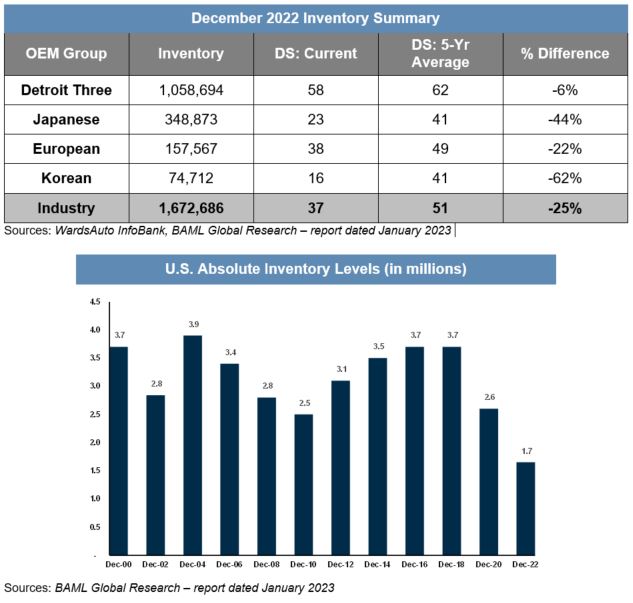

Public policy shifts continue to incentivize electric vehicle (EV) transition as manufacturers continue to commit billions in investment. Analysts issue caution warnings for 2023 volumes, expecting them to remain at recessionary levels. Inventory continues to improve, but sales performance continues to suffer from macroeconomic conditions.

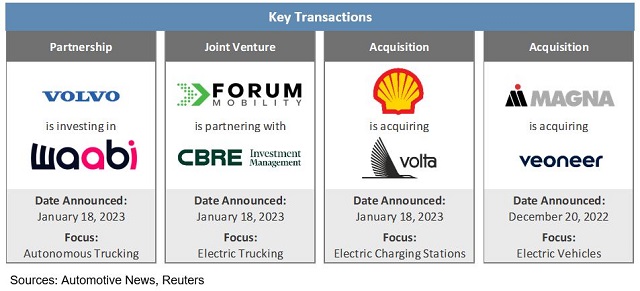

In transaction news, transactions and partnerships continue to have an electric focus. Volvo is acquiring autonomous trucking company Waabi. Forum Mobility is partnering with CBRE Investment Management to create electric trucking hubs in California ports. Shell is acquiring electric charging distributor Volta to expand charging stations to grocery stores, office parks and more. Lastly, Magna is acquiring Veoneer to expand capabilities in autonomous driving and sensor system capabilities.

In regulatory news, the Biden administration has announced its blueprints for decarbonizing the transportation sector in partnership with several government agencies.

Additional January insights are included below.

Financial Performance

Automakers eliminated no additional vehicles from their 2023 worldwide production plans this week because of the ongoing global microchip shortage, according to AutoForecast Solutions (AFS), and the estimate for North America was revised downward slightly. The latest total estimate of losses was 219,100 vehicles, virtually unchanged from a week prior. Automakers are now more concerned with how a downturn in economic conditions will impact their production schedules. Nonetheless, the chip shortage is not over, and AFS still expects that over 2.77 million vehicles will have to be cut from production plans for lack of chips in 2023, down from 4.38 million in 2022 and 10.56 million in 2021. So far this year, plants in Asia outside of China have accounted for about 78 percent of the world's chip-related cuts, eliminating about 170,100 vehicles.

Analysts from Bank of America Global Research anticipate complicated negotiations for Detroit's Big Three with the UAW for a contract set to expire in September 2023. The current expectation would result in increases of average total compensation by 25-30 percent, providing an estimated EBIT impact of 50-150 basis points for GM and Ford. The negotiations come at a time of high inflation (the first time this will happen in decades), low volume with high company-level profits and a once-in-a-100-plus year powertrain transition to electric focus.

Industry Update

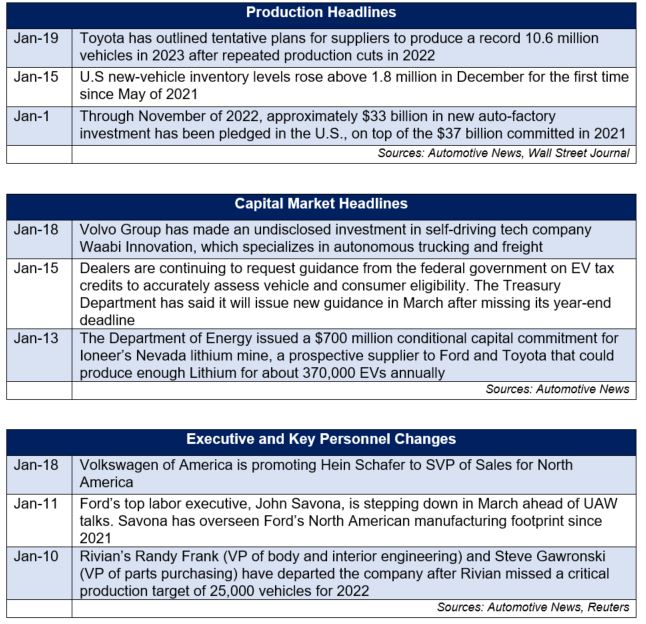

Since September 2021, inventory levels have increased by approximately 700,000 units but remain at lower levels than historical averages. December 2022 month-ending days' supply (DS) closed at 37, approximately 25 percent below the five-year average (consistent with November results.) With the personal savings rate now at record lows and real disposable income dropping below pre-pandemic levels, fundamentals in the consumer economy are on shakier ground than they have been in the recent past. These factors, combined with the Federal Reserve continuing to raise interest rates, suggest there is little room for new vehicle pricing to move higher. For used vehicles, prices have declined since early 2022 by nearly 15 percent, down from record highs in the later part of 2021.

Modest expectations for increased sales volume in 2023 are overshadowed by more hopeful expectations for 2024 and beyond. A variety of difficulties in the macro environment places Bank of America Global Research (BofA Global Research) 2023 U.S. seasonally adjusted annualized rate (SAAR) of sales at 14.3 million units, up from 13.7 million in 2022. However, BofA Global Research projects a steeper increase in 2024 to 16.1 million units, driven by supply chain streamlining, slowdown of interest rate pressures and easing used car prices.

Transaction Activity

In recent transaction news, activity remains focused on re-positioning for an EV-focused future for the automotive industry. Major players continue to purchase capabilities in the face of an evolving regulatory environment: Volvo will be investing in autonomous trucking company Waabi for an undisclosed amount, Shell will acquire Volta for its charging station distribution, and Magna will acquire Veoneer for its capabilities in self-driving spaces. Additionally, real estate group CBRE is partnering with Forum Mobility to deliver electric trucking capabilities in several California ports.

See below for additional detail on recently announced transactions.

- Volvo is investing an undisclosed amount in autonomous trucking technology company Waabi Innovation. The investment represents Volvo's view that commercialization of autonomous technology will come in freight before passenger vehicles. Volvo also said its investment did not represent a material financial event.

- Forum Mobility and CBRE Investment Management have created a $400 million joint venture. The partnership aims to electrify the infrastructure of California's coastal port communities and independent truck operators. The partnership comes amidst news that the California Air Resources Board is considering rules that would require all of California's drayage fleet (approximately 30,000 trucks) to be carbon neutral by 2035.

- Shell will acquire EV charging firm Volta for $169 million in an all-cash deal. Volta, which went public in 2021 through a special purpose acquisition company (SPAC), installs chargers at grocery stores, office buildings and elsewhere. Volta issued a going-concern warning in May of 2022, citing dwindling cash reserves and workforce cuts.

- Canadian supplier Magna is set to acquire Veoneer Active Safety for $1.53 billion from SSW Partners. The deal will bolster Magna's portfolio of self-driving technology and add to their sensor and systems capabilities, including radar and driver monitoring. The deal will also add approximately 2,200 engineers for system, software and sensor development. The deal is expected to close in mid-2023.

Regulatory Landscape

National Blueprint for Transportation Decarbonization: The Biden administration unveiled comprehensive blueprints this week for decarbonizing the transportation sector. The plan was jointly developed by the EPA and Energy, Transportation and Housing and Urban Development departments to eliminate nearly all greenhouse gas emissions from the transportation sector by 2050. A senior administration official said this means continued investment in EV and battery manufacturing for the automotive industry.

Tesla Autopilot: First reported by Bloomberg News, the U.S. Justice Department's investigation into whether Tesla made misleading claims about its vehicles' autonomous capabilities has found that Elon Musk oversaw the creation of a video that exaggerated the abilities of the company's Autopilot system. The company has maintained the video was intended to demonstrate potential future possibilities rather than delivery features.

Mercedes Benz Recall: Mercedes Benz is recalling about 324,000 vehicles in the U.S. for a water intrusion risk that can cause the engine to stall. The company has indicated they are not aware of any crashes, injuries or death related to the issue, and expects to mail affected customers by February 21st.

NHTSA Hertz Investigation: The National Highway Transportation Safety Administration opened an investigation at the end of December into whether Hertz was renting unrepaired recalled vehicles to customers. The issue is primarily focused on Ford Explorer and Nissan Altima vehicles. The investigation comes on the heels of Hertz agreeing to pay $168 million to resolve pending claims from owners who alleged the company filed wrongful theft reports.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.