On October 14, 2021, the New York Court of Appeals issued its decision in Adar Bays. The Adar Bays decision put a major dent in the toxic lending industry and secured a victory for our client based on the Court's answer to two certified questions pertaining to New York's usury statutes. One question inquired whether voiding of the loan was the proper remedy for a criminally usurious loan to a corporation. (Yes) The other question pertained to convertible promissory notes, specifically asking whether the value of a conversion option with a guaranteed fixed-discount should be considered interest for purposes of usury law. (Yes) Adar Bays, LLC v GeneSYS ID, Inc., 179 N.E.3d 612 (2021). This firm secured a winning decision on both questions: the count was 7-0 on the voiding question, and 6-1 on the convertible note question. With regard to the latter, the Adar Bays decision upends more than a dozen federal court decisions on "market adjustable" convertible notes, decisions that the Firm has long regarded as having been wrongly decided.

A resounding victory that overturns such a large number of decisions doesn't happen often; when it does, it is a strong signal that either the facts or the law were simply not well explained in the lower courts. Convertible notes are complex and easily misunderstood lending instruments, even by the courts. We were convinced that the Court of Appeals would ultimately reach the right conclusion if the issues were fully explained and afforded plenary analysis. Fortunately, we were correct.

But what if your company has already repaid a usurious Adar Bays type loan, or was severely damaged by a lender's inevitable dumping when it takes repayment in stock? Is your company stuck with the damage even if the loan was criminally usurious under New York law?

Maybe Not.

This article will first explain the result in Adar Bays and what it means for victims of toxic loans under New York usury law. Next, we propose that, for companies that had no choice but to endure the onerous repayment terms of toxic loans prior to Adar Bays, relief may be available under the federal Racketeering Influenced and Corrupt Organizations Act, also known as RICO.

"Market Adjustable" Convertible Notes: A Brief Explanation

The convertible securities used by toxic lenders are essentially loans that include an option to take repayment in company stock instead of cash, essentially using the debt to pay the exercise price of the option. A "market adjustable" conversion option has at least one important difference: instead of a fixed exercise price, the lender is given a fixed discount to the market price at the time of conversion, typically 35-50% off the lowest trading price for the 20-day period prior to exercise. Since the fixed-discount feature allows the exercise price to fluctuate in order to maintain the same discount, it is often deemed a "market adjustable" price.

Keep in mind that the fixed percentage discount is not the same as the interest rate percentage. Interest is based upon the lender's gains. A 50% discount on stock means that the lender receives $100 in stock for every $50 of debt converted, yielding a 100% gain. (35/65 = .538 ; 45/55 = .818).

The Adar Bays Convertible Note

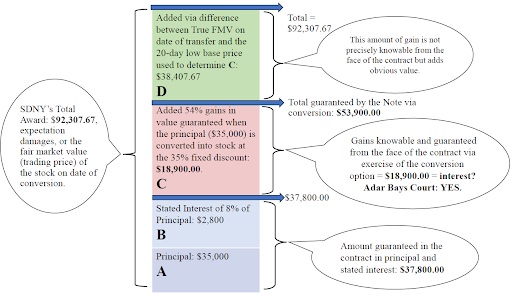

A breakdown of the gains in Adar Bays (above): Lender Adar Bays lent GeneSYS $35,000 (A) with a stated interest rate of 8% APR (B). The fixed conversion discount guaranteed Adar Bays a 54% gain (C). The massive gains typically imparted by the 20 day low are shown as (D).

The Adar Bays Court rightly concluded that, for the purposes of New York's usury statutes, the value guaranteed by the fixed-percentage conversion discount (shown above at C) must be included in the interest calculation. The Adar Bays court also dispensed with some of the more dubious holdings repeated in the lower court decisions, such as the notion that payment in stock retroactively transforms a loan into an investment, or that the value of the conversion option should not be considered because the holder may never exercise the option. Id. at 334-5, 339. The Court left the precise valuation and the method for calculation to fact finders. Adar Bays, 37 N.Y.3d at 338.

"Market Adjustable" Convertible Notes are "Death Spiral" Loans.

The Death Spiral. These securities have a second vital feature: the lender can choose to convert any amount of debt at any one time, in as many tranches as needed. Keep in mind, the goal of the lender is to immediately sell the stock into the market to reap the spread between the 35% discount and the market price. Hence, the ability to convert in tranches enables the lender to lock in the same 54% gain with each tranche converted. If the stock price falls, the lender simply gets more stock in repayment of the same amount of debt converted. The lower the stock price, the more shares the lender receives at conversion, and the more shares it dumps into the market - thus depressing the stock price even further. This is why market-adjustable debt securities are often referred to as "death-spiral," or "toxic" loans, because the floating conversion rate and repeated conversions almost guarantees price depression and substantial dilution to existing shareholders. Even the Securities and Exchange Commission recognizes that "market adjustable" convertible debt can cause devastation to unsuspecting small public companies usually trading on the OTC Markets https://www.investor.gov/introduction-investing/investing-basics/glossary/convertible-securities.

What if your company has already paid off a criminally usurious, death-spiral loan? For a corporation, New York's "criminal usury" law may only be used as an affirmative defense when a lender sues to collect the debt. Most case law holds that the borrowing company cannot bring an affirmative action to void the loan. (See N.Y. Gen. Oblig. Law §5-523(3)Compare with Texas, Florida, Massachusetts, and California, which allow direct suits based on a usury claim). Although some toxic lenders may choose not to enforce the loans as the best strategy in response to Adar Bays, that makes no difference to companies that have already been through the toxic-loan wringer.

RICO and The Collection of Unlawful Debt.

The Racketeering Influenced and Corrupt Organizations (RICO) Act, (18 U.S.C. §§ 1961-1968) was passed in 1970 as the "ultimate hit man" in mob prosecutions. Prior to RICO, prosecutors could only try mob-related crimes against individual perpetrators. Since different mobsters perpetrated each crime, the government could only prosecute individual criminals instead of shutting down an entire criminal organization. RICO was designed to get at the conduct of the enterprise itself.

Today, the law's real power is its civil component. A civil suit may be brought by (1) a "person" who has (2) suffered injury to (3) his or her business or property (4) by reason of the defendant's violation of § 1962. 18 U.S.C. § 1964(c). Although RICO is naturally associated with injury incurred from "racketeering activities," the lesser-used portion of the statute provides actionable claims for injury stemming from "collection of an unlawful debt," defined as:

(6) "unlawful debt" means a debt (A) which is unenforceable under Federal or State law in whole or in part as to principal or interest because of the laws relating to usury, and (B) which was incurred in connection with . . . the business of lending money or a thing of value at a usurious rate under state or federal law, where the usurious rate is at least twice the enforceable rate. (emphasis added) 18 U.S.C §1961(6). Hence, RICO authorizes lawsuits directly against a lender for collection of a debt if (1) it was unenforceable in whole or in part because of state or federal laws relating to usury; (2) it was incurred in connection with the business of lending money at a usurious rate; and (3) it charged a usurious interest rate of at least twice the enforceable rate. (See 18. U.S.C §1961(6)).

Under New York law, a corporate loan is usurious and unenforceable if the interest rate charged is excess of 25%. APR. See N.Y. Penal Law §190.40. Hence, RICO applies if a lender charged interest in excess of 50% APR, and is in the business of lending at a usurious rate. For most lenders and most convertible notes, these requirements are easily met: even a 35% conversion discount alone adds interest charges of 54% to 81% (35/65 = .538 ; 45/55 = .818).

Four-Year Statute of Limitations. The Supreme Court held that RICO has a four-year statute of limitations, which begins running from the time the victim discovers, or should have discovered, his or her damages.

Treble Damages and Attorney Fees. The RICO cause of action may offer a way for corporations to recover from unscrupulous lenders that have already taken repayment and aggrieved parties may recoup up to three times the damages suffered.

The Adar Bays decision reiterated what New York's legislature intended, and the law has existed for more than a century. Moreover, the New York Court of Appeals Adar Bays decision hardly announces a new concept: the duty of courts to examine transactions for hidden usury has been articulated in many cases. As the Court stated:

"Our Court has recognized for more than a century that the economy changes and with it, the ability of lenders to extract unlawful interest rates through novel and increasingly sophisticated instruments, noting: 'The usurer usually seeks to conceal the usury, and to accomplish his purpose by indirect methods, but no matter what the disguise, if the court can see that the real transaction was the loan or forbearance of money at usurious interest, its plain and imperative duty is to so declare."

Adar Bays, 37 N.Y.3d at 342 (citations omitted).

Accordingly, the courts must determine whether added consideration, including the conversion option, causes the transaction to exceed the state's usury limits. If they do, they are void completely under state law. For example, a market-adjustable security that charges a 35% fixed discount results in a return equaling 54% interest which was the rate charged by the lender in the Adar Bays case. That rate is in addition to all other charges including the notes stated interest rate. If the interest charged exceeds double the stated state usury limits, the federal RICO statute provides a separate remedy that can be pursued.

The RICO Act was the federal government's direct response to illegal loansharking, as is New York's criminal usury statute (See Adar Bays, LLC v GeneSYS ID, Inc., 179 N.E.3d 612 (2021) ("[t]his measure is vital in curbing the loan-sharking racket as a complement to the basic proposal creating the crime of criminal usury . loan sharks with full knowledge of the present law , make it a policy to loan to corporations.").

The RICO claim offers a remedy to corporations that were unable to utilize the affirmative defense offered under N.Y. Gen. Oblig. Law section 5-521(3) prior to Adar Bays. New York is not the only state with usury laws. California, Florida, Texas, and Massachusetts all have civil and criminal usury statutes as well as an additional 26 states. This means that RICO suits premised on violations of these states' usury laws are another claim that can be asserted against the toxic market-adjustable securities lenders.

Our next article will discuss the fiduciary duty of a public company's Board of Directors or Executive Management team to pursue those that have engaged in usurious or other unlawful securities practices and transactions with the company and whether shareholders, through derivative and class action lawsuits, can directly sue company boards members as well as the lenders if the companies refuse to act.

Originally Published by 27 February 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.