It may be a familiar role for legal and compliance teams to advise on and implement compliance decisions related to registrations, but that doesn't mean the upcoming deadlines for complying with the first-of-its-kind CFPB nonbank registry won't produce hand-wringing and angst.

With the initial registration period for the Nonbank Registration Orders Rule, as defined by 12 CFR Part 1092, for larger participant CFPB-supervised covered nonbanks beginning on October 16, 2024, and ending on January 14, 2025, and others starting soon, entities will need to determine whether they fall under the scope of the rule and have to register.

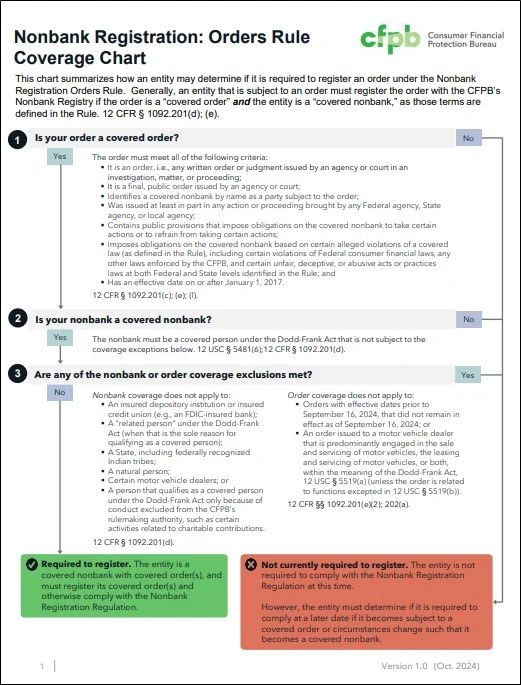

To help, the CFPB has been publishing guidance materials, including a coverage chart to help entities determine whether they are required to register an enforcement order. Entities must be proactive in assessing their obligations to avoid potential enforcement actions. For more on the Rule, see our article here.

Key Definitions Under the Nonbank Registration Orders Rule

The requirement for registration depends on whether an entity and its enforcement order meet the criteria of a "covered order" and a "covered nonbank" as defined by the Rule.

- Covered Order: The term "covered order" is defined in 12 CFR § 1092.201(d) as any public enforcement order issued by federal, state, or local agencies that imposes obligations on an entity to comply with consumer protection laws. These orders must be final and include provisions related to violations of consumer financial laws, such as the Truth in Lending Act, Fair Debt Collection Practices Act, or other relevant consumer protection statutes, e.g., Consumer Financial Protection Act prohibition on UDAAP, Federal Trade Commission Act, and identified state mini-FTC Acts.

- Covered Nonbank: According to 12 CFR § 1092.201(e), a "covered nonbank" is defined as a nonbank financial services provider that falls within the scope of CFPB's authority and is subject to a covered order. This includes a wide range of entities, such as debt collectors, consumer lenders, and others not affiliated with traditional banks but engaged in consumer financial activities.

CFPB Guidance for Compliance

The CFPB's guidance includes a chart that breaks down the process for determining if an entity needs to register.

Generally, if an entity is subject to a public enforcement order meeting the requirements for a "covered order," and it qualifies as a "covered nonbank," it must register that order with the CFPB. But the analysis can be complex, particularly when determining whether an order qualifies as a "covered order" or if an entity falls within the definition of a "covered nonbank."

In addition, the CFPB has released a filing instruction guide, a nonbank registration orders final rule executive summary, a company registration sample form, and instructions for viewing state regulatory actions in NMS (not all orders will be in NMLS).

Key Dates/Implementation Submission Periods

|

Covered nonbank type |

Registration submission period |

Registration deadline |

|

Larger Participant CFPB-Supervised Covered Nonbanks |

October 16, 2024 through January 14, 2025 |

January 14, 2025 |

|

Other CFPB-Supervised Covered Nonbanks |

January 14, 2025 through April 14, 2025 |

April 14, 2025 |

|

All Other Covered Nonbanks |

April 14, 2025 through July 14, 2025 |

July 14, 2025 |

* * * * *

Given the intricacies of applying these definitions and understanding their impact on registration requirements, careful consideration of specific facts and circumstances will be necessary. While the CFPB's materials attempt to simplify the criteria, nuances in fact situations often require deeper analysis to ensure compliance and avoid potential penalties.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.