A little over two months ago, the federal banking authorities (Feds) issued a new Policy Statement, a re-vamp and expansion of the 2008 "extend and hold" or "pretend and extend" policy that emerged from the 2008 Bank Liquidity Crisis.

Like 2008, the Feds recognize four huge factors:

- A real estate financing crisis is beginning, and will

significantly worsen in 2024 and 2025 when $4-5 Trillion in office

loans will mature and need to be refinanced. This is due to Post

Pandemic economic conditions in the real estate industry,

especially office properties, where the national average vacancy

rate is 18.2% and fair market values nationwide are down

approximately 30%.

- The above crisis in the office market will affect other real

estate sectors, such as retail, hotels, multi-family properties,

etc., as the effects of an office market collapse and a banking

collapse will spread throughout the real estate and banking

industries.

- This problem is NOT the fault of over-development by property

owners or lax lending oversight (like the 1980s S&L Crisis);

instead, good, hard-working middle American and foreign companies

were and are still caught in the effects of an unexpected, once in

a century, pandemic. Literal enforcement of banking regulations

would wipe out an incalculable number of large, middle, and small

American and foreign companies, resulting in an industry

collapse.

- Even if the Feds were to disregard innocent property owners, they do not want to crash the banks, as happened in the 1980s S&L Crisis, when banks and savings and loans foreclosed on and ate the losses of the entire property market collapse. Therefore, if nothing else, to save the banks, the Feds have to relax literal compliance with current banking regulations.

The Policy Statement discusses how the Feds will view upcoming workouts and restructurings used to avert the aforementioned crises, including, various elements of a lender's review and analysis such as the future likelihood of debt service payments, the ability of guarantors and sponsors to assist in supporting repayment of the debt, assessment of collateral values, how certain workout arrangements would be classified by the bank's auditors, and whether such arrangements would be classified by the auditors as accrual or non-accrual. The Policy Statement also provides specific examples of different loan extension scenarios for office, retail, hotel, residential, construction of single family residences and commercial properties, owner occupied properties, land loans and multi-family, and how each scenario would be classified for loan grading and accrual or non-accrual purposes.

In the Policy Statement, the Feds explain that, even in cases where the fair market value of a property has actually fallen below the outstanding principal balance of the loan, i.e., the property is worth less than the debt, banks can still extend the term of the loan if the extension is made in circumstances where the borrower can show it can continue to pay debt service (preferably at current market interest rates) and prospects for repayment of the loan, "on reasonable terms," can be seen due to positive actions by the borrower, guarantor and/or sponsor to support the property.

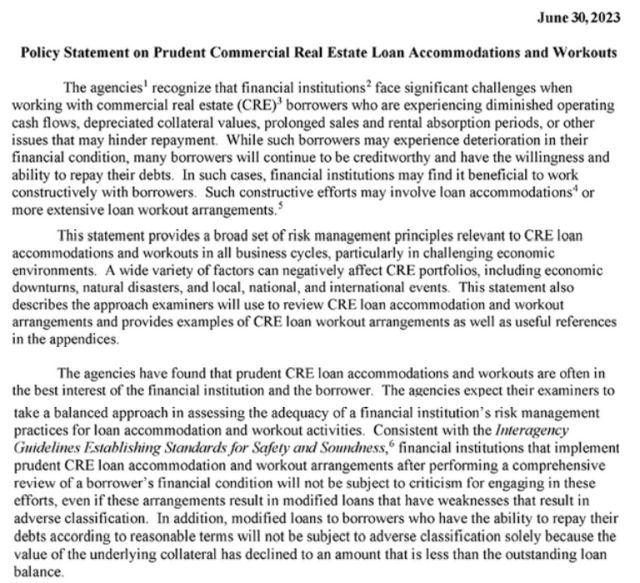

The Policy Statement's overall first page introductory explanation is set forth below:

Examples of CRE Loan RETAIL Workout Arrangements

In addition to laying out the rationale and methodologies that banks and examiners should follow, the Policy Statement also provides examples of extended office property loans and how banks and examiners should classify each type of scenario. These examples are helpful when examining the pros and cons of your property and evaluating and planning your options and approach when you meet with your lender.

For examples of loan extension scenarios for multiple types of different properties, click here to read examples in their entirety with footnotes. As this piece focuses on retail properties, below are scenario examples provided in the Policy Statement covering retail properties.

Income Producing Property – Retail Properties

Base Case

A lender originated a 36-month, $10 million loan for the construction of a shopping mall. The construction period was 24 months with a 12-month lease-up period to allow the borrower time to achieve stabilized occupancy before obtaining permanent financing. The loan had an interest reserve to cover interest payments over the three-year term. At the end of the third year, there is $10 million outstanding on the loan, as the shopping mall has been built and the interest reserve, which has been covering interest payments, has been fully drawn.

At the time of origination, the appraisal reported an "as stabilized" market value of $13.5 million for the property. In addition, the borrower had a take-out commitment that would provide permanent financing at maturity. A condition of the take-out lender was that the shopping mall had to achieve a 75 percent occupancy level.

Due to weak economic conditions and a shift in consumer behavior to a greater reliance on e-commerce, the property only reached a 55 percent occupancy level at the end of the 12-month lease up period. As a result, the original takeout commitment became void. In addition, there has been a considerable tightening of credit for these types of loans, and the borrower has been unable to obtain permanent financing elsewhere since the loan matured. To date, the few interested lenders are demanding significant equity contributions and much higher pricing.

Scenario 1:

The lender renewed the loan for an additional 12 months to provide the borrower time for higher lease-up and to obtain permanent financing. The extension was made at a market interest rate that provides for the incremental risk and is on an interest-only basis. While the property's historical cash flow was insufficient at a 0.92x debt service ratio, recent improvements in the occupancy level now provide adequate coverage based on the interest-only payments. Recent events include the signing of several new leases with additional leases under negotiation; however, takeout financing continues to be tight in the market.

In addition, current financial statements reflect that the builder, who personally guarantees the debt, has cash on deposit at the lender plus other unencumbered liquid assets. These assets provide sufficient cash flow to service the borrower's global debt service requirements on a principal and interest basis, if necessary, for the next 12 months. The guarantor covered the initial cash flow shortfalls from the project and provided a good faith principal curtailment of $200,000 at renewal, reducing the loan balance to $9.8 million. A recent appraisal on the shopping mall reports an "as is" market value of $10 million and an "as stabilized" market value of $11 million, resulting in LTVs of 98 percent and 89 percent, respectively.

Classification:

The lender internally graded the loan as a pass and is monitoring

the credit. The examiner disagreed with the lender's internal

loan grade and listed it as special mention. While the project

continues to lease up, cash flows cover only the interest payments.

The guarantor has the ability, and has demonstrated the

willingness, to cover cash flow shortfalls; however, there remains

considerable uncertainty surrounding the takeout financing for this

loan.

Nonaccrual Treatment:

The lender maintained the loan in accrual status as the guarantor

has sufficient funds to cover the borrower's global debt

service requirements over the one-year period of the renewed loan.

Full repayment of principal and interest is reasonably assured from

the project's and guarantor's cash resources, despite a

decline in the collateral margin. The examiner concurred with the

lender's accrual treatment.

Scenario 2:

The lender restructured the loan on an interest-only basis at a below market interest rate for one year to provide additional time to increase the occupancy level and, thereby, enable the borrower to arrange permanent financing. The level of lease-up remains relatively unchanged at 55 percent, and the shopping mall projects a DSC ratio of 1.02x based on the preferential loan terms. At the time of the restructuring, the lender used outdated financial information, which resulted in a positive cash flow projection. However, other file documentation available at the time of the restructuring reflected that the borrower anticipates the shopping mall's revenue stream will further decline due to rent concessions, the loss of a tenant, and limited prospects for finding new tenants. Current financial statements indicate the builder, who personally guarantees the debt, cannot cover any cash flow shortfall. The builder is highly leveraged, has limited cash or unencumbered liquid assets, and has other projects with delinquent payments. A recent appraisal on the shopping mall reports an "as is" market value of $9 million, which results in an LTV ratio of 111 percent.

Classification:

The lender internally classified the loan as substandard. The

examiner disagreed with the internal grade and classified the

amount not protected by the collateral value, $1 million, as loss

and required the lender to charge-off this amount. The examiner did

not factor costs to sell into the loss classification analysis, as

the current source of repayment is not reliant on the sale of the

collateral. The examiner classified the remaining loan balance,

based on the property's "as is" market value of $9

million, as substandard given the borrower's uncertain

repayment ability and weak financial support.

Nonaccrual Treatment:

The lender determined the loan did not warrant being placed in

nonaccrual status. The examiner did not concur with this treatment

because the partial charge-off is indicative that full collection

of principal is not anticipated, and the lender has continued

exposure to additional loss due to the project's insufficient

cash flow and reduced collateral margin and the guarantor's

inability to provide further support. After a discussion with the

examiner on regulatory reporting requirements, the lender placed

the loan on nonaccrual.

Scenario 3:

The loan has become delinquent. Recent financial statements indicate the borrower and the guarantor have minimal other resources available to support this loan. The lender chose not to restructure the $10 million loan into a new single amortizing note of $10 million at a market interest rate because the project's projected cash flow would only provide a 0.88x DSC ratio as the borrower has been unable to lease space. A recent appraisal which reasonably estimates the fair value on the shopping mall reported an "as is" market value of $7 million, resulting in an LTV of 143 percent. At the original loan's maturity, the lender restructured the $10 million debt, which is a collateral-dependent loan, into two notes. The lender placed the first note of $7 million (Note A) on monthly payments that amortize the debt over 20 years at a market interest rate that provides for the incremental risk. The project's DSC ratio equals 1.20x for the $7 million loan based on the shopping mall's projected net operating income. For the second note (Note B), the lender placed the remaining $3 million, which represents the excess of the $10 million debt over the $7 million market value of the shopping mall, into a 2 percent interest-only loan that resets in five years into an amortizing payment. The lender then charged-off the $3 million note due to the project's lack of repayment ability and to provide reasonable collateral protection for the remaining on-book loan of $7 million. The lender also reversed accrued but unpaid interest. Since the restructuring, the borrower has made payments on both loans for more than six consecutive months and an updated financial analysis shows continued ability to repay under the new terms.

Classification:

The lender internally graded the on-book loan of $7 million as a

pass loan due to the borrower's demonstrated ability to perform

under the modified terms. The examiner agreed with the lender's

grade as the lender restructured the original obligation into Notes

A and B, the lender charged off Note B, and the borrower has

demonstrated the ability to repay Note A. Using this multiple note

structure with charge-off of the Note B enables the lender to

recognize interest income.

Nonaccrual Treatment:

The lender placed the on-book loan (Note A) of $7 million loan in

nonaccrual status at the time of the restructure. The lender later

restored the $7 million to accrual status as the borrower has the

ability to repay the loan, has a record of performing at the

revised terms for more than six months, and full repayment of

principal and interest is expected. The examiner concurred with the

lender's accrual treatment. Interest payments received on the

off-book loan have been recorded as recoveries because full

recovery of principal and interest on this loan (Note B) was not

reasonably assured.

Scenario 4:

Current financial statements indicate the borrower and the guarantor have minimal other resources available to support this loan. The lender restructured the $10 million loan into a new single note of $10 million at a market interest rate that provides for the incremental risk and is on an amortizing basis. The project's projected cash flow reflects a 0.88x DSC ratio as the borrower has been unable to lease space. A recent appraisal on the shopping mall reports an "as is" market value of $9 million, which results in an LTV of 111 percent. Based on the property's current market value of $9 million, the lender charged-off $1 million immediately after the renewal.

Classification:

The lender internally graded the remaining $9 million on-book

portion of the loan as a pass loan because the lender's

analysis of the project's cash flow indicated a 1.05x DSC ratio

when just considering the on-book balance. The examiner disagreed

with the internal grade and classified the $9 million on-book

balance as substandard due to the borrower's marginal financial

condition, lack of guarantor support, and uncertainty over the

source of repayment. The DSC ratio remains at 0.88x due to the

single note restructure, and other resources are scant.

Nonaccrual Treatment:

The lender maintained the remaining $9 million on-book portion of

the loan on accrual, as the borrower has the ability to repay the

principal and interest on this balance. The examiner did not concur

with this treatment. Because the lender restructured the debt into

a single note and had charged-off a portion of the restructured

loan, the repayment of the principal and interest contractually due

on the entire debt is not reasonably assured given the DSC ratio of

0.88x and nominal other resources. After a discussion with the

examiner on regulatory reporting requirements, the lender placed

the loan on nonaccrual. The loan can be returned to accrual

status34 if the lender can document that subsequent improvement in

the borrower's financial condition has enabled the loan to be

brought fully current with respect to principal and interest and

the lender expects the contractual balance of the loan (including

the partial charge-off) will be fully collected. In addition,

interest income may be recognized on a cash basis for the partially

charged-off portion of the loan when the remaining recorded balance

is considered fully collectible.

However, the partial charge-off would not be reversed.

While the Policy Statement does not govern CMBS loans, there is no doubt that CMBS has to consider the same issues and look at the same extension concepts. In facing the same market circumstances (and maybe even worse as CMBS loans often only use "bad-boy non-recourse guaranties instead of full repayment guaranties), CMBS should hopefully conclude that it will be best for its certificate holders not to crash the market with underwater foreclosed properties thereby killing the value of their certificates. Additionally, the above Fed standards should be used as arguments for borrowers when negotiating with CMBS as to what is reasonable in today's market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.