- within Corporate/Commercial Law and Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy, Business & Consumer Services and Healthcare industries

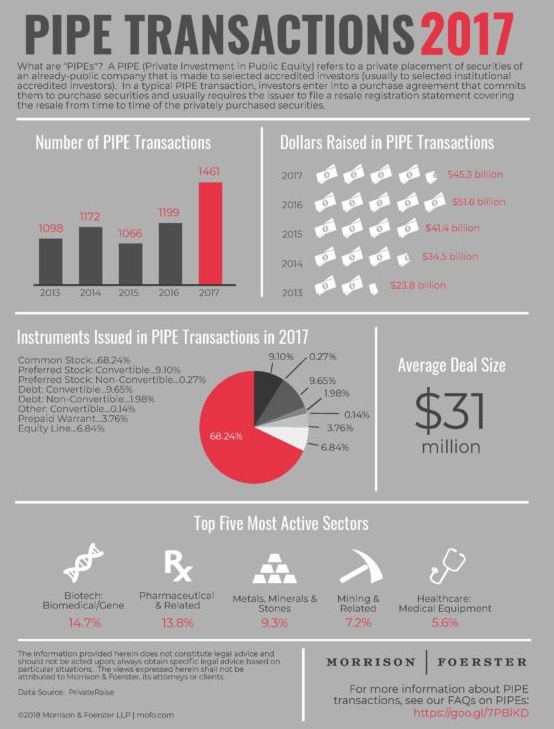

PIPE transactions have provided a useful capital-raising alternative when the public markets are inhospitable. A PIPE transaction also has become the financing of choice when it comes time to raise capital to finance an acquisition, recapitalize a company through a change-of-control transaction, or effect an orderly exit for an existing stockholder with a significant percentage ownership of the company. We summarize the PIPE activity for 2017 in our infographic.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved