- within Energy and Natural Resources topic(s)

- in United States

- with readers working within the Accounting & Consultancy and Construction & Engineering industries

- within Criminal Law, Technology and Family and Matrimonial topic(s)

Key Takeaways:

- The One Big Beautiful Bill Act accelerates clean energy tax credit deadlines and tightens eligibility for state and local governments and Tribal nations.

- Key credits for EV fleets, charging stations, and clean power generation now require faster project timelines to qualify.

- Acting now could help your government or Tribal nation preserve access to millions in federal clean energy funding before it disappears.

In recent years, federal incentives have made it easier for state and local government and Tribal nations to fund sustainability projects such as electric vehicle (EV) fleets, charging stations, and renewable energy power infrastructure. But many of these benefits are now expiring sooner than expected.

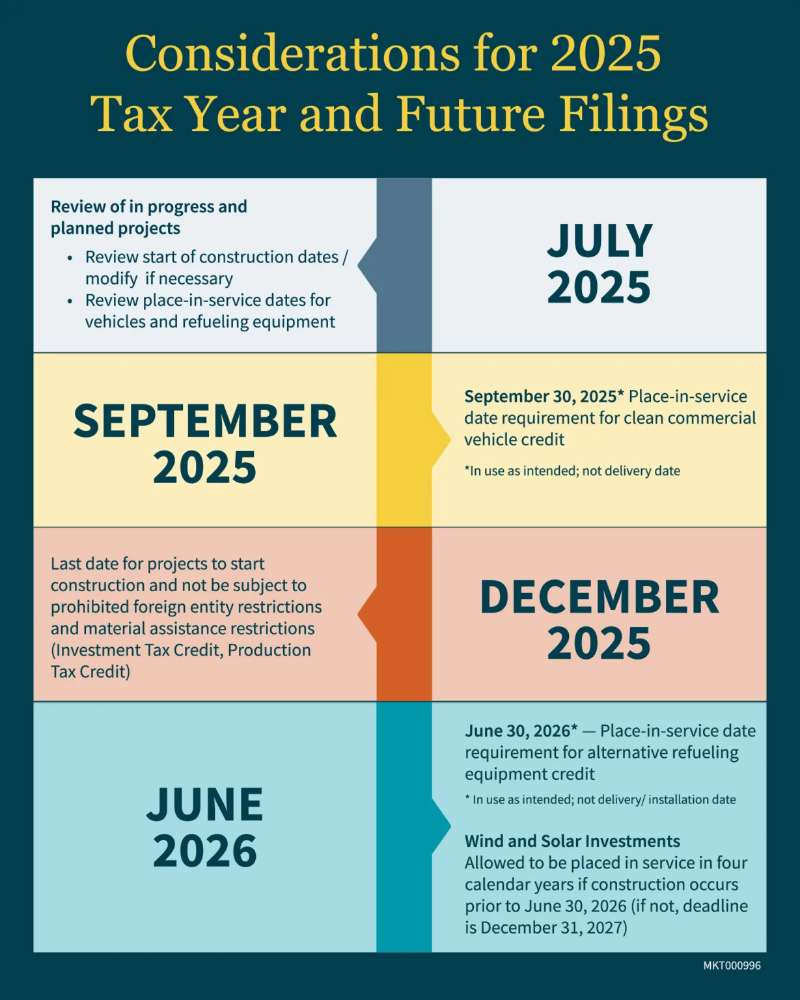

The One Big Beautiful Bill Act (OBBBA) accelerates the deadlines and narrows the eligibility criteria for several cornerstone energy tax credits. These changes are already affecting planning decisions for fiscal year 2025 and beyond. If you don't take action soon, your government or Tribal nation could lose access to millions of dollars in direct federal support for clean energy projects.

From the IRA to OBBBA: How We Got Here

When Congress passed the Inflation Reduction Act (IRA) of 2022, it dramatically expanded clean energy incentives across the country. Most notably, it introduced elective pay (also called direct pay) starting with tax years beginning after December 31, 2022 — giving state and local governments and Tribal nations the ability to receive the full value of qualifying clean energy tax credits as a cash payment from the IRS even if they have no federal tax liability.

The elective pay option helped governments, Tribes, and nonprofits (tax-exempt) launch projects that previously lacked financial viability. However, with the passage of the OBBA on July 4, 2025, new restrictions are coming into play. Understanding these changes is essential if you want to stay on track — and fully capture the credits you're eligible for.

What's Changing — and What It Means for Your Government or Tribal Nation

Several key clean energy tax credits have been modified under the OBBBA. Here's what's changing and how it could affect your clean energy initiatives:

Commercial Clean Vehicle Credit (§45W)

If your government or Tribal nation is planning to transition to electric buses, trucks, or light-duty fleet vehicles, this credit likely plays a critical role in your funding model.

Previous Rule:

Credit available through December 31, 2032

OBBA Update:

Accelerated expiration — vehicles must be placed in service by September 30, 2025

Credit Value:

- Up to $7,500 per vehicle under 14,000 pounds

- Up to $40,000 per vehicle over 14,000 pounds

What This Means for You:

Fleet upgrades must be finalized soon. Procurement and delivery timelines are critical — if vehicles aren't placed in service by the deadline, you may miss out entirely.

Alternative Fuel Infrastructure Credit (§30C)

If you're installing EV charging stations or alternative fuel infrastructure (like hydrogen), this credit directly offsets installation costs.

Previous Rule:

Available through December 31, 2032

OBBA Update:

Accelerated expiration — equipment must be placed in service by June 30, 2026

Credit Value:

- 6% base credit, up to $100,000 per unit/port

- 30% credit when prevailing wage and apprenticeship requirements are met

What This Means for You:

If you have eligible projects in the pipeline, now is the time to accelerate timelines — ideally placing ports in service by the end of the current calendar year. This strategy could help you preserve credit eligibility.

Clean Electricity Investment and Production Credits (§48 and §48E)

These credits apply to large-scale clean energy generation projects — including solar, wind, and other qualifying technologies.

OBBA Update:

- Construction on wind and solar projects that begins by June 2026 (12 months from the passage of the OBBBA) is not subject to the accelerated placed-in-service date. These projects can be placed in service within four calendar years after the year construction begins.

- Accelerated timeline applies to wind and solar projects starting construction after June 2026. These projects must be placed in service by December 31, 2027.

- Prohibited foreign entity restrictions and material assistance applies for projects starting construction in 2026 or later, disqualifying projects with certain supply chain components.

Credit Value:

- 6% to 70% for investment credit

- Production credit varies depending on source and place-in-service date. Credit is between 0.3 cents to 2.8 cents/kWh.

What This Means for You:

Project lead times are long, especially for solar and wind. Now is the time to meet with relevant departments to identify project timelines and prioritize needs to begin construction by mid-2026. You should also assess any foreign involvement in current or planned energy projects as materials or partnerships linked to prohibited foreign entities could affect eligibility starting in 2026, and why starting construction by December 31, 2025, may be necessary for eligibility.

What You Should Do Now

These accelerated timelines mean waiting is no longer an option. To protect your ability to access elective pay and federal clean energy credits, you should:

- Engage tax and legal advisors immediately to review your current project portfolio and identify which initiatives can realistically meet the new requirements. Consider safe harbor strategies that might preserve current credit rates for projects already in development.

- Accelerate project timelines for any clean energy projects in your pipeline. Review permitting, financing, and construction schedules to ensure they align with new deadlines.

- Secure allocations and submit documentation now rather than waiting for more convenient timing. The administrative processes for these credits can be complex and time-consuming.

- Coordinate across departments to ensure your legal, tax, engineering, and procurement teams are aligned on the urgency of these changes and new timeline requirements.

- Explore transitional provisions or grandfathering opportunities that might apply to projects already in your planning pipeline.

- Stay agile with your project planning given ongoing legislative uncertainty around continued support for renewables under current terms.

Why These Changes Matter to Your Government or Tribal Nation

These credits represent not just funding — but flexibility. They make it possible to stretch your budget, pursue larger projects, and deliver visible environmental and economic benefits to your community. With federal support shifting, your ability to act decisively today will shape your portfolio for years to come. Delays now could mean leaving millions in funding on the table.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.