- with readers working within the Securities & Investment industries

- within Compliance topic(s)

Best Practices and Considerations

Wage inflation and high prices are proving to be persistent issues.

CFOs are navigating numerous macroeconomic factors that are squeezing margins, including elevated financing costs due to high interest rates, increased freight costs related to geopolitical conflicts, and unpredictable consumer behavior. Amidst these challenges, concerns about personnel and technology costs, as well as weaker demand, remain prevalent.

CFOs are under increasing pressure to reduce operating costs and improve efficiency.

They are tasked with finding solutions that balance cost optimization with service quality enhancement. Often, they resort to increasing headcount or investing in technology to achieve these objectives.

Consider a BPO

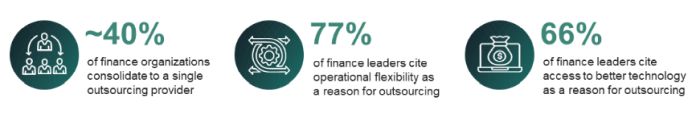

It is essential to evaluate the merits and potential returns of engaging a third-party BPO (business process outsourcing) provider that offers technology solutions, processes, and full-time employees. While BPO providers may not be suitable for every situation, they should be seriously considered as a solution because their business model is based on investing in process execution.

Weighing Sourcing Models

BPO providers offer solutions that can help finance

organizations reduce costs and increase efficiency.

Whether a company opts for a center of excellence (internally owned

and focused on higher value-added services), a shared services

center (internally owned in a low-cost location, focused on

tactical operations and routine transactional activities), or a

third-party BPO provider, the sourcing model must enable the

company to concentrate on its core competencies and align with its

strategic goals and objectives.

Each model offers benefits and has drawbacks.

Factors such as the type and complexity of finance and accounting activities involved, the technology investment needed to achieve optimal efficiency, the cost of labor in local offices versus offshore, and associated risks, among others, must all be considered.

Learn more about How We Support BPO Selection >>

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.