On March 23, 2018, President Trump signed the Consolidated Appropriations Act of 2018, which included the Small Business Credit Availability Act (the "SBCAA"). The SBCAA was, at the time, a material "win" for BDCs. Pursuant to the SBCAA, business development companies or "BDCs" have the ability to elect for more lenient asset coverage requirements, thereby increasing their ability to take on more leverage for purposes of making investments.

Background

BDCs are regulated by the Investment Company Act of 1940 (the "1940 Act"). Prior to the SBCAA, Section 61(a) of the 1940 Act made it unlawful for a BDC to issue or sell any class of its senior securities, where such senior securities represented indebtedness, unless immediately after such issuance or sale such BDC's asset coverage was at least 200% (effectively representing a 1:1 debt to equity ratio). With the passage of the SBCAA however, BDCs can now elect to reduce their asset coverage from 200% to 150% (effectively representing a 2:1 debt to equity ratio), subject to certain requirements.

Pursuant to Section 61(a)(2)(D) of the 1940 Act, in order to elect the reduced asset coverage, publically listed BDCs must first either obtain approval through (i) a vote of the required majority of its disinterested board of directors or general partners (the "Board") or (ii) a vote of more than 50% of shareholder/partner (the "Shareholders") votes cast at a special or annual meeting, where a quorum is present. If a Board has granted the approval, the reduced asset coverage requirement becomes effective one year after the date of such approval. On the other hand, if Shareholders have granted the approval, the reduced asset coverage requirement may be implemented the very next day.

In addition to obtaining Board or Shareholder approval, within five business days of such approval the BDC must also provide public notice of such approval and the effective date thereof by both a public filing submitted to the Securities Exchange Commission pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (the "1934 Act") and a notice on the BDC's website. Additional periodic filings under Section 13(a) of the 1934 Act must include (i) the aggregate amount of senior securities of such BDC as well as their asset coverage percentage, (ii) a statement that the BDC has approved the new asset coverage requirement and (iii) the effective date thereof.

BDC Activity After New Leverage Rules

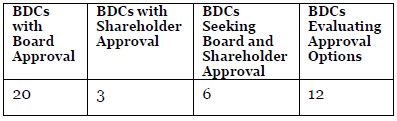

Since the passage of the SBCAA, a number of BDCs are seeking or have already sought approval of the reduced asset coverage requirement. According to public filings made between March 23rd and May 17th of this year, at least twenty three BDCs have obtained Board or Shareholder approval of the reduced asset coverage requirement, with twenty of those BDCs obtaining approval via a Board vote and three BDCs obtaining approval via a Shareholder vote. Of those twenty BDCs that obtained Board approval, at least six have planned or are planning on having shareholder meetings to obtain shareholder approval (so that the reduced asset coverage can be implemented sooner than the one year period required in connection with Board approval). In addition, two BDCs have scheduled stockholder meetings for June to approve such asset coverage reduction and two additional BDCs are currently in discussions with their boards/stockholders to evaluate such an approval.

In addition to those BDCs discussed above, which have sought or are seeking approval, there are approximately twelve additional BDCs that are discussing the SBCAA and the new asset coverage levels in their recent public filings without providing a public stance on the matter. Moreover, at least two additional BDCs have noted they have no present intentions of seeking approval of the reduced asset coverage ratio at this time.

The chart below summarizes the aforementioned survey results based on publicly available documents:

Reconsidering BDC Leverage

While it seems that many BDCs have quickly sought (or are seeking) approval of the reduced asset coverage requirement, there are some BDCs that are rethinking their original position given the viewpoint shared by the ratings agencies.

S&P Global Ratings ("S&P") presented a live webcast on April 4, 2018, entitled "The Impact of New Leverage Rules on BDC" in which they discussed the impact of the SBCAA and the interplay with their ratings of BDCs. In that presentation, S&P noted that the "new legislation narrows the gap between BDCs and other nonbank finance companies". The presentation materials further state that S&P will likely downgrade BDCs that have approved the new asset coverage requirement by one notch and that "further downgrades would be dependent on the extent to which a BDC increases leverage in combination with the impact on earnings and changes in investment strategies".

Joining in S&P's concerns over the impact of the SBCAA, Fitch Ratings ("Fitch") issued a press release on April 18, 2018, noting that while ratings will not change immediately, the increased leverage is seen as a "credit negative for the sector". One of Fitch's Managing Directors, Meghan Neenan has also stated "negative rating actions will depend on how individual BDCs utilize the relaxed leverage guidelines relative to their portfolio risk profile in regards to asset seniority, issuer credit strength and secondary market asset liquidity".

In connection with the guidance provided by S&P in April of this year, at least two BDCs have reconsidered their original approval of the reduced asset coverage. Both BDCs noted in their latest 8-k filings in April that as a direct result of the April report issued by S&P, as well as the positions and guidance provided therein, both boards had determined to reverse their initial approvals.

While the allure of the increased leverage capacity has led some BDCs to seek early approval of the new asset coverage requirement, time will tell if more BDCs will join the ranks of those BDCs now moving to reverse their original approvals in light of industry and rating agency guidance or rather, if BDCs will continue to hold off seeking approval completely in order to evaluate how the market reacts to these changes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.