- within Technology topic(s)

- in United States

- within Insurance, Wealth Management and Tax topic(s)

Chief financial officers (CFOs) focused on building tomorrow's finance function today will need to incorporate artificial intelligence (AI) into their organization in the near future, and they will need the right talent and processes to do so. By considering some crucial elements ahead of time, the AI journey can be a highly successful and effective transformation of the organization, and it can start today.

Where Are We Today?

Starting the AI journey requires more than technology — it requires skilled teams and targeted process improvements. Before diving into an AI solution, re-examine existing talent, processes, and data gaps.

Do You Have the Right Team?

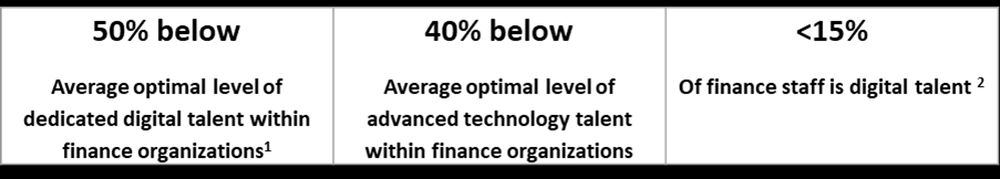

Many finance organizations today are operating with digital talent gaps that would make the addition of an AI solution challenging:

Consider if changes to the organization are needed to enable AI:

- Identify existing talent that can be utilized

- Create a cross-functional task force to identify areas AI has been implemented in and further opportunities to implement

- Hire external AI talent

- Upskill existing team members with training

Watchout! Bad Data Leads to Bad Results

While AI solutions can improve specific pain points, they cannot improve end-to-end processes or data quality issues in isolation. Finance leaders should collaborate with their teams to understand where gaps exist across specific process steps and data sets to determine the solutions that are most appropriate:

- Existing finance processes, cycle time to complete processes, manual interventions, and other inefficiencies

- Data quality, integrity, and accuracy, data cleansing efforts, and data consolidation efforts

- AI initiatives underway that may impact current state processes or data

CFOs may find that AI tools can only improve one piece of a much larger process flow or one discrete data set, or that other process and data improvements should take priority over an AI implementation.

What Is Your Use Case, and Can It Work Effectively?

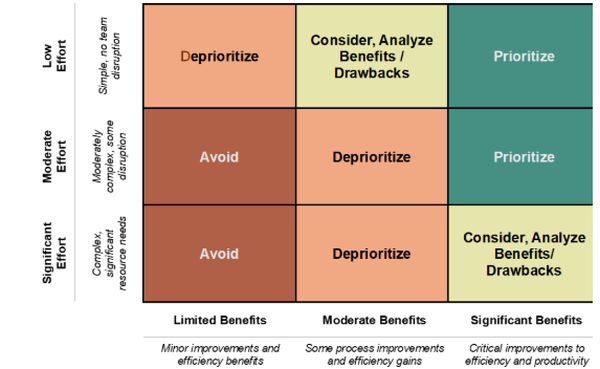

Once talent and process gaps are addressed, evaluate the pain points and associated initiatives, consider the level of effort it would take to incorporate an AI solution into activities, and analyze the potential benefit. Prioritize AI solutions that can have a positive impact on their organizations without disrupting their teams.

- Get excited! This is not a master boot record (MBR) prep session. Bring the energy and soak in the science.

- Hold a workshop with the team to detail all finance initiatives underway or planned.

- Tie initiatives to potential AI applications and assign teams to research AI opportunities.

- Prioritize all finance initiatives into primary, secondary, and tertiary categories, incorporating AI research conducted.

- Evaluate level of effort to incorporate vs. benefits to the team.

- Include ideas at the individual level as well as those at the enterprise level. Daily work improvement tricks help all of us.

- Select priority initiatives.

- Have an AI community council to funnel new ideas to and foster learning.

- Push, push, push and do not give up. AI is moving faster than the U.S. National Debt Clock.

- Get started! Your competitors are moving fast too!

How Can We Be Successful?

To maximize success, finance leaders should drive their organizational, data, and process initiatives to set a foundation for finance. AI solutions can start small as additive tools in parallel to implementing longer-term transformational changes. Enable success with some key steps:

- Set Expectations:AI solutions will not fix all finance functional challenges. AI tools can dramatically increase efficiency and effectiveness, and become force multipliers for the organization, but are not a substitute for process, data, and other team initiatives. As with any project, setting clear goals and timelines is also essential for success.

- Invest in Talent Development: Training and team development are essential. Resources should be allocated to training team members, who should not only become adept at using AI tools, but be adaptable to new tools and have an eye to identifying additional implementation opportunities.

- Tackle Data Challenges First:AI itself cannot change underlying data quality and integrity issues. It is essential that the data source AI draws on is clean and reliable so that the results can likewise be trusted.

- Stabilize and Rebuild Poorly Performing Processes: Address pain points in the process before implementing AI. As with data, an ineffective, cumbersome process will not yield valuable results.

What Are Some Examples of Starting Small?

While there are many ways to leverage AI across the finance function, there are a handful of ways our clients have begun to utilize AI. These AI solutions can offer significant benefits and tend to require low or moderate effort to implement.

- Automated Expense Management: The AI ecosystem can be leveraged to create efficiencies across the expense management process — processing receipts, validating expenses against policy, and flagging anomalies with accuracy. There has been rapid maturity in this area within the last 12 to 18 months as numerous providers have offered solutions to improve and accelerate the expense management process.

- Predictive Cash Flow Optimization: By analyzing payment patterns, seasonal variations, customer behavior, and economic indicators, an AI model can assist with improving the accuracy of a company's existing cash flow model.

- Dynamic Resource Reallocation:AI can be leveraged to transform static annual budgeting into dynamic resource optimization by identifying spend patterns and recommending reallocations. Such a tool can improve capital allocation and enable more efficient deployment of capital for growth investments.

- Scenario Planning: AI can provide sophisticated scenario analyses — whether for strategic planning or evaluating transactions. Scenario analyses can support robust due diligence and enhance decision-making.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.