- within Technology topic(s)

- with readers working within the Retail & Leisure industries

- within Antitrust/Competition Law topic(s)

The video gaming industry has grown into a $273 billion global market in 2024 and is projected to reach $656 billion by 2033. Yet valuing studios remains unusually difficult. While a single successful title can return 1,000%+ on investment, most games fail to break even—creating asymmetric risk-reward profiles that defy conventional valuation frameworks.

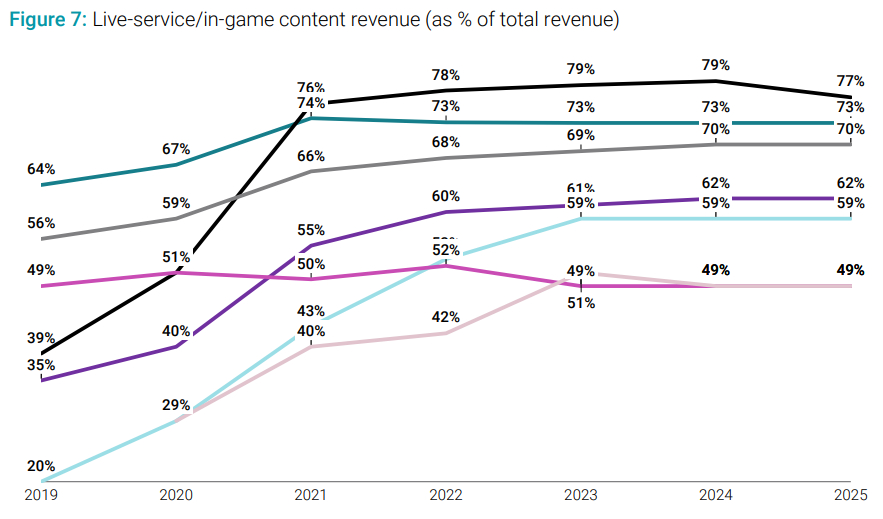

AI is now reshaping these valuation dynamics, transforming player engagement, content generation, and monetization. Leading studios are deploying AI not only as a cost-saving tool, but as a revenue engine that personalizes experiences, extends player life cycles, and unlocks new commercial opportunities within live-service environments. AI-driven player engagement measures are already producing ARPU lifts (180%+ in early implementations like OfferFit) and meaningful revenue growth (Tencent attributed 15% YoY gains partly to sustained investments and focus in AI). As investor focus shifts from traditional IP strength alone to IP amplified by AI-driven revenue capabilities, the gap between leaders and laggards is widening and will soon become insurmountable.

By the end of 2026, gaming companies that successfully integrate AI into strong IP will command valuation multiples 2-3x higher than AI-laggard peers—a bifurcation driven by deeper engagement and higher average revenue per user.

Established studio valuations and AI adoption

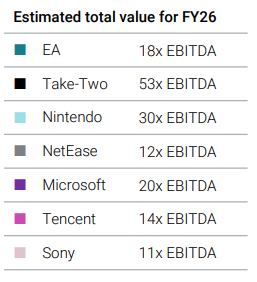

Major publishers are already valued on their ability to monetize IP through AI-enhanced engagement rather than relying solely on franchise strength. For example, Take-Two's premium valuation ahead of its Grand Theft Auto (GTA) VI release prices in AI as a multiplier on the franchise; investors are betting that AI-driven engagement systems will generate billions in incremental lifetime value that a static GTA VI could not deliver alone. This is supported by the fact that GTA Online, which is the primary use case for AI-based gameplay, has generated $3 billion in microtransactions (estimated by Gabelli's The Video Game Industry 2025 Preview), and gaming communities online expect AI to be most visible in enhanced non-playable character (NPC) behavior, procedural generation, and replayability. Take-Two's industry-leading total enterprise value (based on EBITDA; see figure below) underscores a market belief that AI will redefine franchise value creation—shifting gaming from hit-driven cycles to sustained engagement platforms.

Market data shows a clear valuation premium for diversified publishers with live-service and AI capabilities. According to Equidam's 2025 Gaming Studio Valuation Guide, these companies trade around 13-15x forward EBITDA, compared with 8-10x for traditional content-only studios and roughly 5x for mobile developers with more limited AI use. More investors are rewarding studios that use AI to drive measurable revenue growth, through higher ARPU, longer player retention, or recurring monetization, rather than those focused solely on reducing costs.

These valuation premiums align with selective capital flows rather than speculative momentum. Norton Rose Fulbright's 2024 M&A data shows aggregate deal value rose to $10.5 billion despite a small decrease in deal count, indicating that acquirers were concentrating capital in highperforming assets. Deals such as Tencent-owned Miniclip's $1.2 billion acquisition of Easybrain and EQT's £1.2 billion take-private of Keywords Studios exemplify this pattern: Both targets had durable user monetization and operating scale that benefited from automation and engagement technologies, making them credible beneficiaries of AI-enhanced efficiency rather than AI "story stocks."

The formula moving forward for gaming companies will be the following: Strong IP attracts large audiences, AI deepens engagement and spending, and those results support higher valuation multiples. As AI's contribution to top-line growth becomes more visible, the gap between IP-rich, AI-enabled publishers and legacy content houses will widen further, redefining what "premium" means in gaming in 2026.

Startups and the AI advantage

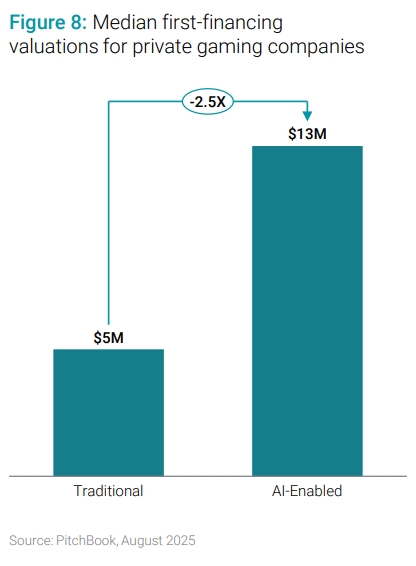

Among private gaming companies that raised capital between 2023 and 2025 with disclosed valuations, AIenabled gaming and adjacent companies command a significant premium. Analysis of 130 venture-backed companies reveals that the 21 startups explicitly incorporating AI into their products or platforms secured median first-financing valuations ~2.5x higher than those of 109 non-AI startups. AI-focused gaming startups such as Backflip AI, Cartwheel, and Encultured AI that center their products on content generation, AI-driven characters, and creator platforms to boost player engagement are leading this trend.

The valuation premium suggests early-stage investors are differentiating AI-native gaming models, particularly those targeting revenue-driving applications over pure efficiency gains. However, AI-focused startups still represent only 16% of companies with disclosed valuations, indicating the market remains in early formation. We predict a far greater percentage of companies with disclosed valuations will be AI-focused as of this time next year.

The new "battle royale" in video games

By 2026, studios that fuse advanced AI with durable IP will earn a clear 2–3x valuation premium, driven chiefly by revenue outcomes—deeper engagement, higher ARPU, and faster monetization—while cost efficiencies play a supporting role.

For executives, the path is pragmatic: Tilt AI toward playerfelt depth (adaptive challenges, richer systems, and credible NPCs) within franchises that can compound those gains, and let quiet AI use cases—procedural levels, localization, and dialog scaffolds—improve gameplay quality without fanfare. Companies that keep a light but continuous read on sentiment and in-game KPIs to reinforce what delights and retire what doesn't will, over time, find their business on the right side of the AI valuation bifurcation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.