- within Corporate/Commercial Law topic(s)

- in United States

- within Environment, Real Estate and Construction and Wealth Management topic(s)

On December 15, 2023, the U.S. Treasury Department ("Treasury") and the U.S. Internal Revenue Service ("IRS") issued Notice 2024-10 (the "Notice"), providing much needed interim guidance on the application of the Corporate Alternative Minimum Tax ("CAMT") with respect to controlled foreign corporations within the meaning of section 957(a)1 ("CFCs") and affiliated groups of corporations filing consolidated tax returns ("Consolidated Groups"). Relying generally on existing U.S. tax principles for taxing CFC earnings, the Notice provides a fix to the potential "double counting" issue that taxpayers worried may arise under a statutory application of the CAMT (as we ourselves noted in a prior alert). The Notice also provides interim guidance on the appropriate applicable financial statement ("AFS") to be used by members of Consolidated Groups. We discuss in further detail below the key provisions of the Notice.

Application of the CAMT with Respect to CFCs

Background

Effective for taxable years beginning after December 31, 2022, the CAMT2 imposes a 15% minimum tax on the adjusted financial statement income ("AFSI") of applicable corporations. Generally, an "applicable corporation" is a corporation (other than an S corporation, a regulated investment company or a real estate investment trust) that, determined under group aggregation rules, has modified average annual AFSI of $1 billion over a period of three consecutive prior tax years. An applicable corporation's AFSI is defined as the net income or loss on a taxpayer's AFS for a tax year, with certain adjustments set forth in section 56A(c). Although the CAMT may directly apply with a more limited scope to a non-U.S. applicable corporation, the following discussion focuses on the application of the CAMT to an applicable U.S. corporation that is a direct or indirect shareholder in a non-U.S. corporation.

In addition to providing rules to aggregate income and loss of Consolidated Group members, the CAMT requires an applicable U.S. corporation to include in its AFSI (i) dividends from lower-tier corporations that are not members of its Consolidated Group and (ii) other amounts that are includable in gross income or deductible as a loss with respect to such lower-tier corporations (other than amounts required to be included under sections 951 and 951A). Additionally, an applicable U.S. corporation that is a U.S. shareholder (within the meaning of section 951(b)) of a CFC is required to adjust its AFSI by its pro rata share (determined under rules similar to the rules in section 951(a)(2)) of items that are taken into account in computing the net income or loss set forth on such CFC's AFS.

Because an applicable U.S. corporation that is a U.S. shareholder of a CFC is required by statute to include in its AFSI both dividends received from a CFC and its pro rata share of such CFC's income or loss, absent guidance, taxpayers were concerned that a CFC's earnings may be counted twice in the computation of an applicable U.S. corporation's AFSI. Treasury and the IRS acknowledged in the Notice that such double counting may discourage U.S. shareholders from repatriating CFC earnings until guidance is issued.

To address the double-counting concern, the Notice provides interim guidance for distributions from (i) a first-tier CFC to a U.S. shareholder and (ii) one CFC to another CFC.

Distributions from a First-Tier CFC to a U.S. Shareholder

For distributions from a first-tier CFC to a U.S. shareholder, the Notice provides a two-step process to calculate the amount of the distribution that is included in the U.S. shareholder's AFSI:

- In the first step, the U.S. shareholder removes from

its AFSI any items included on its AFS that relate to the receipt

of a so-called "Covered CFC Distribution."

- A "Covered CFC Distribution" is defined as a distribution received with respect to CFC stock to the extent it is a dividend within the meaning of section 316, determined without taking into account section 959(d).

- Under section 959(d), a distribution of a CFC's previously taxed earnings and profits ("PTEP") that is excluded from a U.S. shareholder's gross income under section 959(a) is not treated as a "dividend" for purposes of chapter 1 of the Code, except that it does decrease the distributing CFC's earnings and profits.

- Therefore, for purposes of the first step, only a distribution made out of the first-tier CFC's earnings and profits would constitute a "Covered CFC Distribution," even if such distribution would be treated as a non-dividend under section 959(d).

- In the second step, the U.S. shareholder includes in

its AFSI the income and deductions under chapter 1 of the Code

associated with the receipt of the Covered CFC Distribution, taking

into account section 959(d) and excluding sections 56A and 78.

- Thus, for purposes of the second step, section 959(d) is applied to determine whether a distribution constitutes a dividend under chapter 1 of the Code that must be included in the recipient's AFSI. If the distribution would be excluded from gross income under section 959(a) as a PTEP distribution, the Notice excludes it from AFSI.

The Notice thus piggybacks on existing U.S. tax principles, including the maintenance of PTEP accounts, to determine the amount of a first-tier CFC's distributions that should not constitute a dividend and be excluded from the recipient U.S. shareholder's AFSI. Therefore, the Notice strongly suggests that taxpayers should not have to maintain new or distinct PTEP accounts for previously taxed AFSI of CFCs.

Significantly, in addition to excluding PTEP distributions from a U.S. shareholder's AFSI, we read the Notice as clearly indicating that a U.S. shareholder that would otherwise qualify for a section 245A dividends-received deduction ("Section 245A DRD") on the receipt of a dividend from a CFC may apply such deduction in determining its AFSI. In particular, the Notice requires in step 2 that the U.S. shareholder include in its AFSI "items of income and deductions under chapter 1" (emphasis added) of the Code associated with the receipt of a Covered CFC Distribution. Because the Section 245A DRD is found under chapter 1 of the Code, the Notice suggests such deduction applies in determining a U.S. shareholder's AFSI attributable to the receipt of a dividend from a CFC.3 We expect all the traditional limits on the application of the Section 245A DRD (e.g., holding period, hybridity) to apply equally in determining an applicable U.S. corporation's AFSI. Furthermore, it is unclear whether amounts that the applicable U.S. corporation is required to include in income under section 961(b)(2) and section 1059(a)(2) with respect to a Covered CFC Distribution are "items of income and deduction under chapter 1 . . . resulting from the receipt of the Covered CFC Distribution" that the applicable U.S. corporation is required to include in its AFSI.

Distributions from One CFC to Another CFC

Similar to distributions from first-tier CFCs to U.S. shareholders, relying on established U.S. tax principles, the Notice includes a two-step process to determine a U.S. shareholder's AFSI in connection with a CFC-to-CFC distribution:

- In the first step, in calculating the income or loss of a CFC that may be currently taken into account by a U.S. shareholder in computing its AFSI, such CFC removes from its AFS any items that relate to the receipt of a Covered CFC Distribution from a lower-tier CFC.

- In the second step, such recipient CFC includes in its

income any items of income under chapter 1 of the Code resulting

from the receipt of such Covered CFC Distribution, determined

without regard to any exclusion under chapter 1 (for example, the

high-tax exception of section 954(b)(4)) and reduced to the extent

the Covered CFC Distribution is excluded from either:

- both (a) such recipient CFC's foreign personal holding company income ("FPHCI") under section 954(c)(3) or section 954(c)(6) (relating to certain income received from related persons or certain amounts received from related CFCs, respectively), and (b) such recipient CFC's gross tested income under section 1.951A-2(c)(1)(iv) of the Treasury regulations (relating to dividends received from related persons), or

- such recipient CFC's gross income under section 959(b).

Accordingly, as with first-tier CFC dividend distributions, book items attributable to a CFC-to-CFC dividend are first removed from the recipient CFC's AFSI and then added back based on U.S. tax principles generally applicable to CFC-to-CFC distributions. Under those rules, a U.S. shareholder should not have any additional amount of AFSI attributable to a CFC-to-CFC dividend if such dividend consists of either (i) a distribution of PTEP that would be excluded from the recipient CFC's gross income for purposes of section 951(a) under section 959(b), or (ii) a non-PTEP distribution that would be excluded from the recipient CFC's FPHCI (under the same-country or look-through exceptions to FPHCI) and tested income (as a dividend received from a related person).

As with section 959(a) in the first-tier CFC context, the Notice indicates Treasury and the IRS's reliance on existing PTEP principles and accounts to exclude amounts from a CFC's gross income both for purposes of section 951(a) and the CAMT. However, because the Notice relies on related-party exclusions under section 954(c)(3), section 954(c)(6) and section 1.951A-2(c)(1)(iv) of the Treasury regulations, and otherwise contemplates only items of income and not deductions in computing a recipient CFC's income, the Notice suggests that non-PTEP distributions from a foreign corporation to a CFC may be included in a U.S. shareholder's AFSI if the distributing foreign corporation is not a CFC or is not related to the recipient CFC within the meaning of section 954(d)(3).

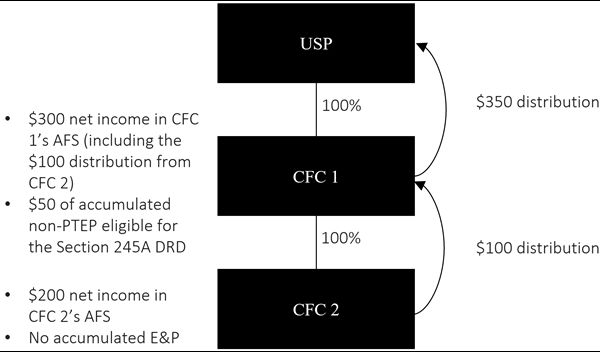

Illustration of CFC Distribution Rules

Facts

- USP is an applicable corporation under section 55(k).

- CFC 1 started the 2023 calendar taxable year with $0 of PTEP and $50 of untaxed E&P that would be eligible for the 100% Section 245A DRD if distributed to USP.

- USP formed CFC 2 on 1/1/2023.

- USP does not own an interest in any foreign corporations other than CFC 1 and CFC 2.

- CFC 1 and CFC 2 do not have any "qualified business asset investment" under section 951A(d)(1).

- CFC 1 and CFC 2 each has $200 of tested income for the 2023 calendar taxable year.

Analysis

- With respect to CFC 2, USP's AFSI is increased by $200 (USP's pro rata share of CFC 2's net income reported on CFC 2's AFS). This is the same amount as the GILTI inclusion that USP has in 2023 that is attributable to CFC 2.

- With respect to CFC 1, USP's AFSI is increased by $200 (USP's pro rata share of CFC 1's net income reported on CFC 1's AFS without regard to the $100 PTEP distribution it received from CFC 2). This is the same amount as the GILTI inclusion that USP has in 2023 that is attributable to CFC 1.

- USP's AFSI should not be increased by the $100 distribution that CFC 1 receives from CFC 2, because such amount should constitute a PTEP distribution that would be excluded from CFC 1's gross income under section 959(b).

- USP's AFSI should not be increased by the $350 distribution from CFC 1 because (i) $300 of such distribution should constitute PTEP that would be excluded from USP's gross income under section 959(a) and (ii) $50 of such distribution should constitute a dividend that is eligible for the 100% Section 245A DRD.

- Thus, as a result of USP's direct and indirect ownership of CFC 1 and CFC 2, USP's AFSI would be increased by a total of $400 ($200 from each CFC).

- Absent the guidance provided in the Notice, taxpayers were concerned that USP would have been required to include $850 in its AFSI with respect to its investment in CFC 1 and CFC 2 ((i) $200 from CFC 2, (ii) $300 from CFC 1, and (iii) $350 from the distribution from CFC 1 to USP).

Items Not Covered by the Notice

The Notice offers much-needed relief to avoid double counting of CFC earnings in a U.S. shareholder's AFSI. Such relief is consistent with congressional intent, as evidenced by the grant of regulatory authority in section 56A(c)(15) (to "prevent the omission or duplication of any item"). Furthermore, the Notice does not limit its application to earnings of a CFC generated only after the effective date of the CAMT rules, and thus has broad application to CFCs' historic previously taxed and non-previously taxed earnings.

However, with respect to both first-tier CFC distributions and CFC-to-CFC distributions, the Notice explicitly defers guidance regarding the treatment of CFC distributions that are not "Covered CFC Distributions," dispositions of stock of a CFC (including the treatment of deemed dividends under section 1248) or any other amounts that may relate to ownership of CFC stock. Importantly, this leaves open questions regarding if, and how, the section 961 basis rules may apply to determine an applicable U.S. corporation's AFSI in connection with a sale or exchange of CFC stock. One potential approach would be to determine AFSI from the sale of CFC stock in a manner that takes into account principles under chapter 1 of the Code, which should include the basis adjustments under section 961 and other relevant basis provisions (e.g., section 1059(a)(1)). This would be consistent with the provisions in the Notice that effectively eliminate book-tax differences in connection with Covered CFC Distributions by applying principles under chapter 1 of the Code.

Moreover, the Notice does not provide guidance on distributions that an applicable U.S. corporation receives from non-U.S. corporations that are not CFCs, even if such non-U.S. corporations may be "specified 10-percent owned foreign corporations" with respect to such applicable U.S. corporation within the meaning of section 245A. It is not immediately clear why Treasury and the IRS determined it was appropriate to apply the Section 245A DRD to determine AFSI in the context of a first-tier CFC distribution but not a distribution from a non-CFC specified 10-percent owned foreign corporation.

AFS Guidance for Members of a Consolidated Group

In Notice 2023-64, released on September 12, 2023, the IRS provided interim guidance regarding the application of the CAMT to Consolidated Groups. More specifically, it contained rules for determining a corporation's AFS when the financial results of such corporation are included in a financial statement covering a group of entities (a "Consolidated Financial Statement").

The Notice modifies and clarifies the guidance contained in Notice 2023-64 for purposes of determining the appropriate AFS to be used by a corporation that is part of a Consolidated Group. Broadly, the Notice introduces more detailed rules for determining the appropriate AFS for members of Consolidated Groups in addition to addressing specific scenarios, such as when there are multiple Consolidated Financial Statements that do not contain the results of all members of such Consolidate Group.

Reliance on the Notice

According to the Notice, Treasury and the IRS intend to issue proposed regulations that should be consistent with the interim guidance contained in the Notice.

In the meantime, the Notice provides that taxpayers may rely on its guidance for Covered CFC Distributions received on or before the date forthcoming proposed regulations are published in the Federal Register and, regardless of when such proposed rules are published, for Covered CFC Distributions received before January 1, 2024.

Regarding the modifications and clarifications to the AFS guidance for members of a Consolidated Group, the Notice states that taxpayers may rely on such guidance for taxable years ending before the date forthcoming proposed regulations are published in the Federal Register and, regardless of when such proposed rules are published, for any taxable year beginning before January 1, 2024. Taxpayers may not rely on the unmodified text of Notice 2023-64 for any tax return filed on or after December 15, 2023.

Footnotes

1. All section references herein are to the Internal Revenue Code of 1986, as amended (the "Code"), or the Treasury regulations promulgated thereunder.

2. Congress enacted the CAMT as part of the Inflation Reduction Act of 2022, Pub. L. No. 117-169.

3. Similarly, the deduction under section 245 may apply in determining a U.S. shareholder's AFSI attributable to the receipt of a dividend from a CFC.

Originally published December 22, 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.