- with readers working within the Accounting & Consultancy, Banking & Credit and Healthcare industries

- within Government, Public Sector, Transport and Real Estate and Construction topic(s)

Key Takeaways:

- Changing government auditors is a strategic move that impacts transparency, compliance, and public trust.

- To make a smooth transition, focus on legal requirements, institutional knowledge, and communication style.

- Choosing an audit firm with deep public sector experience can deliver long-term value beyond just the lowest bid.

—

For state and local governments, changing auditors isn't just a matter of compliance — it's about trust, transparency, and public accountability. Whether you're making a required rotation or looking for a fresh perspective, choosing a new audit firm involves more than a cost comparison. It's an opportunity to reassess how your audit function supports your mission, enhances internal controls, and maintains the public's confidence.

If you're preparing to transition audit firms, here are five essential moves to make to keep your agency on track.

1. Align the Switch With State Requirements and Oversight Bodies

Unlike private companies, you operate in a regulatory environment that blends state laws, federal grant requirements, and oversight from entities like the Government Accountability Office (GAO) or single audit requirements under Uniform Guidance. Before you change auditors, take time to map out the legal and procedural requirements specific to your jurisdiction.

Some questions to ask yourself:

- Is auditor rotation required by statute or policy?

- Do procurement rules mandate an RFP process?

- Are there any reporting deadlines tied to federal funding that might impact your timing?

Failing to align with these standards can delay your financial statements or risk your standing with grantors. Check with your finance team and legal counsel to confirm compliance before moving forward.

2. Look for Government-Specific Experience

Auditing a city, county, school district, or special district isn't the same as auditing a corporation. You need an audit team that understands fund accounting, GASB standards, budgetary compliance, and the unique challenges of public sector operations — like pension obligations, enterprise funds, or capital project reporting.

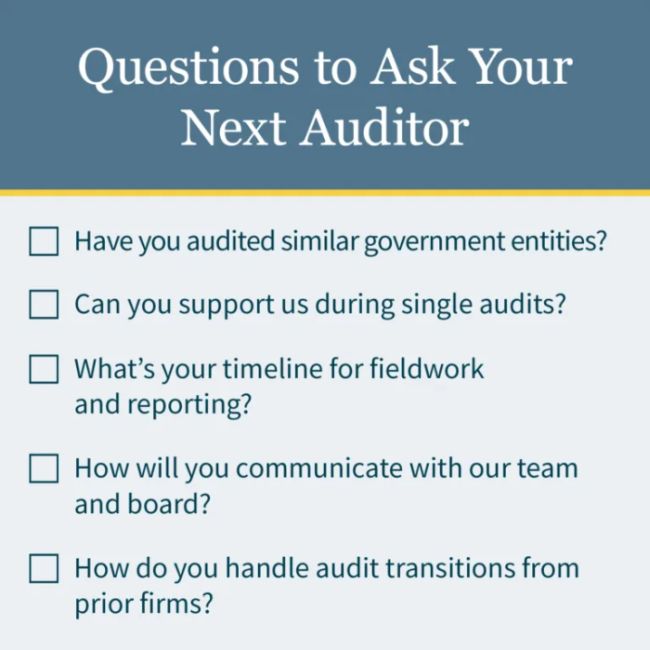

Ask potential firms:

- Do you have experience with similar-sized government entities?

- How familiar are you with GASB updates that affect our reporting?

- Can you provide guidance on complying with the Uniform Guidance if we receive federal funds?

This isn't about general financial knowledge — it's about understanding how to apply that knowledge in the context of the public good.

3. Create a Transition Plan That Protects Institutional Knowledge

A smooth transition isn't automatic. If your previous auditors have been with you for years, they've likely developed deep institutional knowledge that won't appear in a handoff memo. Losing that knowledge can affect the audit timeline and your team's efficiency.

Start planning early:

- Assign a staff lead to coordinate the transition.

- Facilitate the successor auditors' inquiries of the predecessor auditors by providing contact information early.

- Document major accounting treatments, past audit findings, and any open recommendations.

The more clarity you provide up front, the faster the new firm can ramp up — and the less disruption your internal team will face during the change.

4. Evaluate Communication Style and Accessibility

You know that a government audit doesn't just result in a report — it may be discussed at public meetings, reviewed by oversight boards, or used by external stakeholders to assess performance. That makes the auditor's communication style a critical factor.

When meeting with candidates, look for:

- Responsiveness: Will they answer questions promptly during audit season?

- Clarity: Can they explain complex issues in plain language to council members or board trustees?

- Proactiveness: Will they flag potential issues early instead of waiting until the final report?

A firm that keeps you informed and is available throughout the process can help you avoid surprises — and prepare you for responding to public scrutiny if tough questions arise.

5. Balance Cost With Public Value

Budgets are tight, and it's tempting to go with the lowest bid. But remember — the audit is a public trust tool, not just a procurement line item. A low-cost provider who lacks specific government knowledge or experience may cost more in the long run if the audit takes longer or puts federal funding at risk.

Instead of focusing only on fees, ask:

- What's included in the base fee? Are there charges for follow-up work or extra support?

- How many hours will be dedicated to planning and fieldwork?

- What's your track record for completing audits on time?

Value means more than price — it's about what you're getting in return, and how the audit supports your long-term goals for transparency, accountability, and operational excellence.

Make the Move With Confidence

Switching auditors is more than a change in paperwork — it's a strategic move that reflects your values and commitment to sound governance. When done thoughtfully, the transition can bring fresh insights, stronger internal controls, and more effective use of public resources.

Take the time to choose an audit team that understands the public sector, recognizes your operational complexities, and communicates clearly with your leadership. Because at the end of the day, this isn't just about compliance — it's about credibility.

How MGO Can Help

We help governments like yours navigate auditor transitions with clarity and confidence. With one of the largest and most experienced State and Local Government practices in the nation, we bring deep knowledge of GASB standards, single audit requirements, and performance expectations to support your goals for transparency, accountability, and operational excellence.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.