- with readers working within the Advertising & Public Relations industries

- within Criminal Law, Strategy and Real Estate and Construction topic(s)

- in United States

Key Takeaways:

- R&D tax credits can offset a company's qualified research expenditures, with more than $10 billion in credits claimed annually.

- While industries like manufacturing, software, and biotech benefit the most, many eligible businesses (across industries) overlook the credit.

- Recent tax law changes require R&D expenses to be amortized, making careful documentation and tax planning essential.

The research and development (R&D) tax credit offers substantial tax savings for businesses conducting innovative research. It supports technological progress by reducing tax liability for companies engaged in qualifying R&D activities.

While the credit provides critical financial relief, your business must stay ahead of regulatory changes and compliance requirements to maximize its benefits. Recent modifications — including mandatory amortization of R&E expenses under IRC 174 — have added new layers of complexity to tax planning.

Understanding the Financial Impact of R&D Tax Credits

The R&D tax credit can significantly reduce tax burdens, yet many businesses do not claim their full eligible amount. In fact, less than 20% of qualifying businesses take advantage of this credit — leaving millions in unclaimed tax savings.

How Much Can a Business Save?

Companies that properly document and claim the R&D tax credit can offset qualified research expenditures back in tax savings. In total, businesses claim over $10 billion annually through this incentive.

For startups and small businesses, the credit can also be applied against payroll taxes — offering up to $500,000 per year in offsets. This is a key benefit for companies that are pre-revenue or have limited taxable income.

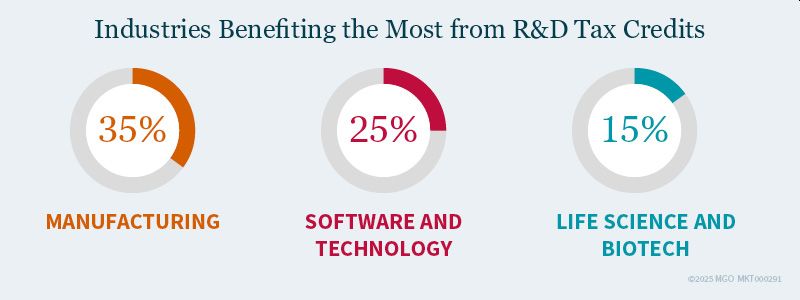

Industries Benefiting the Most

Several industries consistently receive help from R&D tax credits. Manufacturing leads the way with 35% of total claims. Close behind are software and technology (25%), with companies conducting R&D to develop new software, automation tools, or cloud-based solutions; and life sciences and biotech (15%), with research activities in pharmaceuticals, medical devices, and genetics.

- Despite these trends, many businesses mistakenly believe they don't qualify — overlooking valuable tax-saving opportunities.

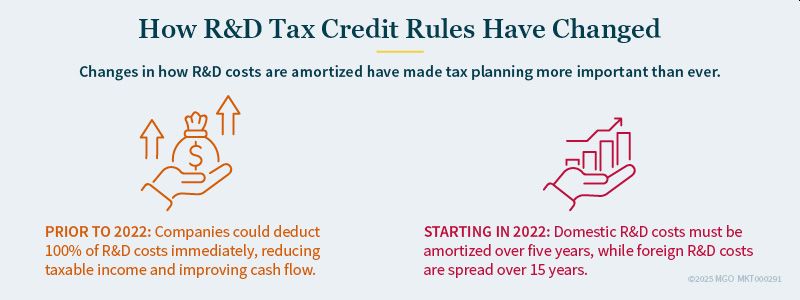

Regulatory Changes Affecting R&D Tax Planning

For tax years before 2022, businesses could fully deduct R&D expenses in the year they were incurred, providing immediate tax benefits. However, under the Tax Cuts and Jobs Act (TCJA), a key change to IRC 174 took effect for tax years beginning after December 31, 2021. Now, businesses must amortize R&D costs over multiple years rather than deducting them all at once.

- This shift increases taxable income in the short term, making careful tax planning and documentation even more important if your business claims or plans to claim the R&D tax credit.

Common Pitfalls and Compliance Challenges

Not meeting compliance standards or properly documenting R&D activities can lead to reduced or denied credits. Common mistakes include:

- Insufficient documentation: Lack of detailed project records and technical reports to support credit claims.

- Misclassifying costs: Including expenses like market research or routine quality testing that do not qualify.

- Overlooking payroll tax offsets: Small businesses are missing the opportunity to apply the credit against payroll tax liabilities.

To avoid these issues, your company must develop clear processes for tracking research activities and keep strong documentation to support credit claims.

Maximizing R&D Tax Credit Benefits

Your business can take several proactive steps to improve its R&D tax credit claims. Maintaining detailed records of research projects, employee activities, and technical findings is essential. Proper tracking of time logs, technical reports, and iterative testing processes strengthens credit claims and supports compliance.

Choosing the most helpful credit calculation method also plays a key role in maximizing tax savings. The regular research credit (RRC) method can offer higher benefits for businesses with a consistent R&D investment history, while the alternative simplified credit (ASC) method is often easier to apply and requires less historical data.

Additionally, staying informed about potential legislative changes is important. Congress has debated reinstating immediate expensing for R&D costs, which would allow businesses to deduct expenses upfront rather than amortizing them over time. Keeping an eye on tax policy developments can help your business adapt your tax planning strategy accordingly.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.