- within Intellectual Property topic(s)

- with readers working within the Metals & Mining, Pharmaceuticals & BioTech and Law Firm industries

PatentNext Takeaway: WIPO published a Patent Landscape Report on GenAI. The Patent Landscape Report discusses trends in GenAI, including trends in: GenAI scientific publications, GenAI patents, GenAI models, types of data used in GenAI, and GenAI application areas.

****

GenAI Scientific Publications and Patent Families

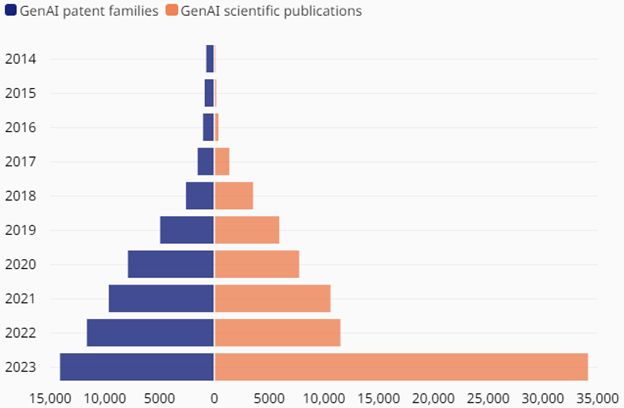

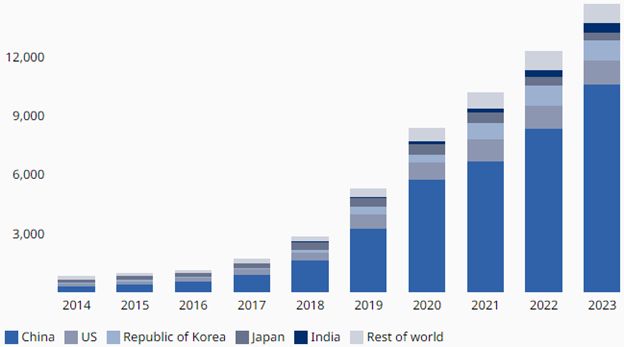

There has been a sharp increase in the number of patent families over the past 10 years. Specifically, GenAI has grown from 733 in 2014 to more than 14,000 in 2023.

This rise of GenAI has been mainly driven by three factors: (i) more powerful computers, (ii) the availability of large datasets as a source of training data, and (iii) improved AI/machine learning algorithms.

Regarding (iii), one major advancement has been the development of the transformer in 2017. The transformer is a type of deep neural network (DNN) architecture devised specifically for natural language processing (NLP) tasks. Transformers allow researchers to train increasingly AI models without having to label all the data beforehand. Transformers are based on the principle of self-attention; that is, transformers may simultaneously focus on different parts of the text. This allows them to capture long-range dependencies in text, thereby improving understanding and phrasing complex language. LLM-based chatbots are consequently able to generate text that is coherent and contextually relevant.

Following the introduction of the transformer in 2017, the number of GenAI patents has increased by over 800%. The number of scientific publications has increased by an even larger margin: from just 116 in 2014 to more than 34,000 in 2023. However, it is expected that there will be a similar acceleration for patent family publications in 2024 and 2025 becuase there is generally an 18-month lag between the filing and publication of new patents.

In addition, popular GenAI models and tools released in 2022, such as ChatGPT, Stable Diffusion, LlaMA, etc., launched a new wave of GenAI research. Much of the most recent research seems to be focused on reducing the size of large generative models, on better controlling the generation process, and on exploring various applications and domains. The trends continued in 2023, and 2023 was itself a record-breaking year, with over 25% of all GenAI patents and over 45% of all GenAI scientific papers published.

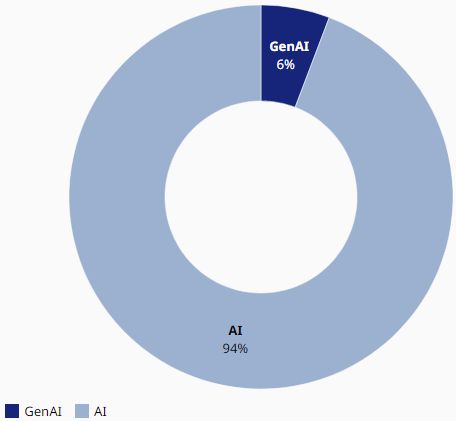

Relative to AI as a whole, GenAI is small but growing. In 2023, overall there were almost 230,000 AI patent family publications, and 14,080 GenAI patent family publications. However, since 2017 the GenAI share of all AI patents has been increasing (from 4.2% in 2017 to 6.1% in 2023, as shown in the Figure below).

Share of GenAI of total AI patent family publications, 2014–2023

Top GenAI Patent Owners

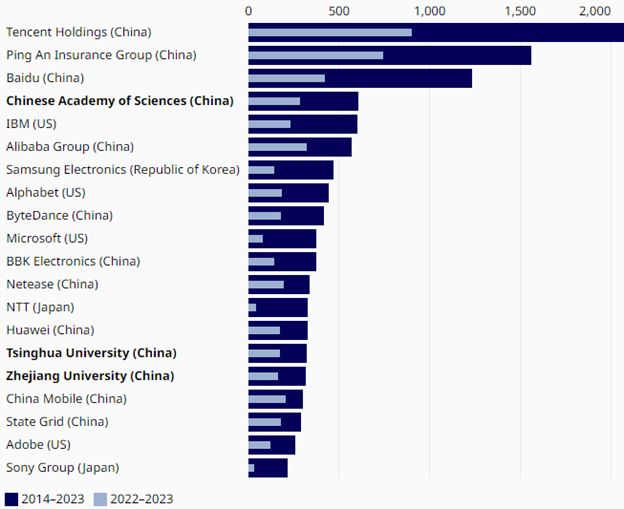

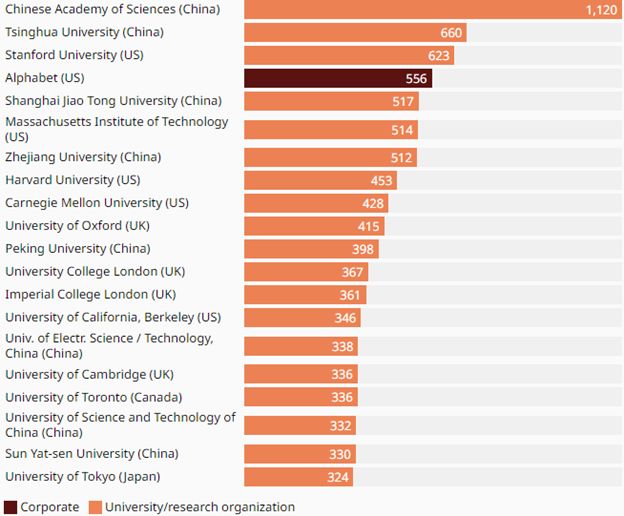

Corporations are the largest GenAI patent owners, but some research organizations still make the top 12.

Top patent owners (all entities, including both companies and research organizations) in GenAI, 2014–2023, with research organizations shown in bold

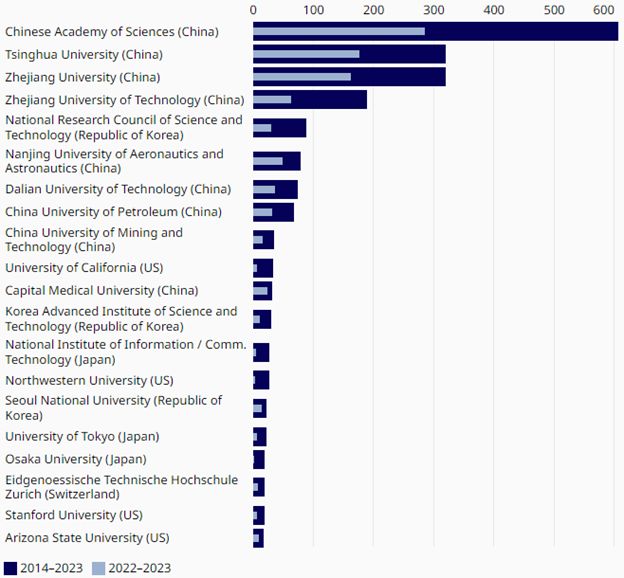

Top patenting research organizations in GenAI, 2014–2023

Top GenAI Scientific Publication Producers

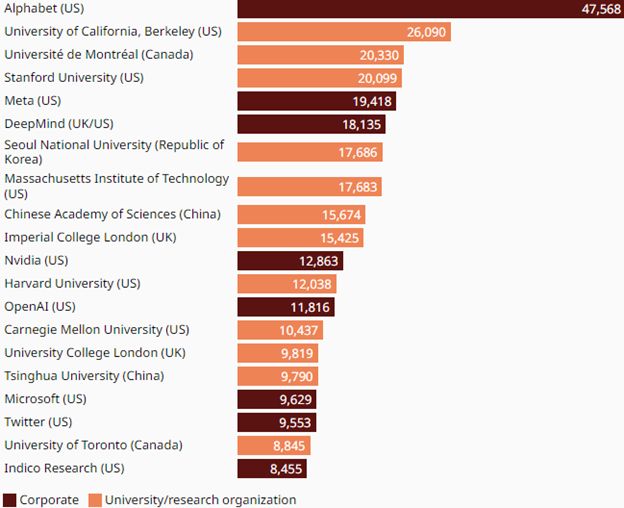

Regarding scientific publications, the Figure below shows the number of GenAI scientific publications for the top 20 institutions for 2010–2023. The only company making the list is Alphabet/Google.

Yet, the number of publications as a performance indicator has limitations because it does not reflect the impact of the publications. The number of citations a publication receives is therefore often considered a more reliable indicator. The citation numbers by institution show higher positions for companies (see Figure below). By this metric, Alphabet/Google becomes the leading institution by a large margin, and seven other companies are present in the top 20. OpenAI is also noteworthy. OpenAI has published only 48 articles according to the GenAI corpus (325th institution in term of document count), but these publications received a total of 11,816 citations from other publications of the corpus (position 13 in total). This is even further noteworthy because many of OpenAI's publications are pre-prints and not published in major conferences and journals.

Number of citations to GenAI scientific publications for the top 20 institutions, 2010–2023

OpenAI, which—because of the success of ChatGPT, has become a synonym for GenAI in the public eye—is interesting for other reasons as well. OpenAI does not appear to have filed any patents for its research activities until the beginning of 2023. One reason might be the non-profit origin of OpenAI. Originally, OpenAI was founded as a non-profit organization that encouraged its researchers to publish and share their work to "digital intelligence in the way that is most likely to benefit humanity as a whole" (Brockmann, G. and I. Sutskever (2015). Introducing OpenAI. Available at: https://openai.com/blog/introducing-openai (accessed May 18, 2024).). OpenAI initially made open-source significant parts of its technology. The company later transitioned from non-profit to a "capped" for-profit model (with a split of OpenAI into the non-profit OpenAI, Inc and the for-profit subsidiary OpenAI Global, LLC with Microsoft as one of the key investors). An alternative explanation might be that OpenAI is opting to retain its IP in the form of trade secrets.

OpenAI seemed first to protect parts of its technology with trade secrets (Keseris, D. and R. Kovarik (2023). ChatGPT: IP strategy in the AI space. Lexology data hub. Available at: https://www.lexology.com/library/detail.aspx?g=bed7b5f6-5e7a-49c5-a8fc-accb59f95819 (accessed May 18, 2024).). However, six U.S. patents from OpenAI were published in the first quarter of 2024 (three granted and three pending), filed in early 2023, indicating a change of IP strategy and the creation of a patent portfolio.

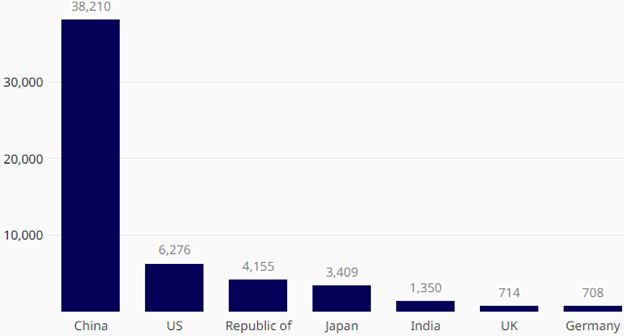

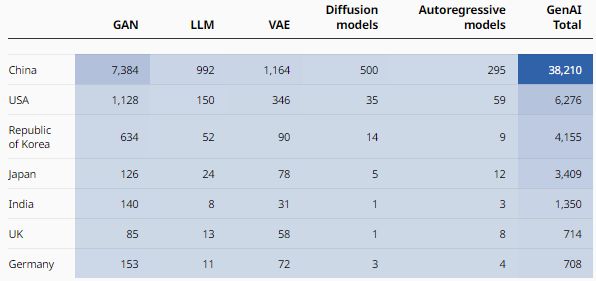

On a Country Level

From a country perspective, since 2017, China, with more than 38,000 patent families published, has published more patent families in the GenAI field every year than all other countries combined (based on the inventor addresses from published patents). The U.S. is in second, with a total of around 6,300 patent families between 2014 and 2023.

Development of GenAI patent families in key inventor locations, 2014–2023

Country comparison of the number of GenAI-related patent families, 2014–2023

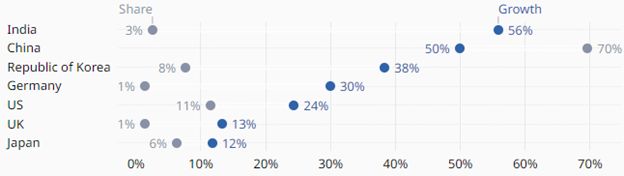

Country comparison of the share and growth rate of GenAI-related patent families, 2014–2023

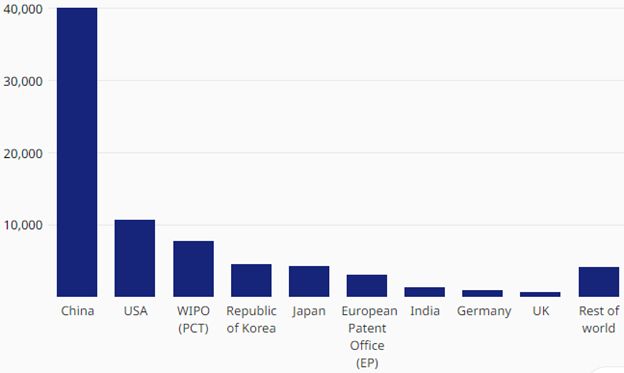

Regarding jurisdictions that GenAI patents are filed in, China is not only the leading inventor location, but also the top country for patent filings. Between 2014 and 2023, more than 40,000 GenAI patent application families were filed in China. In the U.S., the number of patent families filed climbed to more than 10,700 over the last decade. Also noteworthy are the Patent Cooperation Treaty (PCT) and the European Patent Convention (EP) are routes. Over the last decade, there have been more than 7,700 PCT filings, and more than 3,100 EP filings.

Key patent filing jurisdictions in GenAI, 2014–2023

GenAI Models

The three most popular GenAI models are:

- generative adversarial networks (GANs)

- variational autoencoders (VAEs)

- decoder-based large language models (LLMs)

This is based on patent abstracts, claims, and titles. However, not all GenAI patents can be assigned to these three models based on this information. More specifically, many GenAI patents do not include keywords about the specific model used in the patent abstract, claims or title, and rather focus on describing the use case for the subject matter. This makes it difficult to find and map the patents to the five core GenAI models studied. In addition, some of the GenAI models studied have some content overlap. As a result, only about 25% of all GenAI patent family publications since 2014 can be mapped to one of the five models.

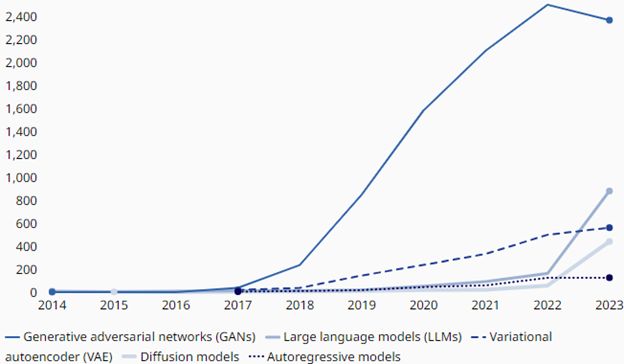

Among the top three GenAI models, most patents are associated with GANs. Between 2014 and 2023, there were 9,700 patent families of the GAN model type, with 2,400 patent families published in 2023 alone. VAEs come in second with around 1,800 patent families between 2014 and 2023. And LLMs come in third with around 1,300 new patent families between 2014 and 2023.

In terms of growth, GAN patents have the largest increase over the past decade, but this has slowed down. In contrast, diffusion models and LLMs have much higher growth rates over the last three years, with the number of patent families for diffusion models increasing from 18 in 2020 to 441 in 2023 and for LLMs increasing from 53 in 2020 to 881 in 2023. The GenAI boom caused by modern chatbots, such as ChatGPT, has clearly increased research interest in LLMs.

Development of global patent families in five GenAI core models, 2014–2023

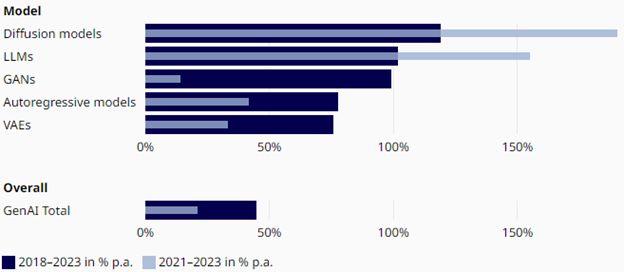

Average annual growth of patent families in the different GenAI models

Most companies focus on patenting one dominant GenAI model; however, there are some exceptions, such as Tencent and Alphabet/Google, that have filed patents in several model types. The table below shows published GenAI patent families between 2014 and 2023. A large proportion of GenAI patents do not fit into any of the specific models because those patents do not contain keywords relating to the specific model used in the patent abstract, claims or title. Accordingly, the total number of GenAI patent families is larger than the sum of the five models in the Figure below.

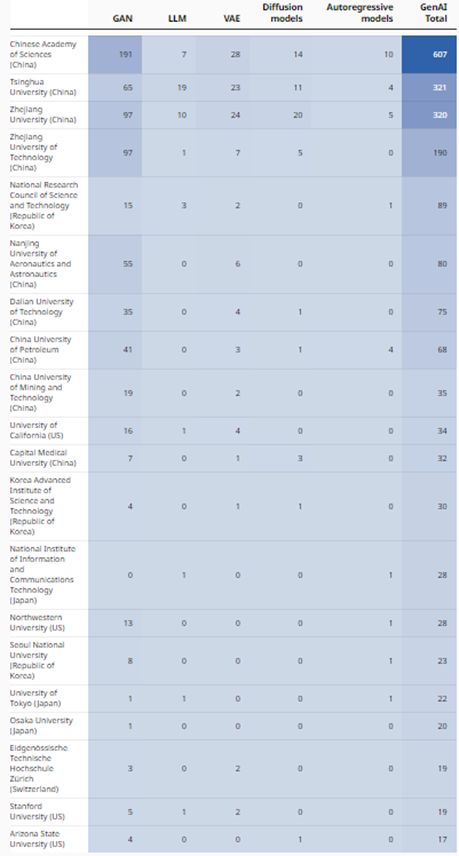

Similarly, research organizations file patents in predominantly one type of model, with GAN being the most preferred type. The table below shows published GenAI patent families between 2014 and 2023. A large proportion of GenAI patents do not fit into any of the specific models, because those patents do not contain keywords relating to the specific model used in the patent abstract, claims or title. Accordingly, the total number of GenAI patent families is larger than the sum of the five models in the Figure below.

On a country level, China has filed the most for all five GenAI models. This is particularly true with respect to diffusion models, where China has published more than 14 times as many patent families since 2014 as the second largest inventor location, the US—500 patent families vs.35 patent families.

GenAI Data Types

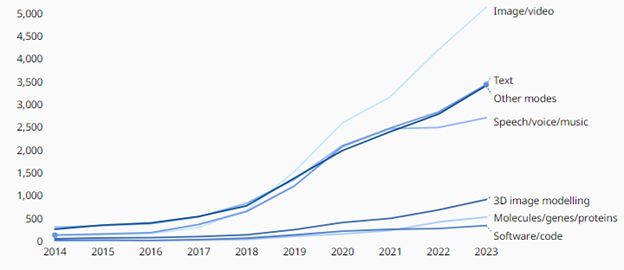

The main data types (e.g., modes, inputs/outputs, etc.) used by GenAI include:

- Image

- Video

- Speech

- Sound

- Music

Most patents belong to the image/video category. Image/video data is particularly important for GANs. For LLMs, patents involving the processing of text and speech/sound/music are more common. There are other modes available as well, such as 3D image models, chemical molecules/genes/proteins and code/software, but they have far fewer patents so far. As with patents related to GenAI core models, some patents cannot be clearly assigned to a specific data type. In addition, some patents are assigned to more than one mode because certain GenAI models, such as multimodal large language models (MLLMs), overcome the limitation of using only one type of data input or output.

GenAI Application Areas

Top application areas for GenAI patents include:

- Software

- Life sciences

- Document management and publishing

- Business solutions

- Industry and manufacturing

- Transportation

- Security

- Telecommunications

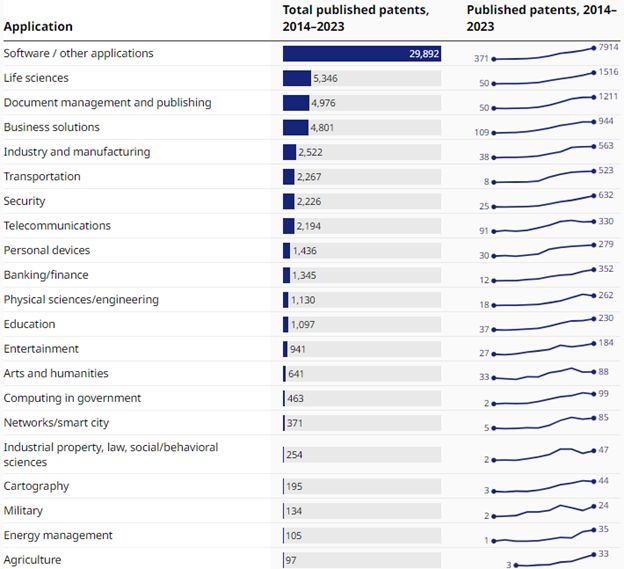

GenAI is predicted to have a significant impact on many industries as it finds its way into products, services and processes. It will likely become a technological enabler for content creation and productivity improvement. Examples include GenAI patents in: life sciences (5,346 patent families between 2014 and 2023), and document management and publishing (4,976). Other notable applications with GenAI patents ranging from around 2,000 to around 5,000 over the same period are business solutions, industry and manufacturing, transportation, security and telecommunications.

Regarding life sciences, GenAI can expedite drug development by screening and designing molecules for new drug formulations and personalized medicine. In document management and publishing, GenAI can automate tasks, save time and money, and create tailored marketing materials. In business solutions, GenAI can be used for customer service chatbots, retail assistance systems, and employee knowledge retrieval. In industry and manufacturing, GenAI enables new features, such as product design optimization and digital twin programming. In transportation, GenAI plays a crucial role in autonomous driving and public transportation optimization.

The Figure below shows development of global patent families in GenAI applications 2014–2023. However, many patent families (around 29,900 patent families between 2014 and 2023) cannot be assigned to a specific application based on the patent abstract, claims or title. These patents are instead included in the category software/other applications.

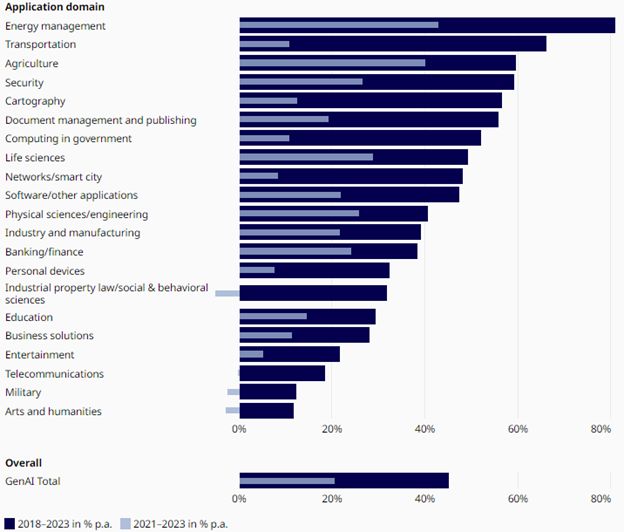

In terms of growth, energy management GenAI patents have seen the largest increase, both since 2018 and also in the last three years, with applications in agriculture also growing more in the last three years.

Average annual growth of patent families in GenAI applications

Acknowledgement: WIPO is the source of the content, including images and text, of this article although much of the content has been changed from its original form.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.