- within Food, Drugs, Healthcare and Life Sciences topic(s)

- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United States

- with readers working within the Advertising & Public Relations, Banking & Credit and Retail & Leisure industries

The PBM regulatory landscape continues to evolve at both the federal and state levels, making it critical for our clients involved in the PBM space to stay apprised of developments in the industry as they happen. Our team actively monitors these developments to provide you with this quarterly PBM Policy and Legislative Update. This update builds on prior issues and highlights federal and state activity from July, August, and September 2024. Activity in this space did slow down a bit over the summer as Congress and state legislators were in recess and stakeholders were generally focused on the election.

FEDERAL LEGISLATIVE ACTIVITY AND OVERSIGHT

Federal Legislative Activity

House Committee on Oversight and Accountability Focuses on PBMs as the Cause of Rising Drug Costs. On July 23, 2024, the House Committee on Oversight and Accountability (HCOA) released a report titled The Role of Pharmacy Benefit Managers in Prescription Drug Markets (Report). The Report was largely critical of the roles the three largest PBMs — CVS Caremark, Express Scripts, and OptumRx — have in the prescription drug market. The Report argues that these PBMs "have monopolized the pharmaceutical marketplace by deploying deliberate, anticompetitive pricing tactics that are raising prescription drug prices, undermining community pharmacies, and harming patients across the United States."

Following the release of the Report, HCOA held its third hearing in a series of hearings discussing PBMs and their role in the pharmaceutical market titled "The Role of Pharmacy Benefit Managers in Prescription Drug Markets Part III: Transparency and Accountability." As we reported, the first two hearings featured providers, practitioners, and industry stakeholders (e.g., PhRMA, etc.) discussing the importance of PBM reform in reducing the costs of prescription drugs. The third hearing featured the CEOs of CVS Caremark, Express Scripts, and Optum Rx. During the hearing, the PBM executives pushed back against the Report's claims tying PBMs to increasing drug costs. Adam Kautzner of ESI explained to the Committee that ESI is responsible for lowering patient costs and often protects patients from high prices in the pipeline. David Joyner of CVS also highlighted the role that drug manufacturers have with respect to rising costs, specifically highlighting "patent abuses" that delay launches of less costly generic and biosimilar medicines and the rising launch prices of new drugs as a contributor to high drug costs.

In an August 28, 2024 letter, sent to each of the "Big 3" PBM executives, Chairman Comey urged the executives to "correct the record" over what the Chairman described as claims contradicting the committee's and FTC's findings regarding certain controversial practices such as contract negotiations, contract opt-outs, payments to owned-pharmacies, and inappropriately steering patients to their own pharmacies. The executives defended their statements and declined to revise their testimony.

It remains to be seen what steps the HCOA will take next in its ongoing bipartisan efforts to seek PBM reform.

Senate Hearings Intensify Focus on Novo Nordisk's Pricing of Ozempic and Wegovy. In a Senate committee hearing led by Sen. Bernie Sanders, Novo Nordisk CEO Lars Fruergaard Jørgensen faced bipartisan pressure over the high US prices of Ozempic and Wegovy. Sen. Sanders revealed commitments from major PBMs, including UnitedHealth and CVS, to maintain drug coverage if prices were reduced, contradicting Novo's assertion that PBM rebates drive high list prices. The hearing sparked bipartisan scrutiny of Novo's pricing practices, with some senators, like Sen. Ben Ray Luján and Sen. Mike Braun, urging greater transparency, while others, such as Sen. Roger Marshall and Sen. Mitt Romney, defended Novo and called for PBM reform instead. The session highlighted ongoing debates over US drug costs, the role of PBMs and pharmaceutical manufacturers, and patient access.

Other Federal Activity

FTC Takes Aim at Insulin Rebating Practices of Major PBMs. The Federal Trade Commission (FTC) filed an in-house administrative complaint against CVS Caremark, Express Scripts, and Optum Rx and each PBM's associated group purchasing organization (GPO). The FTC's complaint alleges that the PBMs engaged in unfair methods of competition and unfair acts or practices under Section 5 of the FTC Act resulting from the PBMs' insulin rebating practices. The FTC's complaint argues that the PBMs incentivized insulin manufacturers to increase list prices in exchange for larger rebates. According to the FTC, this practice created a system where PBMs allegedly prioritized maximizing their own profits through rebates, rather than securing lower drug prices for patients. This case demonstrates the FTC's ongoing campaign to address the rising costs of health care, and it could have significant implications for the future of certain drug pricing practices and, potentially, the role of PBMs in the pharmaceutical market.

Express Scripts, Inc. Sues Federal Trade Commission for Defamatory Report. On September 17, 2024, Express Scripts, Inc. (ESI) filed a lawsuit against the FTC in the US District Court for the Eastern District of Missouri. The lawsuit challenges the FTC's July 9, 2024 interim staff report, Pharmacy Benefit Managers: The Powerful Middlemen Inflating Drug Costs and Squeezing Main Street Pharmacies, alleging that the report is defamatory, unlawful, and violates ESI's statutory and constitutional rights. ESI asserts that the FTC report contains numerous factual errors and misrepresentations, including the assertion that PBMs control drug prices and that rebates inflate drug costs. The lawsuit also alleges that the report reflects FTC Chair Lina Khan's longstanding bias against PBMs. ESI seeks injunctive relief, including a declaration that the FTC report is defamatory, removal of the report from the FTC's website, and recusal of Chair Khan from all FTC actions involving ESI.

BREAKING NEWS...

On November 19, 2024, CVS, Cigna, and United sued the FTC, asking the US District Court for the Eastern District of Missouri to issue an injunction to halt proceedings in the FTC's in-house case against CVS Caremark, ESI, and OptumRx regarding insulin rebating practices. The companies argue that the FTC's private administrative forum violates the due process rights under the Fifth Amendment and further involves private rights that should be litigated in federal court.

The historic election earlier this month has spurred a lot of discussion around how the Trump administration and the Republican-controlled 119th Congress will act on a range of health care issues, including pharmacy benefit manager (PBM) reforms around transparency and pricing models. During his first administration, President Trump showed his willingness to take on PBMs when he signed an executive order (EO) that would limit rebates paid to PBMs by drugmakers in Medicare. The Trump executive order would have removed safe harbor protections for such rebates under the Anti-Kickback Statute but created new, limited protections for certain point-of-sale discounts. The Trump EO blamed PBMs for the rising drug costs for Medicare patients, who "pay more than they should for drugs while the middlemen collect large 'rebate' checks." Four years later, the official Republican Party platform stated that "prescription drug prices are out of control" and pledges to "increase transparency" and "promote choice and competition" in the health care space.

On Capitol Hill, Republicans in both the House and Senate have supported a number of measures to regulate PBMs, focusing on the PBM pricing model and transparency. Bipartisan bills passed out of the House and a Senate committee would specifically end spread pricing, while other bills that have advanced with bipartisan support would increase transparency by requiring PBMs to publish reports on drug costs, rebates, and formulary placements. While these bills will likely serve as a starting point for the PBM activity in the next Congress, it is possible that legislative action could take place during the current post-election, "lame-duck" session — depending, of course, on whether a bipartisan consensus emerges as part of a broader, end-of-year omnibus appropriations package.

Needless to say, the next Congress will likely consider bipartisan PBM legislation that will focus on increased transparency for and scrutiny of PBMs.

When Republicans take the majority in Congress come January, they may be poised to act on the several bipartisan PBM pieces of legislation that have advanced in both chambers of the current Congress. In the Senate, the Modernizing and Ensuring PBM Accountability Act, introduced by Sen. Ron Wyden (D-OR) and voted 26-1 out of Committee, would prohibit spread pricing in Medicare and delink PBM compensation from the price of a drug in Medicare Part D. The PBM Transparency Act, introduced by Sen. Maria Cantwell (D-WA) and co-sponsored by 10 Republican Senators, would require that PBMs disclose information about rebates, including the amount passed through the plan sponsor, to the FTC. The bill was advanced to the full Senate by an 18-9 vote last year. And last December, the House passed the Lower Costs, More Transparency Act, introduced by Rep. Cathy Morris Rodgers (R-WA) and co-sponsored by Reps. Frank Pallone (D-NJ), Jason Smith (R-MO), and Virginia Foxx (R-NC). The bill would require that PBMs disclose information about rebates, including the amount passed through the plan sponsor, to the FTC. Interested stakeholders should pay close attention to all of these pieces of legislation, as they highlight the bipartisan PBM reform priorities that have emerged in Congress and that may guide the next Congress' activity on PBM reform.

>> Click here to access slides from our recent webinar – Flash Update: What the New Administration and Congress Mean for Health Plans and PBMs.

STATE LEGISLATION AND LITIGATION

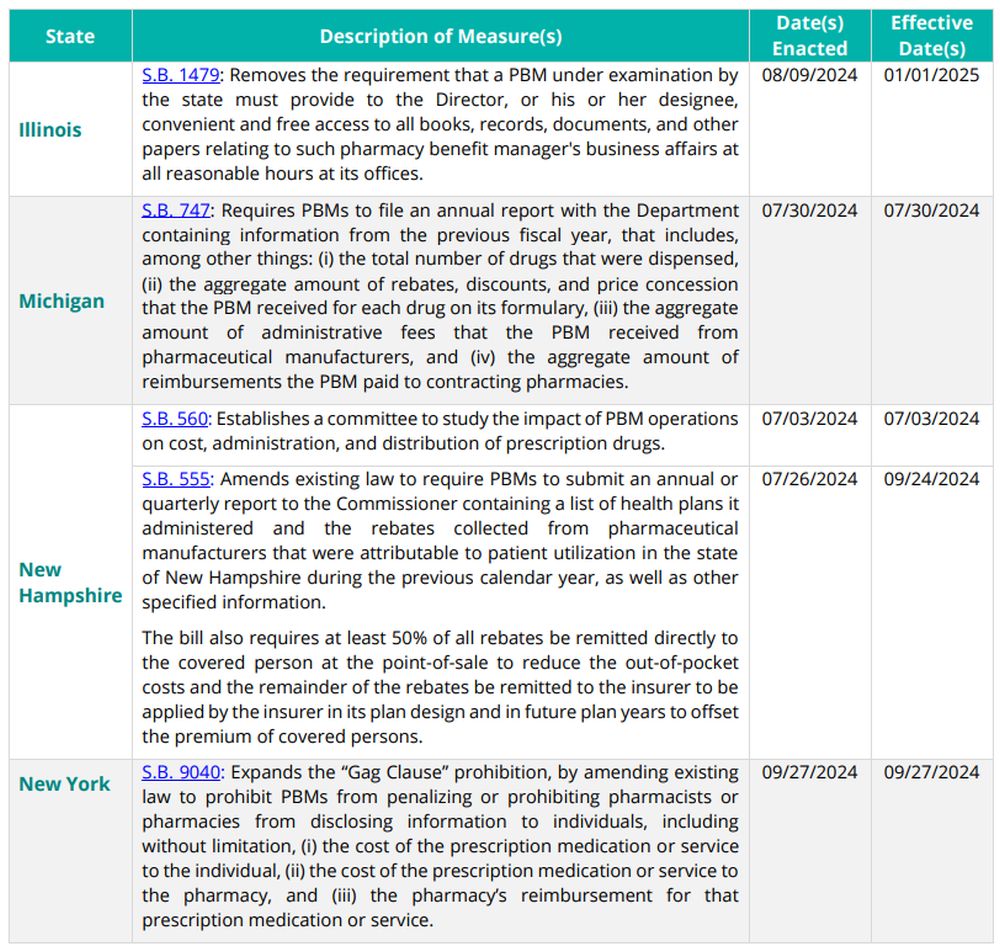

Recently Enacted State Legislation

States enacted the following initiatives during the third quarter of 2024. The initiatives listed below impact: (i) PBM contracts with pharmacies and providers; (ii) pharmacy pricing and reimbursement requirements; (iii) pharmacy network requirements; and/or (iv) PBM licensure and registration requirements.

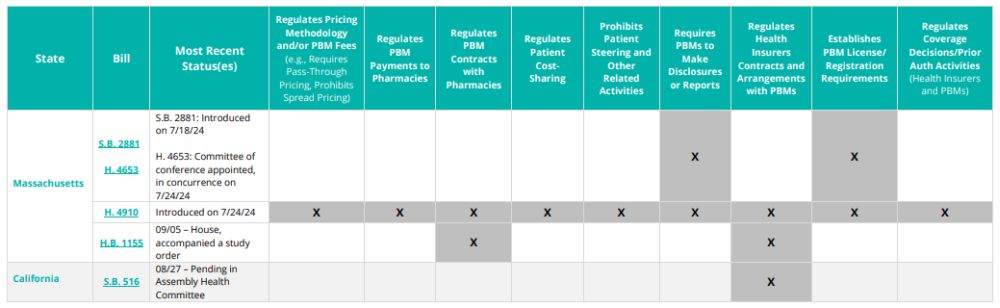

Pending State Legislation

The following state initiatives affecting (i) pricing methodology for PBM fees; (ii) PBM contract terms with pharmacies and providers; (iii) PBM contract terms with health insurers; (vi) pharmacy pricing and reimbursement requirements; (v) pharmacy network requirements; and/or (vi) PBM licensure and registration requirements were introduced in the third quarter of 2024.

JULY – SEPTEMBER 2024

State Law Challenges

As Legislative Efforts to Enact PBM Reform Continue, States Show Signs of Restraint. The first half of 2024 saw a continued trend of state legislative efforts to regulate PBMs. An ongoing analysis conducted by the National Academy for State Health Policy (NASHP) indicates that as many as 173 bills to regulate PBM activity have been introduced across 42 states. At the core of some of these state legislative proposals are efforts to limit or prohibit PBMs from engaging in spread pricing.

"Spread pricing" refers to arrangements in which the PBM's payment to a pharmacy is less than the amount the PBM receives from its client for the same prescription. Spread Pricing has long been decried by the National Community Pharmacists Association (NCPA) as a key contributor to the closure of numerous independent pharmacies across the United States. This past February, the NCPA released the results of a survey of independent pharmacy owners and managers. The survey highlighted some of the financial difficulties independent pharmacies have faced lately. According to the survey, over 99% of pharmacies indicated a reduction in reimbursements for prescribed medicines at the point of sale. The survey also showed that roughly one-third of respondents have considered closing their pharmacy in response to the financial strain. NCPA's report also shows that independent pharmacies are largely placing the blame for low reimbursements on the country's largest PBMs.

Such findings, and continued lobbying from entities such as the NCPA, likely contribute to the consistent state legislative activity surrounding PBM activity. An earlier analysis conducted by NASHP in 2023 found that state laws to regulate PBM activity include some or all of the following provisions:

- Prohibitions of gag clauses on pharmacies

- Limits on patient cost-sharing

- PBM licensing/registration

- Prohibitions on discrimination against nonaffiliated or independent pharmacies

- Prohibitions on clawbacks and retroactive denials

- Prohibitions on spread pricing

- Other practices

While plenty of states have charged forward with implementing such restrictions, there are others that continue to debate the best approach to regulate the PBM industry. Massachusetts, for example, has debated for well over a year on legislation such as H. 1215. This proposed bill, first introduced in February 2023, seeks to ban spread pricing in the state and would also prohibit PBMs operating in Massachusetts from reimbursing any pharmacy less than the amount the PBM would reimburse to a PBM-affiliated pharmacy. The Massachusetts bill has been championed by pharmacy advocacy organizations such as the National Association of Chain Drug Stores (NACDS). This past June, NACDS joined a coalition media event in Boston to urge state lawmakers to enact PBM reform, including H. 1215. The proposed bill remains pending.

In a surprise to PBM reform advocates, California did not join with other states in enacting PBM legislation. California's Senate Bill 966 would have been one of the nation's most comprehensive pieces of PBM reform legislation to date. The bill, which passed the legislature with near unanimous support, was unexpectedly vetoed by Governor Gavin Newsom on September 28, 2024. The vetoed law borrowed heavily from various enacted PBM legislation across the country. If approved, the bill would have established a PBM licensing requirement with the California Department of Insurance, introduced annual PBM reporting obligations, prohibited PBMs from engaging in certain "anticompetitive" practices directed at nonaffiliated and independent pharmacies, including steering patients to use PBM-affiliated pharmacies. The law would have also required the insertion of certain contractual provisions in agreements between PBMs and health plans, such as a requirement that the PBM pass through 100% of rebates received to the health plan clients.

In a statement released by Governor Newsom alongside the veto, he stated "I believe that PBMs must be held accountable to ensure that prescription drugs remain accessible throughout pharmacies across California and available at the lowest price possible. However, I am not convinced that [Senate Bill] 966's expansive licensing scheme will achieve such results, we need more granular information to fully understand the cost drivers in the prescription drug market and the role that PBMs play in pricing." While the Governor's veto and subsequent statement may come as a surprise because of the bill's strong support in the state legislature, it largely aligns with the "wait and see" approach adopted by federal lawmakers.

Massachusetts and California may ultimately move forward with PBM legislation in the near future, but the current state-level discussions and calls for more research and understanding of the effects of PBM on drug pricing and pharmacy operations offer a seemingly rare glimpse of restraint that may or may not be adopted across other states looking to further expand their own PBM regulation efforts.

State Drug Pricing Activities

PRESCRIPTION DRUG AFFORDABILITY BOARDS

As Colorado and Maryland Prescription Drug Affordability Boards (PDABs) Implement Upper Payment Limits, Cracks Show. Two of the nation's most active PDABs continue to inch towards implementing upper payment limits (UPLs) on drugs identified as unaffordable by their respective committees. However, recent changes to state Medicaid guidance by the federal government may require PDABs to reassess how they conduct and ultimately implement their drug affordability findings.

Colorado's PDAB decided at its July 2024 meeting to pursue UPLs on three of the drugs the PDAB previously designated as unaffordable, Amgen's Embrel, J&J's Stelara, and Novartis' Cosentyx. At its September and October meetings, the PDAB outlined the process for implementing an UPL and the information that the PDAB would utilize to make such a determination. The PDAB confirmed in its meeting materials that it will first make changes to the affordability review rulemaking process and will then begin the rulemaking process for initiating UPLs on the three designated "unaffordable" drugs.

Despite being the first PDAB in the nation, Maryland continues to lag behind its fellow states. In fact, this summer, members of the Maryland PDAB expressed frustration with the PDAB's slower-thanexpected cost-review process at one of its public meetings. PDAB Chair Van T. Mitchell was quoted by a state publication as saying, "We've been at this now for four years ... I think it's important for us to find a timeline and know exactly whether we're going to hit them or not[.] They're [board members are] at a point where they want to get it across the finish line." In May of this year, Maryland's PDAB had previously selected six drugs as unaffordable. Although the executive director of the PDAB indicated that a timeline for the cost-review process could be ready by November, PDAB members, such as Mitchell, stressed the importance of such a timeline, whenever it is released, being complete and accurate to allow the PDAB to move forward with its business.

One potential snag for state PDABs lies in guidance to states provided by the Centers for Medicare & Medicaid Services (CMS) in the Medicaid Drug Rebate Program Final Guidance released on September 26, 2024. Although the Final Rule dealt primarily with drug manufacturer compliance with the federal drug rebate program, CMS did finalize a proposal that could affect the type of information that state PDABs can consider in their affordability review. The Final Rule required that state Medicaid assessments of professional dispensing fees to pharmacy providers, which are paid in addition to reimbursement for drug ingredient costs and are frequently reviewed by PDABs, "must be based on pharmacy cost data, and [...] cannot be solely determined or supported by a market-based review or by an assessment or comparison of what other payers may reimburse pharmacies for dispensing prescriptions." CMS also clarified that if a state seeks to change the amount by which it reimburses pharmacy providers for drug ingredient costs, those changes not only "must be consistent with [actual acquisition costs], [but] States must support determinations or proposed changes [...] with adequate cost based data." 89 Fed. Reg. at 79062.

This new CMS provision is likely to affect the ability of PDABs to mandate UPLs. Rather than permitting states to adopt a one-size-fits-all approach developed from a broad market-based review, CMS is requiring states to use actual acquisition costs in its determinations and proposed reimbursement changes for Medicaid. It remains to be seen how states will respond to the requirement and how this will affect the affordability review process and associated state reporting requirements.

INSULIN CASES

Sanofi Settles Minnesota Insulin Price Case. Minnesota Attorney General Keith Ellison announced a settlement agreement with Sanofi that requires the drugmaker to offer insulin at no more than $35 per month for five years to Minnesotans whether they have insurance or not. The terms of the settlement were set to take effect within 90 days of July 19, 2024, and the settlement concludes the AG's 2018 lawsuit against Sanofi that claimed the drug manufacturer "deceptively priced" its insulin products. The settlement, which mirrors a similar agreement Minnesota reached with Eli Lilly earlier this year, includes provisions for patients to enroll in savings programs and receive information about low-cost insulin options. The settlement is part of a broader litigation effort by Minnesota against insulin manufacturers for alleged price inflation. The state's case against Novo Nordisk, which along with Sanofi and Eli Lilly produces roughly 90% of the global insulin supply, is still ongoing.

California's Case against CVS Caremark and ESI Regarding Insulin Prices Will Remain in Federal Court. The Ninth Circuit Court of Appeals ruled that California's case against CVS Caremark and ESI will proceed in federal court, reversing a US district court's order to keep the case in state court. The decision is the latest procedural development in the California's AG case against CVS Caremark and ESI, brought in January 2023, for allegedly inflating the price of insulin. After the case was filed, the PBMs removed the case to federal court, citing the federal officer removal statute and the work they do for federal government health programs. California objected to the move, arguing that its case was not challenging the work the PBMs did in connection with federal health programs. In June 2023, a federal district court sided with California, sending the case back to state court, while the PBMs appealed the decision to the Ninth Circuit. Now, the Ninth Circuit has sent the case back to the district court to analyze California's arguments for remanding to state court.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.