Digital commerce powered retail's growth over the last ten years. Retailers invested nearly $1T in the channel over the last five years alone, according to Gartner.

But our analysis shows that as online penetration grows, retailers' profits shrink. The cost of serving customers anytime, anywhere, at any speed does not bring in enough topline growth to optimize existing investments in machinery and technology.

Given consumer preferences for digital aren't changing, how can retailers revamp their strategy and improve efficiency as they further expand their digital businesses?

We conducted a global study of retail executives and line

managers to understand digital transformation and how opinions

differ between the c-suite and the digital practitioners on the

ground. We found that:

Retailers spend big but inefficiently on digital, so they don't see the intended results

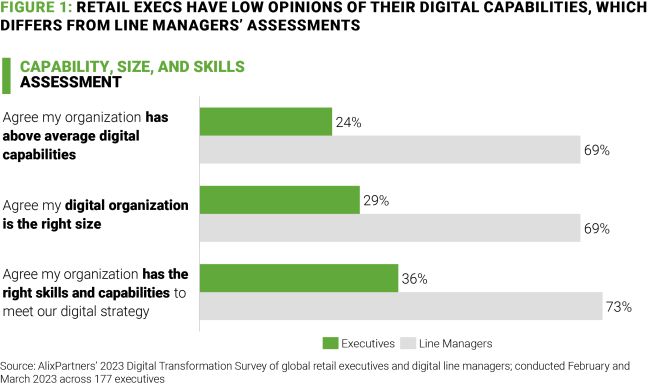

Despite the large spend on digital enhancements, 50% of executives view their digital capabilities as "average". There is a growing disconnect in assessment between the executives making the decisions and the line managers doing the work—69% of whom rank their digital capabilities as "above average".

Business and digital leaders need to better collaborate and

align on priorities to promote efficient digital growth strategies

across the organization. Simply getting a project approved by

calling it "digital" cannot be the process going

forward.

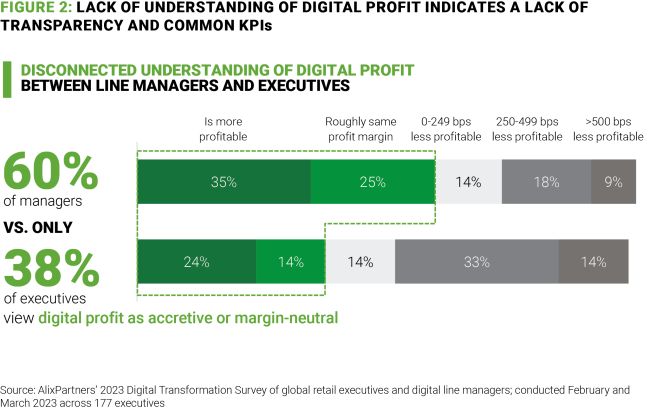

Retailers lack understanding of digital profit across the organization, which drives misaligned actions

Our 2022 Digital-First Executive Survey found only 48% of retail

executives are measuring the true costs and benefits of an

omnichannel approach. How can retailers make the right decisions

when they don't understand the data?

Companies must enact a means of measuring success, as otherwise,

they will continue making digital investments that prove

ineffective. Many retail leaders still view e-commerce

profitability as the chief measure of digital efficiency. But this

misses the larger point of a digital-first retail model, which

gears your full ecosystem of channels towards digital-first demand

to drive accretive customer lifetime value.

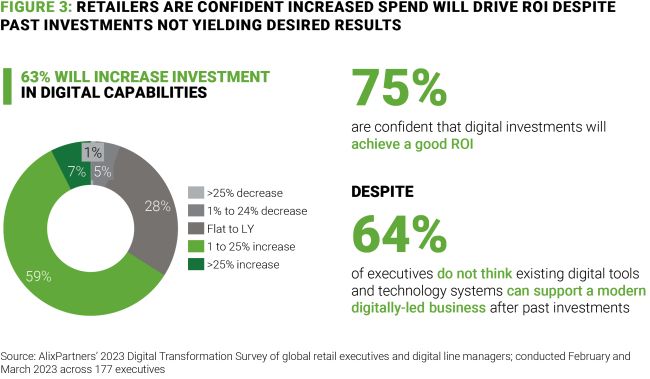

Retailers increase digital spend year-over-year, but don't ensure positive ROI

If past investments have failed to meet expectations, why is there

confidence future investments will perform differently?

Moving to a digital-first approach requires a big shift in investment, but retail CEOs concentrate on hitting quarterly profit goals. As such, they tend to focus on short-term earnings rather than long-term decisions.

If short-term earnings are steady, they lack incentive to enact

widescale change. But without change, digital efficiency problems

and poor investments will continue.

How digital-first retail can turn the tide

With digital-first retail (DFR), digital is not a channel, but rather the core of your business model. Your mindset shifts from product-centric to customer-centric and your KPIs shift from conventional metrics to digital-first benchmarks.

DFR has four major pillars, underpinned by a digital-first operating model:

Customer: Customer lifetime value growth, paired with a rich customer data backbone, must be front and center in your approach. Retailers need to leverage the rich customer data from digital channels, browsing histories, email interactions, and more to improve all operating decisions.

Omnichannel journey: An easy-to-navigate site, app, and store experience are crucial. Personalized experiences are driving success here—consumers now expect personalization in retail. Our study of 150 public retail companies shows that retailers that execute well on this pillar have 27% higher profit than those that don't.

Product and promotion: Decide what you're driving for online: traffic or margin. Use promotions as an opportunity to drive sell-through. Our study shows that those that get this pillar right have 10% higher profit than those that don't.

Network and fulfillment: When we polled

customers in our 2022 Home Delivery Survey, their most important

feature was free shipping, not speed. Retailers have overinvested

in this area, trying to keep up with Amazon. To reduce return rates

and reverse logistics costs, retailers must focus on three levers:

improving (or maintaining) sales, driving additional revenue, and

reducing return volume.

To build a digital-first operating model, you need:

Data-driven decision making: Harness the vast data you collect through e-commerce to improve your product development and supply chain performance—particularly in areas such as forecasting and replenishment planning.

Automation: Along with supply chain automation, you can automate processes for workplace and vendor sourcing, contract management, SEO optimization, writing product descriptions, aggregating user reviews, and more.

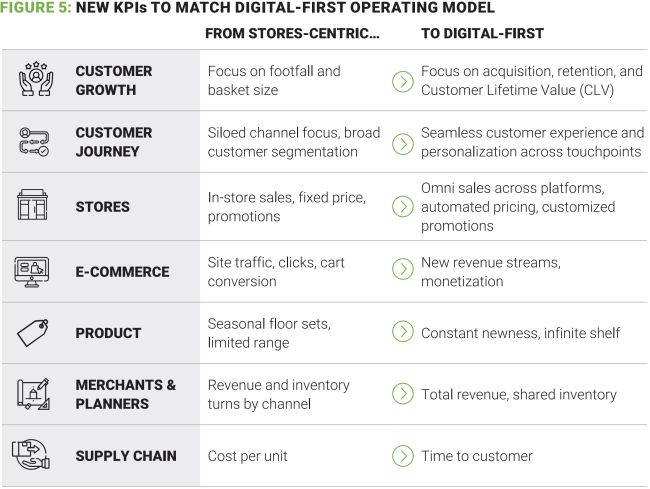

New KPIs: Establish new KPIs with a digital-first lens to match your new operating model. These thought-starters can guide your thinking on how to shift KPIs from a stores-centric to digital-first focus:

It's clear that retailers can't keep operating the same way and expect different results. By retooling your business model towards digital-first demand, you will reset how your company thinks about everything from customer acquisition and lifetime value to entire org charts and the relationship between marketing and sales.

Retailers that don't may be part of the next $1T spent on

failed digital transformations.

To learn more about how we approach digital-first retail, read our 2023 whitepaper in partnership with World Retail Congress.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.