- in Canada

- with readers working within the Accounting & Consultancy, Banking & Credit and Pharmaceuticals & BioTech industries

- within Government, Public Sector, Criminal Law and Technology topic(s)

Key Takeaways:

- The SLFRF program's reporting deadlines have passed, but compliance reviews and documentation requests from the Treasury are now underway.

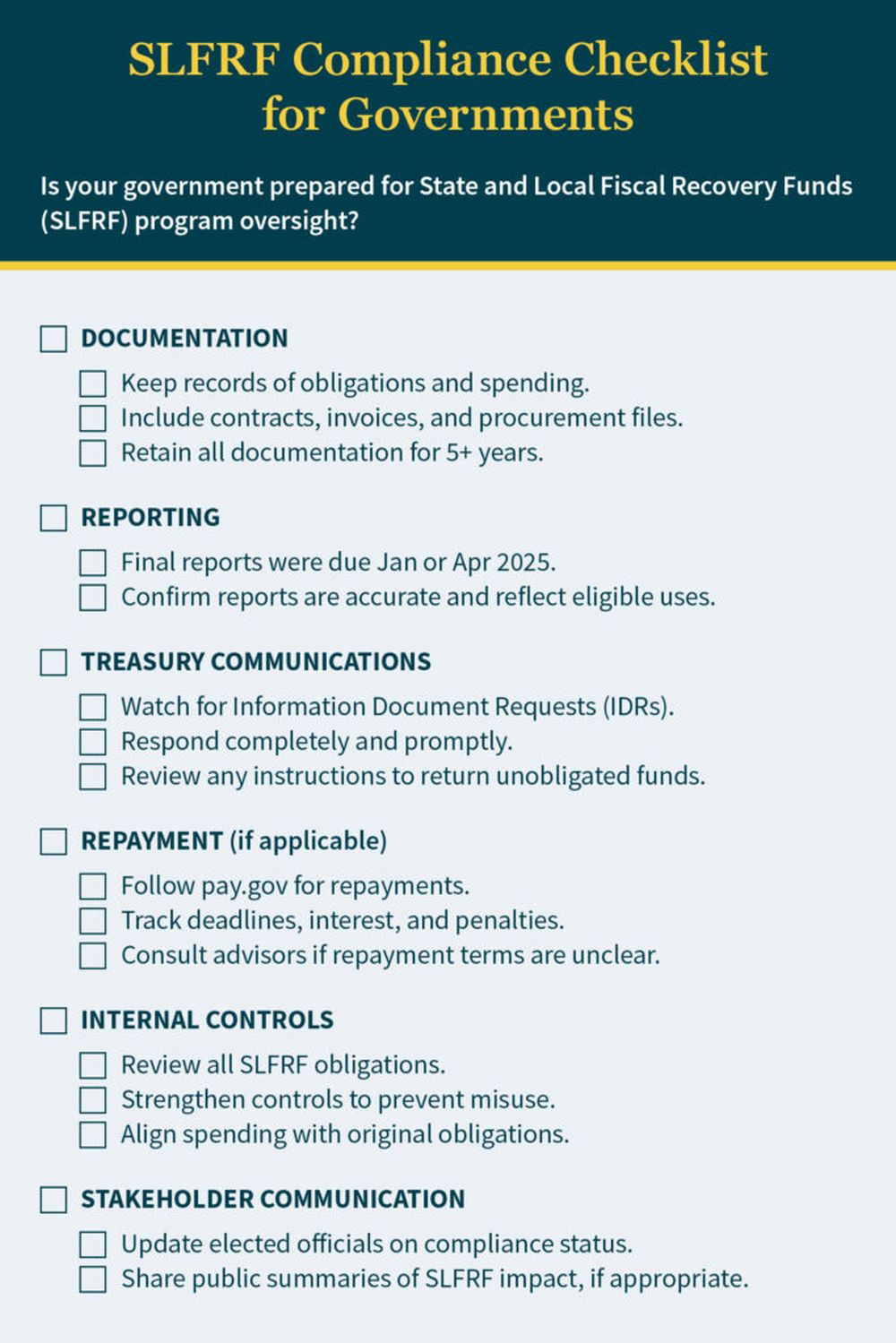

- A detailed checklist can help your government stay organized and responsive during this oversight phase.

- Proactively reviewing records and internal controls helps confirm your use of funds aligns with what was reported to the Treasury.

The State and Local Fiscal Recovery Funds (SLFRF) program, established under the American Rescue Plan Act, delivered $350 billion in federal aid to help state, local, territorial, and Tribal governments address the public health and economic impacts of the COVID-19 pandemic. While the program provided critical flexibility, it also came with deadlines and oversight requirements.

The key deadline to obligate SLFRF funds was December 31, 2024. Final reports were due earlier this year, and the U.S. Department of the Treasury has shifted its focus to compliance reviews, documentation requests, and potential fund recovery actions. That means your role isn't over.

Even though the obligation and reporting windows have closed, there's still time to strengthen your compliance posture. Whether you're preparing for Treasury inquiries, reviewing internal documentation, or confirming your use of funds aligns with what you reported, this checklist is designed to help you stay proactive and prepared.

SLFRF Compliance Checklist for State and Local Government

Use this checklist to make sure you're covered for SLFRF compliance and oversight:

1. Adequate Documentation

- Maintain detailed records of all obligations and expenditures.

- Ensure documentation substantiates obligations were made by December 31, 2024.

- Retain contracts, invoices, and procurement records.

- Keep records for at least 5 years after the end of the period of performance.

2. Reporting Requirements

- Submit final obligation reports:

- Quarterly reporters: by January 31, 2025

- Annual reporters: by April 30, 2025

- Review submitted reports for accuracy and completeness.

- Confirm that all obligated funds are eligible uses under SLFRF guidelines.

3. Treasury Communications

- Monitor for Information Document Requests from U.S. Treasury.

- Respond to Information Document Requests promptly and thoroughly.

- Watch for financial instructions to return unobligated funds if applicable.

4. Repayment (if applicable)

- Follow instructions for repayment options via pay.gov.

- Take note of deadlines and potential interest and penalties.

- Consult legal or financial advisors if repayment is disputed or unclear.

5. Internal Controls and Oversight

- Conduct an internal review of and track all SLFRF obligations.

- Implement or update internal controls to prevent misuse of funds.

- Ensure spending of SLFRF funds is in line with obligations made.

6. Stakeholder Communication

- Inform elected officials and stakeholders of compliance status.

- Prepare a public summary of SLFRF use and impact, if appropriate.

Stay Ahead of Compliance Risks

With the Treasury increasing oversight and requesting documentation from recipients, staying prepared is essential. This is your opportunity to review your internal records, verify alignment with what was reported, and make adjustments to avoid compliance issues. Proactive steps today can help you minimize the risk of repayment and preserve your funding impact.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.