On May 21, 2020, the U.S. Department of the Treasury published a proposed rule (the "Proposed Rule") that would significantly broaden the scope of mandatory filing requirements of the Committee on Foreign Investment in the United States ("CFIUS") for foreign investments involving U.S. critical technology businesses.1 The Proposed Rule abandons the current restriction to specified industries and focuses on whether the target develops, tests, or manufactures critical technologies that would require a license for export-whether or not the critical technologies are exported or sold to third parties at all (e.g., proprietary manufacturing technologies)-to the jurisdiction of the foreign investor and its parent entities, effectively creating different mandatory notification requirements for different countries.

The Proposed Rule would:

- Expand the CFIUS mandatory critical technology notification requirement to cover foreign investments in all industries, if the target U.S. business develops, tests, or manufactures technology that would require a license or other authorization under any of the four main U.S. export control regimes to export or transfer to any foreign party in the ownership chain of the investors in the transaction.

- Complicate the mandatory CFIUS notification analysis by requiring parties to identify the export control status of all products, software, and technology produced, designed, tested, manufactured, fabricated, or developed by the U.S. business (whether or not sold to third parties), all jurisdictions relevant to the investors, and the corresponding licensing requirements, potentially introducing significant delays.

- Provide a significant exemption from the mandatory notification requirement for a wide range of dual-use goods, software, and technology eligible for export to a list of countries thought to pose a low risk of diversion, based on an existing license exception in the export control rules.

The Proposed Rule also clarifies the ownership rules used to determine when an investor linked to a foreign government is required to file with CFIUS for an investment in a sensitive U.S. technology, infrastructure, or data business.

I. Key Takeaways

The Proposed Rule would:

- Expand the CFIUS mandatory notification requirement to cover foreign investments in all industries, if the target U.S. business involves technology that would require a license or other authorization under any of the four main U.S. export control regimes to export or transfer to any foreign party in the ownership chain of the investors in the transaction.

- Complicate the mandatory CFIUS notification analysis by requiring parties to identify the export control status of all products, software, and technology produced, designed, tested, manufactured, fabricated, or developed by the U.S. business (whether or not sold to third parties), all jurisdictions relevant to the investors, and the corresponding licensing requirements, potentially introducing significant delays.

- Provide a significant exemption from the mandatory notification requirement for a wide range of dual-use goods, software, and technology eligible for export to a list of countries thought to pose a low risk of diversion, based on an existing license exception in the export control rules.

II. Critical Technology Mandatory Reporting Requirement

a. Proposed Changes

Since November 2018, certain non-controlling investments2 by foreign persons in, and transactions that could result in "control" by foreign persons of,3 U.S. businesses that produce, design, test, manufacture, fabricate, or develop one or more critical technologies potentially trigger a mandatory CFIUS notification. To trigger the notification requirement under the existing rule, the critical technology must also be used in connection with the U.S. business's activity in one or more targeted industries or designed by the U.S. business specifically for use in one or more of those industries. (The 27 targeted industries are identified by reference to the North American Industry Classification System ("NAICS")).4 Where a U.S. business is involved with critical technology outside of one of the 27 targeted industries, foreign investments into that U.S. business currently do not trigger a mandatory CFIUS notification. Although the industry restriction narrows the notification requirement, there is no official source assigning NAICS codes (which have broad and often overlapping descriptions) to companies, nor is it even clear whether companies have only a single NAICS code or may have more than one. The resulting uncertainty led to calls to shift the analysis away from NAICS industry codes to a more objective standard.

The Proposed Rule would remove the industry prong of the analysis and instead focus on whether a license or other authorization would be required to export the critical technology to the principal places of business5 (for entities) or countries of nationality (for individuals) of the foreign investor and its parent entities under the four main U.S. export control regimes covered by the definition of critical technologies (see footnote 11). If any of the types of licenses or authorizations identified in the Proposed Rule (defined as a "U.S. regulatory authorization") would apply in the context of a particular transaction (i.e., a license or other authorization would be required to export the technology to the principal place of business or country of nationality of the foreign investor or any of its parent entities), the investment would trigger a mandatory CFIUS notification requirement.6 Importantly, a U.S. regulatory authorization is considered to be required for purposes of this analysis even if a license exception or exemption might be available under U.S. export control laws.7

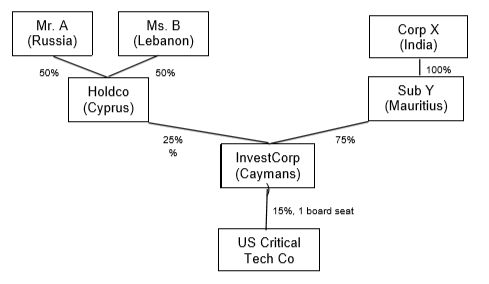

With respect to parent entities, it appears that the nationality of any person or entity with a direct or indirect voting interest of 25% or more in the foreign person making the investment would need to be taken into account when determining whether a U.S. regulatory authorization is required.8 With respect to indirect interests, any entity that is a "parent" of a shareholder (essentially, has a majority of either the economic or voting rights in that entity)9 is attributed 100% of its interest. These rules may substantially expand the number of jurisdictions to be assessed in consortium transactions or when acquirors have complex ownership structures. In the following example, if the critical technology of the target requires a license for export to any of Russia, Lebanon, India, Cyprus, Mauritius or the Cayman Islands, a mandatory filing is triggered:

The Proposed Rule clarifies that for limited partnerships, LLCs, and similar investment vehicles with passive investors, such as are commonly found in private equity funds, the applicable threshold is a 25% interest in the general partner, managing member, or equivalent. The Proposed Rule also states that the ownership interests of foreign persons acting in concert or controlled by a single foreign state will be aggregated.10

b. Covered Technologies

As noted, the covered "critical technologies" are any goods, software, or technology for which a U.S. regulatory authorization is required for export or transfer to the jurisdiction of the investor or its parent entities under any of the U.S. export control regimes.11 Current CFIUS regulations include exceptions to the critical technology mandatory CFIUS notification requirement for certain types of foreign investments, including where the target U.S. business is considered a critical technology business solely because it designs or develops items subject to encryption export controls that are eligible for a widely used license exception known as license exception ENC (ENC stands for encryption). The Proposed Rule narrows the availability of the encryption exemption and exempts critical technologies eligible for two other license exceptions with respect to the acquiror and its covered parents (technology and software-unrestricted (TSU) and portions of strategic trade authorization (STA)).12 If these exceptions would apply to the specific foreign acquirors and parent entities involved, the transaction would not trigger a mandatory CFIUS notification.

The additional license exceptions would expand the exceptions to the critical technology rule significantly. In particular, the relevant section of License Exception STA exempts a broad range of exports subject to dual-use controls under the EAR (but not those subject to military controls under ITAR or other specialized regimes) to a wide range of countries provided favorable export treatment because they are seen to pose a low risk of diversion.13 License Exception TSU is less significant, covering a limited range of eligible products, including: (i) the minimum technology necessary for the installation, operation, maintenance, or repair of previously exported items; (ii) sales technology and software (i.e., data supporting a prospective or actual quotation, bid, or offer to sell, lease, or otherwise supply any item) customarily transmitted with a prospective or actual quotation, bid, or offer; (iii) software updates (bug fixes) for previously exported software; and (iv) certain mass market software. There would be, however, a meaningful reduction in the scope of the exception for controlled encryption items (ENC), under the Proposed Rule, which would limit eligibility for the exception to technologies with respect to which the target has satisfied certain classification or reporting requirements set out in the exception (or, to put it the other way around, bringing a number of encryption technologies within the scope of the mandatory notification).

c. Potential Impact

If implemented in a form similar to the Proposed Rule, the shift in focus from specified industries identified by NAICS codes to the export control status of the underlying critical technology would significantly expand the scope and complexity of the critical technology mandatory notification requirement (while, at the same time, making it more objective and more precisely targeting particular technology transfers of concern). Parties to all transactions that could be covered transactions or covered investments, regardless of industry, will need to evaluate the export control status of all products, software, and technology developed, produced, designed, tested, manufactured, or fabricated by the U.S. business, even if the business has never exported them or does not even sell them (e.g.¸ manufacturing technologies developed solely for internal use). Export control analyses, which can be burdensome and time-consuming, often require someone familiar with the U.S. export control laws working closely with personnel familiar with the technical aspects of a company's products, software, and technologies to wade through the potentially applicable export control regimes.14 If any of them would require a license for export to the foreign investor or any of its covered upstream entities, filing (either a short-form notification or a full filing) is mandatory and comes with a 30-day waiting period between filing and closing, and the potential consequences of getting it wrong (including a fine of up to the total value of the transaction) are severe. This may lead parties to make at least a short-form notification to CFIUS in cases of doubt, though even then the parties are expected to provide information on potential critical technologies.

III. Clarifications to the Definition of "Substantial Interest"

Since February 2020, acquisitions of a "substantial interest" in certain U.S. businesses involved in critical technology, critical infrastructure, or sensitive personal data by a foreign person in which a single foreign government holds a "substantial interest" trigger a mandatory CFIUS notification. "Substantial interest" is defined as (i) 25% or more of the direct or indirect voting equity of the U.S. business and (ii) 49% or more of the direct or indirect voting equity of a foreign person.15 For entities with a general partner, managing member, or equivalent, a "substantial interest" under the current regulations is 49% or more of the general partner (or equivalent), essentially discounting limited partner ownership interests.

The Proposed Rule introduces two clarifications regarding which interests are relevant for the "substantial interest" calculation. First, the Proposed Rule clarifies that the exception for limited partner interests only applies to entities whose activities are "primarily directed, controlled, or coordinated" by a general partner (or equivalent). Second, the Proposed Rule clarifies that for calculating indirect ownership percentages, any interest by a parent entity is deemed a 100% interest in any entity of which it is a parent (rather than only voting interests).

An example illustrates the impact of these clarifications. As a result of the Proposed Rule, if an entity controlled by a foreign government owns 50% of an LLC of which it is not the managing member but has significant rights to direct, control, or coordinate the activities of the investment fund, 100% of the LLC's shareholdings would be included in the calculation of whether the foreign government was acquiring a "substantial interest" in a target.

* * *

Parties have until June 20, 2020 to submit comments on the Proposed Rule. We expect that CFIUS will then review and consider the various comments submitted, after which CFIUS likely will publish the final version of the rule. The exact timing of when the changes will become effective is not yet clear.

To view original article, please click here.

Footnotes

1 85 Fed. Reg. 30893 (May 21, 2020). The Proposed Rule is available at: https://www.govinfo.gov/content/pkg/FR-2020-0521/pdf/2020-10034.pdf.

2 The non-controlling investments covered are those that provide foreign persons with: (i) access to any material nonpublic technical information in the possession of the U.S. business; (ii) membership or observer rights on, or the right to nominate an individual to a position on, the board of directors or equivalent governing body of the U.S. business; or (iii) any involvement, other than through voting of shares, in substantive decision-making of the U.S. business regarding the use, development, acquisition, or release of critical technologies. See 31 C.F.R. § 800.211.

3 "Control" is nominally defined as "the power...to determine, direct, or decide important matters affecting an entity. 31 C.F.R. § 800.208. However, CFIUS has long interpreted the term very broadly to mean something more like "substantial influence," finding "control" in cases where the investor acquired as little as 15% of the target's shares and a single board seat.

4 31 C.F.R. Part 800, Appendix B.

5 "Principal place of business" means the primary location where an entity's management directs, controls, or coordinates the entity's activities, or, in the case of an investment fund, where the fund's activities and investments are primarily directed, controlled, or coordinated by or on behalf of the general partner, managing member, or equivalent.

6 To be subject to certain narrow exceptions, as discussed below.

7 In an illustrative example in the Proposed Rule, the acquisition of a U.S. business that manufactures an item controlled under the International Traffic in Arms Regulations (ITAR) by a corporation from Country F is still subject to a mandatory notification requirement even if exports of the ITAR-controlled goods are permitted to Country F under a valid exemption.

8 There is what appears to be a drafting error in the Proposed Rule; the Proposed Rule states that it applies "to a foreign person that is a party to the transaction and such foreign person...holds a voting interest for purposes of critical technology mandatory declarations...." Proposed Rule at 30898. Because "party to a transaction" is a term defined in the regulations to include only the acquiring person, the seller, and the target, and not their parent entities, see 31 C.F.R. § 800.236, read literally the rule cannot apply to parent entities (which may hold a "voting interest for purposes of critical technology mandatory declarations" but are not also a "party to the transaction". However, the narrative description of the Proposed Rule refers to "certain foreign persons in the ownership chain" as being subject to the rule, and so it appears that the rule is intended to apply to upstream entities. Proposed Rule at 30896.

9 The definition is more fully elaborated at 31 C.F.R. § 800.235.

10 Note that the "excepted investor" framework of the existing FIRRMA rules would be maintained, but every entity in the ownership chain between the U.S. critical technology business and the excepted investor must also be a U.S. or excepted entity for the exception to apply. See our prior memorandum, "CFIUS Releases Final FIRRMA Regulations" (Jan. 22, 2020), available at https://www.clearygottlieb.com/news-and-insights/publication-listing/cfius-releases-final-firrmaregulations.

11 Critical technologies include:

- Defense articles or defense services included on the United States Munitions List (USML) set forth in the International Traffic in Arms Regulations (ITAR) (22 CFR parts 120-130);

- Items included on the Commerce Control List (CCL) set forth in Supplement No. 1 to part 774 of the Export Administration Regulations (EAR) (15 CFR parts 730-774), and controlled pursuant to multilateral regimes, including for reasons relating to national security, chemical and biological weapons proliferation, nuclear nonproliferation, or missile technology; or for reasons relating to regional stability or surreptitious listening;

- Specially designed and prepared nuclear equipment, parts and components, materials, software, and technology covered by 10 CFR part 810 (relating to assistance to foreign atomic energy activities);

- Nuclear facilities, equipment, and material covered by 10 CFR part 110 (relating to export and import of nuclear equipment and material);

- Select agents and toxins covered by 7 CFR part 331, 9 CFR part 121, or 42 CFR part 73; and

- Emerging and foundational technologies controlled under section 1758 of the Export Control Reform Act of 2018 (50 U.S.C. 4817).

12 The eligible exceptions and portions of exceptions are 15 C.F.R. § 740.13 (TSU), 15 C.F.R. § 740.17(b) (ENC), and 15 C.F.R. § 740.20(c)(1).

13 The eligible countries are Argentina, Australia, Austria, Belgium, Bulgaria, Canada, Croatia, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, India, Ireland, Italy, Japan, South Korea, Latvia, Lithuania, Luxembourg, the Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, and the United Kingdom.

14 It is possible to request export control classifications from the U.S. authorities if the answer is unclear at the end of the review, but that could take even longer.

15 31 C.F.R. § 800.244.

To view original article, please click here.

Originally Published 26 May 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.