rights,

etc).

- The target can commit to assist with regulatory clearances, but

the board is otherwise free to withdraw and switch its

recommendation.

- Reverse break fees are seen where there are substantive

regulatory risks and/or bidder shareholder approval is

required.

- Bidders focus on director and shareholder irrevocable

undertakings, price, speed and execution certainty to impose

hurdles for potential interlopers.

|

- Deal protection measures are ubiquitous in U.S. transactions,

which typically have a no-shop covenant, with a "fiduciary

out" – an ability for the board to change its

recommendation and terminate the agreement upon payment of a break

fee (which typically is between 2% and 4% of equity value based on

constraints imposed by fiduciary principles under Delaware law) and

matching rights.

- Some U.S. transactions include a "go shop", which

permits the target company to shop itself to others for an agreed

number of days after signing, typically with a lower break fee

payable if an alternative deal is struck during this period.

- Reverse break fees are common to address substantive regulatory

approval risks. No upper limit on reverse break fees imposed by

applicable law, so on average, amounts tend to be higher than

typical break fees.

- Tender/support/voting agreements with directors and significant

shareholders are common.

|

|

Regulatory conditions

|

- Panel requires all reasonable steps to be taken to satisfy

conditions.

- Panel will not permit a condition to be invoked unless

circumstances are of material significance in context of offer.

Panel will apply this test to a remedy required by a regulator to

the extent known before the long-stop date.

- Target companies typically negotiate contractual commitments to

obtain regulatory clearances, which exist alongside Panel regime,

although litigation is rare.

- Long-stop date is a key focus, in particular whether it should

accommodate a second request/in-depth review notwithstanding

financing cost of longer period.

|

- Unlike in the U.K., the parties are free to agree on conditions

to the transaction by contract and the SEC and courts will not

intervene in what those conditions are.

- Similarly, invocation of a condition is a matter between the

parties (and ultimately the courts if there is a dispute as to

whether it was properly invoked) and not something the SEC is

involved in.

- Similar approach to U.K. around negotiation of contractual

commitments to obtain regulatory clearances and long-stop

date.

- Litigation more common in the U.S.

|

|

MAC and other general conditions

|

- Very difficult to invoke. Bidder can improve ability to invoke

by including specific negotiated conditions and clearly disclosing

to shareholders the circumstances in which bidder would seek to

invoke.

|

- Again, parties are free to agree contractually on the

conditions to the transaction, and the SEC will not get involved.

MAC provisions in the U.S. rarely include specific triggers,

leaving this to the parties' (and courts') interpretation

However, similar to the U.K., the no MAC condition is very

difficult to successfully invoke – a landmark Delaware case

in 2018 marked the first ever successful invocation of a MAC in

Delaware.

|

|

Deal structure

|

- Scheme of arrangement most common structure on recommended

transactions – requires two-limbed shareholder approval: (i)

majority in number; and (ii) 75% by value, in each case of

shareholders voting.

|

- Statutory merger most common structure in friendly

transactions, which requires (in Delaware) the affirmative vote of

a simple majority of the target's outstanding shares to

approve.

- Tender offers are also fairly commonly used in situations where

speed is paramount and the regulatory approval process can be

completed very quickly, as well as in hostile situations.

|

|

Financing

|

- Certain funds required at time of firm offer announcement (full

financing documentation). Financial advisor must provide cash

confirmation statement and will appoint own counsel to verify

source(s) of funds.

|

- No certain funds type rules or cash confirmation as in the

U.K., but rather a matter of contract between the parties.

- Typically acquiror will provide target company with signed debt

commitment letters that, subject to limited customary conditions,

require the lender party thereto to provide the required debt

financing at closing.

|

|

Intention statements

|

- Bidder must disclose intentions for the business, locations,

management, employees and R&D (pre-vetted by Panel before deal

is announced). Panel review after 12 months to ensure

compliance.

|

- No similar requirements in U.S. transactions, though often, as

an IR, PR and retention matter, buyers will explain their plans at

a high level to market the transaction.

|

|

Management incentives

|

- Any post-completion incentives package requires full disclosure

and fairness opinion. Equity arrangements (outside ordinary course

awards) or unusual incentive arrangements can require separate

shareholder vote. Incentive arrangements often deferred until

post-completion.

|

- Disclosure will also be required, but no requirement to obtain

a fairness opinion.

- Certain arrangements may require a shareholder vote, but these

are not that common in the typical U.S. public company transaction

as they are usually handled post-closing once the target company is

no longer public.

- Arrangements with target company management will generally not

be negotiated until key deal terms, including price, have been

agreed.

|

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.