- in United States

- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Construction & Engineering industries

- within Corporate/Commercial Law, Compliance, Media, Telecoms, IT and Entertainment topic(s)

In response to investor demand for clear and consistent pay-for-performance analysis as executive compensation plans become increasingly complex, Glass Lewis recently announced a new pay-for-performance methodology (here). To provide greater transparency and more meaningful and predictable analysis in its reports, Glass Lewis will now provide a quantitative score based on five key tests and a qualitative assessment. The new methodology and scoring will be applicable starting January 1, 2026. The Glass Lewis announcement comes shortly after the launch of its annual benchmark policy survey (as discussed in our prior Alert here).

Five Tests Provide Framework for New Pay-for-Performance Scorecard

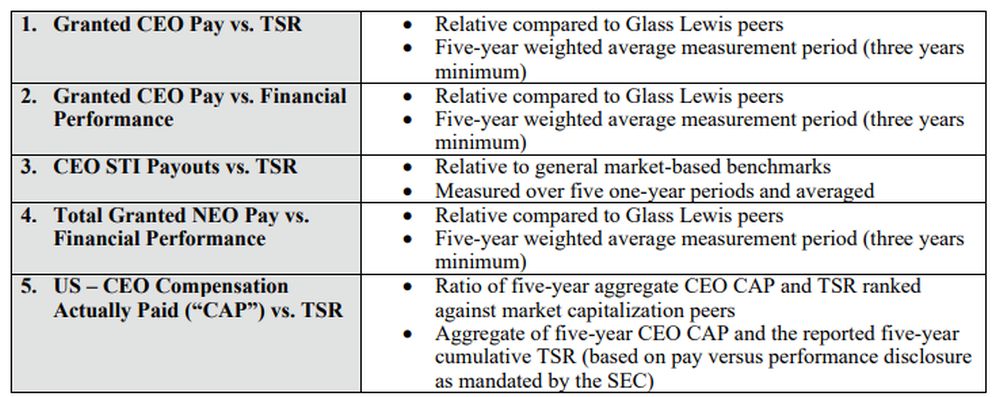

The five quantitative tests that comprise the new Glass Lewis pay-for-performance scorecard applicable to U.S. companies will be weighted and scored to determine a company's overall numerical score from 0-100 (replacing the prior "A-F" letter grades). Four of five of these tests will review company performance against a peer group generated using Glass Lewis' proprietary methodology or more general market benchmarks. Based on the numerical score generated using the factors described in the table below, companies will receive a concern level from "Low" to "Severe" that reflects how closely the company links executive compensation to performance relative to Glass Lewis peers.

Voting Recommendation Influenced by Qualitative Test

Glass Lewis will also conduct a qualitative review of companies' executive compensation programs when finalizing its recommendation, asking the following questions:

- Were any one-off awards granted?

- Is fixed pay greater than variable pay?

- Is maximum LTIP payout potential excessive?

- Are any performance goals not disclosed?

- Was upward discretion exercised?

- Are incentives unlimited/not disclosed?

- Is there a short vesting period for LTIs?

Although companies that receive negative concern ratings, such as "Severe Concern" or "High Concern," based on the quantitative test are more likely to receive a negative say-on-pay recommendation, Glass Lewis considers additional qualitative factors to develop their recommendations, including the questions above, as well as overall incentive structure, trajectory of the program and disclosed future changes, and the operational, overall compensation structure, the compensation-related decisions made in the past year, changes to the program going forward, lingering impact of previous pay practices, context, such as the company's operations and other unique circumstances.

Glass Lewis Methodology FAQs

Financial Performance Metrics. Glass Lewis provides additional insight into the new methodology in the FAQ, including that its pay-for-performance model evaluates indicators of business performance including revenue growth, return on equity and return on assets, as well as other industry and sector-specific metrics.

Comapny Criteria Within the Coverage Universe. North American companies in scope must generally meet the following criteria:

- Must have three consecutive years of comparable compensation data available.

- Must have three consecutive years of comparable financial data available, covering a minimum of four financial metrics, including TSR plus three metrics from among ROE, ROA, EPS, Revenue, OCF, TBV, and FFO.

- Must have at least 10 peer companies (as selected by Glass Lewis) that fulfill the same compensation and financial data requirements.

What to do Now?

- Review New Scoring with Compensation Committee. Ensure that the Compensation Committee understands how the new framework will be applied to the company's compensation program and expectations for any changes in the Glass Lewis review of the company.

- Re-evaluate Compensation Peer Group. Glass Lewis assesses executive compensation in large part relative to company peers, as noted in four of the five quantitative tests described above. Companies should review the peers against which Glass Lewis compares them and provide regular updates as applicable.

- Consider Time Horizon of Compensation Program. Notably, Glass Lewis has extended the compensation look back from three years to five years so companies should consider five years of compensation practices.

- Monitor for Potential Changes to SEC Rules and Interpretations. As discussed in our prior Alert here, the SEC Staff is examining whether its executive compensation disclosure regime still meets the goal of "clear, concise and understandable" information that is material to investors. Although the Staff continues to digest comment letters and recent roundtable feedback, we believe that a formal rule proposal will not appear until late 2025 at the earliest (although we do expect some interpretive guidance or "perks").

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.