- within Finance and Banking topic(s)

- within Finance and Banking topic(s)

- in South America

- with readers working within the Accounting & Consultancy, Banking & Credit and Media & Information industries

- within Finance and Banking, Tax, Government and Public Sector topic(s)

KEY TAKEAWAYS

- The GENIUS Act introduces the first comprehensive federal framework for fiat-backed stablecoins in the U.S.

- Only permitted issuers—insured bank subsidiaries, OCC-approved non-banks, and state-licensed entities—can legally issue payment stablecoins.

- Issuers must maintain 1:1 reserves in high-quality liquid assets, publish monthly reserve disclosures, and meet strict redemption and reporting requirements.

- Lending or rehypothecation of reserves is prohibited; robust governance and consumer protection measures are mandated.

- The UAE's framework offers a unified, centralised model for payment tokens, contrasting the U.S.'s layered federal-state regime.

INTRODUCTION

On 17 June 2025, the United States Senate passed the Guiding and Establishing National Innovation for U.S. Stablecoins Act ("GENIUS Act"), which seeks to define the legal contours of "payment stablecoins" in federal legislation for the first time.1 The bill proposes a unified regulatory framework for issuing, supervising, and operating payment stablecoins across the U.S., addressing long-standing gaps in oversight and jurisdiction.

Stablecoins have long operated in a grey area under U.S. law. Despite piecemeal oversight at the state level, the absence of federal legislation has left issuers navigating regulatory uncertainty. The GENIUS Act represents a watershed moment, offering comprehensive legal recognition for fiat-backed stablecoins while setting forth clear operational, disclosure, and supervisory requirements for issuers.

WHAT IS A PAYMENT STABLECOIN?

The GENIUS Act introduces a specific legal definition of a "payment stablecoin" for the first time in U.S. federal law. To qualify, a digital asset must meet all of the following conditions:

- It is designed to be used as a means of payment or settlement;

- The issuer is obligated to redeem, repurchase, or convert the token for a fixed amount of monetary value (e.g. 1 USD);

- It is marketed or structured in a way that reasonably creates the expectation that its value will remain stable relative to that fixed amount;

- It is not itself a digital asset denominated in the fixed monetary value (e.g. a token just reflecting a USD price point); and

- It is not a national currency, a bank deposit, or a security under U.S. law.

This definition makes clear that the Act is intended to regulate fiat-backed stablecoins that aim to function like digital dollars, while excluding securities, and other forms of crypto assets not explicitly designed or obligated to maintain parity with fiat currency.

WHO CAN ISSUE STABLECOINS UNDER THE GENIUS ACT?

The GENIUS Act introduces a closed-loop issuance framework that defines who may legally issue a "payment stablecoin" within the U.S.—and prohibits all others from doing so.

At the heart of the Act is a clear prohibition:

"It shall be unlawful for any person other than a permitted payment stablecoin issuer to issue a payment stablecoin in the U.S."2

A Permitted Payment Stablecoin Issuer must meet one of the following criteria:3

- Subsidiary of an Insured Depository Institution

A company formed in the U.S. that is a subsidiary of a federally insured bank or credit union, and that has been specifically approved to issue payment stablecoins under applicable regulatory oversight.

2. Federal Qualified Payment Stablecoin Issuer

A non-bank entity formed in the U.S. approved by the Office of the Comptroller of the Currency ("OCC") to issue payment stablecoins. This includes:

- Non-bank entities that are not state-qualified issuers;

- Uninsured national banks; and

- Federal branches of foreign banks, each having obtained OCC approval.

3. State Qualified Payment Stablecoin Issuer

An entity licensed and approved by a state regulatory authority to issue payment stablecoins, provided it complies with federal notification and oversight requirements.

This tri-tiered structure defines who can participate in the U.S. payment stablecoin ecosystem. The GENIUS Act does not permit decentralised protocols, foreign entities without reciprocal arrangements, or unlicensed digital asset service providers to issue or distribute payment stablecoins.

Additional Prohibitions on Distribution and Foreign Stablecoin Offerings

The Act also imposes strict limitations on the distribution and sale of payment stablecoins within the U.S.:4

- No digital asset service provider may offer, sell, or otherwise make available a payment stablecoin to any person in the U.S. unless a permitted payment stablecoin issuer issues the token.

- It is unlawful for any digital asset service provider to offer or sell in the U.S. any stablecoin issued by a foreign payment stablecoin issuer,5 unless:

- That issuer has the technological capability to comply with lawful orders of U.S. authorities; and

- A reciprocal supervisory arrangement is in place pursuant to the provision of the Act.

WHAT DO ISSUERS NEED TO COMPLY WITH?

The GENIUS Act establishes clear and robust requirements for entities issuing payment stablecoins.6 These include detailed rules on reserves, disclosures, and reporting obligations—designed to ensure solvency, transparency, and investor protection. While the Act contains an extensive list of criteria, some of the key requirements are outlined below:

- Backed by Real Reserves

Every stablecoin issued must be backed one-to-one by high-quality liquid assets. These include U.S. currency, balances with the Federal Reserve, short-term Treasury securities, insured bank deposits, and other low-risk instruments regulators approve.

2. Transparent Redemption Terms

Issuers must publish a clear redemption policy outlining how users can redeem stablecoins and within what timeframe. All associated fees must also be disclosed upfront and in plain language.

3. Monthly Disclosures

Issuers are required to release monthly reports showing how many stablecoins are in circulation and what assets back them. These reports must be certified by the chief executive and financial officer and submitted to federal or state regulators, as applicable.

4. Audit Obligations

Regulators may initiate audits to confirm that reserves are properly maintained and that issuers are following all compliance requirements.

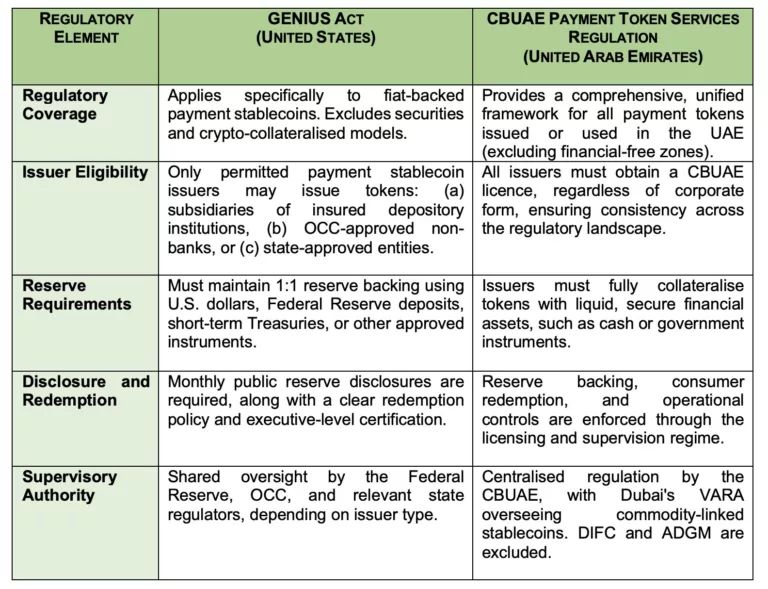

COMPARATIVE OVERVIEW: GENIUS ACT (U.S.) VS. CBUAE PTSR (UAE)

CONCLUSION

The GENIUS Act marks a pivotal step in the U.S.'s attempt to bring stablecoins within a clear federal framework. By setting standards for issuer eligibility, reserve backing, and public disclosure, the Act lays the groundwork for treating payment stablecoins as part of the regulated financial system—without forcing them into traditional banking models. However, its narrow scope and layered oversight may pose operational friction for innovators.

In contrast, the UAE offers a more unified, licence-based regime under the CBUAE, allowing issuers to operate under a centralised structure with clear expectations from day one.

Footnotes

1. S.1582 – GENIUS Act, 119th Congress (2025-2026), https://www.congress.gov/bill/119th-congress/senate-bill/1582/text>.

2. Section 3(a), GENIUS Act.

3. Section 2 (23), GENIUS Act.

4. Section 3(b), GENIUS Act.

5. Section 3(b)(2), GENIUS Act.

6. Section 4, GENIUS Act.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]