Insider Trading Policy: Hedging and Pledging

Cooley is committed to providing public companies and their boards with relevant, on-demand resources. As a part of that effort, we are excited to be conducting a multipart survey series designed to provide insights and best practices on key corporate governance topics, practices and market trends.

Here are the results and key takeaways from Part 3 of the survey series, which focused on policies and procedures related to hedging and pledging of company securities.

Hedging and pledging

Addressed in policies

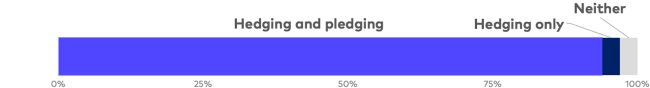

The vast majority of company respondents address hedging and pledging of company securities in their insider trading policy or a separate policy. Notably, the companies with policies that address hedging only – or do not address hedging or pledging – have less than five years of maturity as a public company and a market cap below $500 million.

Hedging coverage

Prohibitions for all employees and directors

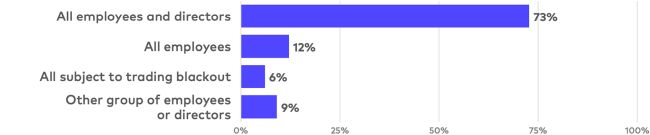

Almost three-quarters of company respondents prohibit hedging of company shares for all employees and directors.

Hedging policies covering company securities

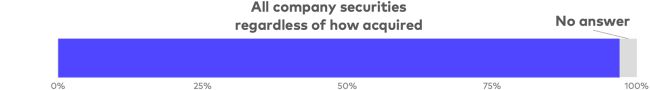

The hedging policies of nearly all company respondents cover all company securities, regardless of how they were acquired.

Prohibiting hedging of company securities

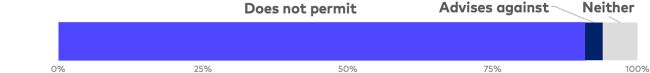

Company respondents were largely aligned in never permitting hedging of company securities.

Pledging coverage

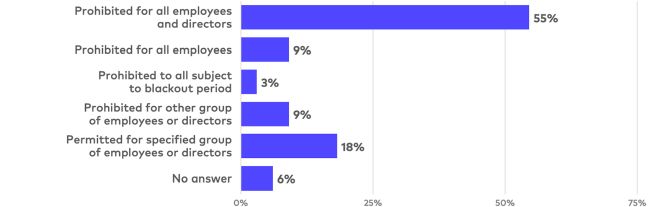

Variation among companies

There was more variation in the coverage of the pledging policies among company respondents. While more than half of respondents flatly prohibit pledging for all employees and directors, 18% permit pledges for a specified group of employees and/or directors, with the remainder generally prohibiting pledging for a subset of people. Notably, less than a third of technology companies indicated that they prohibit pledging for all employees and directors.

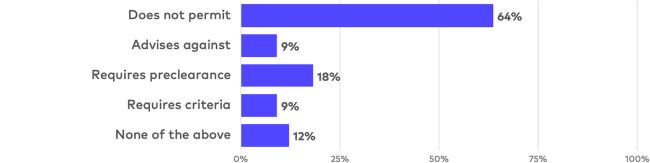

Permitting pledging of securities

While most company respondents never permit pledging, a minority of companies permit pledging if the pledge is precleared or if specified enumerated criteria are met. Responses indicated that these criteria are typically related to limiting the pledging to a specified percentage of holdings, the pledgor's financial wherewithal, the presence of alternate collateral and the status of the lender.

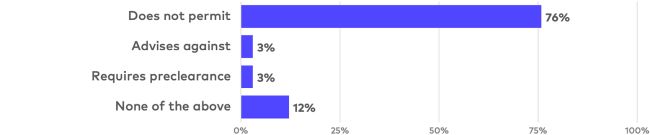

Margin accounts

Holding company shares

More than three-quarters of company respondents never permit people to hold company shares in a margin account.

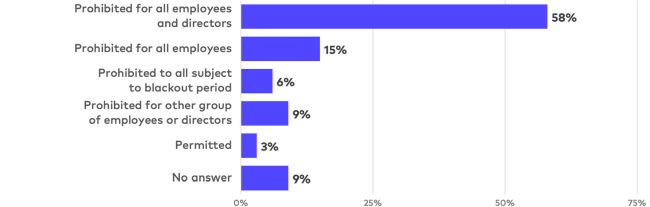

Prohibition by role

A significant majority of company respondents prohibit at least some people from holding company shares in a margin account, with the prohibition most commonly applying for all employees and directors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.