- within Finance and Banking topic(s)

- in United States

- with readers working within the Healthcare and Media & Information industries

- within Insurance, Wealth Management and Tax topic(s)

In the complex and highly regulated financial services environment, the cost of poor data management is staggering, estimated to cost businesses billions annually in operational inefficiencies, regulatory fines, and missed opportunities. Yet, amidst these challenges lies an unprecedented opportunity. Data, when meticulously managed and effectively leveraged, has emerged as one of a company's most valuable assets. Indeed, organizations that effectively harness their data consistently report stronger financial outcomes and greater market agility, enabling improvements in revenue, reduction in costs, and mitigation of risks. The transformative potential of artificial intelligence (AI) hinges entirely on the quality and accessibility of this data, making robust data asset management a foundational imperative. For instance, financial institutions implementing predictive analytics solutions have reported an average return on investment (ROI) of 250-500% within the first year of deployment.1 Achieving this is difficult, as many financial services organizations struggle to fully harness the full potential of data, facing a myriad of challenges that prevent them from transforming raw data into actionable insights and a true competitive advantage.

The Strategic Imperative of Data

Data represents more than just information; it is a critical resource that can drive significant business outcomes. For financial services firms, a data-first approach directly supports the pursuit of increased revenue, reduced costs, and minimized risks, leading to improved product offerings, personalized customer experiences, and streamlined operations.

Specifically, the strategic value of data manifests in several key areas:

| Value Pillar | Strategic Value of Data |

|---|---|

| Enhanced Customer Understanding | Developing personalized products, predicting churn (e.g., identifying investment clients likely to close their accounts), identifying cross-sell opportunities (e.g., suggesting suitable wealth management products to retail banking customers), and proactively retaining customers. |

| Optimized Operational Efficiency | Identifying bottlenecks, streamlining processes (e.g., claims, loan origination), and automating decisions for cost savings and faster processing (e.g., AI-driven automation of routine loan application reviews or insurance claims triage). |

| Informed Decision-Making | Providing real-time, near-term, and long-term predictive capabilities for strategic and impactful decisions (e.g., using market data and sentiment analysis to optimize trading strategies or forecast branch traffic). |

| New Product Development | Understanding market trends and customer needs to rapidly develop new, competitively positioned products and services (e.g., predicting demand for new insurance products based on demographic shifts or identifying underserved segments for micro-lending). |

| Enhanced Operational Oversight | Real-time monitoring, anomaly detection, error pinpointing, and effective tracking/analysis of customer feedback to reduce friction and improve satisfaction (e.g., flagging unusual transaction volumes in specific regions or identifying recurring issues from customer service interactions). |

| Proactive Risk Management | Detecting fraud (e.g., identifying novel fraud patterns in credit card transactions or detecting suspicious activities in real-time (ADD) such as account takeover attempts), spotting emerging complaints, managing third parties, identifying business resilience concerns, and assessing credit/market risk accurately to mitigate losses (e.g., predicting loan defaults with greater accuracy than traditional models or assessing climate-related financial risks). |

The Data Dilemma: Common Challenges in Financial Services

Despite the clear benefits outlined above, realizing this value is often hindered by common challenges, which are mitigated with a strong data management program. Financial services companies inherently deal with vast volumes of data in many disparate systems and applications. Adding to this complexity, this data is often highly sensitive and may require extensive protection controls and subject to diverse regulatory requirements.

| Key Challenge | Description of Impact |

|---|---|

| Lack of Cohesive Data Strategy | No alignment with company strategy, siloed initiatives, duplicated efforts, inconsistent definitions, inability to share insights, lack of prioritized tracking for data initiatives, spending, and outcomes (e.g., different lines of business using conflicting customer data for their respective reporting, leading to an inconsistent view of customer relationships). |

| Reliance on Outdated Legacy Systems | Decades-old systems are not designed for modern data volume, velocity, and variety, hindering efficient data retrieval, extraction, and loading (e.g., inability to integrate real-time streaming data from payment networks into older core banking systems, delaying fraud detection). |

| Fragmented Data Management | Data scattered across numerous disparate systems, departments, and vendors, leading to inconsistent data quality, accuracy, and accessibility; making it difficult to establish a "single source of truth" (e.g., customer addresses stored differently across credit card, mortgage, and investment platforms, an insurance customer with fragments of data in different sales, commissions, new business, claims and beneficiary systems). |

| Unclear Data Ownership and Governance | Lack of accountability for data quality, security, and usage leads to conflicts, redundancy, and distrust in data integrity. Stringent protection and regulatory adherence are crucial for sensitive financial data (e.g., no clear owner for client transaction data, resulting in inconsistent data entry and incomplete audit trails; no consistent definition and use of fields like assets under management (AUM) or Premium making aggregation nearly impossible). |

| Poor Data Quality | Results in flawed insights, inaccurate reporting, and ultimately, poor business decisions. This can lead to financial losses, missed opportunities, reduced customer trust, and an inability to leverage advanced analytics and AI effectively (e.g., incorrect customer segmentation for marketing campaigns due to outdated income data). |

| Limited Cross-Functional Data Expertise | Business leaders do not fully grasp technological capabilities or limitations, and information technology (IT) professionals may lack a deep understanding of core business objectives and processes. This misalignment frequently results in misdirected investments, inefficient operations, and missed opportunities for innovation and growth (e.g., a data science team building a predictive model that does not align with the actual business problem faced by the loan department). |

| Data Sourcing and Integration Complexity | Sourcing, normalizing, and integrating data from various internal, external, and customer systems consumes significant effort, often diverting enterprise focus away from crucial analysis. This complexity is compounded by the need to ensure quality, protection, and fairness across all data sources (e.g., difficulties combining disparate market data feeds with internal trading data for real-time risk assessment, obtaining premium and claims data from brokers, agents, and managing general agents). |

| Lack of Robust Data Protection | Exposes the organization to severe risks including data breaches, regulatory penalties, reputational damage, and loss of customer trust. It hampers compliance with critical data privacy mandates (e.g., General Data Protection Regulation and the California Consumer Privacy Act) and can lead to significant financial liabilities and legal repercussions, compromising the integrity and security of sensitive financial data throughout its lifecycle (e.g., a cyberattack exposing sensitive client investment portfolios due to inadequate encryption or access controls). |

| Immature Data Analytics | Struggle to move beyond basic reporting to strategic analytics; lack of clear objectives, inability to prioritize, difficulties scaling pilots, and struggle to embed data-driven decision-making; focus often on descriptive vs. predictive/prescriptive (e.g., a bank consistently producing historical reports on loan performance but failing to develop predictive models for early default detection). |

| Data Retention and Destruction | Leads to increased storage costs, unnecessary exposure to data breaches, and significant compliance risks due to the prolonged retention of unneeded data. It can result in severe legal penalties, reputational damage, and an inability to meet evolving regulatory requirements for data privacy and disposal (e.g., retaining customer data beyond regulatory requirements, leading to higher storage costs and increased liability during a breach). |

| Incomplete Data Inventory and Monitoring | Hinders effective risk management, compromises compliance efforts, and severely limits the ability to respond effectively to data breaches, audits, or regulatory inquiries (e.g., an audit revealing missing documentation for a critical customer database, or an inability to quickly identify all affected customer data after a security incident). |

Foundational Elements of a Data Management Program

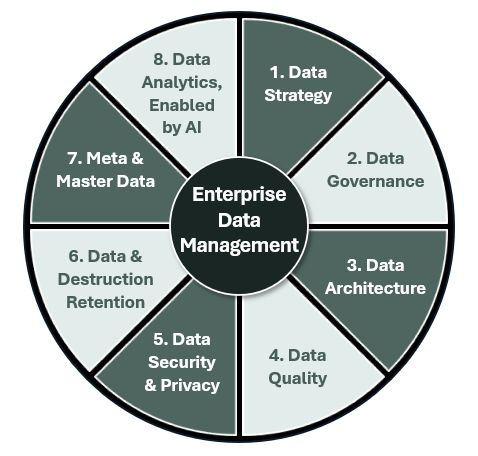

To successfully navigate these prevalent challenges and effectively meet growing regulatory demands, a robust assessment of your current data management program is essential. Key areas to evaluate include:

- Data Strategy:Is a clear strategy defined, communicated, implemented, and aligned with overall company objectives?

- Data Governance: Are roles, responsibilities, policies, and standards specified and implemented? Is there sufficient executive engagement and resourcing?

- Data Architecture: Is the underlying data infrastructure designed to support current and future data needs effectively?

- Data Quality: Are standards, processes, and measures in place, with ongoing assessments and corrective actions to improve quality?

- Data Security and Privacy: Are capabilities sufficient to prevent unauthorized access and ensure compliance with privacy regulations?

- Data Retention and Destruction:Are there clear policies and technology-enabled processes, along with a comprehensive data inventory and classification by risk?

- Meta and Master Data:Are master data and metadata defined, governed, and actively managed to ensure consistency, accuracy, and usability across the enterprise?

- Data Analytics, Enabled by AI: Are analytics requirements understood, and is the process for data sourcing, conformance, and integration reliable and efficient? Are results actionable, and are both structured and unstructured data leveraged? Is the organization equipped with the necessary technology, data, and expertise to effectively develop, deploy, and derive value from AI solutions?

Footnote

1. 8 Real-World Stats on the Application of Predictive Analytics for Finance

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.